Credit histories of the citizens of the RF will be declassified

Today, in a period of financial uncertainty, when the economy of the country shows negative signs of slowdown and the debt burden on banking sector increases, the Ministry of Finance of the RF simplifies the access to the credit histories of the citizens, either for the citizens themselves who has taken out a loan, or for legal persons.

At the present time under the current Federal law «About credit histories», a borrower has an opportunity to get the mentioned data free of charge once a year, for the repeated requests he will have to pay to the Credit history bureaus (CHB).

At the moment the new initiative of the Ministry of Finance is at the stage of discussion, the law «About Consumer credit (loan)» passed at the end of December will come into effect on the 1st of July 2014. According to new legislation, not only banks, but also other creditors are obliged to convey information on the borrower to the CHB, with no concurrence required from him. Informational part of the credit application, where a person fills out the details about himself, from now on will be accessible to legal entities and IE, who has entered into a relevant contract with the CHB. Besides, the credit history of the borrower will contain not only the whole information on the loan provided, but also request denials and about their reasons. Such data will be interesting as well for financial institutions, as, for example, for employers hiring new employees.

It should seem, commonsense initiative of openness and accessibility of information with the purpose of the business safety, security of a bank from citizens not in good faith has to be approved, however it raises the question which remains open: how protect the right-minded citizens from underhand dealing with their personal documentary materials or using of them by questionable legal entities and individual entrepreneurs (IE)?

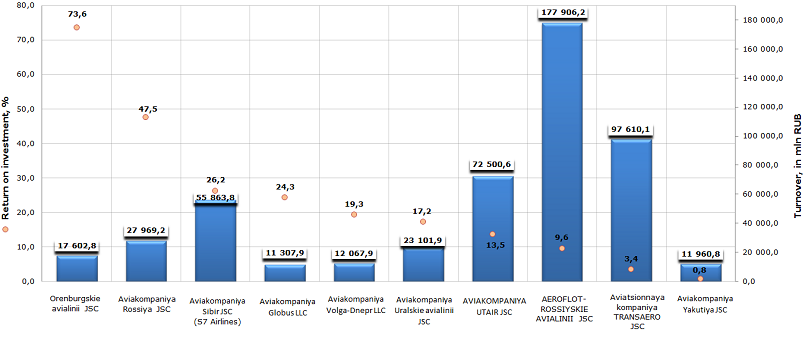

Return on investment of airline companies

Information agency Credinform prepared a ranking of Russian airline companies having the Air Operator Certificate for commercial air transport operations (as of the 10th of January 2014).

The companies with highest volume of revenue were selected for this ranking according to data from the Statistical Register for the latest available period (for the year 2012). Then, the first 10 enterprises selected by turnover were ranked by decrease in return on investment.

Return on investment (%) is the ratio of net profit (loss) of a company to its net asset value. The ratio shows how many monetary units were needed to an enterprise to get one monetary unit of net profit. The higher is the return on investment, the more effective a company has worked with the assets being at its disposal.

There is no recommended and specified value prescribed for profitability ratios, because their values vary depending on economic sphere, where each concrete enterprise operates. Therefore, a company should be assessed first of all relying on industry-average indicators, as well as focusing on other market players.

It should be noted, that the return on investment helps estimate not only the return of invested assets, but also the advisability of borrowing funds at certain interest. Thus the companies should take credits, interest on which is lower than the profitability of investment capital.

| № | Name, INN | Region | Turnover for 2012, in mln RUB | Return on investments, (%) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Orenburgskieavialinii JSC INN 5638057840 |

Orenburg region | 17 603 | 73,6 | 226 (high) |

| 2 | AviakompaniyaRossiyaJSC INN 7810814522 |

Saint-Petersburg | 47,5 | 27 969 | 282 (high) |

| 3 | Aviakompaniya Sibir JSC (S7 Airlines) INN 5448100656 |

Novosibirsk region | 55 864 | 26,2 | 206 (high) |

| 4 | Globus LLC INN 5448451904 |

Novosibirsk region | 11 308 | 24,3 | 233 (high) |

| 5 | AVIAKOMPANIYA VOLGA-DNEPR LLC INN 7328510118 |

Ulyanovsk region | 12 068 | 19,3 | 254 (high) |

| 6 | Aviakompaniya Uralskie avialinii JSC INN 6608003013 |

Sverdlovsk Region | 23 102 | 17,2 | 183 (the highest) |

| 7 | AVIAKOMPANIYAUTAIRJSC INN 7204002873 |

Khanty-Mansiysk Autonomous Region - Yugra | 72 501 | 13,5 | 223 (high) |

| 8 | AEROFLOT-ROSSIYSKIE AVIALINII JSC INN 7712040126 |

Moscow | 177 906 | 9,6 | 199 (the highest) |

| 9 | Aviatsionnaya kompaniya TRANSAERO JSC INN 5701000985 |

Saint-Petersburg | 97 610 | 3,4 | 224 (high) |

| 10 | AviakompaniyaYakutiya JSC INN 1435149030 |

the Republic of Sakha (Yakutia) | 11 961 | 0,8 | 232 (high) |

Cumulative turnover of TOP-10 the largest airline companies at year-end 2012 reached 507,9 mln RUB, increased by 22,5% in comparison with the year 2011, that is an positive trend. By that the average value of the analyzed ratio for the largest air carriers of Russia made 23,5% at year-end 2012.

The first place of the ranking list belongs to Orenburgskie avialinii JSC with the return on investment value 73,6%, that is more than a triple higher than the average value for leaders, what testifies to favorable investment climate. It means that the company has more alternatives for borrowing funds and their further use to its own benefit. Besides the enterprise got a high solvency index GLOBAS-i®, that characterizes it as financially stable.

Picture. Ranking «Return on investment (%) and turnover of the largest airline companies of the RF» (TOP-10)

Companies Aviakompaniya Rossiya JSC, Aviakompaniya Sibir JSC (S7 Airlines) and Globus LLC also showed the return on investment value higher than the average value for industry leaders, what testifies to effective use by companies of assets being at their disposal. All three organizations got a high solvency index GLOBAS-i®.

Industry leader by turnover - AEROFLOT-ROSSIYSKIE AVIALINII JSC, is only on the 8th place of the ranking with the return on investment ratio 9,6%. Although, the company got the highest solvency index GLOBAS-i®, that characterizes it as the most attractive for investments. This conclusion confirms once again the rule, that for an objective assessment of a company it is necessary to take comprehensive approach with using of either financial or non-financial indicators.