Activity trends in IT-companies

Information agency Credinform has observed trends in the activity of the largest Russian IT-companies.

Enterprises with the largest volume of annual revenue (TOP-1000) were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2013-2018). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets is an indicator, reflecting the real value of company's property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest company in terms of net assets amount is LLC MAIL.RU, INN 7743001840, Moscow. In 2018 net assets of the company amounted to more than 129 billion RUB.

LLC STACK DATA NETWORK, INN 7713730490, Moscow, had the smallest amount of net assets in the TOP-1000 group. Case on declaring the company bankrupt (insolvent) is proceeding, supervision since 02.09.2019. Insufficiency of property of the company in 2018 was expressed in negative value -1,2 billion RUB.

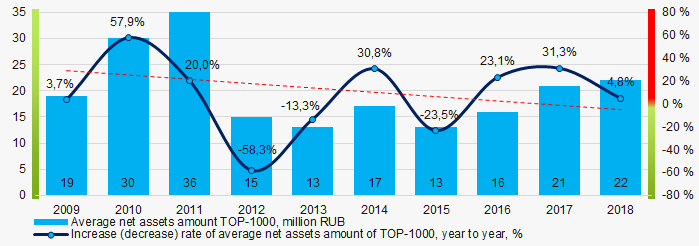

For a ten-year period average amount of net assets of TOP-1000 companies has decreasing tendency (Picture 1).

Picture 1. Change in average indicators of the net asset amount in 2009 – 2018

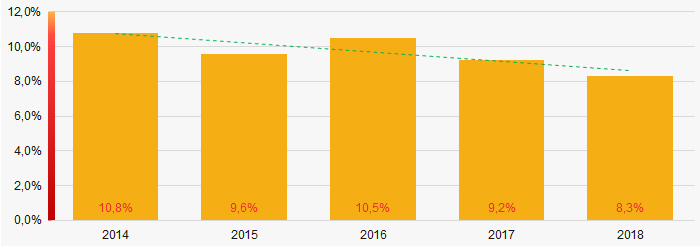

Picture 1. Change in average indicators of the net asset amount in 2009 – 2018Share of companies with insufficiency of property in the TOP-1000 demonstrate decreasing tendency for the last five years (Picture 2).

Picture 2. Shares of companies with negative values of net assets in TOP-1000 companies

Picture 2. Shares of companies with negative values of net assets in TOP-1000 companies Sales revenue

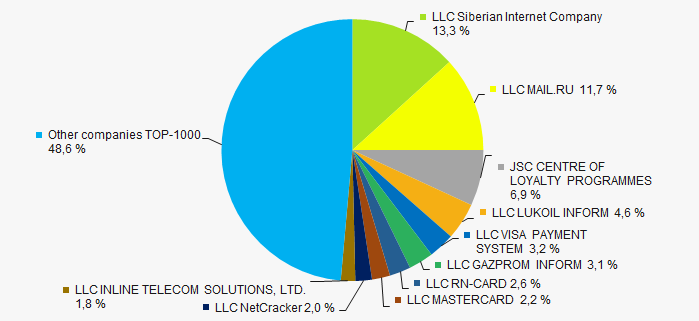

The revenue volume of 10 leaders of the industry made 51% of the total revenue of TOP-1000 companies in 2018 (Picture 3). It demonstrates high level of monopolization.

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 companies for 2018

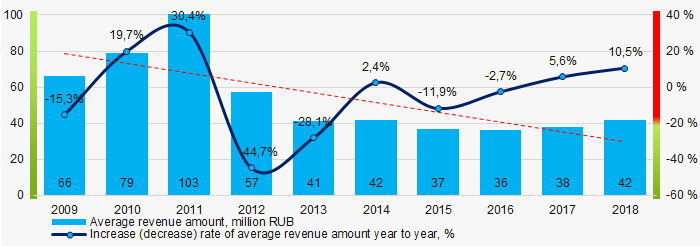

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 companies for 2018In general, a decreasing tendency in revenue volume is observed (Picture 4).

Picture 4. Change in the average revenue of TOP-1000 in 2009 – 2018

Picture 4. Change in the average revenue of TOP-1000 in 2009 – 2018Profit and losses

The largest company in terms of net profit amount also is LLC MAIL.RU, INN 7743001840, Moscow. Net profit of the company amounted to 5.8 billion RUB for 2018.

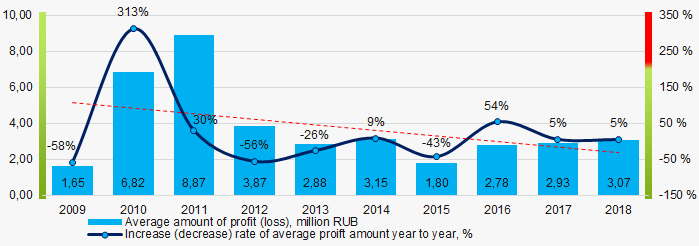

For the five-year period average industrial indicators of net profit in TOP-1000 have decreasing tendency (Picture 5).

