Acquiring

Revocation of the Master-Bank license (one of top 100 bank of Russia) has put into flutter not only ordinary depositors, but also the business community. For instance, many trade organizations met with serious losses using a popular for the moment service «acquiring» on the part of the failed bank.

Acquiring – range of services for accepting plastic cards in trade outlets. The credit organization rendering this service (acquirer bank) installs in outlets special equipment for accepting cards and makes all the calculations on operations with its using. The bank individually creates the terms of servicing and the commission rate and lay them down in a contract. The bank commission amounts to a certain interest of the purchase sum paid by a card in the trade outlet. In most cases the acquirer trains the personnel of the trade organization, installs all the necessary equipment and accesses the service for free. At the same time, it’s unnecessary to have bank account in the acquirer bank, in order to get this service. In this case money flows from the bank account of the buyer to acquirer’s correspondent account (in the bank, where the account of the trade organization is) and then to the bank account of the trade organization.

If the bank license is revoked, trade organizations may face the problem of collection of their own money assets, when using this service, in 3 cases: if the client paid by the credit card of the failed bank; if the trade organization has an account in the failed bank or if the failed bank rendered the service of acquiring. But how is it possible to protect one’s own business from losses in such cases?

In first case the company will lose the share of proceeds of the clients that paid by cards of the failed bank, as the information about operations “has hung up”. In order to get money, the company should apply to payment service provider. According to experts, the companies usually manage to get their money back within a very short time.

In the second case, the things are more complicated. It’s necessary to assure oneself of the reliability of the bank, opening an account in the bank. The experts recommend paying attention to major banks, included in the top 20 and also to the banks with a state participation. Besides, it’s important to specify if the bank is a member of the deposit insurance system (for the moment the maximal sum of compensation is 700 thousand rubles; if deposit is more than 700 thousand rubles, the depositor has a right to demand the rest sum of money, but it will take a lot of time). If it turned out that the bank had become a bankrupt the company could return money only when the insolvency proceeding starts and the competitive is formed. It should be mentioned that the Bank of Russia begins the insolvency proceeding after the revocation of the license, if the credit organization has the indices of insolvency, specified in the article 2 of the federal law № 40-FL; in case of lack of these indices, the Central Bank of Russia applies to arbitration court with a demand to liquidate the credit organization by enforcement.

As one of the ways to protect one’s business, experts offer to open accounts in different banks.

In the third case, if the license of the bank, which renders acquiring, was revoked, the part of trade organization proceeds will hang up on the correspondent account of the failed bank in the bank where this organization has an account (when the trading organization doesn’t have an account in the acquirer bank). In this case the company may file a claim in the arbitration court against the failed bank. Having proved that the money had hit the account before the revocation of the license, the companies, as a rule manage to get their money back within a very short time.

It is important to note that acquiring being widespread is a new service, therefore the legal system doesn’t have solutions to all the problems, such as deposit insurance against bankruptcy. That is why in order to protect one’s own business, it is important to be very prudent when choosing the bank.

Information agency Credinform is preparing to issue an independent methodology for identification of the bank financial condition that will help trade entrepreneurs, when choosing the bank.

Ranking of 400 the largest Russian companies

Information agency Credinform prepared а ranking of 400 the largest by total revenue Russian companies. The ranking list includes 400 companies with the highest volume of total revenue according to 2012 financial statements.

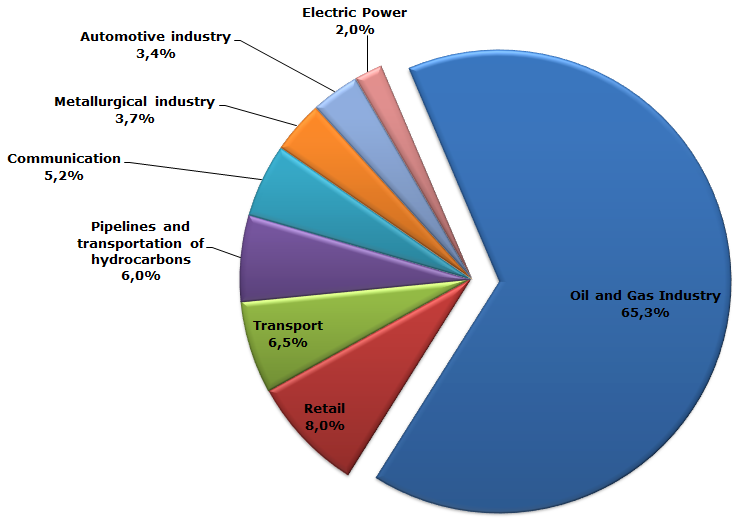

Picture 1. Industry’s structure of TOP-40 the largest companies

Diagram includes data about first 40 companies of ranking list and is based on total revenue. The diagram visually confirms the thesis about the prevalence of oil and gas industry in branch structure of national economy. Companies of mentioned field accumulate 65,3% of total TOP-40 turnover, further are trade companies – 8,0% and transport companies – 6,5%.

