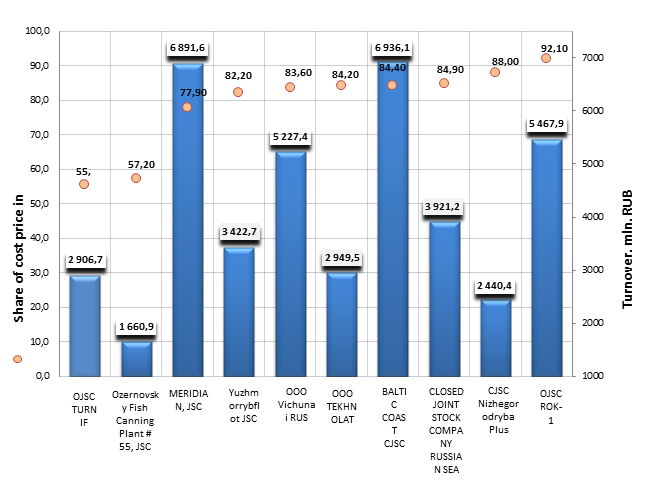

Products cost of enterprises engaged in processing and preserving of fish and seafood

Information agency Credinform prepared a ranking of companies engaged in processing and preserving of fish and seafood in terms of products cost. Companies with the mentioned activity type and the highest volume of turnover were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2013). The enterprises of the Top-10 were ranked by increase in the share of manufactured products cost in the company's turnover.

The cost price is a cost (expenses) for production, works or services. It is an important qualitative indicator reflecting how much the company costs on production and marketing. The lower is the cost price, the higher are profit and profitability. Normative values for this indicator are not specified. For evaluating the effectiveness of cost management, it is necessary to look through the percentage of the cost price in the company's turnover.

| № | Name, INN | Region | Turnover 2013, mln. RUB | Products cost, mln. RUB | Cost price share in turnover, (%) | Solvency index Globas-i® |

|---|---|---|---|---|---|---|

| 1 | OPEN JOINT - STOCK COMPANY PACIFIC DEPARTMENT OF FISH SURVEY AND RESEARCH FLEET TURNIF INN 2536053382 |

Primorsky Krai | 2907 | 1616 | 55,6 | 184 (the highest) |

| 2 | Ozernovsky Fish Canning Plant # 55, JSC INN 4108003484 |

Kamchatka Krai | 1661 | 950 | 57,2 | 240 (high) |

| 3 | Meridian, JSC INN 7713016180 |

Moscow | 6892 | 5369 | 77,9 | 181 (the highest) |

| 4 | Yuzhmorrybflot JSC INN 2508098600 |

Primorsky Krai | 3423 | 2814 | 82,2 | 269 (high) |

| 5 | OOO Vichunai RUS INN 3911008930 |

the Kaliningrad region | 5227 | 4370 | 83,6 | 248 (high) |

| 6 | ООО TEKHNOLAT INN 3906145113 |

the Kaliningrad region | 2949 | 2483 | 84,2 | 600 (unsatisfactory) |

| 7 | BALTIC COAST CJSC INN 7826059025 |

the Leningrad region | 6936 | 5856 | 84,4 | 217 (high) |

| 8 | CLOSED JOINT STOCK COMPANY RUSSIAN SEA INN 5031033020 |

the Moscow region | 3921 | 3328 | 84,9 | 292 (high) |

| 9 | CJSC Nizhegorodryba Plus INN 5260072045 |

the Nizhniy Novgorod region | 2440 | 2148 | 88,0 | 262 (high) |

| 10 | OPEN JOINT-STOCK COMPANY ROK-1 INN 7805024462 |

Saint-Petersburg | 5468 | 5033 | 92,1 | 195 (the highest) |

The average cost price share in the turnover of the Russian fish processing enterprises exceeds 70%. That shows high expenses on production and can be an indicator of an outdated industrial base.

Last year, the Russian enterprises engaged in processing and preserving of fish and seafood, have faced with serious problems due to the introduction of the food embargo. According to the experts, only in the Kaliningrad region about 40% of raw material for canned fish were delivered from countries, came under the Russian countersanctions. Thus, enterprises urgently had to find new suppliers of raw materials. The already difficult situation was exacerbated by serious competition from foreign producers, since the import of canned fish wasn’t under the embargo.

As a reminder, in August 2014 Russia imposed an embargo on the supply of food products from the EU, US, Australia, Canada and Norway. In particular, the ban was imposed on the import of fish. However, Moscow restrictions were not applied at canned fish.

Products cost of the major enterprises engaged in processing and preserving of fish and seafood in Russia, Top-10

The Top-3 is presented with the following companies: OPEN JOINT - STOCK COMPANY PACIFIC DEPARTMENT OF FISH SURVEY AND RESEARCH FLEET TURNIF (55,6%), Ozernovsky Fish Canning Plant # 55, JSC (57,2%) and Meridian, JSC (77,9%). The companies have shown quite high values of products cost against turnover. This result demonstrates the high production costs. However, the enterprises got high and the highest solvency index Globas-i® in terms of financial and non-financial factors set; that characterizes them as financially stable.

The rest of the Top-10 companies have shown the value of the index above the average (70%), that indicates that enterprises of the industry should be more rational in approach to their own costs management to improve competitiveness.

Asian arbitration centers become more and more popular

Domestic companies are faced with difficulties while dealing with European arbitrations. Though arbitration institutions are non-commercial, they are private and their activity comes within the purview of the local legislation. Thus arbitrage institutions registered in EU fall within the ambit of sanctions. The sanctions affected the interests of the key corporations for the Russian economy. The deals with these companies were prohibited for the citizens of countries taken sanctions. The current situation made the Russian business to focus on Asian arbitration centers.

Vladimir Khvalei, the Chairman of Russian Arbitration Association board, stated that recently some of the European Arbitration decisions concerning cases where one of the parties was a Russian company were significantly dragged along or delayed. In some cases international arbitrators refused to handle legal matters of the companies added to the sanction list.

The last statistics concerning references to arbitrations show that in the context of sanctions the state companies more often refer to Asian arbitration centers, which are ready for cooperation with Russia. Thus the start-up Dubai international arbitration center handles a big amount of matters on regulation of disputes with Russian companies.

The representatives of the Hong Kong arbitration center note the increase of references on the part of the Russian companies. Major state companies, trading on Hong Kong Exchange, work with the Hong Kong arbitration center. Hong Kong boasts the differences in its legislation in comparison with the English one. However, the differences are minimal.

The increases in references are marked by the other Asian arbitration centers. Akira Kawamura, the President of International bar association, suggested creating a new regional arbitration center for dealing with Russian and Japanese companies.

Among other advantages of Asian centers are: the possibility of urgent trial, disputes resolution within 6 months, great experience and judges’ proficiency, as well as political apathy while decision-making. At the same time each Asian arbitration center has several advantages and they all extensively compete against each other.

The legislation reform in the field of arbitration in Russia has been passing along for 2 years. The particular part of the new commercial arbitration law is about the role of arbitration institutions and arbitration activity regulations. In particular the new law limits the possibility of arbitration institution establishment. The changes are necessary due to the fact that the previous legislation gave the possibility for any legal entity to create its own dispute resolution institution. It led to introduction of the surplus of arbitration institutions and consequently to arbitration abuses.