Total liquidity ratio of educational institutions for adults

Information agency Credinform has prepared a ranking of Russian organizations specialized to the provision of educational services - training centers, foreign language schools, design, driving schools, etc. The ranking list includes the largest educational institutions and is based on revenue as stated in the Statistics register, with the reference period of 2012. These companies were ranked then in terms of total liquidity ratio.

Total liquidity ratio (x) is the ratio of current assets to current liabilities of the company. It shows capital adequacy of the enterprise to repay current liabilities. Recommended value varies from 2% to 3%, but should be at least 1%. This ratio describes the ability of the company to provide for its short-term liabilities on the most marketable (liquid) share of assets - current assets. It also provides an overall assessment of the assets liquidity.

If the ratio is much higher than 1, it can be concluded that the organization has a sufficiently large amount of free resources, which were formed through owned sources. This alternative of working capital formation is the most appropriate from the opinion of enterprise creditors. However, from the perspective of management it shows a lack of efficiency in the assets management (money "does not work").

The ratio value 1 implies the equality of the current assets and liabilities. Missing ratio value indicates that the company had no short-term liabilities as of year-end 2012.

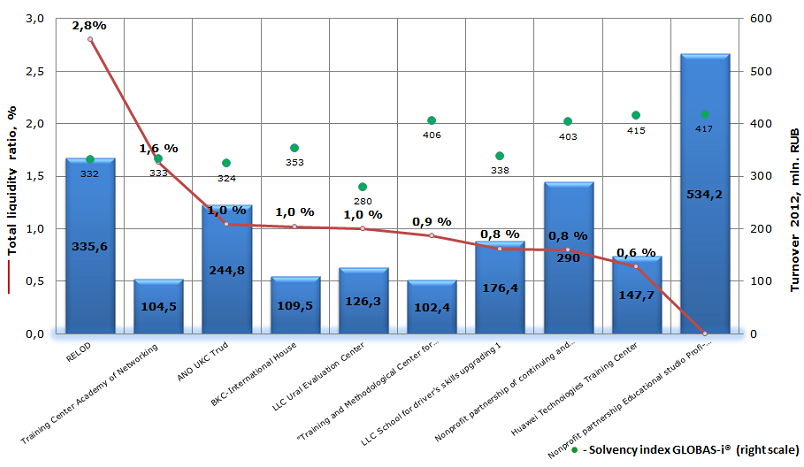

| № | Name | INN | Region | Turnover 2012,mln. RUB | Total liquidity ratio, (%) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|---|

| 1 | RELOD | 7706010268 | Moscow | 335,6 | 2,80 | 332 (satisfactory) |

| 2 | Training Center Academy of Networking | 7701110607 | Moscow | 104,5 | 1,63 | 333(satisfactory) |

| 2 | ANO UKC Trud | 7709335271 | Moscow | 244,8 | 1,04 | 324 (satisfactory) |

| 4 | BKC-International House | 7731244534 | Moscow | 109,5 | 1,02 | 353 (satisfactory) |

| 5 | LLC Ural Evaluation Center | 6664069610 | Sverdlovsk region | 126,3 | 1,00 | 280 (high) |

| 6 | "Training and Methodological Center for Nuclear and Radiation Safety" | 7719287002 | Moscow | 102,4 | 0,93 | 406 (satisfactory) |

| 7 | LLC School for driver’s skills upgrading 1 | 7714554656 | Moscow | 176,4 | 0,81 | 338 (satisfactory) |

| 8 | Nonprofit partnership of continuing and continuing professional education "British Higher School of Art and Design" | 7719236569 | Moscow | 290,0 | 0,80 | 403 (satisfactory) |

| 9 | Huawei Techno logies Training Center | 7734227375 | Moscow | 147,7 | 0,64 | 415 (satisfactory) |

| 10 | Nonprofit partnership Educational studio Profi-style | 5256079545 | Nizhny Novgorod region | 534,2 | - | 417 (satisfactory) |

Diagram. Total liquidity ratio of the largest Russian educational institutions for adults

The largest educational institutions for adults (further education) in terms of 2012 turnover are expectedly located in Moscow - eight out of ten of the Top-10.