| № | Name | Region | Turnover 2012, mln. RUB. | 2011 growth rate, % | Net profit 2012, mln. RUB. | 2011 growth rate, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|---|---|

| 1 | JSC Gasprom INN 7736050003 |

Moscow | 3 659 150,8 | 3,5 | 556 340,4 | -36,8 | 157(the highest) |

| 2 | JSC Rosneft Oil Company INN 7706107510 |

Moscow | 2 595 672,3 | 89,2 | 302 500,6 | 27,7 | 145(the highest) |

| 3 | JSC Russian Railways INN 7708503727 |

Moscow | 1 366 015,0 | 6,0 | 14 110,0 | -16,1 | 211(high) |

| 4 | JSC RN Holding INN 7225004092 |

Tyumen region | 1 084 373,3 | 14,3 | 185 586,4 | -23,9 | 244(high) |

| 5 | JSC Gazprom Neft INN 5504036333 |

Saint-Petersburg | 905 513,7 | 9,8 | 84 505,2 | 10,3 | 179(the highest) |

| 6 | LLC Gazprom mezhregiongaz INN 5003021311 |

Moscow | 828 040,8 | 0,9 | -11 541,8 | -3,0 | 236(high) |

| 7 | JSC SURGUTNEFTEGAS INN 8602060555 |

Khanty-Mansijsk Autonomous District-Yugra | 815 574,4 | 8,1 | 160 940,3 | -31,0 | 164(the highest) |

| 8 | JSC Transneft INN 7706061801 |

Moscow | 687 139,6 | 8,6 | 10 652,4 | -4,4 | 162(the highest) |

| 9 | LLC LUKOIL-West Siberia INN 8608048498 |

Khanty-Mansijsk Autonomous District-Yugra | 645 717,5 | 18,4 | 118 831,5 | 18,6 | 197(the highest) |

| 10 | JSC Bashneft INN 274051582 |

Republic of Bashkortostan | 489 213,4 | 1,1 | 46 509,9 | 34,9 | 190(the highest) |

| 11 | ZAO Tander INN 2310031475 |

Krasnoyarsk Territory | 477 464,8 | 36,2 | 18 878,8 | 214,9 | 210(high) |

| 12 | ZAO Trade House PEREKRIOSTOK INN 7728029110 |

Moscow | 419 821,6 | n.a. | 1 367,6 | n.a. | 260(high) |

| 13 | ZAO TC Megapolis INN 5003052454 |

Moscow Region | 381 845,2 | 20,8 | 8 714,7 | 27,8 | 181(the highest) |

| 14 | JSC Tatneft imeni V.D.Shashina INN 1644003838 |

Republic of Tatarstan (Tatarstan) | 344 563,3 | 8,2 | 66 707,4 | 21,5 | 133(the highest) |

| 15 | LLC LUKOIL-Nizhegorodnefteorgsintez INN 5250043567 |

Nizhny Novgorod Region | 326 188,7 | 1,7 | 27 765,5 | -3,4 | 174(the highest) |

| 16 | LLC STROYGAZMONTAZH INN 7729588440 |

Moscow | 324 697,9 | 31,9 | 29 649,2 | 104,0 | 231(high) |

| 17 | JSC Mining and Metallurgical Company "NORILSK NICKEL" INN 8401005730 |

Krasnoyarsk Territory | 288 554,5 | -6,6 | 70 136,6 | -37,5 | 157(the highest) |

| 18 | JSC Rostelecom INN 7707049388 |

Saint-Petersburg | 282 904,3 | 31,8 | 32 674,4 | 0,3 | 178(the highest) |

| 19 | JSC Vimpel-Communications INN 7713076301 |

Moscow | 280 300,6 | 7,4 | 36 329,2 | -11,9 | 237(high) |

| 20 | LLC LUKOIL-Komi INN 1106014140 |

Komi Republic | 279 879,2 | 14,6 | 37 596,7 | -8,2 | 217(high) |

| 21 | JSC Mobile TeleSystems INN 7740000076 |

Moscow | 270 828,7 | 9,7 | 44 706,2 | -15,4 | 199(the highest) |

| 22 | LLC VOLKSWAGEN Group Rus INN 5042059767 |

Kaluga Region | 258 762,8 | 34,7 | 10 513,4 | 466,6 | 201(high) |

| 23 | LLC LUKOIL Permnefteorgsintez INN 5905099475 |

Perm Territory | 256 666,0 | 7,5 | 35 958,1 | 15,6 | 169(the highest) |

| 24 | LLC Gazprom transgaz Yugorsk INN 8622000931 |

Khanty-Mansijsk Autonomous District-Yugra | 255 917,7 | 8,8 | 1 447,2 | -1 519,5 | 223(high) |

