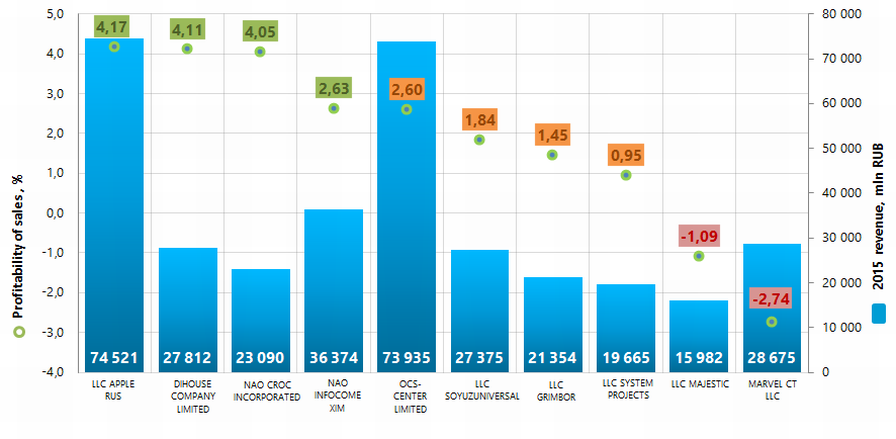

Profitability of sales of the largest Russian wholesalers of information and communication equipment

Information Agency Credinform has prepared the ranking of the largest Russian wholesalers of information and communication equipment. The largest enterprises (TOP-10) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2015 and 2014). Then the companies were ranged by 2015 profitability of sales ratio (Table 1). The analysis was based on data of the Information and Analytical system Globas.

Profitability of sales (%) is the share of operating profit in the sales volume of the company. The ratio characterizes the efficiency of the industrial and commercial activity and shows the company’s funds, which remained after covering the cost of production, interest and tax payments.

The rage of ratio’s values within companies of the same industry is defined by the differences in competitive strategies and product lines. Therefore, it should be taken into account, that at equal values of revenue, operational expenses and profit before tax, the profitability of sales ratio of two companies can be different due to the influence of interest payments on net profit.

The calculation of practical values of financial indicators, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas by the experts of Information Agency Credinform, taking into account the actual situation of the economy as a whole and the industries. The practical value of profitability of sales ratio for the wholesalers of information and communication equipment starts from 2,63%.

For the most full and fair opinion about the company’s financial position, the whole set of financial indicators and ratios of the company should be taken into account.

| Name, INN, region | Net profit, mln RUB * | Revenue, mln RUB * | Profitability of sales, % | Solvency index Globas | ||||

| 2014 | 2015 | 2016 | 2014 | 2015 | 2016 | |||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| LLC APPLE RUS INN 7707767220 Moscow |

1 343,4 | 7,2 | 6 452,2 | 96 057,4 | 74 520,9 | 123 565,1 | 4,17 | 191 The highest |

| DIHOUSE COMPANY LIMITED INN 7709751313 Moscow |

1 301,3 | 509,7 | 634,7 | 38 722,2 | 27 811,7 | 39 236,5 | 4,11 | 215 High |

| NAO CROC INCORPORATED INN 7701004101 Moscow |

502,0 | 383,2 | 353,1 | 22 455,1 | 23 090,1 | 24 095,8 | 4,05 | 212 High |

| NAO INFOCOMEXIM INN 7733562074 Moscow |

123,1 | 1 086,2 | 529,2 | 20 978,1 | 36 374,4 | 29 860,6 | 2,63 | 222 High |

| OCS-CENTER LIMITED INN 7701341820 Moscow |

612,4 | 773,5 | 999,6 | 86 229,6 | 73 934,8 | 92 616,8 | 2,60 | 218 High |

| LLC SOYUZUNIVERSAL INN 7701153505 Moscow |

7,3 | 200,0 | -68,3 | 10 421,0 | 27 374,7 | 25 208,6 | 1,84 | 251 High |

| LLC GRIMBOR INN 7707798531 Moscow |

2,3 | 38,5 | н/д | 20 494,8 | 21 354,1 | н/д | 1,45 | 262 High |

| LLC SYSTEM PROJECTS INN 7838502682 Saint-Petersburg |

1,0 | 105,2 | 31,7 | 776,4 | 19 665,0 | 6 562,6 | 0,95 | 284 High |

| LLC MAJESTIC INN 7701621619 Moscow |

1,6 | 1,7 | 4,5 | 5 386,6 | 15 981,6 | 11 867,4 | -1,09 | 231 High |

| MARVEL CT LLC INN 7811365157 Moscow |

59,0 | 122,1 | 2 407,6 | 9 320,8 | 28 674,9 | 63 877,9 | -2,74 | 207 High |

| Total for TOP-10 group of companies | 3 953,4 | 3 227,5 | 310 842,0 | 348 782,4 | ||||

| Average value within TOP-10 group of companies | 395,3 | 322,7 | 31 084,2 | 34 878,2 | 1,80 | |||

| Industry average value | 1,3 | 2,3 | 210,7 | 83,6 | 2,63 | |||

*2016 data is for reference

The average value of profitability of sales ratio in TOP-10 group of companies is lower than practical value. Four companies have values higher than practical value (green color in column 8 of Table 1 and Picture 1). The negative value of the ratio have two companies (red color in column 8 of Table 1 and Picture 1). In 2015 four companies from TOP-10 list have decrease in revenue and net profit in comparison with previous period (red color in 3 and 6 columns of Table 1).