Picture 5. Change in the average indicators of profit (loss) of TOP-1000 companies in 2009 – 2018

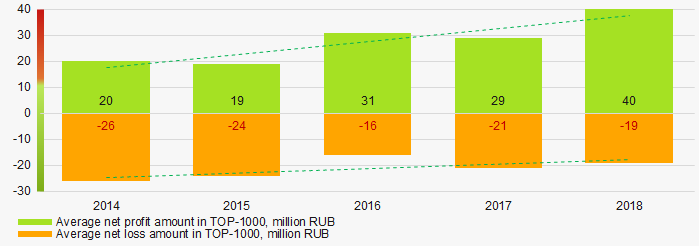

Picture 5. Change in the average indicators of profit (loss) of TOP-1000 companies in 2009 – 2018Over a five-year period, the average values of net profit indicators of TOP-1000 companies have increasing tendency. Besides, the average value of net loss decreases (Picture 6).

Picture 6. Change in the average indicators of net profit and loss of TOP-1000 companies in 2014 – 2018

Picture 6. Change in the average indicators of net profit and loss of TOP-1000 companies in 2014 – 2018Key financial ratios

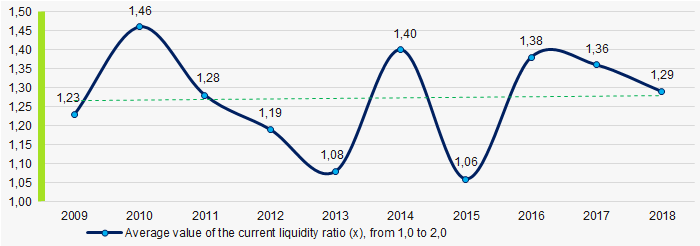

Over the five-year period the average indicators of the current liquidity ratio were within the range of recommended values – from 1,0 up to 2,0 with increasing tendency (Picture 7).

The current liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 7. Change in the average values of the current liquidity ratio of TOP-1000 companies in 2009 – 2018

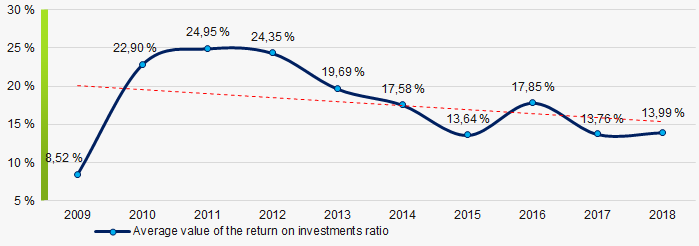

Picture 7. Change in the average values of the current liquidity ratio of TOP-1000 companies in 2009 – 2018 Average values of the indicators of the return on investment ratio have decreasing tendency for ten years (Picture 8).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity of own capital and the long-term borrowed funds of an organization.

Picture 8. Change in the average values of the return on investment ratio of TOP-1000 companies in 2009 – 2018

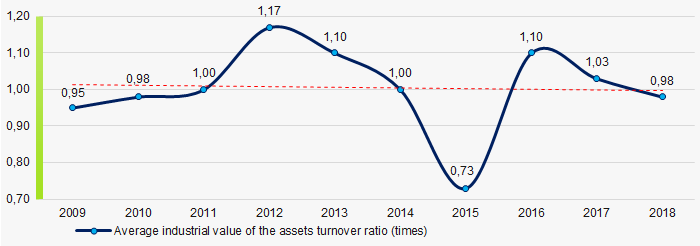

Picture 8. Change in the average values of the return on investment ratio of TOP-1000 companies in 2009 – 2018 Asset turnover ratio is calculated as the relation of sales revenue to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

This business activity ratio showed a tendency to decrease for a ten-year period (Picture 9).

Picture 9. Change in the average values of the assets turnover ratio of TOP-1000 companies in 2009 – 2018

Picture 9. Change in the average values of the assets turnover ratio of TOP-1000 companies in 2009 – 2018Small business

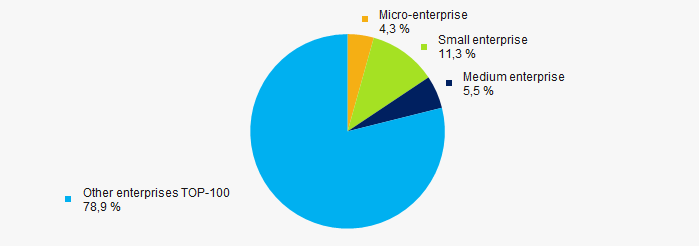

78% of the TOP-1000 companies are registered in the Register of small and medium enterprises of the Federal Tax Service of the RF. Besides, share of revenue in the total volume is 21,1%, that is equal to the average indicator countrywide (Picture 10).

