Criminal liability for non-payment of insurance contributions was introduced

In August 2017 the Federal Law №250-FZ «On Amendments to the Criminal Code of the Russian Federation and the Criminal Procedure Code of the Russian Federation due to the improvement of legal regulation of relations connected with payment of insurance contributions to state non-budgetary funds» dated 29.07.2017 came into effect.

Evasion in payment of contributions is recognized as a crime and falls under the validity of articles of the Criminal Code 198 (Evasion of an individual from payment of taxes, fees and (or) an individual - payer of insurance contributions from payment of insurance contributions) and 199 (Evasion from payment of taxes, fees payable by an organization, and (or) insurance contributions payable by an organization - payer of insurance contributions).

Criminal liability for such crimes for enterprises and individuals occurs in cases if it is committed in a large or especially large amount. The rules of engagement to criminal responsibility and sanctions for crimes are set out in the table.

| Category of contributions’ payers | Rules of engagement to criminal responsibility | ||

| Large amount | Especially large amount | The share of unpaid taxes and fees from the amount payable to the budget | |

| Organization (Article 199 of the Criminal Code of the RF) | More than 15 million rubles or More than 5 million rubles for 3 years in a row | More than 45 million rubles or More than 15 million rubles for 3 years in a row | 25% - by large amount; 50% - by especially large amount |

| individual, including individual entrepreneur (Article 198 of the Criminal Code of the RF) | More than 2,7 million rubles or More than 900 million rubles for 3 years in a row | More than 13,5 million rubles or More than 4,5 million rubles for 3 years in a row | 10% - by large amount; 20% - by especially large amount |

| Category of contributions’ payers | Penalty (sanctions) | |

| Large amount | Especially large amount | |

| Organization, including officials or individual entrepreneurs | fine at a rate of 200 000 - 500 000 rubles or - in the amount of salary (income) for the period from 18 months up to 3 years, or forced labour up to 3 years with or without deprivation of the right to occupy determined posts (to engage in activity) up to 3 years, or deprivation of liberty up to 2 years with or without deprivation of the right to occupy determined posts (to engage in activity) up to 3 years | fine at a rate of 500 000 – 2 mln rubles or - in the amount of salary (income) for the period from 2 to 5 years, or forced labour up to 5 years with or without deprivation of the right to occupy determined posts (to engage in activity) up to 3 years, or deprivation of liberty up to 7 years with or without deprivation of the right to occupy determined posts (to engage in activity) up to 3 years |

| Individual | fine at a rate of 200 000 rubles or - in the amount of salary (income) for the period up to 2 years, or compulsory community service up to 360 hours | fine at a rate of 300 000 rubles or - in the amount of salary (income) for the period up to 3 years, or forced labour up to 1 year, or deprivation of liberty up to 1 year |

| Organizations or individuals that have committed a crime for the first time are exempted from criminal liability if they repay the amounts of arrears, penalty fees and fines in full in accordance with the Tax Code of the RF. | ||

Unpaid amounts may include arrears both in respect of insurance contributions and in respect of taxes and fees.

Thus, the responsibility for non-payment of insurance contributions is equated with responsibility for non-payment of taxes, that was predictable after the administration of insurance contributions to state non-budgetary funds was transferred to the Federal Tax Service from January 1, 2017 (s. more in the article). Such tightening of responsibility will certainly affect the increase in fees to social funds, but also the risk of excessive pressure from regulatory oversight should not be ruled out.

It should be also remembered that, in addition, since October 1, 2017, the procedure for charging penalty fees for organizations has changed. So, in cases of delay in payment up to 30 calendar days the penalty fee is calculated on account of 1/300 of the refinancing rate the Bank of Russia, and starting from the next (i.e. 31st) day, the penalty fee will be 1/150 of the discount rate.

Asset turnover of the largest Russian stone quarrying companies

Information agency Credinform has prepared a ranking of the largest Russian stone quarrying companies. The companies with the largest volume of annual revenue (TOP-10) have been selected for the ranking, according to the data from the Statistical Register for the latest available accounting periods (2016 and 2015). Then they have been ranked by asset turnover ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Asset turnover is a ratio of sales revenue to average total assets for the period. It is one of the activity ratios and it indicates resource efficiency regardless of source. This ratio shows the number of profit-bearing complete production and distribution cycles per annum.

A calculation of practical values of financial ratios, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas by the experts of the Information Agency Credinform, having taken into account the current situation in the economy as a whole and in the industries. The practical value of asset turnover ratio for stone quarrying companies amounted from 0.7 in 2016.

