High-growth companies will determine the future of the economy

Dynamically developing companies create new markets, implement technologies, set professional standards and form consumer preferences. The key condition for gazelle companies is high growth rate: minimum by 20-30% annually for at least 4 years. Gazelle companies are the most successful and stable-growing companies, providing new jobs, contributing to the GDP increase, and being able to influence the domestic economy growth and be the marker of structural changes.

Are the Russian gazelles able to become the engine of the economy?

The Russian gazelle companies were studied with the Information and Analytical system Globas. Companies with at least 30% of annual growth were selected out of 3,5 million active commercial entities. Revenue exceeding 50 million RUB, and positive net assets were recorded for these companies in 2018.

Regions of activity

About 1% or a little over 3 thousand Russian entities fall under the gazelles criteria. Total 2018 turnover of 5,2 trillion RUB is 2,8% of turnover of all entities. There are from 1% to 5% of gazelle companies in developed economies. At the same time, up to 50% of GDP growth fall for their share.

The majority or 26% of gazelles are located in Moscow, 9% - in Saint Petersburg, and 6% - in Moscow region. By total revenue, high-growth companies from Saint Petersburg are almost close to those from Moscow: gazelles from Saint Petersburg accumulate 1,3 trillion RUB of revenue, and the Moscow ones have 1,5 trillion RUB. Other regions are significantly behind the leaders by both the number of companies and total revenue.

Gazelles are presented in almost all subject of Russia, excluding the Republics of Dagestan and Ingushetia, and sparsely populated Chukotka and Nenets autonomous districts.

Size of the Russian gazelles

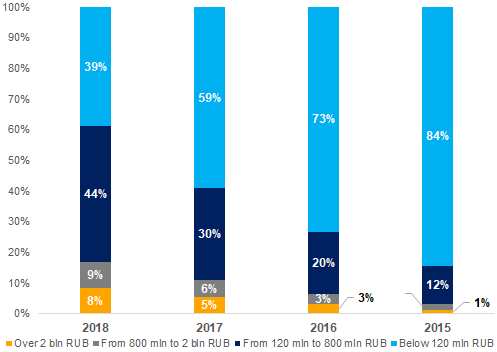

The majority of high-growth companies do not fall under the category of large business. Only 8% of companies have 2018 revenue exceeding 2 billion RUB. 44% of total number of gazelles have revenue from 120 million RUB to 800 million RUB.

In general, high-growth companies became lager for the researched 4 years: in 2015, the revenue of 1% of gazelles exceeded 2 billion RUB. The main share fell for companies with turnover up to 120 million RUB (see Picture 1).

Picture 1. Distribution of high-growth companies by annual revenue

Picture 1. Distribution of high-growth companies by annual revenueEconomic sectors

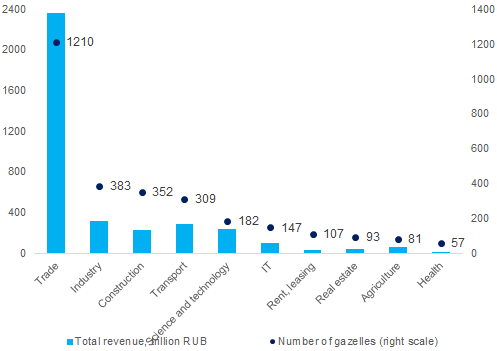

1 210 companies or 38% of total number of gazelles are engaged in wholesale and retail trade. This sector accumulates the majority of total revenue: 2,4 trillion RUB or 45% of total gazelles’ revenue (see Picture 2).

There are no gazelles in mining. Mainly large companies occupy this sector, and the majority of gazelles are medium-sized and small companies.

Picture 2. Distribution of high-growth companies by economic activity; total revenue for 2018

Picture 2. Distribution of high-growth companies by economic activity; total revenue for 2018Leaders

Table 1 presents the largest gazelles in term of revenue. They are included in TOP-10 of economic sectors with the highest number of gazelles involved. The table contains well-known brands, such as Pyatyorochka retail chain, airline company AZUR air, Spasibo by Sberbank and companies engaged in industries the products of which have until recently been mainly imported (production of large-diameter pipes, for instance).

