Solvency ratio of the largest Russian private educational organizations

Information agency Credinform has prepared a ranking of the largest Russian private educational organizations. The enterprises with the highest volume of annual revenue (TOP-10) have been selected for the ranking, according to the data from the Statistical Register for the latest available accounting periods (2015 and 2014). Then they have been ranked by solvency ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Solvency ratio (x) is a ratio of equity to total assets, and it shows the dependence of the company on external loans. Its recommended value: >0.5. A value less than a minimum one is indicative of a dependence on external sources of funds, which may lead to a liquidity crisis, unstable financial position of an organization in case of market degradation.

A calculation of practical values of financial ratios, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas by the experts of Information Agency Credinform, having taken into account the current situation in the economy as a whole and in the industries. The practical value of solvency ratio for private educational organizations in 2015 amounted from 0 to 1. The whole set of financial indicators and ratios of a company is to be considered to get the fullest and fairest opinion about the company’s financial standing.

| Name, INN, region | Net profit, mln RUB | Revenue, mln RUB | Sr, х >0,5 | Solvency index Globas | ||||

| 2014 | 2015 | 2016 | 2014 | 2015 | 2016 | |||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| The Academy of Global Astrology and Metainformation, Non-state Private Educational Institution INN 7725084339 Moscow |

161,92 | 25,38 | н/д | 1 174,00 | 1 578,50 | н/д | 1,00 | 231 High |

| The Russian University of Cooperation, Autonomous Non-profit Educational Organization for Higher Education of Centrosoyuz of the Russian Federation INN 5029088494 Moscow region |

234,84 | 143,71 | 176,34 | 1 522,38 | 1 592,08 | 1 630,87 | 0,75 | 209 High |

| British International School, Non-commercial Private Institution of General Education INN 7713004522 Moscow |

93,03 | 106,85 | -36,93 | 1 302,79 | 1 409,72 | 1 402,52 | 0,75 | 229 High |

| The Modern Academy for the Humanities, Private Higher Educational Institution INN 7701023168 Moscow |

83,67 | 19,85 | -399,43 | 2 044,56 | 1 518,60 | 787,69 | 0,63 | 292 High |

| The Moscow University for Industry and Finance Synergy, Non-state Private Higher Educational Institution INN 7729152149 Moscow |

62,94 | 90,84 | 52,21 | 1 378,55 | 1 517,86 | 1 898,74 | 0,36 | 208 High |

| The Corporate University of Sberbank, Autonomous Non-Commercial Organization for Continuing Professional Education INN 7736128605 Moscow |

0,94 | 6,47 | 26,66 | 1 627,23 | 2 639,18 | 3 310,22 | 0,31 | 240 High |

| The Moscow University of Finance and Law (MFYUA), Certified Private Higher Educational Institution INN 7725082902 Moscow |

41,79 | 41,44 | 57,03 | 1 015,72 | 1 140,78 | 1 142,78 | 0,14 | 226 High |

| The Moscow School of Management SKOLKOVO, Non-state Educational Institution for Continuing Professional Education INN 5032180980 Moscow region |

148,82 | 193,22 | -30,64 | 970,30 | 1 245,85 | 1 833,55 | 0,04 | 278 High |

| Education of Children of Pre-school, Elementary School and Intermediate School Ages Nasledie (Heritage), Autonomous Non-commercial Organization for General Education INN 5024092264 Moscow region |

-8 220,70 | -7 465,57 | n/d | 33 858,00 | 34 688,00 | n/d | -0,31 | 322 Satisfactory |

| Educational Center EF English First CIS, Private Institution, Organization of Additional Education INN 7707082829 Moscow |

-641,88 | -423,73 | -181,10 | 1 453,67 | 1 437,37 | 1 309,03 | -3,44 | 334 Satisfactory |

| Total for TOP-10 companies | -8 034,63 | -7 475,24 | n/d | 46 347,19 | 48 767,93 | n/d | ||

| Average value for TOP-10 companies | -803,46 | -747,52 | n/d | 4 634,72 | 4 876,79 | n/d | 0,02 | |

| Industry average value | -0,20 | -0,04 | n/d | 8,66 | 9,35 | n/d | 0,53 | |

*Data for 2016 is given for reference.

