Net profit ratio of the largest Russian publishing houses

Information agency Credinform represents the ranking of the largest Russian publishing houses. Enterprises with the largest volume of annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (for 2015 and 2016). Then they were ranked by net profit ratio (Table 1). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net profit ratio (%) is calculated as a relation of net profit (loss) to sales revenue and characterizes the level of sales profit. There is no normative value for the indicator. It is recommended to compare enterprises of one industry, or change of the ratio in the course of time of a certain company. A negative value of the ratio indicates a net loss. A high value shows an efficient operation of an enterprise.

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in the sectors, has developed and implemented in the Information and Analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. For publishing houses the practical value of net profit made from 7,78% in 2016.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of indicators and financial ratios.

| Name, INN, region | Revenue, mln RUB | Net profit, mln RUB | Net profit ratio, % | Solvency index Globas | |||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| IZDATELSTVO AST LLC INN 7710899593 Moscow Participates as a defendant in arbitration proceedings, there are unclosed writs of execution. |

4 615,6 | 4 405,7 | 330,0 | 1 630,9 | 7,15 | 37,02 | 550 Insufficient |

| YAUZA-KATALOG LLC INN 7721629285 Moscow |

3 698,8 | 8 844,5 | 400,4 | 2 964,2 | 10,82 | 33,51 | 205 Strong |

| IZDATELSTVO PROSVESHCHENIE NJSC INN 7715995942 Moscow |

11 107,9 | 12 646,6 | 5 680,5 | 2 505,0 | 51,14 | 19,81 | 249 Strong |

| KOMMERSANT NJSC INN 7707120552 Moscow |

2 515,1 | 3 087,6 | 30,3 | 376,0 | 1,20 | 12,18 | 185 High |

| IZDATELSTVO E LLC INN 7708188426 Moscow |

7 231,4 | 9 001,8 | 717,3 | 663,3 | 9,92 | 7,37 | 161 Superior |

| IZDATELSTVO YAUZA LLC INN 7707195170 Moscow |

12 622,0 | 14 700,3 | 860,8 | 1 067,5 | 6,82 | 7,26 | 166 Superior |

| YAUZA-PRESS LLC INN 7721562746 Moscow |

13 469,1 | 17 472,5 | 815,2 | 1 167,6 | 6,05 | 6,68 | 169 Superior |

| PUBLISHING HOUSE KOMSOMOLSKAYA PRAVDA NJSC INN 7714037217 Moscow |

3 656,4 | 3 221,3 | 25,5 | 75,9 | 0,70 | 2,36 | 216 Strong |

| AKTION-PRESS LLC INN 7702272022 Moscow |

2 856,0 | 3 320,7 | 0,4 | 26,7 | 0,01 | 0,80 | 254 Medium |

| HEARST SHKULEV MEDIA LLC INN 7708183322 Moscow |

3 598,3 | 3 839,9 | -10,8 | -87,8 | -0,30 | -2,29 | 258 Medium |

| Total by TOP-10 companies | 65 370,6 | 80 540,8 | 8 849,5 | 10 389,4 | |||

| Average value by TOP-10 companies | 6 537,1 | 8 054,1 | 885,0 | 1 038,9 | 9,35 | 12,47 | |

| Industry average value | 19,8 | 22,5 | -1,2 | 1,8 | -6,11 | 7,78 | |

The average value of the net profit ratio of TOP-10 enterprises is much higher than the industry average. One company from the TOP-10 list increased revenue and net profit indicators in 2015 — 2016 compared to previous periods (marked with green filling in columns 2 — 5 of Table 1). Other companies decreased revenue or profit indicators or have a loss (marked with red filling in columns 2 — 5 of Table 1).

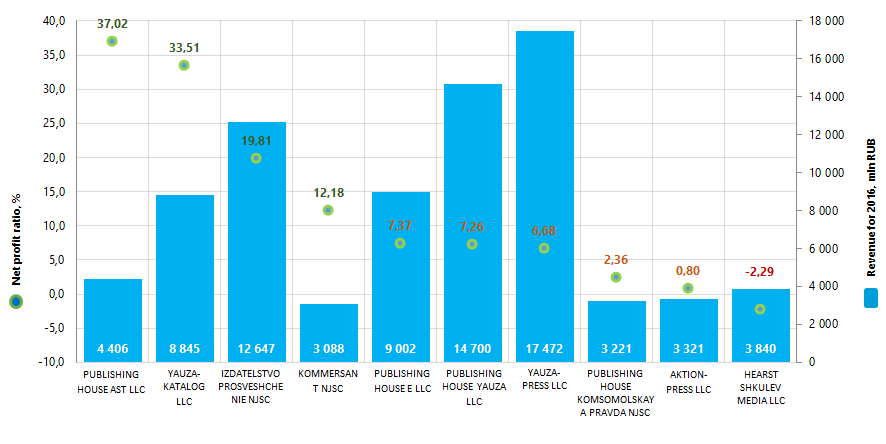

Picture 1. Net profit ratio and revenue of the largest Russian publishing houses (TOP-10)