Table 1. TOP-10 of sectors by the number of high-growth companies represented by the revenue leaders

| Rank | Sector | Company | Revenue in 2018, billion RUB | Average growth of revenue in 2015-2018, % | Scope of business |

| 1 | Trade | LLC AGROTORG | 1 036 | 75 | Pyatyorochka retail chain |

| 2 | Industry | ZAGORSK PIPE PLANT JSC | 39 | 317 | Production of large-diameter pipes |

| 3 | Construction | LLC SPETSTRANSSTROY | 21 | 701 | Construction of transport infrastructure |

| 4 | Transport | AZUR air LLC | 44 | 174 | Charter service |

| 5 | Science and technology | JSC NIPIGAZPERERABOTKA | 115 | 167 | Development and design in oil and gas industry |

| 6 | Information technologies | JSC CENTRE OF LOYALTY PROGRAMMERS | 26 | 57 | Spasibo service by Sberbank |

| 7 | Rent, leasing | LLC LIZPLAN RUS | 3 | 214 | Corporate car leasing |

| 8 | Real estate | LLC OPERATOR OF COMMERCIAL REAL ESTATE | 11 | 1 635 179 | Lease of storage facilities |

| 9 | Agriculture | LLC AGROTEK-VORONEZH | 7 | 249 | Pork production |

| 10 | Health | LLC A410 | 2 | 197 | Aesthetic pharmaceuticals and cosmetology under the Allergan brand |

Conclusion

The number of the Russian high-growth companies is compatible by the level with the developed economies. However, their contribution to the domestic product is significantly less. The potential of the Russian gazelles is not unleashed yet. The majority of high-growth companies by both the number and total revenue are engaged in trade and this sector creates no higher value-added unique product. Only after the existing imbalance is eliminated through the accelerated development of industry, IT and science, it will be possible to talk about the qualitative transformation of domestic GDP, including due to the contribution of gazelle companies.

Trends in heat power industry

Information agency Credinform represents an overview of activity trends of the largest Russian thermal power enterprises.

Enterprises with the largest volume of annual revenue (TOP-1000), producing steam and hot water, were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2013 - 2018). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets value is an indicator, reflecting the real value of company’s property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest thermal power enterprise in terms of net assets is MOSCOW INTEGRATED POWER COMPANY PJSC, NN 7720518494. Its net assets amounted to more than 132 billion rubles in 2018.

The smallest amount of net assets in the TOP-1000 list was hold by REMONTNO-EKSPLUATATSIONNOE UPRAVLENIE NJSC, INN 7714783092, (process of being wound up, 20.10.2015). The insufficiency of property of this company in 2018 was expressed as a negative value of -60,5 billion rubles.

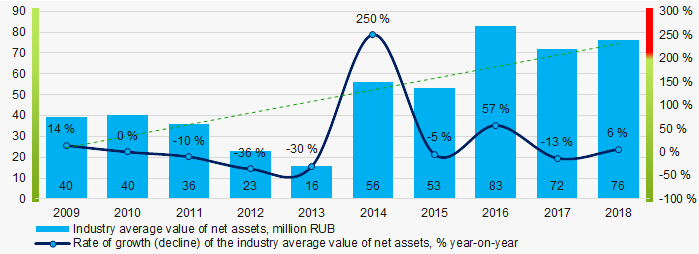

The industry average values of net assets tend to increase over the ten-year period (Picture 1).

Picture 1. Change in the industry average indicators of the net asset value in 2009 – 2018

Picture 1. Change in the industry average indicators of the net asset value in 2009 – 2018The shares of TOP-1000 enterprises with insufficiency of assets have a tendency to increase in the last five years (Picture 2).

Picture 2. Shares of enterprises with negative values of net assets in TOP -1000

Picture 2. Shares of enterprises with negative values of net assets in TOP -1000Sales revenue

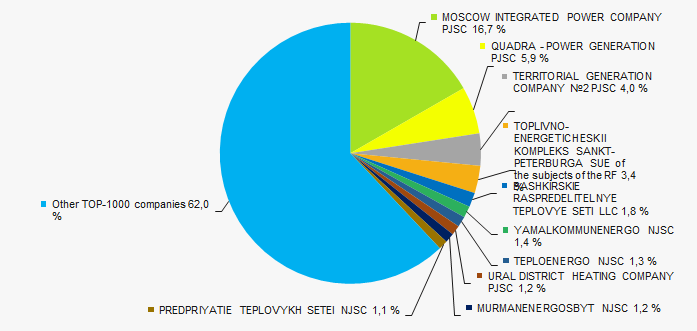

The revenue volume of 10 leading companies of the industry made 38% о of the total revenue of TOP-1000 in 2018. (Picture 3). It points to a relatively high level of monopolization.