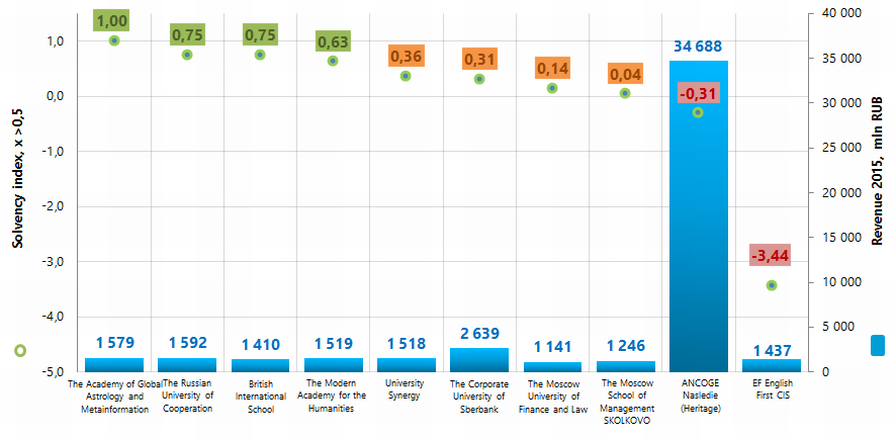

The average value of 2015 solvency ratio in TOP-10 companies is higher than the recommended value and lower than the practical value. Four companies of TOP-10 have an index value that is higher than the recommended one, and four companies have index value within the recommended value (green and yellow highlight respectively in column 8 of Table 1 and Picture 1). Two companies have a negative value (red highlight in column 8 of Table 1 and Picture 1). Seven of TOP-10 companies have a decrease in revenue or net profit as compared to the prior period, or have loss in 2015 (red highlight in columns 3 and 6 of Table 1).

Picture 1. Solvency ratio and revenue of the largest Russian private educational organizations (TOP-10)

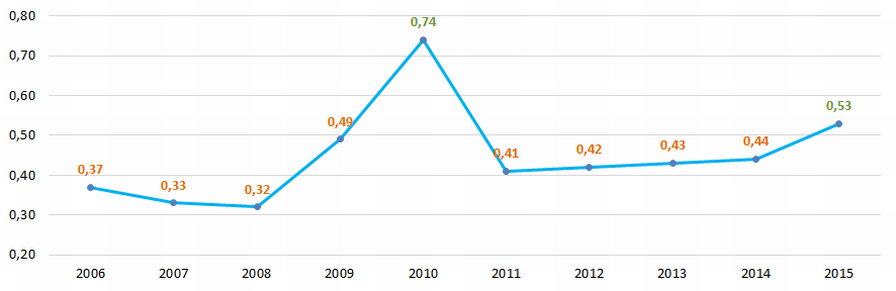

Picture 1. Solvency ratio and revenue of the largest Russian private educational organizations (TOP-10)Industry average values of solvency ratio in 2011-2015 are higher in general than in 2006-2008. The value of the ratio decreased in 2011 after a substantial growth in 2010 (Picture 2).

Picture 2. Change of industry average values of solvency ratio of Russian private educational organizations in 2006-2015.

Picture 2. Change of industry average values of solvency ratio of Russian private educational organizations in 2006-2015.Eight of TOP-10 companies have got a high solvency index Globas, that demonstrates their ability to pay their debts in time and fully.

Education of Children of Pre-school, Elementary School and Intermediate School Ages Nasledie (Heritage), Autonomous Non-commercial Organization for General Education has got a satisfactory solvency index Globas, due to information concerning the organization being a defendant in debt collection arbitration proceedings, and loss within its balance sheet structure. Index development trends are stable.