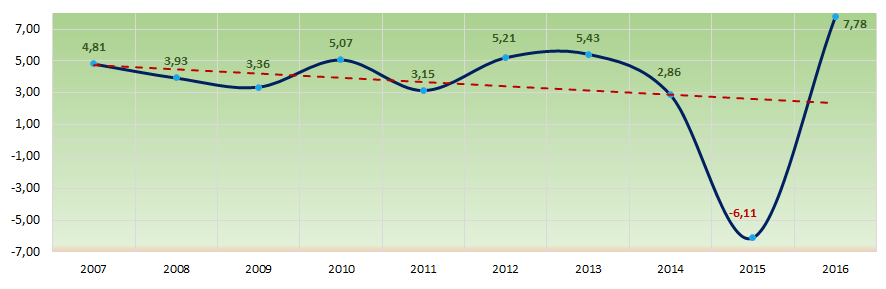

Picture 1. Net profit ratio and revenue of the largest Russian publishing houses (TOP-10)The industry average indicators of the net profit ratio were below the practical value of 2016 over the past 10 years, with a downward trend (Picture 2).

Picture 2. Change in the industry average values of the net profit ratio of the largest Russian publishers in 2007 — 2016

Picture 2. Change in the industry average values of the net profit ratio of the largest Russian publishers in 2007 — 2016Trends in activity of the largest companies of the real economy sector of Krasnodar region

Information Agency Credinform has prepared the review of trends in activity of the largest companies of the real economy sector of Krasnodar region.

The largest enterprises (TOP-10 and TOP-1000) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2014 – 2016). The analysis was based on data of the Information and Analytical system Globas.

Net assets

Indicator of real cost of corporate assets, which is annually calculated as the difference between assets of the company and its debt liabilities. If the company’s debts exceed net worth value, net assets indicator is considered negative (insufficiency of property).

| Position in ТОP-1000 | Name, activity | Net asset value, bln RUB* | Solvency index Globas | ||

| 2014 | 2015 | 2016 | |||

| 1 | 2 | 3 | 4 | 5 | 6 |

| 1. | NAO CHERNOMORSKIE MAGISTRALNYE NEFTEPROVODY Oil and oil products transportation via pipelines |

88,0 | 98,2 | 125,5 | 145 Superior |

| 2. | NAO TANDER Retail trade |

58,2 | 69,1 | 82,1 | 195 High |

| 3. | NAO CASPIAN PIPELINE CONSORTIUM-R Oil transportation via pipelines |

-13,8 | -32,1 | 37,7 | 227 Strong |

| 4. | PAO KUBAN POWER AND ELECTRIFICATION Transmission of electricity and technological connection to power distribution networks |

29,7 | 32,4 | 35,5 | 171 Superior |

| 5. | NAO FIRMA AGROKOMPLEKS IM. N.I.TKACHEVA Mixed farming |

22,6 | 27,6 | 29,7 | 199 High |

| 996. | NAO KRASNAYA POLYANA Hotels and similar accommodation |

16,7 | 1,3 | -4,2 | 287 Medium |

| 997. | NAO TEMPL INС Renting and operating of own or leased untenanted real estate Process of being wound up, 26.04.2017 |

-4,2 | -6,5 | -5,8 | 600 Insufficient |

| 998. | LLC InvestGroup-Hotel Hotels and similar accommodation |

-4,8 | -5,6 | -6,3 | 321 Adequate |

| 999. | LLC University Plaza Real estate management on a fee or contract basis |

-3,4 | -5,7 | -7,4 | 323 Adequate |

| 1000. | LLC YUG-NOVYI VEK Investment in authorized capital, venture capital investment |

-6,7 | -12,3 | -15,5 | 359 Adequate |

*) – growth/decline indicators in comparison with prior period are marked green and red in columns 4 and 5 respectively.