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises for 2018

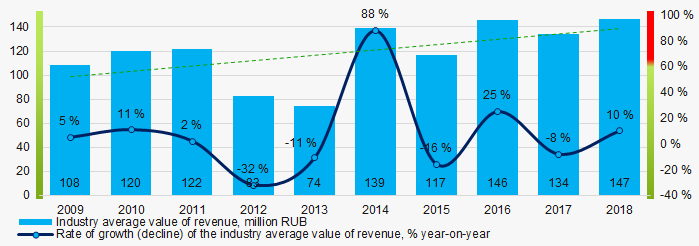

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises for 2018In general, there is a tendency to increase in the revenue volumes (Picture 4).

Picture 4. Change in the industry average revenue in 2009 – 2018

Picture 4. Change in the industry average revenue in 2009 – 2018Profit and loss

The largest company of the industry in terms of net profit value is SIBERIAN GENERATING COMPANY LLC, INN 7709832989. The company's profit amounted to 20,8 billion rubles in 2018.

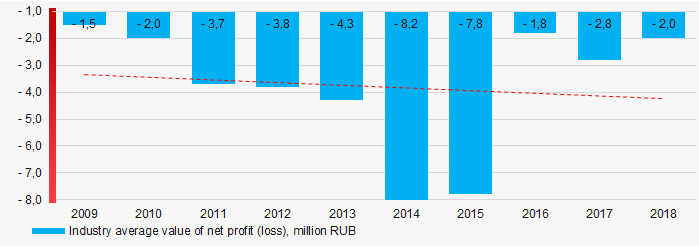

Over a ten-year period, the indicators of industry average profit were in the area of negative values. Thus, there were losses with a tendency to their increase (Picture 5).

Picture 5. Change in the industry average indicators of profit (loss) in 2009 – 2018

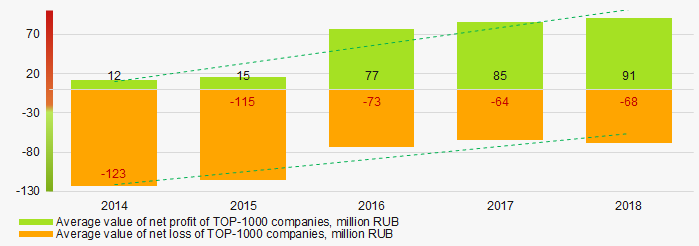

Picture 5. Change in the industry average indicators of profit (loss) in 2009 – 2018 Average values of net profit’s indicators of TOP-1000 enterprises increase over a five-year period, at the same time the average value of net loss decreases. (Picture 6).

Picture 6. Change in the industry average indicators of net profit and net loss of TOP-1000 companies in 2014 – 2018

Picture 6. Change in the industry average indicators of net profit and net loss of TOP-1000 companies in 2014 – 2018Key financial ratios

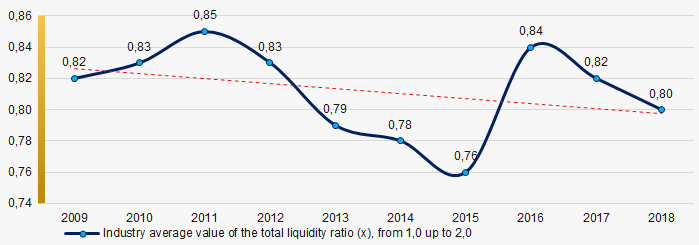

Over the ten-year period the industry average indicators of the total liquidity were below the range of recommended values - from 1,0 up to 2,0, with a tendency to decrease. (Picture 7).