The total turnover of the top-10 companies for the year 2012 amounted to 2 billion 170.5 million RUB. The average calculated value of the leaders’ total liquidity ratio is 1.2% (higher than 1). This indicates the positive balance. From the point of view of the creditors, the mentioned situation may be considered as sufficiently positive signal. However, each case needs more detailed analysis of the company’s financial situation.

The following companies from the top-10 showed the value of total liquidity ratio higher than 1: RELOD (English language courses, training literature) - 2.8%; Training Center Academy of Networking ("Lanit", authorized training center of Microsoft, Novell, Intel, SCO, Informix, programs Certified Internet Webmaster, Security Certified Program) - 1,63%; ANO UKC Trud (certification of employment, work safety training, organization of work safety service) - 1.04 %; BKC-International House (English course) - 1.02 %. LLC Ural Evaluation Center (training of NDT and Welding specialists) has the ratio equal to 1, which indicates the equality of current assets and liabilities.

The rest of the list showed the total liquidity ratio less than 1: "Training and Methodological Center for Nuclear and Radiation Safety" (training for regulatory agencies of safety in the use of nuclear energy and utilities); LLC School for driver’s skills upgrading 1 (driving school); Nonprofit partnership of continuing and continuing professional education "British Higher School of Art and Design" (training in the field of design); Huawei Technologies Training Center (implements programs of additional professional education for specialists working in the Russian research market). Current liabilities of the mentioned organizations exceed current assets, which can be negatively viewed. Supposing that investors (creditors) will request their investments in the business together, the company will not be able to pay it.

The value of the ratio for Nonprofit partnership Educational studio Profi-style (basic education, further training, training for hairdressers) is not calculated, which indicates the lack of short-term liabilities.

It should also be mentioned that all top-10 educational institutions, except LLC Ural Evaluation Center with its high index, received satisfactory solvency index GLOBAS -i ® at an independent credit rating of Credinform. This indicates the lack of stability to the change of economic situation; companies do not guarantee the full and timely repayment of its liabilities. This can be explained by demanding of supplemental educational services from clients - not all companies can afford to send staff to training. Individual training also involves not only the availability of funds, but also a high degree of motivation, focus on results. In times of economic instability this services transfer to the so-called "pent-up demand" area.

Russian companies, accumulating the highest amount of cash as of year-end 2012

Information agency Credinform prepared a research on the accumulation of the largest in terms of 2012 turnover Russian companies. According to the research, 50 largest companies accumulate 2.7 trillion RUB or USD 92.4 billion in their accounts (based on the average exchange rate for 2012). Compared to the year 2011 this figure had dropped by almost a half - 41%, but still remains quite impressive and is 4.6% of nominal GDP for 2012. Thereby the share of short-term investments with 66% overrides in the total amount.

50 companies leading by turnover were selected and ranked in terms of "amount of savings" within the ranking. The amount of savings for the selected companies was calculated on the basis of the balance sheet lines "Cash and equivalents" and "Short-term investments." The top ten is shown in the diagram.

On the top ten "most thrifty" has 77.8% of the total savings of 50 largest companies, accounting for 2.1 trillion RUB or 18% of their total revenues.

The 1st ranking line is for Rosneft Oil Company. During 2012 the company has accumulated 817 billion RUB and the purchase of TNK-BP by Rosneft has become the world's largest mergers and acquisitions as of year-end 2012, resulting in Rosneft will become the largest company in the world in terms of oil production. Experts estimate the cost of the transaction to USD 54.5 billion. Now the company is actively raising funds to pay for the transaction. It has got guarantees from banks to receive about USD 30 billion, USD 16.8 billion of which are already brought out. Rosneft also plans to use loans from Russian banks and asset sales to finance the deal.