| 25 | JSC Megafon INN 7812014560 |

Moscow | 254 453,0 | 12,4 | 43 379,0 | -2,9 | 206(high) |

| 26 | LLC LUKOIL-Yolgogradneftepererabotka INN 3448017919 |

Volgograd Redion | 248 686,3 | 15,8 | 32 456,3 | 14,3 | 157(the highest) |

| 27 | JSC SIBUR Holding INN 7727547261 |

Saint-Petersburg | 243 329,0 | 2,0 | 52 567,6 | -44,4 | 214(high) |

| 28 | JSC Magnitogorsk Iron & Steel Works INN 7414003633 |

Chelyabinsk Region | 243 059,0 | -1,7 | 7 925,0 | -568,4 | 215(high) |

| 29 | JSC Novolipetsk Steel INN 4823006703 |

Lipetsk Region | 240 122,7 | 8,6 | 25 151,8 | -27,4 | 182(the highest) |

| 30 | LLC Ashan INN 7703270067 |

Moscow Region | 232 602,5 | 13,4 | 10 084,5 | 17,2 | 206(high) |

| 31 | LLC Toyota Motor INN 7710390358 |

Moscow Region | 227 666,9 | 25,9 | 13 385,0 | 125,3 | 145(the highest) |

| 32 | JSC Severstal INN 3528000597 |

Vologda Region | 223 610,7 | -12,1 | 14 637,9 | -867,0 | 242(high) |

| 33 | JSC Orenburgneft INN 5612002469 |

Orenburg Region | 218 522,6 | 9,2 | 66 967,7 | -5,6 | 238(high) |

| 34 | JSC Samotlorneftegaz INN 8603089934 |

Khanty-Mansijsk Autonomous District-Yugra | 217 411,0 | 19,1 | 29 000,5 | 22,2 | 188(the highest) |

| 35 | ZAO Vankorneft INN 2437261631 |

Krasnoyarsk Territory | 215 819,0 | -5,2 | 34 469,5 | -64,1 | 277(high) |

| 36 | JSC Mosenergosbyt INN 7736520080 |

Moscow | 213 460,6 | -1,2 | 1 519,6 | -65,3 | 223(high) |

| 37 | LLC Gazprom dobycha Yamburg INN 8904034777 |

Yamal-Nenets autonomous District | 205 698,1 | 50,3 | 1 598,4 | 5,6 | 225(high) |

| 38 | LLC LUKOIL-Reservnefteproduct INN 7709825967 |

Moscow | 202 446,2 | 30,4 | 3 400,5 | 69,7 | 204(high) |

| 39 | JSC Concern Rosenergoatom INN 7721632827 |

Moscow | 200 526,1 | -0,4 | -1 848,7 | -36,5 | 244(high) |

| 40 | LLC METRO Cash & Carry INN 7704218694 |

Moscow | 186 232,7 | n.a. | 13 214,0 | n.a. | 250(high) |

| Total for top-40 | 21 098 452,3 | 18,5 | 2 238 788,6 | -15,6 | - | ||

According to the results of 2012, total turnover of TOP-40 the largest companies amounted to 21 098 452,3 mln.RUB. That is 18,5% more in comparison with the same period of last year. However the dynamic of total financial results of companies’ activity – net profit, is not so good. Last year total gross margin of TOP-40 ranking companies reduced by 15.6%, this could testify of the economic crisis rise. This fact is confirmed by decrease in growth rates of industrial production and gross domestic product.

According to the results of 2013, it is possible to assume with a high degree of probability that net profit of the largest companies will also decrease, as main macroeconomic indicators of the current year will obviously be even worse, than previous. The corporate debt grows, financial risks increase. The management should carefully choose the investment programs, as lack of resources is quite probable.

However, it should be mentioned, that all companies of TOP-40 list have high and the highest solvency index GLOBAS-i® of the agency Credinform. The companies guarantee repayment of the debts. The risk of debt default is minimum or below average. Enterprises are competitive and have a steady consumer demand in their segments. From the investment point of view, the cooperation with the companies from the ranking list seems to be favorable and quite reasonable.