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 7. Change in the industry average values of the total liquidity ratio in 2009 – 2018

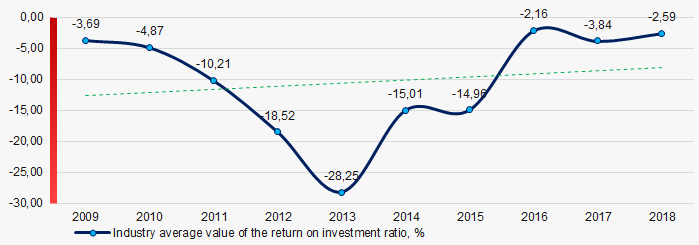

Picture 7. Change in the industry average values of the total liquidity ratio in 2009 – 2018Over the course of ten years, a negative level of industry average indicators of return on investment ratio has been observed, with a tendency to increase. (Picture 8).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity and the long-term borrowed funds of an organization.

Picture 8. Change in the industry average values of the return on investment ratio in 2009 – 2018

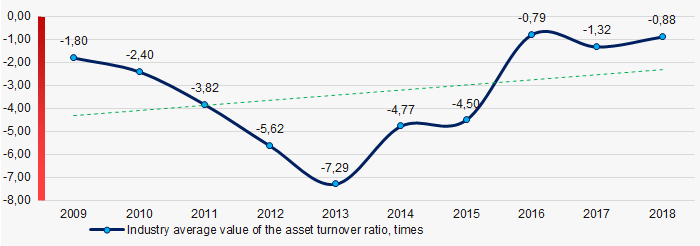

Picture 8. Change in the industry average values of the return on investment ratio in 2009 – 2018Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

Over a ten-year period, indicators of this ratio of business activity were in the zone of negative values with a tendency to increase (Picture 9).

Picture 9. Change in the industry average values of the asset turnover ratio in 2009 – 2018

Picture 9. Change in the industry average values of the asset turnover ratio in 2009 – 2018Small business

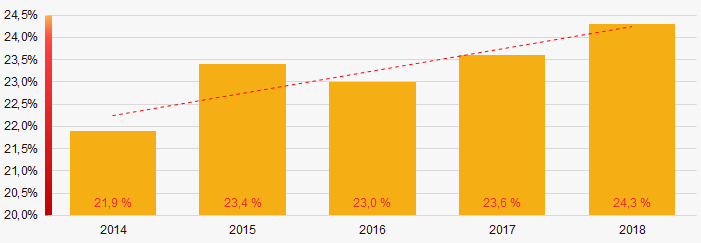

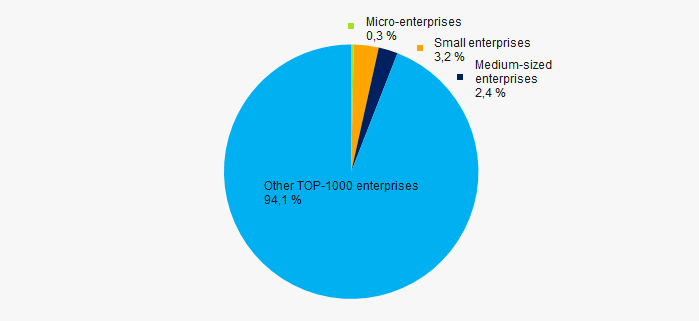

33% of TOP-1000 companies are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the RF. At the same time, their share in the total revenue of TOP-1000 enterprises mounts to 5,9%, that is significantly lower than the national average (Picture 10).

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-1000 companies

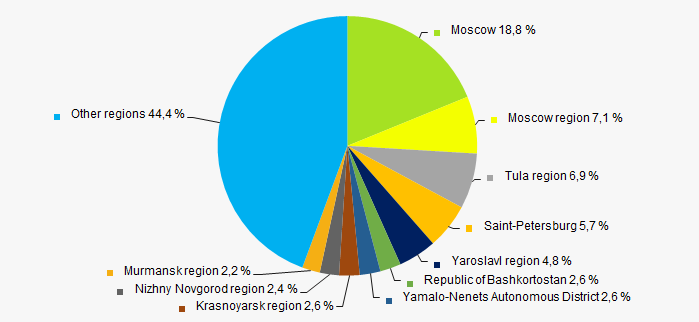

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-1000 companiesMain regions of activity

The TOP-1000 companies are registered in 83 regions and distributed unequal across Russia, taking into account geographical position and climatic characteristics. Almost 56% of the largest enterprises in terms of revenue are concentrated in 10 regions (Picture 11).