The 2nd line of ranking is for Surgutneftegas. The company has long been accused of excessive savings. Surgutneftegas became actively save money after the default of 1998, and in late 2008 the accumulation exceeded the company's capitalization. But despite a respectable second place in the ranking with a score of 336.7 million RUB, the company reduced the accumulation of 9.5% compared to last year. In 2012 the company acquired part of the Shpilman field for 46.2 billion rubles in the course of the auction. Also the construction of the airport "Talakan" in the Republic of Sakha (Yakutia) at the end of 2012 was finished. The construction was carried by Surgutneftegaz. The project cost is estimated at more than 5 billion RUB. In early 2013 the airport was gone into service.

Gazprom and its two subsidiaries, Gazprom Neft and Gazprom mezhregiongaz are also included in the rating. Three mentioned companies have accumulated in their accounts 349.5 billion RUB in the whole. Thereby the parent company has significantly reduced their savings be 32,8% compared to the previous year.

Accumulations of Gazprom Neft are very close to the savings of Gazprom, increased for more than 5 times compared to last year. Among the largest deals in the company's 2012 the purchase of Magma Oil Company, a part of Sibir Energy, for 11.15 billion RUB should be noted. Following the transaction, Magma has been integrated into the structure of a subsidiary - Gazprom Neft-Khantos. Average daily production of Magma Oil Company was about 40 thousand tons in 2012. Yuzhnoe and Orekhovskoye fields in Nizhnevartovsk region are in assets of the company.

Last year Gazprom mezhregiongaz was thriftier and increased the amount of their savings to 31.26%. The company continues to expand the geography of supplies by Russia in accordance with the program of gasification of Russian regions. The amount of money spent on this program since 2005 has already exceeded 180 billion RUB, not counting the 100 billion RUB allocated by Gazprom for the construction of branch pipelines and gas distribution stations. At the same time in 2012, sales of natural gas in "Gazprom" group reduced by 5.9%, while sales of domestic customers increased by 2.4% due to the increase in the average selling price of gas by 8.8%.

The 6th line of the rankings is taken by OJSC Russian Railways (RZD), with total accumulations in 118.5 billion RUB. In 2012, the company completed the largest deal in its history on the absorption, buying French logistics operator Gefco for EUR 800 million from a carmaker PSA Peugeot Citroen. But in addition to large purchases in 2012, RZD was also engaged in sales. So, in December Independent Transportation Company (NTC) bought 25% plus 1 share of Joint Stock Company Freight One from Railways. The total purchase price amounted to 50 billion RUB.

Oil Transporting JSC "Transneft" goes a little bit down to RZD. During 2012 the company has accumulated 111.6 billion RUB in its accounts, which is less by 42.8% than the results of 2011. Revenues for 2012 increased by 8.6% compared with 2011. Unlike most of the Top-10 the majority of savings (69%) accounts for cash and cash equivalents.

OJSC Novolipetsk Steel has increased its savings in 2012 of 11.8% compared to the year 2011 and thus earned the 8th place in the ranking. In 2011 the company entered into a number of large transactions. The most significant agreements include: the purchase of a service center in India; consolidation of renting assets of Steel Invest and Finance SA and the establishment of overseas divisions (total amount is about USD 600 million), the sale of Independent Transportation Company (NTC) to UCL Rail BV for USD 325 million. However, in 2012 the company turned out to be calmer and less remarkable on the big deals.

LLC "LUKOIL Permnefteorgsintez" with the amount of 82.9 billion RUB savings also hit the rating. Company’s bank decreased by 5.22% compared to 2011. Thereby the accumulations are almost 100% made up of financial investments.

Summing up the results of 2012, it can be concluded that despite the reduction in the amount of savings by almost half, the major players in the Russian market still save up rather substantial amount for their accounts. The capital flight to the West is becoming more and more noticeable trend: investments in domestic companies are insignificant against the background of large transactions of Rosneft and Russian Railways. Especially those savings seem intimidating amid stagnation of industry and a lack of investment for the economic development of the country. Let's hope that next year the largest Russian companies will properly dispose of accumulated funds, which could well serve as a lever for development.