Picture 1. Profitability of sales and revenue of the largest Russian wholesalers of information and communication equipment (TOP-10)

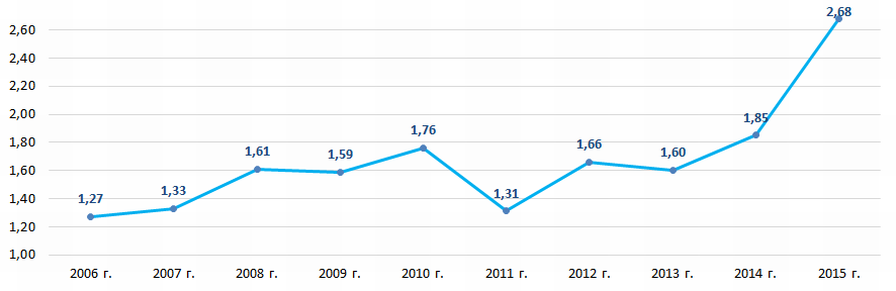

Picture 1. Profitability of sales and revenue of the largest Russian wholesalers of information and communication equipment (TOP-10)In general, the average values of profitability of sales within 2006 – 2015 (Picture 2) have the upward trend. Over the past 10 years, the ratio value decreased only three times in 2009, 2011 and 2013.

Picture 2. The change of profitability of sales average values within 2009-2015 for the wholesalers of information and communication equipment

Picture 2. The change of profitability of sales average values within 2009-2015 for the wholesalers of information and communication equipmentAll companies from TOP-10 list have the highest or high solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully.

Obligatory requirements to founders and management bodies of financial institutions are strengthened

According to the Federal Law No. 281-FZ of July 29, 2017 “On the amendments to individual legislative acts of the Russian Federation improving obligatory requirements for the founders (participants), management bodies and officials of financial institutions ”, prosecution for premeditated or fraudulent bankruptcy of credit institution is a reason for future rejection of the Central Bank of the RF (the Central Bank) to review such persons being appointed to executive positions in banks, as well as rejection of taking a significant stake in the capital.

The law amended the Federal laws “On banks and banking activities ”, “On the Central Bank of the Russian Federation (Bank of Russia)”, “On non-state pension funds”, “On investment funds ”, “On microfinance activity and microfinance organizations”, “On organization of insurance activity in the Russian Federation” and other laws concerning financial activity.

The amendments established the following provisions:

- - with its legislative instruments the Central Bank has the right to specify requirements to financial situation of legal entities of credit institutions. This is also applied to legal entities (shareholders) holding over 10% of shares (stakes) or controlling such shareholders, as well as to legal entities (shareholders) holding less than 10% of shares (stakes) and being included in the group of entities holding over 10% of shares (stakes) or controlling such shareholders (participants);

- - top executives of insurance organizations (appointed or elected in agreement with the insurance supervisors) were specified as being complied with qualifying and goodwill requirements. Criteria of non-compliance with goodwill requirements were specified as well;

- - requirements to financial situation and goodwill of founders or participants of management companies (applied or elected by the Central Bank) were set;

- - the procedure of administration of complaints by the Central Bank concerning decisions on recognition of persons not meeting qualifying and goodwill requirements was specified;

- - taking into account the norms of the Federal Law “On insolvency (bankruptcy)”, the positions for assessing goodwill of chief officers, members of the boards of directors or supervisory boards, purchasers and owners of more than 10% of shares (stakes), controllers, individual executive bodies of credit institutions and microfinance companies were adjusted;

- - appointing or electing chief executive officers and deputy chief executive officers, members of the collegial executive body, chief accountants and their deputies of microfinance companies (including branches), is carried out only upon preliminary agreement with the Central Bank. At the same time, appropriate requirements are established for the founders or participants of the microfinance company and for making transactions with their shares (stakes).

The Federal Law will come into force from January 28, 2018.

Assessing the adopted amendments, experts note that sanctions for violation of goodwill requirements apply almost to the entire financial market - insurance companies, non-state pension funds, management companies of investment funds, mutual funds and microfinance companies. For chief officers and owners who led a credit institution to criminal bankruptcy or repeatedly violated the requirements, a lifetime disqualification in business and ban on holding more than 10% of the shares of any bank were introduced. For other violators the period of professional disqualification has been doubled, i.е. up to 10 years.

Before the signing of this Federal Law, the Central Bank began posting data on its website on bringing the officials of credit institutions which were declared insolvent (bankrupt) to civil and criminal liability for the period from 2005. Previously, such information was not published. As of June 19, 2017, this list contains information on 287 banking and non-banking credit organizations and about 213 individuals.

Subscribers of the Information and Analytical system Globas have possibility to get acquainted with activity of all banking and non-banking credit institutions and their branches with active licenses. The System also contains information about all credit institutions and their branches with revoked licenses.