Industry trends Air transportation

Information agency Credinform presents a review of air transportation industry trends.

Air transportation enterprises with the highest volume of annual revenue (TOP-10 and TOP-500) have been selected for the ranking, according to the data from the Statistical Register for the latest available accounting periods (2015 and 2016). The analysis was based on the data from the Information and Analytical system Globas.

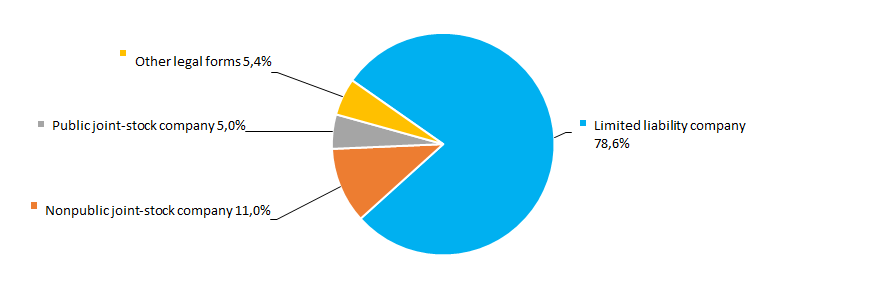

Legal forms

Limited liability company is the prevailing legal form among air transportation companies. Non-public joint stock companies’ fraction is significant too (Picture 1).

Picture 1. TOP-500 companies by legal forms

Picture 1. TOP-500 companies by legal formsSales revenue

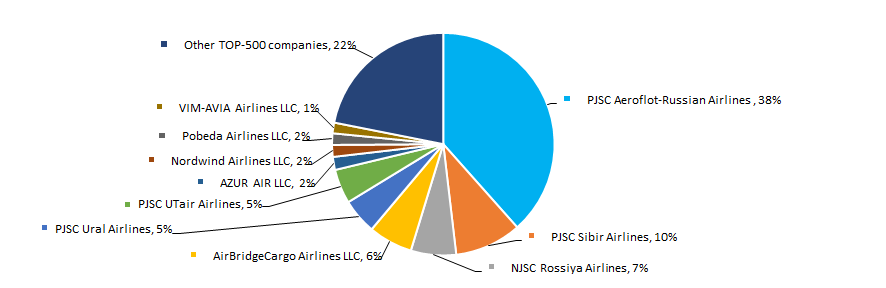

In 2016 sales revenue of 10 industry leaders amounted to 78% of total revenue of TOP-500 companies. This points to a high degree of monopolization within the industry. PJSC Aeroflot-Russian Airlines is the largest company in 2016 by revenue (Picture 2).

Picture 2. TOP-10 companies by their share in 2016 total revenue of TOP-500 companies, %

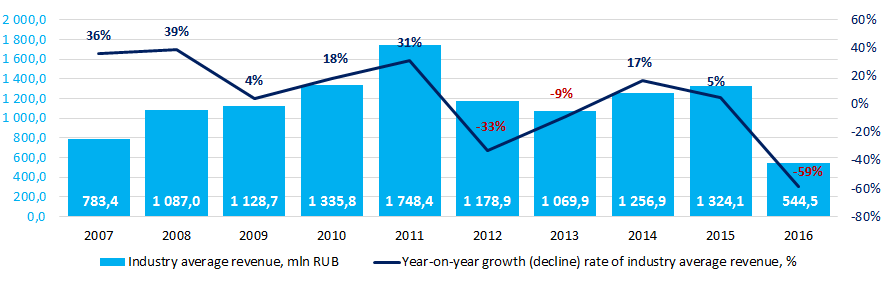

Picture 2. TOP-10 companies by their share in 2016 total revenue of TOP-500 companies, %2011 witnessed the best revenue results in the decade. Crisis periods in economy of 2012, 2013 and 2016 resulted in decrease in industry average values (Picture 3).