Educational Center EF English First CIS, Private Institution, Organization of Additional Education has also got a satisfactory solvency index Globas, due to information concerning the organization being a defendant in debt collection arbitration proceedings, untimely fulfillment of its obligations, and loss within its balance sheet structure. Index development trends are stable.

Debt ratio of the largest Russian scientific-research and design institutions

Information Agency Credinform has prepared the ranking of the largest Russian scientific-research and design institutions. The largest enterprises (TOP-10) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2016 and 2015). Then the companies were ranged by debt ratio (Table 1). The analysis was based on data of the Information and Analytical system Globas.

Debt ratio (or the ratio of borrowed and own funds) is one of the financial stability ratios. The ratios of this group determine the possibility of granting the long-term loans or investing as they characterize the possibility of the company to meet its long-term obligations. The debt ratio (х) is calculated as a ratio of total borrowed funds to equity capital and shows how many units of borrowed funds the company had attracted to each unit of own sources of financing.

The recommended value of the ratio is less than 1. The ratio of borrowed and own funds should not be negative, therefore the ratio value from 0 to 1 is one of the indicators of company’s high ability to meet its obligations.

The calculation of practical values of financial indicators, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas by the experts of Information Agency Credinform, taking into account the actual situation of the economy as a whole and the industries. In 2015 the practical value of debt ratio for scientific-research and design institutions ranged from 0 to 2,02.

For the most full and fair opinion about the company’s financial position, the whole set of financial indicators and ratios of the company should be taken into account.

| Name, INN, region | Net profit, mln RUB | Revenue, mln RUB | Debt ratio 0≤(x)<1 | Solvency index Globas | ||

| 2015 | 2016 | 2015 | 2016 | |||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| NAO JSC ALL-RUSSIAN SCIENTIFIC-RESEARCH INSTITUTE SIGNAL INN 3305708964 Vladimir region |

2 078,4 | 1 343,8 | 6 257,0 | 3 260,7 | 0,32 | 233 High |

| FEDERAL STATE UNITARY ENTERPRISE CENTRAL AEROHYDRODYNAMIC INSTITUTE NAMED AFTER PROFESSOR N.E. ZHUKOVSKY INN 5013009056 Moscow region |

29,0 | 29,3 | 8 269,0 | 7 170,1 | 0,42 | 220 High |

| FEDERAL STATE UNITARY ENTERPRISE KRYLOV STATE RESEARCH CENTRE INN 7810213747 Saint-Petersburg |

-194,2 | 61,1 | 5 603,33 | 9 220,1 | 0,51 | 201 High |

| NAO JSC N.A. DOLLEZHAL RESEARCH AND DEVELOPMENT INSTITUTE OF POWER ENGINEERING INN 7708698473 Moscow |

367,0 | 136,8 | 6 759,0 | 4 935,4 | 0,53 | 247 High |

| NAO JSC STATE MASHINE BUILDING DESIGN BUREAU VYMPEL BY NAME I.I.TOROPOV INN 7733546058 Moscow |

3 143,3 | 798,8 | 37 497,6 | 17 239,6 | 1,52 | 188 The highest |

| NAO JSC ALL-RUSSIAN RESEARCH INSTITUTE FOR NUCLEAR POWER PLANTS OPERATION (VNIIAES) INN 7721247141 Moscow |

848,4 | 757,6 | 7 097,2 | 4 089,1 | 3,80 | 164 The highest |

| NAO JSC CENTRAL DESIGN BUREAU FOR MARINE ENGINEERING RUBIN INN 7838418751 Saint-Petersburg |

3 839,2 | 2 611,0 | 28 737,8 | 37 618,5 | 7,56 | 185 The highest |

| NAO SCIENTIFIC-RESEARCH AND DESIGN INSTITUTE OF CIVIL ENGINEERING, LANDSCAPING AND URBAN DESIGN MOSPRIEKT3 INN 7707820890 Moscow |

257,7 | 261,0 | 7 598,8 | 6 619,6 | 7,76 | 226 High |

| PAO JSC ST. PETERSBURG MARINE DESIGN BUREAU MALACHITE INN 7810537540 Saint-Petersburg |

