Grey economy falls down

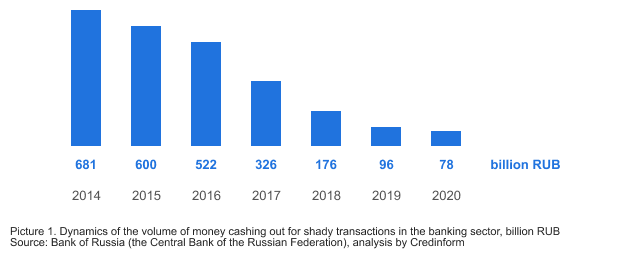

In 2020 – 2021, the volume of shady money transactions has been significantly reduced. In 2020, there was recorded a 26% decrease in such kind of transactions in the banking sector.

Cash-out transactions and withdrawal of foreign currency overseas account for the largest part of shadow schemes.

Cash-out transactions

In 2020, the amount of shady transactions for money cashing out amounted to 78 billion RUB, including the issuance of funds to individuals - 59 billion RUB, to legal entities - 16 billion RUB and individual entrepreneurs - 3 billion RUB.

Over the history of the Bank of Russia keeping statistics since 2014, the volume of cash withdrawal in the banking sector has decreased 9 times (see Picture 1).

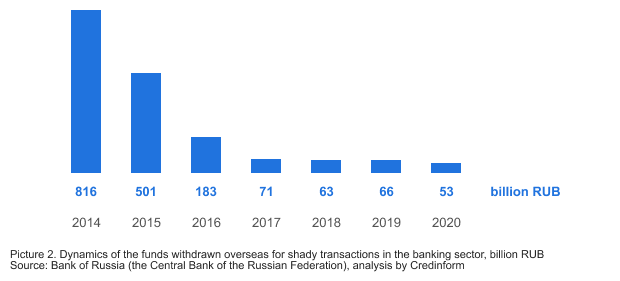

Withdrawal of funds overseas

In 2020, the volume of funds withdrawn overseas under the shady schemes amounted to 53 billion RUB. In the structure of such transactions, the majority or 24 billion RUB (45%) comes from advance payments for imported goods. In addition, funds are withdrawn through payment for the import of goods from the countries of the customs union - 10 billion RUB; transfers under transactions with services - 10 billion RUB, transfers under transactions with securities - 4 billion RUB, transfers under other schemes - 5 billion RUB.

From 2014 to 2020, the volume of funds withdrawn overseas as shady transactions decreased 15 times (see Picture 2).

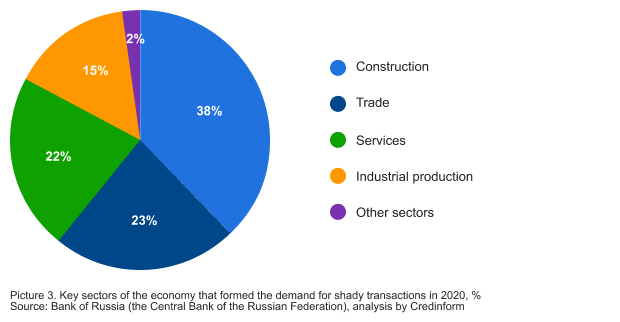

Sectors of economy with the highest volume of shady money transactions

The main demand for shady financial services is coming from the construction sector - 38%, trade - 23% and the service sector - 22% (see Picture 3).

The fight against shady money transactions is taken to a new level

Since 2014, the total volume of shady money transactions for cashing out funds and withdrawing foreign currency overseas has decreased 11 times: from 1,497 billion RUB in 2014 to 131 billion RUB in 2020.

In 2020, the Bank of Russia detected and minimized the withdrawal of funds overseas through international transport channels, advertising services, and securities turnover. The volume of withdrawal of funds on multiple assignments of debt between participants in foreign economic activity has decreased.

Despite the success of the fight against the already known schemes, new illegal methods appear. In particular, signs of illegal cashing out of funds using writs of execution for fictitious debts were detected. Especially often notaries are involved, whose orders on the compulsory recovery of funds from the debtor allow to bypass court procedures. In 2020, the volume of cashing out funds under this scheme increased by more than 60% compared to 2019, and reached 25 billion RUB.

