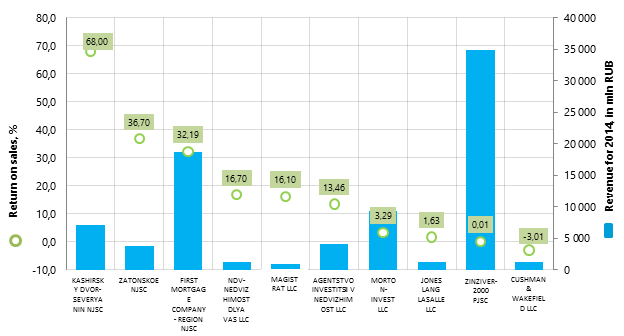

Return on sales of the Russian real estate companies

Information agency Credinform prepared a ranking of Russian real estate companies.

The companies with the highest volume of revenue (TOP-10) were selected for the ranking according to the data from the Statistical Register for the latest available accounting period (for the year 2014). Then they were ranked by decrease in return on sales ratio (Table 1).

Return on sales (%) is the share of operating profit in the company's sales volume. Return on sales reflects the efficiency of industrial and commercial activity. The ratio shows how much money remains by an enterprise in the result of the sale of products after covering its costs, loans interest’s expense and payment of taxes.

Return on sales is an indicator of company’s ability to control costs. Differences in sales strategies and product lines involve a wide range of return on sales values. Therefore, at equal values of revenue, operating expenses and pre-tax profit in two different organizations the return on sales can vary greatly under the influence of the volume of interest payments on the net profit.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to values of financial ratios, but also to all combination of financial and non-financial data.

| Name, INN, Region | Net profit for 2014, in mln RUB | Revenue for 2014, in mln RUB | Revenue for 2014, by 2013, % | Return on sales, % | Solvency index Globas-i |

|---|---|---|---|---|---|

| KASHIRSKY DVOR-SEVERYANIN NJSC INN 7706199246 Moscow |

-7 232,5 | 7 022,0 | 114 | 68,00 | 294 High |

| ZATONSKOE NJSC INN 5024062326 Moscow region |

798,5 | 3 702,6 | 157 | 36,70 | 204 High |

| FIRST MORTGAGE COMPANY - REGION NJSC INN 7729118074 Moscow region |

3 602,6 | 18 585,1 | 147 | 32,19 | 218 High |

| NDV-NEDVIZHIMOST DLYA VAS LLC INN 7701288005 Moscow |

14,2 | 1 208,2 | 128 | 16,70 | 175 The highest |

| MAGISTRAT LLC INN 7703561700 Moscow |

85,3 | 823,3 | 145 | 16,10 | 247 High |

| AGENTSTVO INVESTITSII V NEDVIZHIMOST LLC INN 5902190905 Perm territory |

250,9 | 4 088,9 | 153 | 13,46 | 199 The highest |

| MORTON-INVEST LLC INN 7714611150 Moscow |

117,4 | 9 296,6 | 183 | 3,29 | 203 High |

| JONES LANG LASALLE LLC INN 7710257780 Moscow |

283,3 | 1 203,4 | 93 | 1,63 | 236 High |

| ZINZIVER-2000 PJSC INN 7706215018 Moscow |

-688,1 | 34 831,2 | 200 | 0,01 | 272 High |

| CUSHMAN & WAKEFIELD LLC INN 7705637585 Moscow |

-118,7 | 1 218,8 | 105 | -3,01 | 159 The highest |

The company, leading in the industry in annual revenue for 2014 - ZINZIVER-2000 PJSC, takes the second-to-last place of the ranking. The enterprise showed the best revenue growth rate, and its share in the total revenue of TOP-10 made 42%.

The worst and a negative return on sales ratio in the TOP-10 belongs to CUSHMAN & WAKEFIELD LLC. Such result indicates that the cost of services is higher than the sales profit, the price is not high enough to cover all the costs, and the company's own assets are used inefficiently.

The best indicator was demonstrated by KASHIRSKY DVOR-SEVERYANIN NJSC. However, the same company showed also the largest loss at year-end 2014.

The average rate of return on sales amounted to 18,51% - in the group of TOP-10 companies, 14,69% - in the group of TOP-100 companies, by the industry average value of 6%.

Nine companies from the TOP-10 finished the year 2014 with positive dynamics of revenue. However, six companies have a decrease in net profit compared to the previous period. The same situation with revenue and net profit is observed in the group of TOP- 100 companies.

All TOP-10 companies got the highest and high solvency index Globas-i, that points to their ability to repay their debt obligations timely and fully, which risk of default is minimal.

The total amount of revenue of TOP-10 companies for 2014 amounted to 81,9 bln RUB, that is by 63% more than in 2013. In the group of TOP- 100 companies the revenue growth was 53% for the same period.

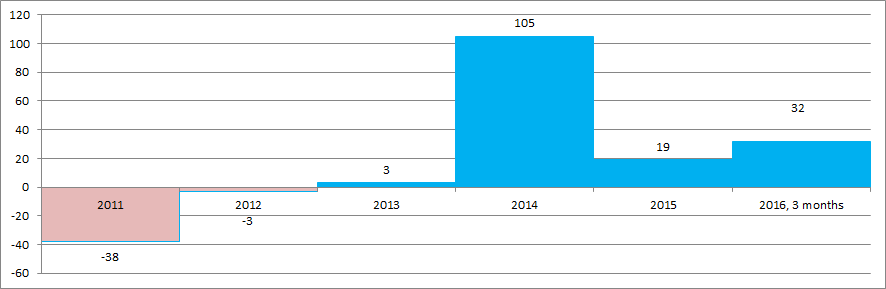

In general, the real estate industry shows a positive trend in revenue in recent years. This is evidenced by the information based on the data of the Federal State Statistics Service (Rosstat) (Picture 2).