Picture 10. Shares of small and medium enterprises in TOP-1000 companies, %

Picture 10. Shares of small and medium enterprises in TOP-1000 companies, %Main regions of activity

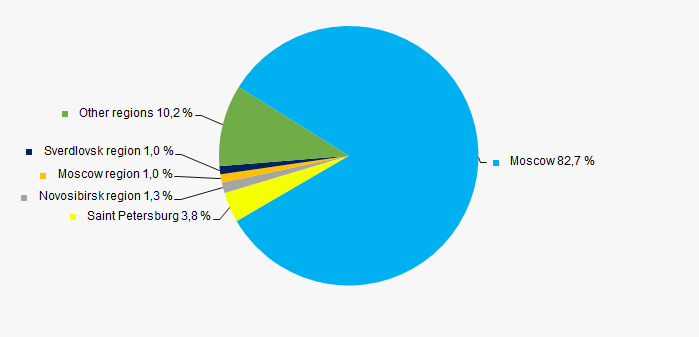

TOP-1000 enterprises are unequally distributed along the territory of Russia and registered in 73 regions. Almost 83% of the largest enterprises in terms of revenue volume is concentrated in Moscow (Picture 11).

Picture 11. Distribution of TOP-1000 companies by regions of Russia

Picture 11. Distribution of TOP-1000 companies by regions of Russia Financial position score

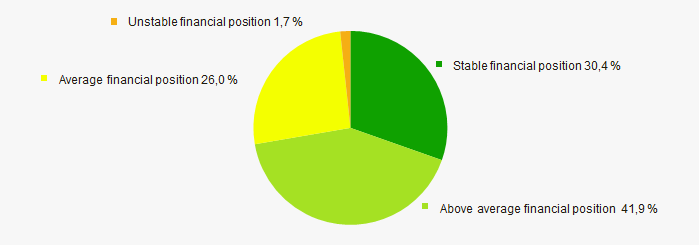

An assessment of the financial position of TOP-1000 companies shows that the largest number is in an above average financial position. (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

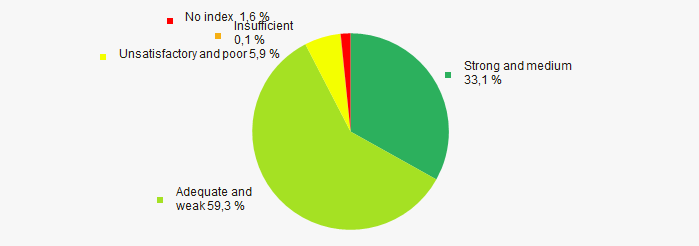

Most of TOP-1000 companies have got from Medium to Superior Solvency index Globas, that points to their ability to repay their debts in time and fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index GlobasConclusion

Comprehensive assessment of the activity of largest Russian IT-companies taking into account the main indexes, financial indicators and ratios, demonstrates the presence of favorable trends (Table 1).

| Trends and assessment factors | Share of factor, % |

| Rate of increase (decrease) of average amount of net assets |  -10 -10 |

| Increase / decrease of share of companies with negative values of net assets |  10 10 |

| Level of competition |  -10 -10 |

| Increase (decrease) rate of average revenue amount |  -10 -10 |

| Increase (decrease) rate of average net profit (loss) amount |  -10 -10 |

| Increase / decrease of average net profit amount of TOP-1000 companies |  10 10 |

| Increase / decrease of average net loss amount of TOP-1000 companies |  10 10 |

| Increase / decrease of average industrial values of the current liquidity ratio |  10 10 |

| Increase / decrease of average industrial values of the return on investments ratio |  -10 -10 |

| Increase / decrease of average industrial values of the assets turnover ratio, times |  -10 -10 |

| Share of small and medium enterprises in the industry in terms of revenue volume more than 21% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (major share) |  10 10 |

| Solvency index Globas (major share) |  10 10 |

| Average value of factors |  0,0 0,0 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).

Amendments to the law on unitary enterprises

The Federal Law №485-FZ dated December 27, 2019 amended the Federal Laws «On state and municipal unitary enterprises» and «On protection of competition».

The amendments limit the fields of activity of unitary enterprises. So, it was established that the purposes of unitary enterprises can be:

- ensuring of the work of the Ministry of Defense and the Russian Guard (Rosguard);

- carrying out of works in the areas of activity of natural monopolies and radioactive waste management;

- elimination of consequences of emergency situations and prevention of threats to the normal functioning of the population;

- use of complexes of sea ports that are strictly federal property;

- activity outside the territory of Russia;

- activity of cultural, art, cinema and cultural property protection institutions;

- ensuring of the life of population in the Far North and equivalent localities.

In all other competitive product markets, the establishment of an unitary enterprise is prohibited since January 8, 2020. Existing unitary enterprises are subject to liquidation or reorganization by decision of shareholders until January 1, 2025.

At the same time, state bodies or organizations authorized to create an unitary enterprise have the right to send requests for compliance of enterprises’ activity with the legislation to the Federal Antimonopoly Service of the RF.

In cases of detection of unitary enterprises founded or functioning with violations of the law, the antimonopoly authorities are required to notify founders of the obligation to liquidate such enterprises. In case of refusal to comply with these requirements, unitary enterprises are liquidated compulsorily by a court order at the suit of antimonopoly bodies.

Subscribers of the Information and Analytical system Globas have the opportunity to get acquainted with the activity of all state and municipal unitary enterprises. In total, the system provides information about more than 12 700 operating and 32 700 inactive enterprises.