In the second half of 2021, the Central Bank of the Russia plans to launch “Know Your Client” platform for banks - a system for providing information on the level of risk of potential and existing customers being involved in shady transactions. The verification will reduce the costs of banks, as well as the number of unreasonable refusals to open and maintain accounts.

| Avoiding suspicions of shady transactions, fines and other consequences is possible only by complying with currency control legislation and AML / CFT (Anti-Money Laundering/Combating the Financing of Terrorism) requirements under the 115-FL. A significant part of the work on AML / CFT within the framework of the corporate checking regulations is performed by the new Globas tool - Reports. Reports tool will help identify the company, check it against the special lists of the Federal Service for Financial Monitoring (Rosfinmonitoring) and the Federal Tax Service, identify beneficial owners, conflicts of interest, affiliation, find facts of violation of the law, and much more. |

TOP of construction companies in Saint Petersburg

Information agency Credinform represents a review of activity trends among construction companies in Saint Petersburg.

The largest companies with the highest annual revenue (TOP 1000) were selected for the ranking, according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2016 – 2020). The selection and analysis of companies were based on the data of the Information and Analytical system Globas.

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest company in term of net assets is JSC ETALON LENSPETSSMU, INN 7802084569, construction of residential and non-residential buildings. In 2020, net assets value of the company exceeded 39 billion RUB.

The lowest net assets value among TOP 1000 was recorder for LLC STROIGAZKONSALTING, INN 7703266053, construction of residential and non-residential buildings. In 2020, insufficiency of property of the enterprise was indicated in negative value of -28 billion RUB.

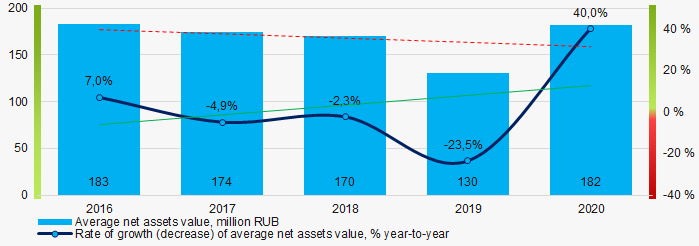

Covering the five-year period, the average net assets values of TOP 100 have a trend to decrease with the increasing growth rate (Picture 1).

Picture 1. Change in industry average net assets value in 2016 – 2020

Picture 1. Change in industry average net assets value in 2016 – 2020Over the past five years, the share of companies with insufficient property had a positive trend to decrease (Picture 2).

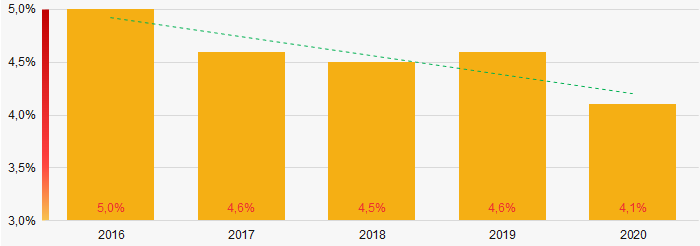

Picture 2. Shares of TOP 1000 companies with negative net assets value in 2016-2020

Picture 2. Shares of TOP 1000 companies with negative net assets value in 2016-2020Sales revenue

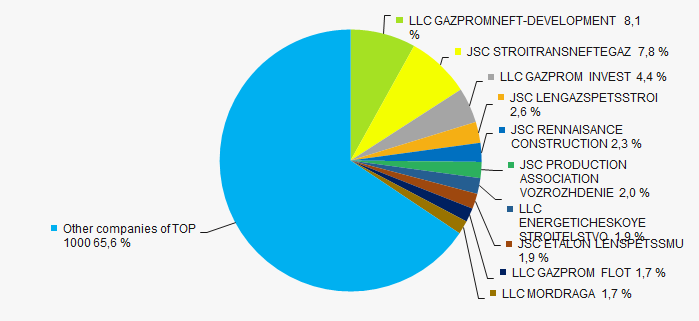

In 2020, the revenue volume of ten largest companies was near 34% of total TOP 1000 revenue (Picture 3). This is indicative of a relatively high level of competition among construction companies in Saint Petersburg.