Picture 11. Distribution of the revenue of TOP-1000 companies by Russian regions

Picture 11. Distribution of the revenue of TOP-1000 companies by Russian regionsFinancial position score

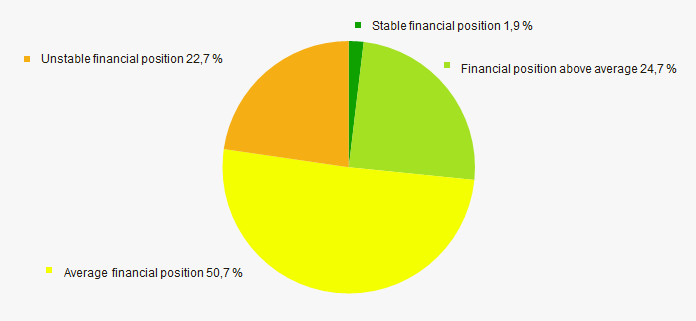

An assessment of the financial position of TOP-1000 companies shows that most of them are in average financial position. (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

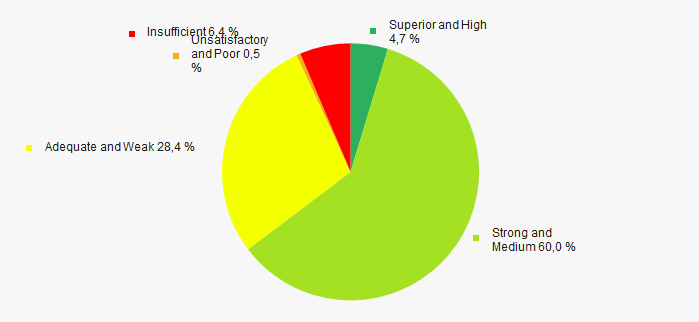

The vast majority of TOP-1000 enterprises got Superior/High or Strong/Medium Solvency index Globas, that points to their ability to pay off their debts in time and fully (Picture 13).

Picture 13. Distribution of TOP-50 companies by solvency index Globas

Picture 13. Distribution of TOP-50 companies by solvency index GlobasIndustrial production index

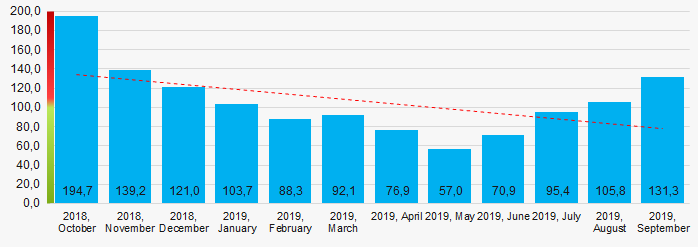

According to the Federal State Statistics Service, there is a tendency towards a decrease in indicators of the industrial production index in the field of the thermal power during 12 months of 2018 - 2019 (Picture 14). At the same time, the average index month-over-month was 106,4%.

Picture 14. Industrial production index in thermal power in 2018 - 2019, month-over-month (%)

Picture 14. Industrial production index in thermal power in 2018 - 2019, month-over-month (%)Conclusion

A comprehensive assessment of activity of the largest Russian thermal power enterprises, taking into account the main indices, financial indicators and ratios, points to the prevalence of positive trends (Table 1).

| Trends and evaluation factors | Specific share of factor, % |

| Rate of growth (decline) in the average size of net assets |  10 10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  -10 -10 |

| Level of competition / monopolization |  5 5 |

| Rate of growth (decline) in the average size of revenue |  10 10 |

| Rate of growth (decline) in the average size of profit (loss) |  -10 -10 |

| Growth / decline in average values of net profit of TOP-1000 companies |  10 10 |

| Growth / decline in average values of net loss of TOP-1000 companies |  10 10 |

| Increase / decrease in average values of total liquidity ratio |  -10 -10 |

| Increase / decrease in average values of return on investment ratio |  -5 -5 |

| Increase / decrease in average values of asset turnover ratio, times |  -5 -5 |

| Share of small and medium-sized enterprises in the region in terms of revenue being more than 22% |  -10 -10 |

| Regional concentration |  -5 -5 |

| Financial position (the largest share) |  5 5 |

| Solvency index Globas (the largest share) |  10 10 |

| Industrial production index |  5 5 |

| Average value of the specific share of factors |  0,7 0,7 |

positive trend (fact),

positive trend (fact),  negative trend (factor).

negative trend (factor).