Picture 3. Change in industry average revenue of air transportation companies in 2007 – 2016

Picture 3. Change in industry average revenue of air transportation companies in 2007 – 2016Profit and loss

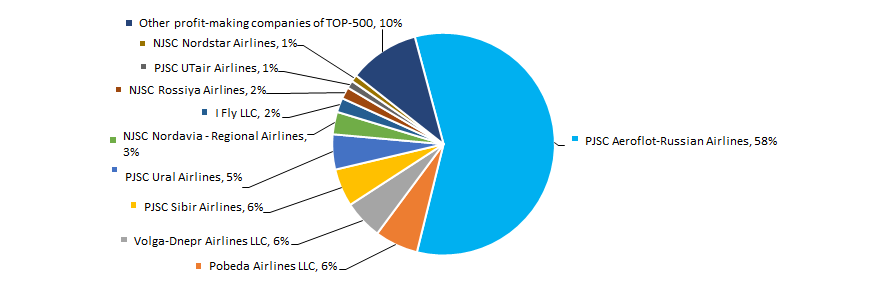

In 2016 profit of 10 industry leaders amounted to 90% of total profit of TOP-500 companies. PJSC Aeroflot-Russian Airlines is also the leading company by profit in 2016 (Picture 4).

Picture 4. TOP-10 companies by their share in 2016 total profit of TOP-500 companies, %

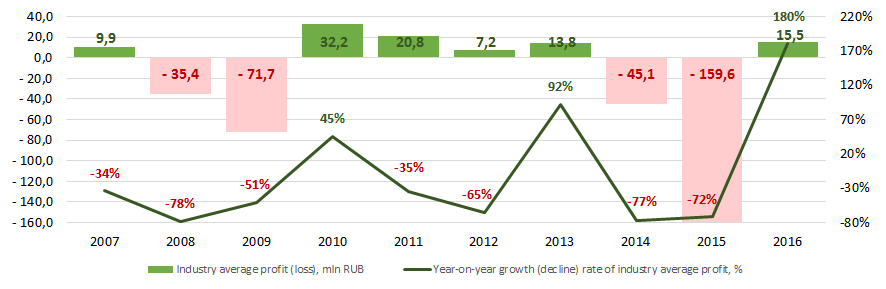

Picture 4. TOP-10 companies by their share in 2016 total profit of TOP-500 companies, %Profit values of the air transportation industry are not stable within the decade. There was a decline in profit in 2007 – 2009, 2011 – 2012 and in 2014 against the backdrop of economic downturn. The industry has performed its best in 2010 (Picture 5).

Picture 5. Change in industry average profit of air transportation companies in 2007 – 2016

Picture 5. Change in industry average profit of air transportation companies in 2007 – 2016There were 136 loss-making enterprises among TOP-500 companies in 2015. In 2016 the number increased to 143 or by 5%. Moreover, their average loss decreased by 88%. As for other TOP-500 companies, their average profit was 5 times higher for the same period (Picture 6).

Picture 6. Number of loss-making companies, average values of loss and profit of TOP-500 companies in 2015 – 2016

Picture 6. Number of loss-making companies, average values of loss and profit of TOP-500 companies in 2015 – 2016Equity

At year-end 2016 PJSC Aeroflot-Russian Airlines had the largest equity among TOP-500 companies. PJSC Transaero Airlines that is under liquidation procedure since October 6, 2017 had the worst equity condition (Table 1).