Picture 3. The share of TOP 10 companies in total 2020 revenue of TOP 1000

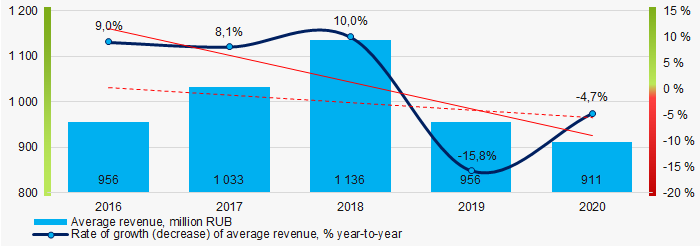

Picture 3. The share of TOP 10 companies in total 2020 revenue of TOP 1000 In general, there is a trend to decrease in revenue and growth rate (Picture 4).

Picture 4. Change in industry average net profit in 2016 – 2020

Picture 4. Change in industry average net profit in 2016 – 2020Profit and loss

In 2020, the largest organization in term of net profit is ООО GAZPROM INVESTGAZIFIKATSIYA, INN 7810170130, construction of engineering communications for water supply and sewerage, gas supply. The company’s profit almost exceeded 16 billion RUB.

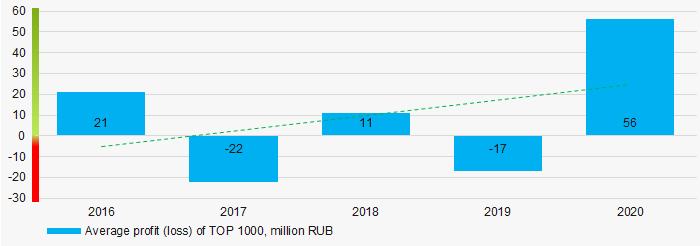

Covering the five-year period, there is a trend to increase in average net profit and growth rate (Picture 5).

Picture 5. Change in average profit (loss) values in 2016 – 2020

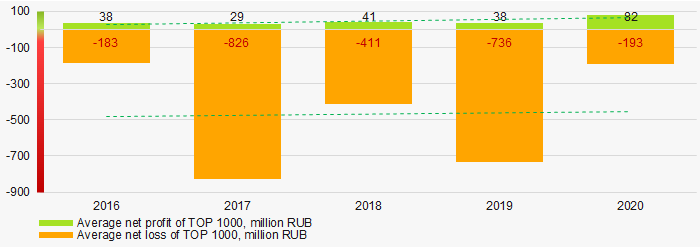

Picture 5. Change in average profit (loss) values in 2016 – 2020For the five-year period, the average net profit values of TOP 1000 have the increasing trend with the decreasing net loss (Picture 6).

Picture 6. Change in average net profit and net loss of ТОP 1000 in 2016 - 2020

Picture 6. Change in average net profit and net loss of ТОP 1000 in 2016 - 2020Key financial ratios

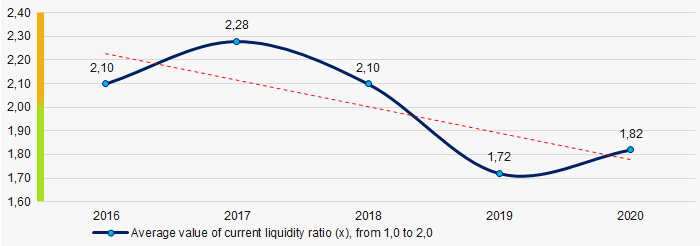

Covering the five-year period, the average values of the current liquidity ratio were close the recommended one - from 1,0 to 2,0 with a trend to decrease (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 7. Change in industry average values of current liquidity ratio in 2016 – 2020

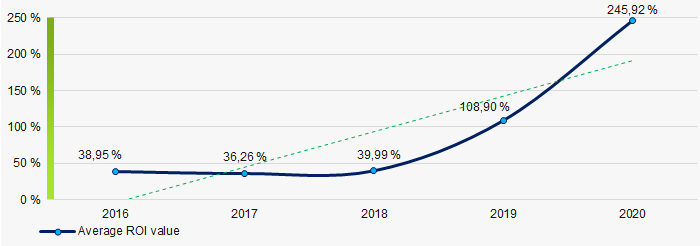

Picture 7. Change in industry average values of current liquidity ratio in 2016 – 2020Covering the five-year period, the average values of ROI ratio had a trend to increase (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in industry average values of ROI ratio in 2016 - 2020