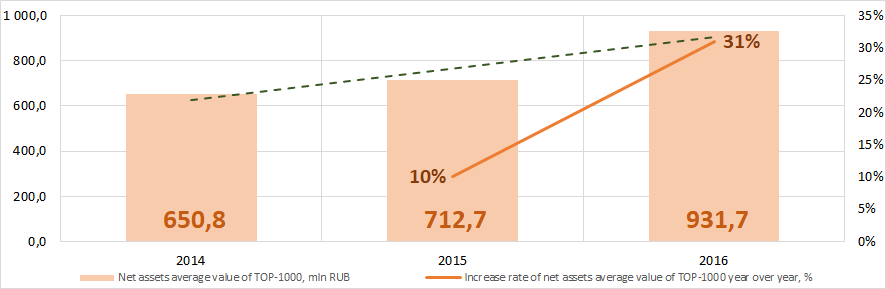

Picture 1. Change in average net assets value of the largest companies of the real economy sector of Krasnodar region in 2014 – 2016

Picture 1. Change in average net assets value of the largest companies of the real economy sector of Krasnodar region in 2014 – 2016Sales revenue

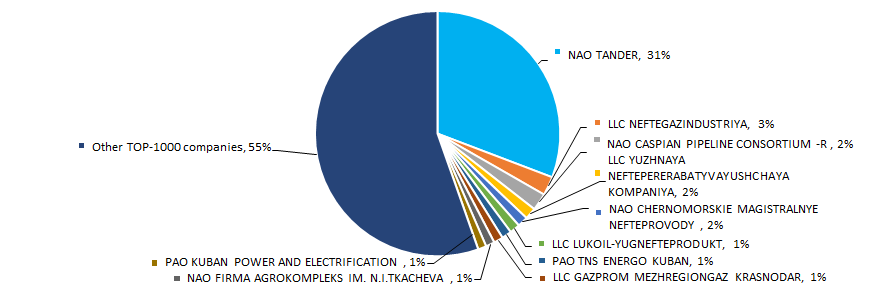

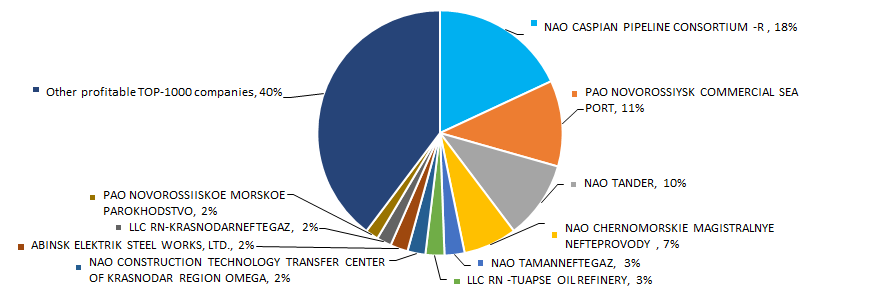

In 2016 total revenue of 10 largest companies amounted to 45% from TOP-1000 total revenue (Picture 2).

Picture 2. Shares of TOP-10 companies in TOP-1000 total revenue for 2016

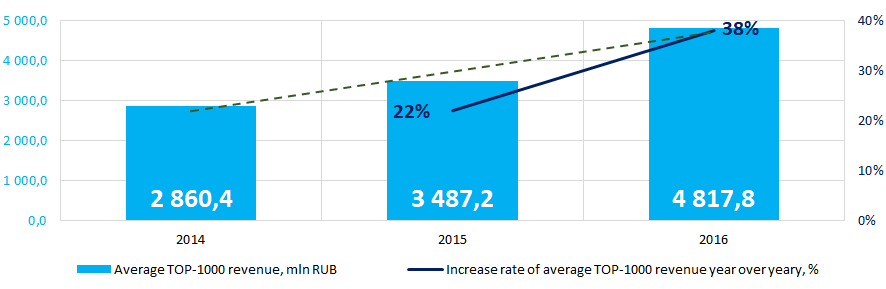

Picture 2. Shares of TOP-10 companies in TOP-1000 total revenue for 2016The increase in sales revenue is observed (Picture 3).

Picture 3. Change in average revenue of the largest companies of the real economy sector of Krasnodar region in 2014 – 2016

Picture 3. Change in average revenue of the largest companies of the real economy sector of Krasnodar region in 2014 – 2016Profit and loss

In 2016, profit of 10 largest companies amounted to 60% from TOP-1000 total profit (Picture 4).

