Legislation amendments

The Decree of the Government of the Russian Federation No. 529 as of 02.04.2021 for the sources of credit histories defined the procedure for disclosing information on persons under the sanctions imposed by foreign states.

In particular, it is established, that the sources of credit histories (banks, leasing companies, operators of investment platforms) are not required to submit to the Bureau of Credit Histories data contained in the credit histories on obligations and persons under the sanctions imposed by foreign states, associations and unions or (inter)state institutions of foreign states.

The basis for this are the statements of these persons and verification of the accuracy of the information specified in these statements.

The specified sources of credit histories are obliged to inform the Bureau of Credit Histories within five working days from the date of confirmation of the statement on obligations not fulfilled on the date of receipt of the application.

The Decree will come into force on January 1, 2022.

According to the Central Bank of the Russian Federation as of 30.04.2021, nine entities are registered in the National Bureau of Credit Histories. Information about these companies is available in the Information and Analytical system Globas.

Equity of the cast iron producers

Information agency Credinform represents a ranking of the largest Russian cast iron and steel producers. Companies with the largest volume of annual revenue (TOP 10 and TOP 100) were selected for the ranking, according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2018 - 2020). They were ranked by the current assets to equity ratio (Table 1). The selection and analysis were based on the data of the Information and Analytical system Globas.

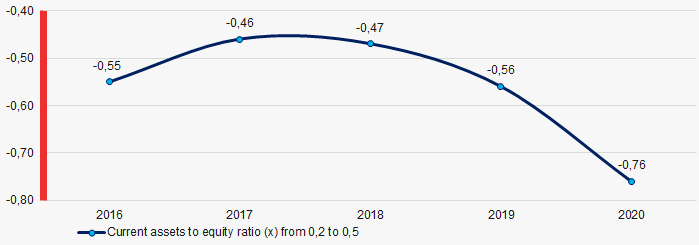

Current assets to equity ratio (х) reflects the company's ability to maintain the level of current assets and replenish it from own funds. The ratio is calculated as current asstes to shareholders’ equity. The recommended value is between 0,2 and 0,5.

The reduction of the ratio shows the possible slowdown in payment of receivables or tightening of commodity credit by suppliers and contractors. The growth means the increasing capability to repay current liabilities.

For the most complete and objective view of the financial condition of the enterprise, it is necessary to pay attention to the complex of indicators and financial ratios of the company.

| Name, INN, region, core activity | Revenue, billion RUB | Net profit (loss), billion RUB | Current assets to equity ratio (x) from 0,2 to 0,5 | Solvency index Globas | |||

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| JSC URAL STEEL INN 5607019523 Orenburg region Cast iron, steel and ferroalloy production |

81,4 81,4 |

73,9 73,9 |

-7,1 -7,1 |

-0,2 -0,2 |

0,20 0,20 |

0,25 0,25 |

253 Medium |

| JSC MAGNITOGORSK IRON & STEEL WORKS INN 7414003633 Chelyabinsk region Cast iron, steel and ferroalloy production |

434,9 434,9 |

400,2 400,2 |

55,6 55,6 |

51,5 51,5 |

0,02 0,02 |

-0,03 -0,03 |

186 Superior |

| JSC NOVOLIPETSK STEEL MILL INN 4823006703 Lipetsk region Production of cold-rolled steel sheets |

421,8 421,8 |

437,1 437,1 |

83,4 83,4 |

61,1 61,1 |

-0,12 -0,12 |

-0,03 -0,03 |

212 Strong |

| JSC EVRAZ NIZHNY TAGIL METALLURGICAL PLANT INN 6623000680 Sverdlovsk region Cast iron, steel and ferroalloy production |

190,7 190,7 |

186,1 186,1 |

110,8 110,8 |

65,3 65,3 |

-0,22 -0,22 |

-0,64 -0,64 |

183 Superior |

| JSC EVRAZ CONSOLIDATED WEST SIBERIAN METALLURGICAL PLANT INN 4218000951 Kemerovo region - Kuzbass Production of high-quality hot-rolled steel and wire rod |

214,1 214,1 |

241,4 241,4 |

4,5 4,5 |

20,3 20,3 |

-0,11 -0,11 |

-0,67 -0,67 |

201 Strong |

| JSC SEVERSTAL INN 3528000597 Vologda region Cast iron, steel and ferroalloy production |

457,6 457,6 |

450,9 450,9 |

105,7 105,7 |

114,9 114,9 |

-0,85 -0,85 |

-0,86 -0,86 |

215 Strong |

| JSC OSKOL ELECTROMETALLURGICAL PLANT INN 3128005752 Belgorod region Production of high-quality hot-rolled steel and wire rod |

103,3 103,3 |

104,1 104,1 |

4,7 4,7 |

-1,2 -1,2 |

-40,64 -40,64 |

-1,25 -1,25 |

252 Medium |

| JSC TULACHERMET INN 7105008031 Tula region Cast iron, steel and ferroalloy production |

53,7 53,7 |

59,3 59,3 |

-2,7 -2,7 |

2,1 2,1 |

-2,56 -2,56 |

-1,74 -1,74 |

217 Strong |

| ABINSK ELECTRIC STEEL WORKS LTD. INN 2323025302 Krasnodar territory Production of high-quality hot-rolled steel and wire rod |

50,2 50,2 |

56,0 56,0 |

2,8 2,8 |

-3,4 -3,4 |

-0,15 -0,15 |

-1,86 -1,86 |

298 Medium |

| JSC CHELYABINSK METALLURGICAL PLANT INN 7450001007 Chelyabinsk region Cast iron, steel and ferroalloy production A lawsuit on bankruptcy was filed against the company. |

113,0 113,0 |

114,0 114,0 |

5,3 5,3 |

-0,5 -0,5 |

-1,84 -1,84 |

-3,37 -3,37 |

400 Weak |

| Average value for TOP 10 |  212,1 212,1 |

212,3 212,3 |

36,3 36,3 |

31,0 31,0 |

-4,63 -4,63 |

-1,06 -1,06 |

|

| Average value for TOP 100 |  26,5 26,5 |

26,3 26,3 |

3,9 3,9 |

3,2 3,2 |

0,25 0,25 |

-0,45 -0,45 |

|

| Average industry value |  5,5 5,5 |

5,4 5,4 |

0,8 0,8 |

0,6 0,6 |

-0,56 -0,56 |

-0,76 -0,76 |

|

growth of indicator to the previous period,

growth of indicator to the previous period,  fall of indicator to the previous period

fall of indicator to the previous period

The industry average 2020 values of current assets to equity ratio, as well as of TOP 10 and TOP 100 companies, were negative. Seven companies decreased their values in 2020, and nine did in 2019.

In 2020, only three companies gained the revenue, and four ones increased net profit. The revenue of TOP 10 climbed at average 1%, and TOP 100’s one fell at average 1%. The industry average figure decreased 2%.

In 2020, four companies showed a loss, while two did in 2019. There was almost 15% gain in TOP 10’s profit, while TOP 100’s one fell more than 6 times. On average for the industry, there was recorded a nearly 7 times decrease.

In general, the industry average current assets to equity ratio was within the negative values. The highest value was recorded in 2017 and the lowest one was in 2020 (Picture 1).

Picture 1. Change in the industry average values of current assets to equity ratio of cast iron and steel producers in 2016 - 2019

Picture 1. Change in the industry average values of current assets to equity ratio of cast iron and steel producers in 2016 - 2019