The whole set of financial indicators and ratios of a company is to be considered to get the fullest and fairest opinion about the company’s financial standing.

| Name, INN, region | Net profit, mln RUB | Revenue, mln RUB | Asset turnover, times | Solvency index Globas | |||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| Kamennogorsk Integrated Plant of Non-metallic Materials NJSC INN 4704006013 Leningrad region |

-7,79 | -8,97 | 666,75 | 763,19 | 2,84 | 3,49 | 310 Adequate |

| Orsk Quarry Administration PJSC INN 5615002820 Orenburg region |

16,16 | 97,44 | 1 145,59 | 2 057,88 | 1,41 | 2,77 | 169 Superior |

| Prionezhe Mining Company LLC INN 1020009123 Republic of Karelia |

-57,37 | 26,34 | 1 208,83 | 1 440,36 | 1,23 | 1,79 | 283 Medium |

| SpecTechProject LLC INN 7430020322 Chelyabinsk region |

2,94 | 8,11 | 611,97 | 836,30 | 1,21 | 1,72 | 277 Medium |

| Korfovsky Stone Quarry PJSC INN 2720002950 Khabarovsk Territory |

76,45 | 5,74 | 963,55 | 983,22 | 1,23 | 1,27 | 229 Strong |

| KARELPRODRESURS LLC INN 1001138331 Republic of Karelia |

0,20 | 8,02 | 1 356,89 | 1 709,17 | 0,62 | 0,84 | 264 Medium |

| First Non-Metallic Company PJSC INN 7708670326 Moscow |

35,97 | 45,20 | 3 905,91 | 5 606,33 | 0,56 | 0,79 | 233 Strong |

| Sunsky Quarry LLC INN 1003008176 Republic of Karelia |

0,18 | 11,81 | 712,98 | 905,09 | 0,63 | 0,78 | 265 Medium |

| Pavlovsk Nerud NJSC INN 3620013598 Voronezh region |

804,23 | 1 152,42 | 3 565,87 | 3 813,51 | 0,58 | 0,68 | 226 Strong |

| PNK-Ural LLC INN 7417018878 Chelyabinsk region |

-78,79 | -93,92 | 2 931,12 | 3 148,45 | 0,46 | 0,49 | 328 Adequate |

| Total for TOP-10 | 79,22 | 125,22 | 1 706,94 | 2 126,35 | |||

| Average value of TOP-10 | 7,92 | 12,52 | 170,69 | 212,63 | 1,08 | 1,46 | |

| Industry average value | 0,01 | 0,41 | 31,80 | 31,80 | 0,67 | 0,70 | |

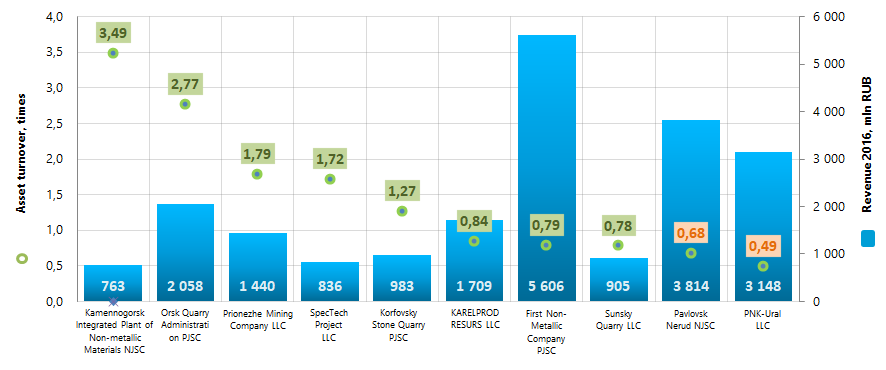

Average asset turnover ratio of TOP-10 companies in 2016 is higher than the practical one and higher than the average industry value. In 2016 eight companies of TOP-10 have a ratio value higher, and two companies have a ratio lower than the practical one (green and orange colors respectively in columns 6 and 7 of Table 1 and in Picture 1). In 2016 three of TOP-10 companies have a decrease in net profit as compared to the prior period, or have loss (red highlight in column 3 of Table 1).

Picture 1. Asset turnover ratio and revenue of the largest Russian stone quarrying companies (TOP-10)

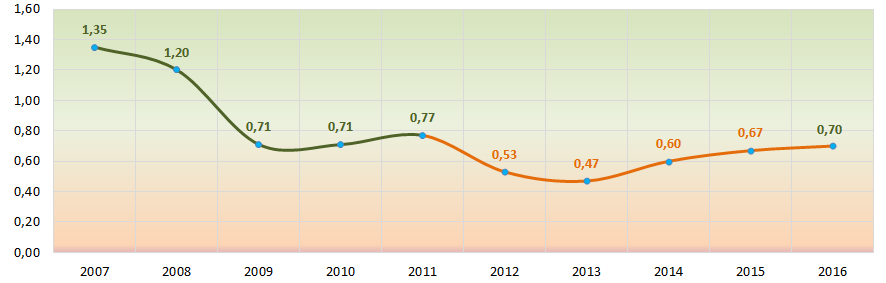

Picture 1. Asset turnover ratio and revenue of the largest Russian stone quarrying companies (TOP-10)Industry average values of asset turnover ratio within the last 10 years follow a downward trend. In 2012-2015 the ratio value was lower than the 2016 practical value. This may indicate a certain downturn in the sector (Picture 2).

Picture 2. Change of industry average values of asset turnover ratio of Russian stone quarrying companies in 2007-2016

Picture 2. Change of industry average values of asset turnover ratio of Russian stone quarrying companies in 2007-2016Eight of TOP-10 companies have got from superior to medium solvency index Globas, which indicates their ability to meet debt obligations timely and in full.

Kamennogorsk Integrated Plant of Non-metallic Materials NJSC and PNK-Ural LLC have got an adequate solvency index Globas, due to the companies being defendants in debt collection arbitration proceedings and loss within the balance sheet figures. Index development trends are stable.