Picture 4. Shares of TOP-10 companies in TOP-1000 total profit for 2016

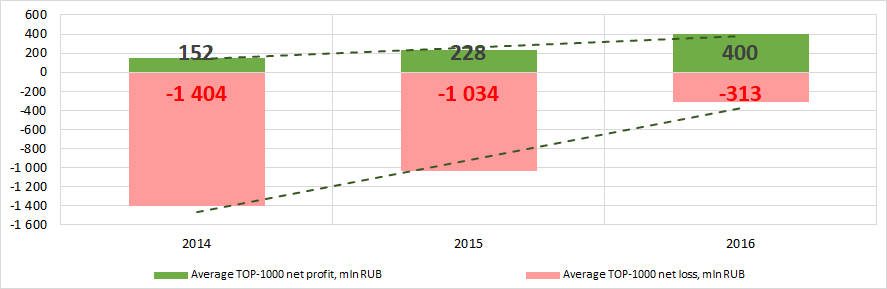

Picture 4. Shares of TOP-10 companies in TOP-1000 total profit for 2016For the three-year period, the average revenue values of TOP-1000 companies show the growing tendency and the average net loss decreases (Picture 5).

Picture 5. Change in average profit/loss of the largest companies of the real economy sector of Krasnodar region in 2014 – 2016

Picture 5. Change in average profit/loss of the largest companies of the real economy sector of Krasnodar region in 2014 – 2016Main financial ratios

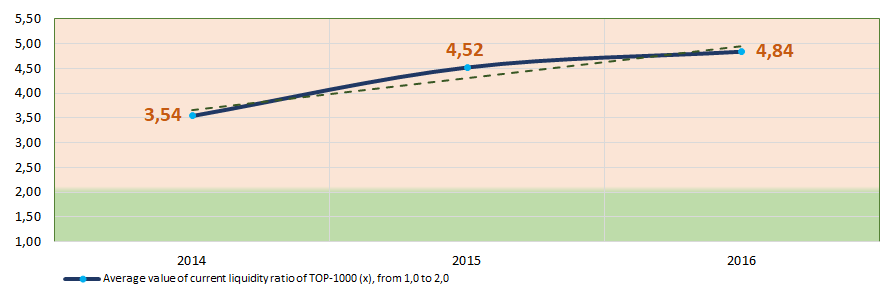

For – 2016 period the average values of current liquidity ratio of TOP-1000 were higher than recommended values – from 1,0 to 2,0 with the growing tendency (Picture 6).

Current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Picture 6. Change in average values of current liquidity ratio of the largest companies of the real economy sector of Krasnodar region in 2014 – 2016

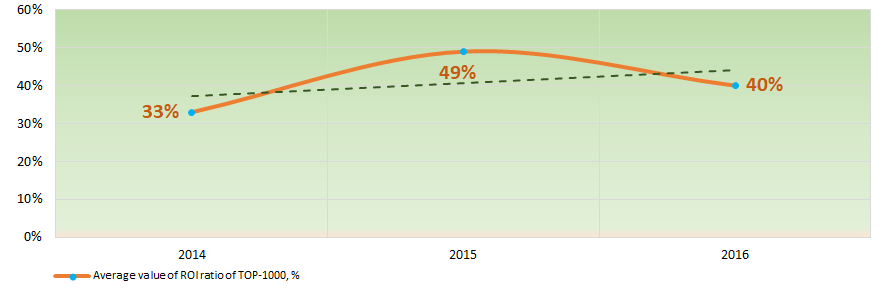

Picture 6. Change in average values of current liquidity ratio of the largest companies of the real economy sector of Krasnodar region in 2014 – 2016For the three-year period, the increasing tendency of ROI ratio is observed (Picture 7). The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Picture 7. Change in average values of ROI ratio of the largest companies of the real economy sector of Krasnodar region in 2014 – 2016

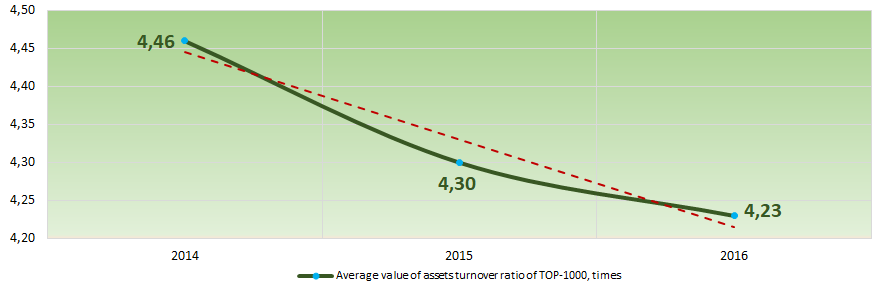

Picture 7. Change in average values of ROI ratio of the largest companies of the real economy sector of Krasnodar region in 2014 – 2016Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

For the three-year period, this business activity ratio demonstrated the downward trend (Picture 8).

