Legislative changes

The new requirements for banks storing money from the compensation fund of a Public Law Company Unified Gambling Regulator will come into force on September 27, 2021. We reported about the creation of the company in our publication dated 11.06.2021.

According to the Federal Law No. 493-FZ dated 30.12.2020, this compensation fund is intended to provide financial support for obligations of gambling organizers to their clients. Money of the fund must be placed on separate special accounts of credit institutions that meet the established requirements.

These requirements are regulated by the Decree of the Government of the Russian Federation No. 751 dated 17.05.2021:

- amount of the bank's capital is over 1 billion rubles.;

- participation in the system of compulsory deposit insurance;

- absence of overdue debts on bank deposits previously placed at expense of the fund.

We recall that among duties of gambling organizers is publication on Internet of information about bank guarantees to fulfill obligations to participants of such games as well as information about documents to submit payment claims under these guarantees.

TOP 10 grain producers

In 2021, the grain harvest in Russia is projected at more than 127 million tons. Cereals are grown by more than 39 thousand enterprises. An assessment of the return on cost ratio of the largest grain producers indicates an increase in income per ruble spent in 2020. All TOP 10 companies have increased their revenues and net profit this year. The same result is likely to be achieved by the end of 2021.

Information agency Credinform has selected the largest agricultural producers of wheat, barley, rye, corn, oats, buckwheat, legumes and oilseeds with the highest annual revenue (TOP 10 and TOP 100), according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2018 – 2020). They were ranked by the return on costs ratio (Table 1). The selection and analysis of companies were based on the data of the Information and Analytical system Globas.

Return on costs (%) is the pre-tax profit to the total sales and production costs. The ratio indicates the volume of income from one ruble spent.

For the most complete and objective view of the financial condition of the enterprise, it is necessary to pay attention to the complex of indicators and financial ratios of the company.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Return on costs, % | Solvency index Globas | |||

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| LLC AGROFIRMA TSELINA INN 6136009530 Rostov region |

511 511 |

3 780 3 780 |

147 147 |

1 897 1 897 |

41,84 41,84 |

104,30 104,30 |

179 High |

| LLC AGROHOLDING IVNYANSKIY INN 3109003728 Belgorod region |

5 362 5 362 |

7 343 7 343 |

2 249 2 249 |

3 684 3 684 |

73,38 73,38 |

99,91 99,91 |

175 High |

| LLC AGROINDUSTRIAL CORPORATION YUNOST INN 5708006707 Oryol region |

1 788 1 788 |

3 913 3 913 |

516 516 |

1 865 1 865 |

48,16 48,16 |

93,92 93,92 |

157 Superior |

| LLC RANENBURG INN 4813012610 Lipetsk region |

2 299 2 299 |

4 528 4 528 |

607 607 |

1 992 1 992 |

40,03 40,03 |

85,09 85,09 |

214 Strong |

| LLC KRASNOYARUZHSKAYA GRAIN COMPANY INN 3113001402 Belgorod region |

4 563 4 563 |

5 853 5 853 |

825 825 |

2 415 2 415 |

24,85 24,85 |

80,34 80,34 |

166 High |

| LLC PRISTENSKAYA GRAIN COMPANY INN 4619004632 Kursk region |

4 196 4 196 |

6 381 6 381 |

1 036 1 036 |

2 711 2 711 |

33,53 33,53 |

72,70 72,70 |

189 High |

| JSC STUDENETSKY FLOUR MILL INN 5815000308 Penza region |

2 170 2 170 |

4 328 4 328 |

275 275 |

1 659 1 659 |

15,72 15,72 |

65,77 65,77 |

147 Superior |

| LLC ROSTOV GRAIN COMPANY RESURS INN 6148003452 Rostov region |

2 782 2 782 |

8 637 8 637 |

71 71 |

3 170 3 170 |

3,59 3,59 |

63,46 63,46 |

218 Strong |

| JSC ISKRA INN 2439001597 Krasnoyarsk region |

3 357 3 357 |

4 007 4 007 |

882 882 |

1 144 1 144 |

34,19 34,19 |

38,73 38,73 |

135 Superior |

| LLC DOBRINYA INN 4804005574 Lipetsk region |

3 499 3 499 |

6 060 6 060 |

507 507 |

1 576 1 576 |

17,82 17,82 |

36,82 36,82 |

195 High |

| Average value for TOP 10 |  3 053 3 053 |

5 483 5 483 |

712 712 |

2 211 2 211 |

33,31 33,31 |

74,10 74,10 |

|

| Average value for TOP 100 |  1 271 1 271 |

1 881 1 881 |

285 285 |

674 674 |

33,53 33,53 |

59,53 59,53 |

|

| Industry average value |  44 44 |

60 60 |

7 7 |

13 13 |

18,69 18,69 |

31,15 31,15 |

|

growth of indicator to the previous period,

growth of indicator to the previous period,  fall of indicator to the previous period

fall of indicator to the previous period

The average 2020 value of return on costs of TOP 10 and TOP 100 companies was above the average one. None of TOP 10 companies had decrease in 2020. However, the fall was recorded for three companies of TOP 100.

At the same time, all companies gained revenue and net profit in 2020.

The increase in revenue was near 80% and 50% for TOP 10 and TOP 100 respectively, while the industry average value climbed almost 36%.

The average profit of TOP 10 have increased 3 times, TOP 100’s one jumped more than 2 times, and on average in the industry, the growth was recorded by almost 86%.

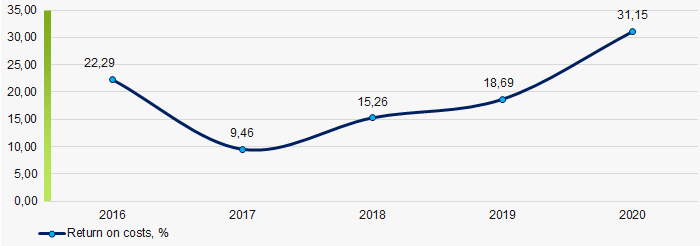

In general, the industry average return on costs values have raised for three periods during the past 5 years. The highest value was recorded in 2020 and the lowest one was in 2011 (Picture 1).

Picture 1. Change in the average return on costs values of agricultural grain producers in 2016 - 2020

Picture 1. Change in the average return on costs values of agricultural grain producers in 2016 - 2020