| No. | Name | Name | |

| 2015 | 2016* | ||

| 1. | PJSC Aeroflot-Russian Airlines | 49,34 | 79,96 |

| 2. | GazpromAvia Aviation Company LLC | 26,44 | 28,94 |

| 3. | Volga-Dnepr Airlines LLC | 9,27 | 12,26 |

| 4. | PJSC Aurora Airlines | 4,37 | 8,49 |

| 5. | PJSC Sibir Airlines | 4,16 | 5,63 |

| 6. | PJSC Aviation Company Ural Airlines | 1,93 | 4,75 |

| 7. | Pobeda Airlines LLC | 9,65 | 4,30 |

| 8. | PJSC Yamal Aviation Transportation Company | 3,94 | 3,95 |

| 9. | AVIASERVICE LLC | 3,14 | 3,41 |

| 10. | AirBridgeCargo Airlines LLC | 2,87 | 1,80 |

| 491. | PJSC DONAVIA | 0,38 | -0,49 |

| 492. | Art Avia LLC | -0,29 | -0,80 |

| 493. | Tomsk Avia Airlines LLC | -0,79 | -1,40 |

| 494. | NJSC Red WingsС | -1,71 | -1,91 |

| 495. | NJSC AEROCOM Company | -1,99 | -2,03 |

| 496. | NJSC Polet Airlines | -2,67 | -2,78 |

| 497. | NJSC NORDAVIA – Regional Airlines | -12,55 | -10,82 |

| 498. | PJSC UTair Airlines | -12,83 | -11,69 |

| 499. | PJSC Orenburg Airlines | -7,55 | -15,75 |

| 500. | PJSC Aviation company Transaero | -97,95 | -104,84 |

*) Companies with positive trends in 2016 as compared to prior year are highlighted green in Table 1, the ones with negative trends are highlighted red.

Key financial ratios

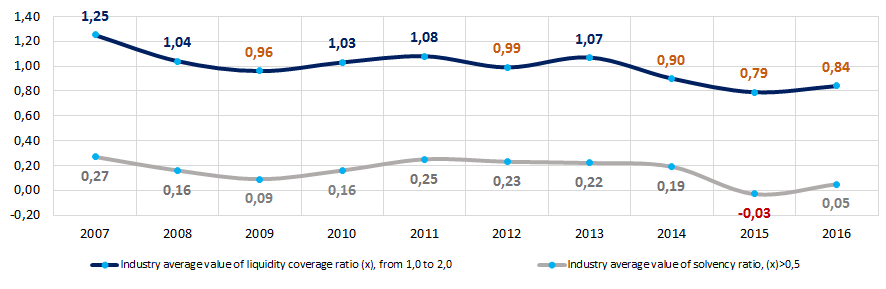

During the decade industry average values of liquidity coverage ratio were declining gradually and in the last 3 years they were below the recommended values – from 1,0 to 2,0 (Picture 7).

Liquidity coverage ratio (a ratio of current assets to current liabilities) reveals the sufficiency of a company’s funds for meeting its liabilities.

Solvency ratio (a ratio of shareholders’ equity to total assets) shows the dependence of the company on external loans. Its recommended value: >0,5. A value less than a minimum one is indicative of a strong dependence on external sources of funds.

A calculation of practical values of financial ratios, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas-i by the experts of Information Agency Credinform www.credinform.ru/en-US, having taken into account the current situation in the economy as a whole and in the industries. The practical value of solvency ratio for air transportation companies is from 0,02 to 0,87.

During the decade industry average values were within practical values, excluding 2015 that showed a negative value (Picture 7).

Picture 7. Change in industry average values of liquidity coverage ratio and solvency ratio of air transportation companies in 2007 – 2016

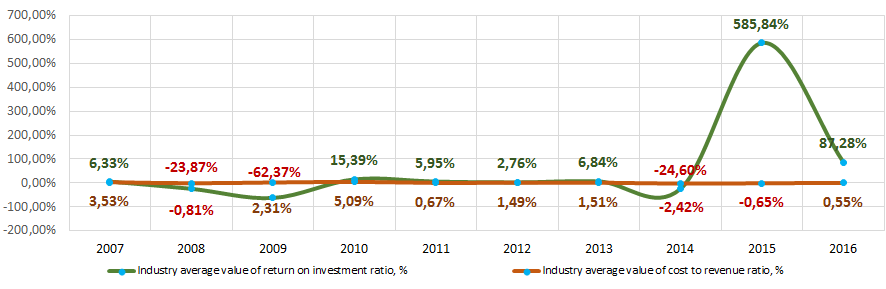

Picture 7. Change in industry average values of liquidity coverage ratio and solvency ratio of air transportation companies in 2007 – 2016The return on investment ratio was not stable during the decade. Ratio values became negative during economic downturn (in 2008, 2014, 2015), (Picture 8). It is a ratio of net profit to shareholders’ equity and noncurrent liabilities, and it demonstrates benefit from shareholders’ equity engaged in business activity and long-term raised funds of the company.

There is a similar trend in cost to revenue ratio (Picture 8). A 2015 skyrocketing growth might be caused by the exit from the market of one of the largest airlines in the country - PJSC Transaero Airlines. The ratio is calculated as a ratio of sales profit to operation costs. In general, it reflects production efficiency.

Picture 8. Change in industry average values of return on investment ratio and cost to revenue ratio of air transportation companies in 2007 – 2016

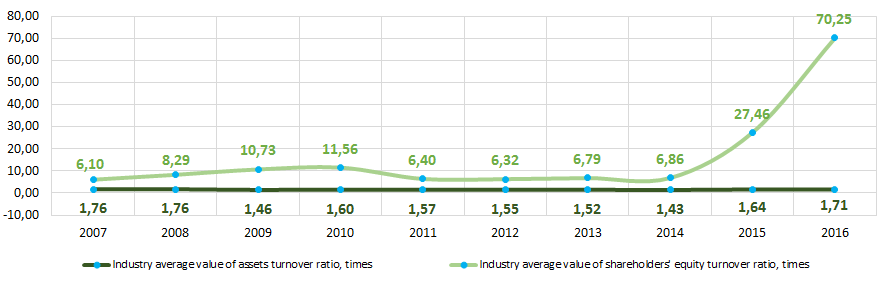

Picture 8. Change in industry average values of return on investment ratio and cost to revenue ratio of air transportation companies in 2007 – 2016Assets turnover ratio is relatively stable within the decade (Picture 9).

Assets turnover ratio is a ratio of sales revenue to average total assets for the period, and measures resource efficiency regardless of the sources. The ratio indicates the number of profit-bearing complete production and distribution cycles per annum.

Shareholders’ equity turnover ratio is a ratio of revenue to annual average shareholders’ equity, and indicates total assets usage rate.

There is a considerable increase in the ratio values in 2015 – 2016 (Picture 9).

Picture 9. Change in industry average values of activity ratios of air transportation companies in 2007 – 2016

Picture 9. Change in industry average values of activity ratios of air transportation companies in 2007 – 2016Structure of services

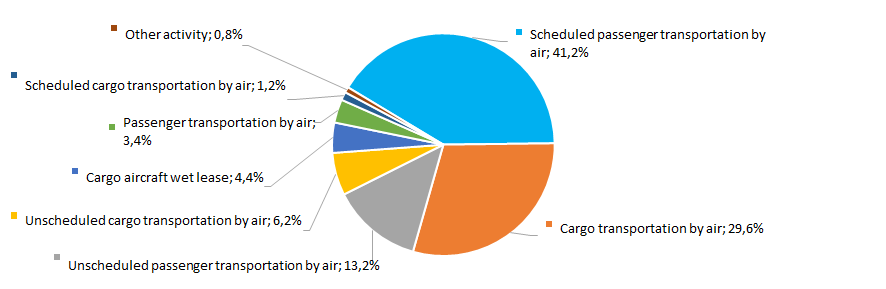

The most of TOP-500 companies specialize in passenger-carriage operations (Picture 10).

Picture 10. TOP-500 companies by types of services, %

Picture 10. TOP-500 companies by types of services, %Business activity trends

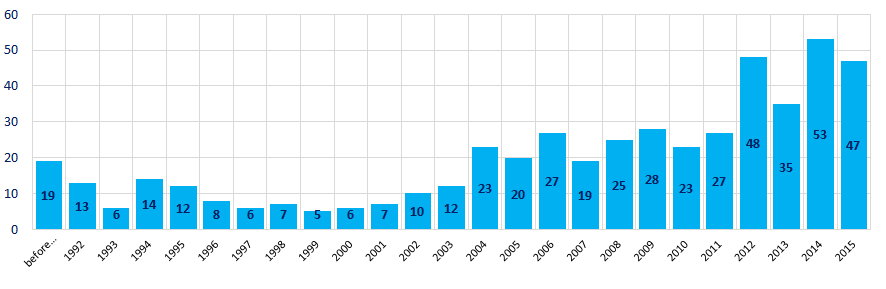

There is a diversity in distribution of registered TOP-500 companies by the year of their foundation within a 25-year period. The most of air transportation companies were founded in 2012 - 2015 (Picture 11).

Picture 11. ТOP-500 companies by the year of foundation

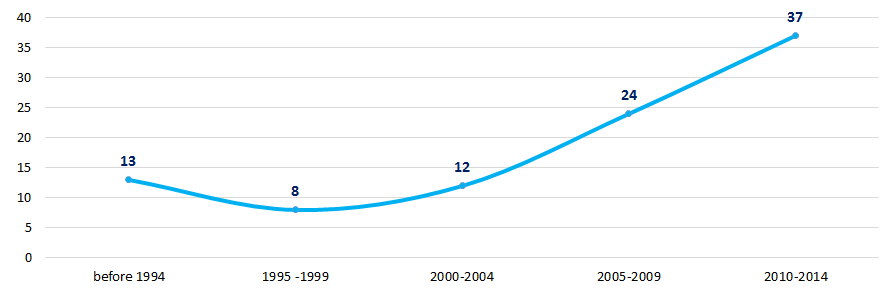

Picture 11. ТOP-500 companies by the year of foundationPrivate sector has shown the strongest interest to air transportation after 2010 when there were registered 37 new companies on average per year (Picture 12).

Picture 12. Average number of TOP-500 companies registered per year by their foundation periods

Picture 12. Average number of TOP-500 companies registered per year by their foundation periodsKey home regions

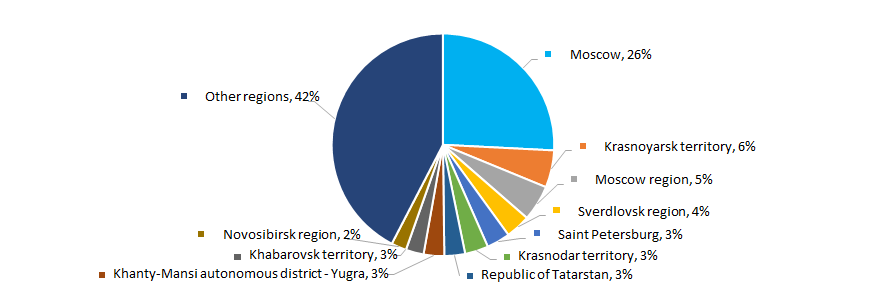

Air transportation companies are unevenly distributed throughout Russian territory. Most of them are registered in Moscow, the largest financial center of the country with an extensive transportation infrastructure (Picture 13). TOP-500 companies are registered in 71 region of Russia.

Picture 13. TOP-500 companies by Russian regions

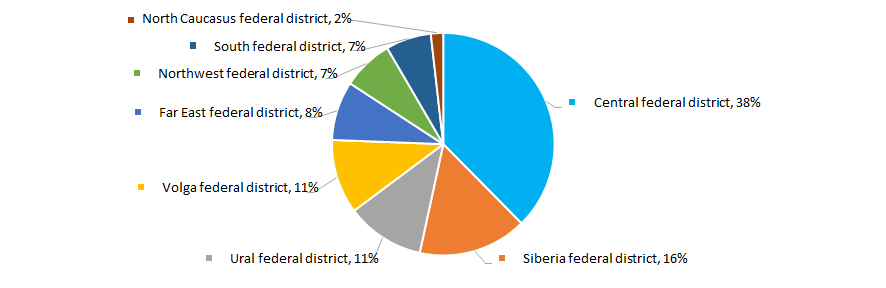

Picture 13. TOP-500 companies by Russian regionsThe most of air transportation companies are accumulated in the Central federal district (Picture 14).

Picture 14. TOP-500 companies by federal districts of Russia

Picture 14. TOP-500 companies by federal districts of Russia11% of TOP-500 companies have branches and representative offices.

Arbitration proceedings

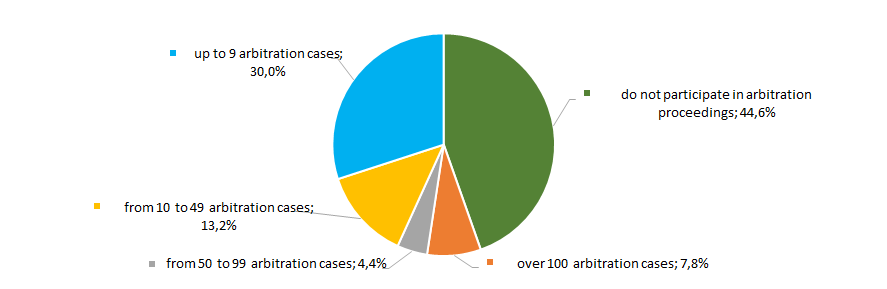

Most companies do not participate in arbitration proceedings. Active participants of arbitration hearings comprise a significant share, and this may be caused by the nature of transportation services (Picture 15).

Picture 15. TOP-500 companies by their participation in arbitration proceedings, %

Picture 15. TOP-500 companies by their participation in arbitration proceedings, %Reliability index

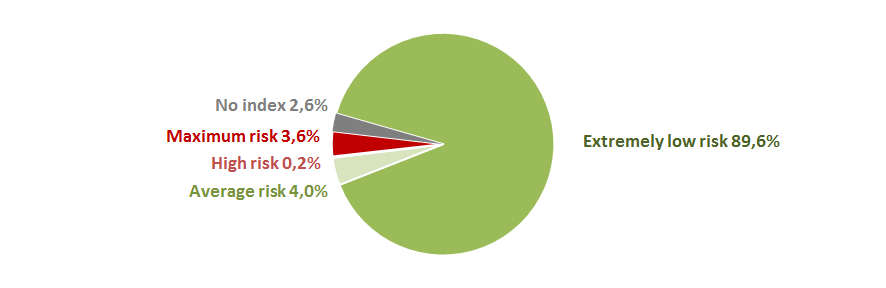

The risk of meeting a fly-by-night company or an unreliable company is extremely low within the most companies of the sector (Picture 16).

Picture 16. TOP-500 companies by Reliability index, %

Picture 16. TOP-500 companies by Reliability index, %Final position score

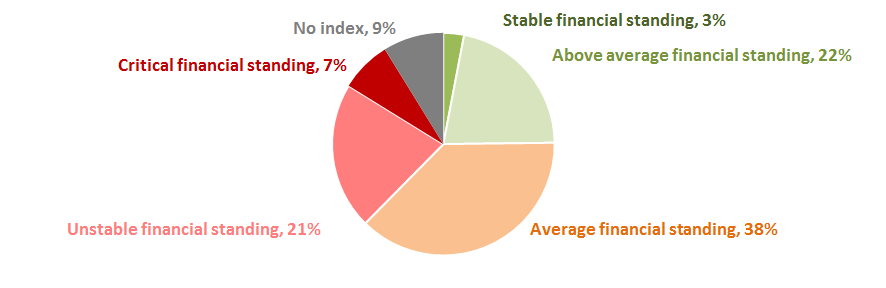

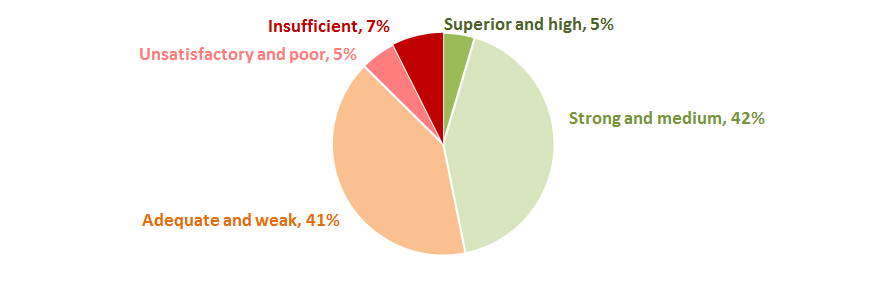

Assessment of financial state of the sector’s companies indicates that the most of the companies have an average financial standing. However, there is a significant share (28%) of companies that have an unstable or critical standing (Picture 17).

Picture 17. TOP-500 companies by Final position score, %

Picture 17. TOP-500 companies by Final position score, %Liquidity index

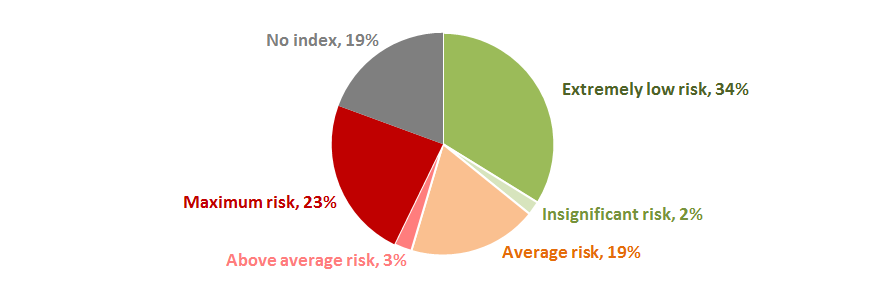

There is a minimal or insignificant risk of bankruptcy in the short term for the most companies of the sector (36%). However, a significant part of 23% of companies have maximum risks of going bankrupt (Picture 18).

Picture 18. TOP-500 companies by Liquidity index, %

Picture 18. TOP-500 companies by Liquidity index, %53% of TOP-500 air transportation companies have got an adequate, weak, unsatisfactory, poor or insufficient Solvency index Globas (Picture 19).

Together with key indexes, financial figures and ratios, this may speak of adverse trends within the industry.

Picture 19. TOP-500 companies by Solvency index Globas

Picture 19. TOP-500 companies by Solvency index GlobasService profitability of the largest Russian air transport service companies

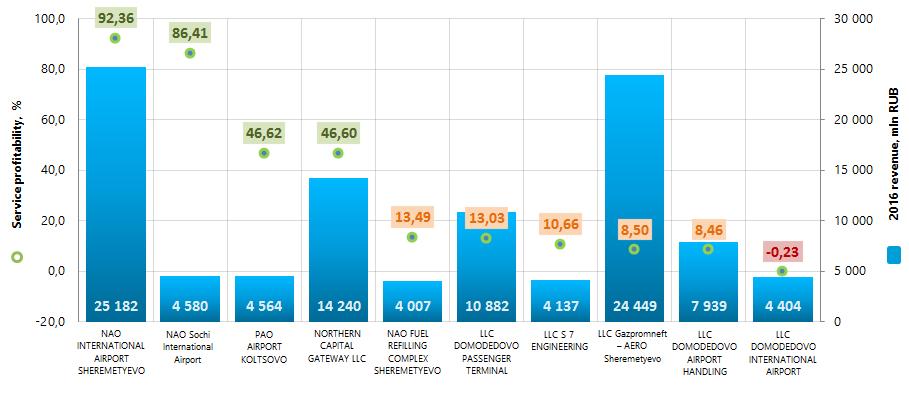

The largest enterprises (TOP-10) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2016 and 2015). Then the companies were ranged by service profitability ratio (Table 1). The analysis was based on data of the Information and Analytical system Globas.

Service or product profitability ratio (%) is a ratio of sales profit to general expenses. In general, the profitability characterizes the production efficiency. The analysis of service profitability allows to estimate the necessity of providing the services or carrying out works. There are no normative values for this group of ratios due to wide rage depending on the industry.

The calculation of practical values of financial indicators, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas by the experts of Information Agency Credinform, taking into account the actual situation of the economy as a whole and the industries. The practical value of service profitability ratio for the air transport service companies in 2016 starts from 26,28%.

For the most full and fair opinion about the company’s financial position, the whole set of financial indicators and ratios of the company should be taken into account.

| Name, INN, region | Net profit, mln RUB | Revenue, mln RUB | Service profitability ratio, % | solvency index Globas | |||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| NAO INTERNATIONAL AIRPORT SHEREMETYEVO INN 7712094033 Moscow region |

-7 860,4 | 15 523,8 | 22 911,1 | 25 181,6 | 60,67 | 92,36 | 217 Strong |

| NAO Sochi International Airport INN 2317044843 Krasnodar region |

857,2 | 1 405,3 | 3 623,5 | 4 579,6 | 51,27 | 86,41 | 203 Strong |

| PAO AIRPORT KOLTSOVO INN 6608000446 Sverdlovsk region |

719,5 | 700,4 | 4 425,1 | 4 564,4 | 46,74 | 46,62 | 183 High |

| NORTHERN CAPITAL GATEWAY LIMITED LIABILITY COMPANY INN 7703590927 Saint-Petersburg |

353,3 | 2 690,6 | 14 028,5 | 14 239,9 | 57,79 | 46,60 | 217 Strong |

| NAO FUEL REFILLING COMPLEX SHEREMETYEVO INN 5047058580 Moscow region |

-193,5 | 173,7 | 4 827,8 | 4 007,4 | 1,51 | 13,49 | 239 Strong |

| LLC DOMODEDOVO PASSENGER TERMINAL ИINN 5009097645 Moscow region |

507,3 | 1 484,3 | 11 023,0 | 10 882,4 | 13,07 | 13,03 | 249 Strong |

| LLC S 7 ENGINEERING INN 5009049835 Moscow region |

227,3 | 368,4 | 3 273,0 | 4 137,0 | 13,29 | 10,66 | 214 Strong |

| LLC Gazpromneft – AERO Sheremetyevo INN 5047095550 Moscow region |

54,9 | 1 421,2 | 22 761,2 | 24 448,6 | 0,05 | 8,50 | 176 High |

| LLC DOMODEDOVO AIRPORT HANDLING INN 5009096948 Moscow region |

-218,5 | 448,7 | 6 905,6 | 7 939,3 | 5,17 | 8,46 | 263 Medium |

| LLC DOMODEDOVO INTERNATIONAL AIRPORT INN 5009097148 Moscow region |

66,2 | -50,6 | 3 978,7 | 4 404,3 | 9,22 | -0,23 | 320 Adequate |

| Total for TOP-10 group of companies | -548,7 | 2 416,6 | 9 775,8 | 10 438,5 | |||

| Average value within TOP-10 group of companies | -54,9 | 241,7 | 977,6 | 1 043,8 | 25,88 | 32,59 | |

| Industry average value | -10,5 | 81,9 | 353,6 | 395,0 | 14,50 | 19,42 | |

In 2016 the average value of service profitability ratio in TOP-10 group of companies is higher than practical and industry average values. In 2016 four companies from TOP-10 list have values higher than practical value, five companies have values lower than practical value and one company (LLC DOMODEDOVO INTERNATIONAL AIRPORT) – has negative value of the ratio (green, orange and red color in column 6 and 7 of Table 1 and Picture 1 respectively).

Picture 1. Service profitability ratio and revenue of the largest Russian air transport service companies (TOP-10)

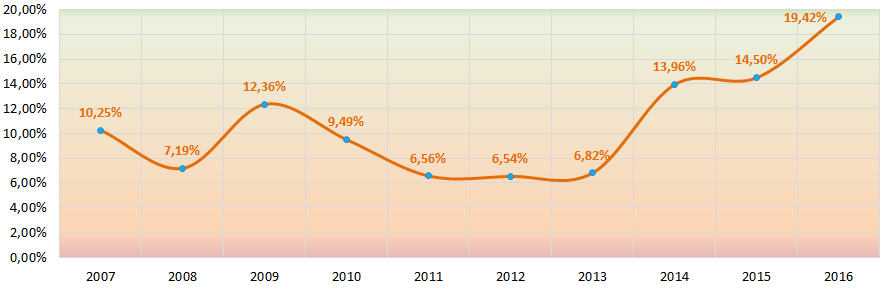

Picture 1. Service profitability ratio and revenue of the largest Russian air transport service companies (TOP-10)For the last 10 years, the average values of service profitability ratio were lower than practical values (Picture 2). This may be a sign of unfavorable trends in the industry.

Picture 2. The change of service profitability ratio average values within 2007-2016 for the Russian air transport service companies

Picture 2. The change of service profitability ratio average values within 2007-2016 for the Russian air transport service companiesNine companies from TOP-10 list have the upper levels of solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully.

LLC DOMODEDOVO INTERNATIONAL AIRPORT has low level of solvency index Globas due to participation as a defendant in debt collection arbitration proceedings, unclosed enforcement lists and losses in balance figures. The forecast for index development is stable.