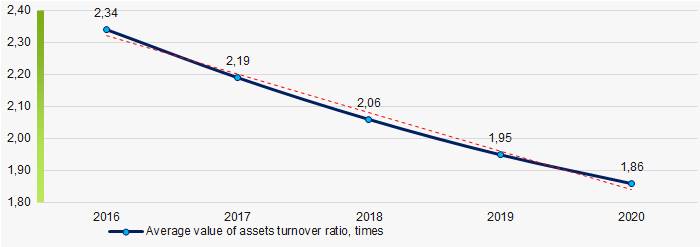

Picture 8. Change in industry average values of ROI ratio in 2016 - 2020Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

Covering the five-year period, business activity ratio demonstrated the decreasing trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio in 2016 – 2020

Picture 9. Change in average values of assets turnover ratio in 2016 – 2020Small business

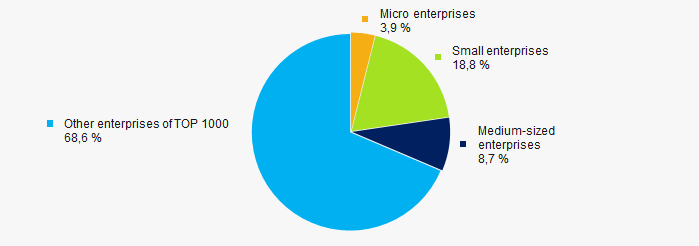

87% of companies of TOP 1000 are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. In 2020, their share in total revenue of TOP 1000 is 31%, more than the average country values in 2018-2019 (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in TOP 1000

Picture 10. Shares of small and medium-sized enterprises in TOP 1000Financial position score

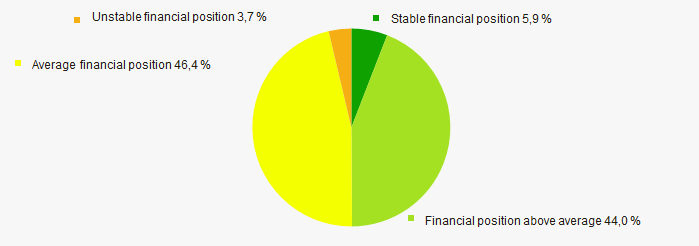

Assessment of the financial position of TOP 1000 companies shows that the majority of them have average financial position (Picture 11).

Picture 11. Distribution of TOP 1000 companies by financial position score

Picture 11. Distribution of TOP 1000 companies by financial position scoreSolvency index Globas

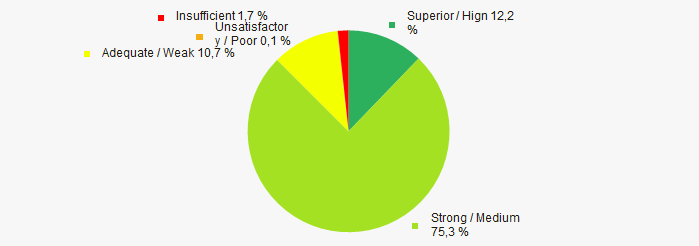

Most of TOP 1000 companies got Superior / High and Strong / Medium indexes Globas. This fact shows their limited ability to meet their obligations fully (Picture 12).

Picture 12. Distribution of TOP 1000 companies by solvency index Globas

Picture 12. Distribution of TOP 1000 companies by solvency index GlobasConclusion

Complex assessment of activity of construction companies of Saint Petersburg, taking into account the main indexes, financial ratios and indicators, demonstrates the prevalence of positive trends in 2016 - 2020 (Table 1).

| Trends and evaluation factors | Relative share of factors, % |

| Dynamics of the average net assets value |  -10 -10 |

| Rate of growth (decrease) in the average size of net assets |  10 10 |

| Increase (decrease) in the share of enterprises with negative values of net assets |  10 10 |

| Level of concentration of capital (monopolization) |  10 10 |

| Dynamics of the average revenue |  -10 -10 |

| Rate of growth (decrease) in the average size of revenue |  -10 -10 |

| Dynamics of the average profit (loss) |  5 5 |

| Rate of growth (decrease) of the average profit |  10 10 |

| Rate of growth (decrease) of the average loss |  10 10 |

| Increase / decrease in average values of total liquidity ratio |  -5 -5 |

| Increase / decrease in average values of return on investment ratio |  10 10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses in terms of revenue being more than 20% |  10 10 |

| Financial position (the largest share) |  5 5 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of relative share of factors |  3,0 3,0 |

positive trend (factor),

positive trend (factor),  negative trend (factor)

negative trend (factor)