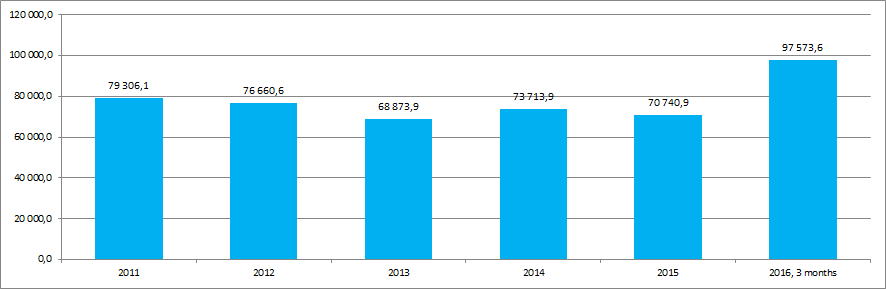

At the same time, the indebtedness under received credits and loans of real estate agencies, according to the same data of Rosstat, is at a very high level and tends to increase (Picture 3).

The real-estate companies are inclined to the most developed regions and first of all to the major financial center of the country - Moscow. Thus, according to the Information and analytical system Globas-i, 100 the largest companies on revenue for 2014 are registered in 27 regions. Most of them are registered in the following regions (TOP-7 Regions):

| Region | Number of companies |

|---|---|

| Moscow | 46 |

| Saint-Petersburg | 9 |

| Moscow region | 7 |

| Novosibirsk region | 5 |

| Perm territory | 4 |

| Republic of Tatarstan | 4 |

| Krasnodar region | 3 |

Problems of anti-crisis plan implementation

After long discussions, disputes and agreements, the 2016 anti-crisis plan was formed in the first quarter of the current year. The plan contained the measures in different sectors of the economy, the aim of which was to stimulate the economic growth. In the plan development process the rational approach was used; taking into account the high level of uncertainty, the approach implied the detailed calculation of costs, proving the feasibility of each measure, introduction of scenario assessment elements.

The first part of the plan included high priority measures focused on stabilization of economic situation using distribution and redistribution of budget funds, facilities allocated from the Government anti-crisis fund and the balances, which were not used by the departments in the past year. The second part of the plan didn’t require financing as it contained the structural measures related to creation of positive environment for business with the focus on ensuring freedom, assistance and support of small and medium-sized business.

The total sum of funds on realization of 2016 anti-crisis measures amounted approximately to 684,8 bln RUB. It was supposed to use different sources of financing: almost 468,32 bln RUB from the budget of the Russian Federation, 176,0 bln RUB from the anti-crisis fund. The volume and source of financing of the last sum had to be defined till the end of half-year period by revenue results.

Among the arranged measures, the following steps were expeditious:

- allocation of budget credits and subsidies to regions for refinancing of their debts to banks, promotion of employment of population in order to prevent the growth of unemployment, social payments to unemployed: the largest item of expenditure is 310 bln RUB, already 208,2 bln RUB are transferred as of the end of first half of the year;

- allocation of funds for the development of single-industry cities, including the co-financing of infrastructure facilities, which promote the realization of investment projects, creation of priority development areas in some regions (7,2 bln RUB);

- recapitalization of the largest banks: 100 bln RUB from the budget of the Russian Federation were transferred for the financial recovery of the State Corporation "Bank for Development and Foreign Economic Affairs (Vnesheconombank)", subsidies in the form of asset contribution on foreign borrowings amounted to 109,5 bln RUB;

- support of promising scientific and technical industries and important for the chain related industries, for example: motor industry (137,69 bln RUB planned), transport engineering (to 10 bln RUB), agricultural machine building (10,5 bln RUB), consumer goods manufacturing (1,4 bln RUB), housing construction, agriculture, the turnover of medicines, besides it is planned to transfer 39,8 bln RUB from the National Wellbeing Fund to RUSSIAN RAILWAYS for the purchase of locomotives;

- it is supposed to allocate 11,1 bln RUB from the budget of the Russian Federation for the support of small and medium-sized enterprises, creation of new enterprises and modernization of existing businesses.

At the July meeting of the Government of the Russian Federation it was noted, that according to the results of the first half of the year only 70 out of 120 anti-crisis measures were applied. Among the reasons of non-fulfillment were: non-allocation of the planned funds, non-receipt of them by the recipients (only the sixth part of its already distributed part was transferred from the anti-crisis fund) or non-use of them by the companies, as a result, the money stay at the bank accounts, bringing only the interest on deposits.

Besides, the Government didn’t define the source of financing for targeted support of single-industry cities (5,1 bln RUB required), stimulating the creation of new small and medium-sized enterprises (10 bln RUB), the expansion of grant program for small innovative enterprises (3 bln RUB), medical supply of certain categories of citizens (36,7 bln RUB), and also the second indexation of non-contributory pension. According to leading experts, the postponement of a decision on the source of financing may lead to enhancement in measures cost by more than 10% and amounted to 62,8 bln RUB.

Against the background of cost reduction the Government didn’t allocate the promised 38,9 bln RUB for RUSSIAN RAILWAYS, the program of state guarantees for loans attracted within the framework of project financing wasn’t renewed, the funds for high-tech export support wasn’t allocated although the Government has agreed to allocate only 7,5 bln RUB out of specified 13 bln RUB. It could be that the postponement of a decision on sources of financing for anti-crisis measures is connected with the opened discussion on the sources and volumes of financing for budget expenditure within 2017-2019.