1 230,5 | 374,5 | 6 877,4 | 6 556,5 | 9,30 | 186 The highest |

| NAO JSC SCIENTIFIC-RESEARCH AND DESIGN INSTITUTE FOR ENERGY TECHNOLOGIES ATOMPROEKT INN 7814417371 Saint-Petersburg |

-1 646,6 | 1 105,4 | 12 026,6 | 9 767,7 | 18,13 | 238 High |

| Total for TOP-10 group of companies | 9 952,7 | 7 479,5 | 126 723,7 | 106 477,4 | ||

| Average value within TOP-10 group of companies | 995,3 | 747,9 | 12 672,4 | 10 647,7 | 4,99 | |

| Industry average value | 0,2 | 46,5 | 1,05 | |||

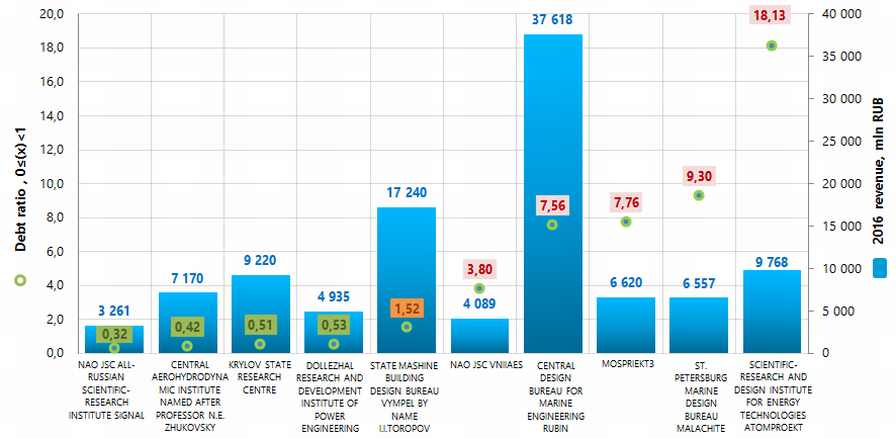

The average value of debt ratio in TOP-10 group of companies is higher than recommended and practical values. Four companies have values within the recommended values, one company within practical values, five companies from TOP-10 list are not within practical values (green, yellow and red colors respectively in column 6 of Table 1 and Picture 1). In 2016, nine companies from TOP-10 list have decrease in revenue and net profit in comparison with previous period (red color in 3 and 5 columns of Table 1).

Picture 1. Debt ratio and revenue of the largest Russian scientific-research and design institutions (TOP-10)

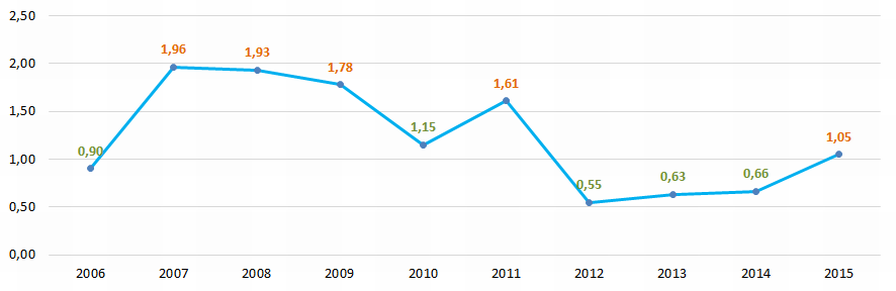

Picture 1. Debt ratio and revenue of the largest Russian scientific-research and design institutions (TOP-10)In the period from 2006 to 2015, the average values of debt ratio were within practical values (Picture 2).

Picture 2. The change of debt ratio average values within 2006-2015 for the scientific-research and design institutions

Picture 2. The change of debt ratio average values within 2006-2015 for the scientific-research and design institutionsAll companies from TOP-10 list have the highest or high solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully.