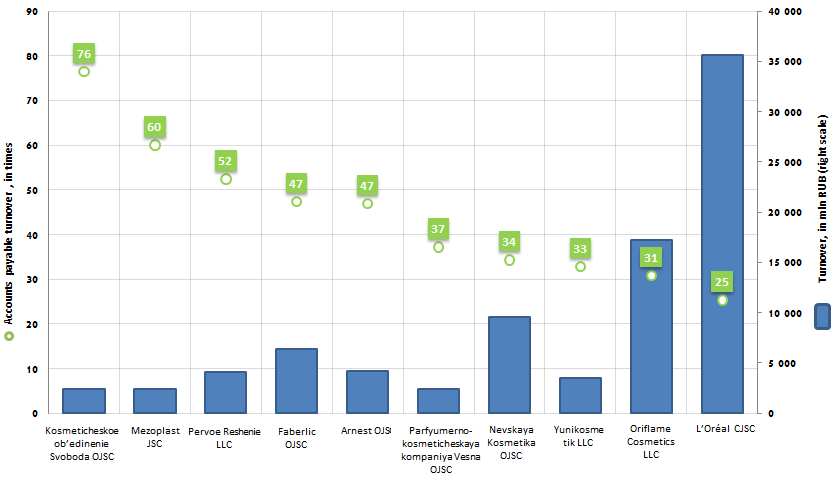

Accounts payable turnover of manufacturers of perfumery products

Information agency Credinform prepared a ranking of Russian perfume companies.

The companies with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2013). These enterprises were ranked by increase in values of accounts payable turnover.

Accounts payable turnover/ payables turnover (in times) is the relation of average accounts payable for the period to sales revenue. The ratio shows, how many times (a year, a s a rule) an enterprise has discharged the average amount of its accounts payable.

The ratio of accounts payable turnover reflects the process of debt repayment to contractors (partners, suppliers, dealers etc). The ratio determines the number of debts satisfied by a firm and is calculated to estimate the cash flows, that allows to draw conclusions about the operating efficiency of an enterprise and chosen financial strategy of the management.

The higher is the mentioned ratio, the soonest a company pays up debts to its supplies. Decline in turnover can mean as well problems with the settlement of accounts, as a more effective organization of relationships with suppliers, which provides a more convenient, deferred payment plan and uses the accounts payable as a source of getting of cheap financial resources.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to industry-average indicators, but also to all presented combination of financial indicators and company’s ratios.

| № | Name | Region | Revenue, in mln RUB, for 2013 | Accounts payable turnover, in times | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Kosmeticheskoe ob’edinenie Svoboda OJSC INN 7714078157 |

Moscow | 2 437 | 76 | 266 high |

| 2 | Mezoplast JSC INN 7721025967 |

Moscow | 2 443 | 60 | 231 high |

| 3 | Pervoe Reshenie LLC INN 7701298966 |

Moscow | 4 071 | 52 | 269 high |

| 4 | Faberlic OJSC INN 5001026970 |

Moscow | 6 383 | 47 | 158 the highest |

| 5 | Arnest OJSC INN 2631006752 |

Stavropol region | 4 207 | 47 | 221 high |

| 6 | Parfyumerno-kosmeticheskaya kompaniya Vesna OJSC INN 6311064600 |

Samara region | 2 402 | 37 | 222 high |

| 7 | Nevskaya Kosmetika OJSC INN 7811038047 |

Saint-Petersburg | 9 607 | 34 | 172 the highest |

| 8 | YunikosmetikLLC INN 7826704356 |

Saint-Petersburg | 3 484 | 33 | 169 the highest |

| 9 | Oriflame Cosmetics LLC INN 7704270172 |

Moscow | 17 212 | 31 | 276 high |

| 10 | L’Oréal CJSC INN 7726059896 |

Moscow | 35 624 | 25 | 221 high |

Accounts payable turnover of the largest manufacturers of perfumery (TOP-10) ranges from 76 days (Kosmeticheskoe ob’edinenie Svoboda OJSC) up to 25 days (L`Oreal CJSC). As it can be seen from the picture, the higher is the annual turnover of the company, the less number of times it can repay its debts to the contractors.

Picture 1. Accounts payable turnover and revenue of the largest manufacturers of perfumery products (TOP-10)

Annual revenue of the TOP-10 market leaders made 87,9 bln RUB, following the results of the latest published financial statement (for 2013), that is by 6,1% higher than in the previous reporting period.

Payables turnover of the leader on turnover of the Russian market of perfumery products, the company L`OREAL CJSC, is below the average values of the TOP-10 group - 25 times a year on the average.

The history of L'Oréal in Russia has been starting since 1990, when a Soviet-French joint venture was founded, which manufactured shampoos Elsève, hair dyes Recital and perfumes Maroussia.

The Russian branch of L’Oréal was organized in 1994 and until 2003 it was known as Rusbel CJSC, in 2003 it was renamed into L’Oréal CJSC. Activity of the branch began with the promotion of goods under the brands “L’Oréal Paris” and “Laboratoires Garnier” in the framework of mass-market products.

Today, L'Oréal is present in all distribution channels in Russia: beauty salons, pharmacies, supermarkets, and an exceptional range of brands takes a leadership position in many market segments, such as make-up, hair care, body care, perfumery etc.

The second company of the industry, Oriflame Cosmetics LLC, leads his longtime rival in the speed of accounts payable turnover (31 times).

Oriflame is the leading cosmetics company in the market of direct sales. The company's products are represented in more than 60 countries, and more than a half of them occupies a leading position in the market.

All participants of the TOP-10 list got high and the highest solvency index, this fact points to companies’ ability to pay off their debts in time and fully, while risk of default is minimal.

Unified concept of a state-private partnership is enshrined in law

The law, which gives the unified concept of a state-private partnership, will come into force on January 1, 2016.

In July 2015 the President of the Russian Federation signed the Federal Law from July 13, 2015 of No. 224-FZ "About state-private partnership, municipal-private partnership in the Russian Federation and modification of separate legal acts of the Russian Federation".

Various infrastructure projects in the form of state-private partnership (SPP) are implemented in Russia within more than 10 years and regulated by 9 Federal Laws and number of acts of federal and regional executive authorities. The regional laws about participation of the Russian subject in the state-private partnerships are adopted in 71 Russian regions, however for implementation in specific projects they were used only in 18 regions; regional legislation, which is estimated as effective, acts only in Saint-Petersburg, Tomsk region and Yamalo-Nenets Autonomous district.

According to the «Unified information system of state-private partnership in Russia», the official resource about state-private partnerships, created with the assistance of the Ministry of economic development, countrywide almost 1000 projects are under practical implementation stage in the following sectors: transport infrastructure and construction, water supply and drainage, heating, electricity, urban beautification, health, culture and education, social services, tourism and sport, waste disposal.

The practice showed undeniable advantages of the state-private partnership such as redistribution of risks, increasing of private initiative role, long-term and stable nature of relationships between public and private partners, confidence in completion of the project according to the original plan, potential profitability and increasing of chances of investors’ participation in large projects.

The new Federal Law generalizes the previous legal framework and practices and also regulates the legal relations in preparation, execution and termination of SPP agreements and projects, including the level of municipal authorities.

The Law clearly describes the range of public and private partners and the objects of SPP agreements; the guarantees of legitimate interests and rights of private partner are fixed; the procedures, starting from projects and agreements development, to their completion or termination are regulated; the criteria and rules of competitive procedures, requirements to tender documents are set; direct agreement of the parties about contract terms and the order of interaction of the partner with funding entity is provided; the object deposit of the SPP agreement (rights under the agreement) is allowed as the way of ensuring the fulfillment of obligations to the funding entity; the potential appearance of the private partner's property right on the object of SPP agreement under the condition of its encumbrance is provided.

The Law also made correlative changes in a number of Codes and Federal laws. For example, in the Federal Law "About insolvency (bankruptcy)", it regulates the sale features of the object of SPP agreement in case of initiation of bankruptcy proceeding in respect of the private partner.

The transitional period for SPP legislative acts of regional and municipal levels is set until July 1, 2016 to make changes in accordance with the Federal law. Thus the agreements, which are already made, can be executed till their completion under previously adopted legislation.

According to the experts of Information Agency Credinform, the implementation of provisions of the law about state-private partnership, as one of the key events of the market, will influence on the harmonization of SPP legislative acts of all levels, give the possibility to the Government to make more informed decisions about projects and increase the effective return in the form of additional investment, increase tax revenues and new working places.