Picture 8. Change in average values of assets turnover ratio of the largest companies of the real economy sector of Krasnodar region in 2014 – 2016

Picture 8. Change in average values of assets turnover ratio of the largest companies of the real economy sector of Krasnodar region in 2014 – 2016Production and services structure

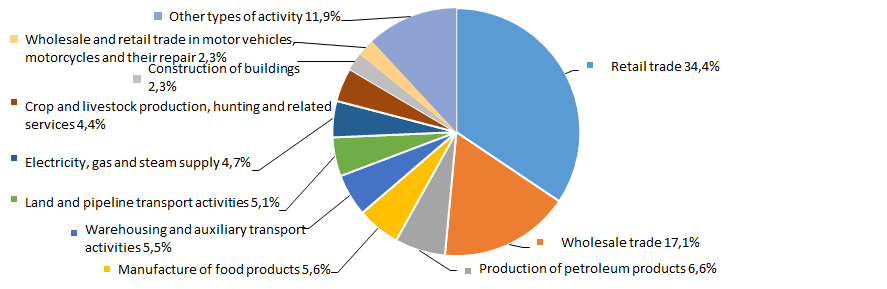

The largest share in TOP-1000 total revenue take companies engaged in trade and production of petroleum products (Picture 9).

Picture 9. Distribution of activities in TOP-1000 total revenue, %

Picture 9. Distribution of activities in TOP-1000 total revenue, %48% of TOP-1000 companies are registered in the Register of Small and Medium-Sized Business Entities of Federal Tax Service of the Russian Federation, among them 25% have status of medium-sized enterprises, 23% are classified as small enterprises.

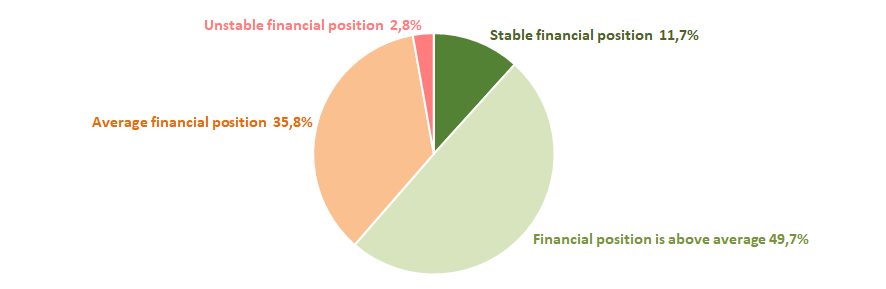

Financial position score

The assessment of company’s financial position shows that more than a half of companies have stable or above average financial position (Picture 10).

Picture 10. Distribution of TOP-1000 companies by financial position score

Picture 10. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

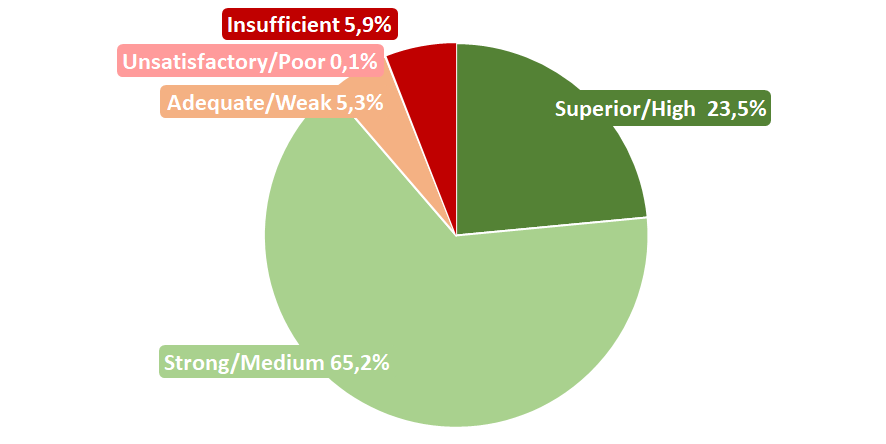

The majority of TOP-1000 companies have superior/high or strong/medium solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully (Picture 11).

Picture 11. Distribution of TOP-1000 companies by solvency index Globas

Picture 11. Distribution of TOP-1000 companies by solvency index GlobasHereby, the complex assessment of the largest real economy companies of Krasnodar region, taking into account main indexes, financial ratios and indicators, demonstrates the denomination of favorable trends.