Consolidated financial statements. For what, to whom and in what form to prepare

Consolidated financial statements is a financial data reporting of a group of companies, in which assets, liabilities, capital, income, expenses and cash flows of the parent enterprise and its subsidiary enterprises are presented as assets, liabilities, capital, income, expenses and cash flows of a single economic entity.

In Russia the preparation and submission of consolidated financial statements is governed by the same-name Federal law №208-FZ "On consolidated financial statements" from 27.07.2010 and the International Financial Reporting Standards (IFRS).

Successfully developing Russian companies face inevitably a question of attracting additional investments, including foreign ones. By establishing standards on the preparation of consolidated financial statements in accordance with IFRS rules, lawmakers aim to make financial statements of companies more transparent and attractive for investors. In fact most often by preparation of reporting in accordance with RSA the main task become not the formation of full-fledged information about company's financial position, but tax optimization and minimization of claims from the part of inspection authorities.

In 2014 the number of companies required to prepare, submit and publish consolidated financial statements in accordance with IFRS, was significantly expanded. Now it includes:

- credit institutions;

- insurance companies (except health insurance companies, operating exclusively in the field of obligatory health insurance);

- non-state pension funds;

- management companies of investment funds, mutual funds and non-state pension funds;

- clearing organizations;

- federal state unitary enterprises, the list of which is approved by the Government of the Russian Federation;

- open joint stock companies, whose shares are federally owned and a list of which is approved by the Government of the Russian Federation;

- other organizations, whose securities are admitted to organized trading by their inclusion in the quotation list.

There are several methods to carry out the consolidation. The choice of one or another method depends on the degree of influence of the parent company. So, for subsidiary enterprises (the interest is more than 50%) the acquisition method is of the priority, and for associated companies and joint ventures (the interest is from 20 up to 49%) – the equity method. By this, a number of procedures is the common one regardless of the method: the statements of parent company and controlled entity must be prepared as of the same accounting date, it must be complied with unified accounting policy.

To be acquainted with consolidated statements of group companies you can use the database of the Information and analytical system Globas-i®.

Is there a future for small and medium-sized business?

Dear Madams and Sirs,

St. Petersburg Economic Forum will be held in Saint-Petersburg on 18th June 2015. One of the issue for discussion is “Small and medium-sized business as a driver of the Russian economy growth”. Shortly before the Forum, the experts of the Credinform information agency have analyzed the small and medium-sized business (SMB) dynamism in Russia and assessed its prospects.

In 2014 the total amount of SMB subjects (here and after excluding the individual entrepreneurs) has grown by 1,7% compared to 2013, and reached 2,1 mln, 88% whereas accounts for micro-enterprises, 11% for small and 1% for medium-sized enterprises.

On the 27th January 2015 the Government of the RF has enacted the crisis bailout plan of high priority measures aimed at sustainable economic development and social stability in the year of 2015. Within its frameworks it was suggested to double the value limit of sales revenue for counting the economic entities as SMB categories. This measure will undoubtedly influence the number of enterprises fall into small and medium-sized.

Despite of the Federal program of financial support for SMB acting in Russia since 2005, the share of these enterprises in the national economy is still low. As of the year 2014, the SMB share in the Russian GDP is 29,3%. As a comparison, this figure ranges from 40% to 70% in the EU countries, developed Asian countries and the USA. According to the conclusion of the Organisation for Economic Co-operation and Development (OECD), the countries with SMB share of 60-70% effectively overcome the crisis, than countries with lower share.

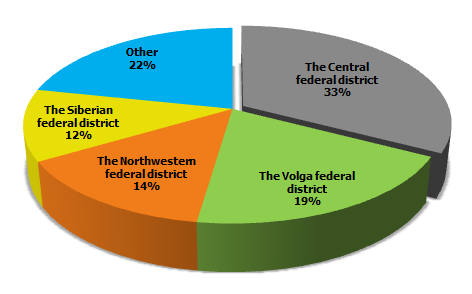

The experts also notice the high degree of SMB enterprises regional aggregation. For example, 33% of small business enterprises are located in the Central federal district, 19% of which accounts for Moscow and the Moscow region. This situation undoubtedly has a negative impact on the formation of regional budgets.

Figure 1. The scheme of SMB enterprises by the regions

17 bln. RUB will be distributed for SMB support within the frameworks of the Economic development and innovative economy program. The majority of funds will be send to the Moscow region (817 mln. RUB), the Krasnodar Territory (623 mln. RUB) and Saint-Petersburg (600 mln. RUB). It is expected that the federal money will increase the capitalization of regional SMB support programs.

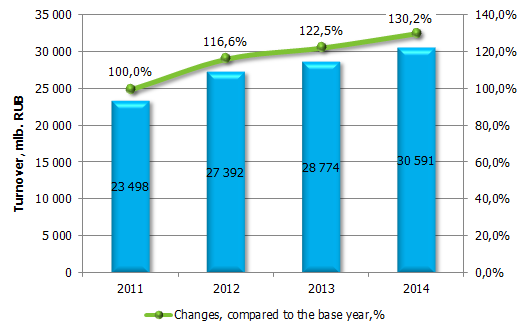

According to the Information and analytical System Globas-i®, the SMB total turnover amounted to 30,5 bln. RUB at 2014 year-end. More than a half (54,6%) accounts for small enterprises, 31,5% for micro-enterprises and 13,7% for medium-sized.

Figure 2. Turnover dynamics of SMB in Russia, mln. RUB

Sectorial specific nature of small and medium-sized business remains pretty much the same: the main lines of business are trade (32%) and services provision (19,6%), as well as processing industry (14,3%) and construction (12,3%).

The following problems, thwarting progress, should be noted: instability of the legislation in the field of tax and financial regulation, problems of access to funding sources, keeping of high level of administrative barriers, problems of finding sales markets, as well as low level of entrepreneurial activity among the population and a lack of qualified employees. Concerning tax legislation, the government has already prepared a proposal for a moratorium on imposing the new tax payments for the next three years. However, the situation with access to sources of finance is not so rosy firstly due to the almost blocking-off loans value. Loans for business remain unavailable. Perhaps, the Russian government in the near future will continue to take certain steps to support individual business sectors - in the form of subsidies or issuing guarantees.

As foreign experience shows, SMB companies can contribute in improvement of the socio-economic situation during the crisis, being a sort of “safety bag”. Under the stability they are able to provide an opportunity for the efficient economic growth. But the government should get the effective cooperation policy for realization of SMB potential. First of all, this policy should be aimed at integration of SMB enterprises in associations and unions, improvement of interaction with large business, as well as reduction of the administrative pressure.

For all information on enterprises, as well as subjects of small and medium-sized business and analytical reports on various economic sectors you can refer to our Custom Service Department specialists:

+7 (812) 406 8414 (Saint-Petersburg), +7 (495) 640 4116 (Moscow).