The salary dynamics of Russians in 2014

According to 2014 results, the average salary in Russia amounted to 32 629 RUB. (845 USD), the actual growth of wages was insignificant – only +0,7%. According to official average annual exchange rate of The Central Bank, there was a decrease in salaries by 10,5% in dollar terms (945 USD in 2013). In January-December 2014 the inflation level in general across the country exceeded the planned Russian Government expectations and amounted to 7,6%.

At the moment the significant regional differentiation of the wages is observed on the territory of the Russian Federation. Thus the ratio of maximum (Chukotka Autonomous Okrug) and minimum (Republic of Crimea) salary is estimated almost by 5,5 times.

Traditionally, the highest wage is in the Far North regions and equal districts, Moscow and Saint-Petersburg; moreover according to 2014 results, the actual growth of wages in Moscow was positive, as against Saint-Petersburg with a decrease in ratio by 0,1%.

The salary of Moscow residents is 1,5 times more than salary of Saint-Petersburg residents (61 357 RUB. and 40 676 RUB. respectively).

In addition to Saint-Petersburg, the decrease in 2014 wages was observed in other 28 regions of the country. The last place took The Chechen Republic (-3,4%).

In new subjects of the Russian Federation - Republic of Crimea (14 221 RUB.) and Sevastopol (14 333 RUB.) the salaries, if to take into account the recalculation of currencies, are significantly increased, but still considerably less than in Republic of Kalmykia (the closest list region, 19 384 RUB.).

Taking into account the accelerated inflation and difficult economic situation, it is expected that the current year won’t bring good news and the actual wages in the most regions of the country might decrease in the end of the period.

| № | Subject | Average2014 salary, RUB. | Growth (decrease) to 2013 level, % | Inflation January-December 2014, % | Growth (decrease) ofactual wage to 2013, % |

|---|---|---|---|---|---|

| Russian Federation | 32 629 | 8,3 | 7,6 | 0,7 | |

| 1 | Chukotka Autonomous Okrug | 76 204 | 8,5 | 3,5 | 5,1 |

| 2 | Yamal-Nenets Autonomous Okrug | 74 502 | 7,3 | 7,6 | -0,4 |

| 3 | Nenets Autonomous Okrug | 66 746 | 6,8 | 6,6 | 0,2 |

| 4 | Magadan Region | 61 552 | 7,9 | 7,7 | 0,2 |

| 5 | Moscow | 61 357 | 9,1 | 7,9 | 1,2 |

| 6 | Khanty-Mansi Autonomous Area - Yugra | 57 898 | 6,2 | 5,5 | 0,7 |

| 7 | Sakhalin Region | 54 533 | 12,5 | 7,1 | 5,4 |

| 8 | Tyumen Region (including the autonomous districts) | 54 471 | 6,8 | 6,7 | 0,1 |

| 9 | Kamchatka Krai | 52 883 | 9,3 | 7,7 | 1,7 |

| 10 | The Republic of Sakha (Yakutia) | 50 794 | 9,9 | 6,5 | 3,4 |

| 11 | Murmansk Region | 42 862 | 7,2 | 7,7 | -0,4 |

| 12 | Saint-Petersburg | 40 676 | 8,3 | 8,4 | -0,1 |

| 13 | Komi Republic | 39 750 | 6,5 | 7,9 | -1,4 |

| 14 | Moscow Region | 39 051 | 8,6 | 8,1 | 0,5 |

| 15 | Khabarovsk Krai | 36 260 | 7,2 | 7,2 | 0,0 |

| 16 | Arkhangelsk Region | 35 640 | 9,6 | 8,6 | 1,0 |

| 17 | Krasnoyarsk Territory | 34 073 | 7,6 | 6,1 | 1,4 |

| 18 | Tomsk Region | 32 506 | 6,8 | 7,6 | -0,8 |

| 19 | Primorsky Krai | 32 441 | 8,8 | 7,1 | 1,7 |

| 20 | Amur Region | 32 261 | 7,9 | 8,2 | -0,2 |

| 21 | Leningrad Region | 32 115 | 8,6 | 7,9 | 0,7 |

| 22 | Irkutsk Region | 31 407 | 7,4 | 6,2 | 1,2 |

| 23 | Sverdlovsk Region | 29 778 | 6,4 | 7,8 | -1,4 |

| 24 | Jewish Autonomous Region | 29 292 | 7,8 | 7,8 | 0,0 |

| 25 | The Republic of Karelia | 29 283 | 5,5 | 6,7 | -1,2 |

| 26 | Trans-Baikal Territory | 29 153 | 7,6 | 7,3 | 0,3 |

| 27 | The Republic of Khakassia | 28 962 | 7,1 | 7,3 | -0,2 |

| 28 | The Republic of Tatarstan | 28 347 | 9,0 | 7,2 | 1,8 |

| 29 | Chelyabinsk Region | 27 977 | 8,2 | 7,1 | 1,1 |

| 30 | Kaluga Region | 27 973 | 8,6 | 9,2 | -0,6 |

| 31 | The Republic of Buryatia | 27 803 | 6,9 | 8,2 | -1,2 |

| 32 | Tuva Republic | 27 747 | 8,4 | 5,1 | 3,3 |

| 33 | Novosibirsk Region | 27 333 | 6,8 | 6,5 | 0,3 |

| 34 | Perm Region | 27 213 | 9,9 | 7,1 | 2,8 |

| 35 | Kaliningrad Region | 26 948 | 5,9 | 8,7 | -2,8 |

| 36 | Vologda Region | 26 764 | 7,2 | 8,1 | -1,0 |

| 37 | Kemerovo Region | 26 729 | 5,4 | 7,9 | -2,4 |

| 38 | Omsk Region | 26 307 | 5,8 | 7,4 | -1,6 |

| 39 | Krasnodar Region | 25 979 | 6,9 | 8,9 | -2,0 |

| 40 | Nizhny Novgorod Region | 25 949 | 9,1 | 8,2 | 0,9 |

| 41 | Samara Region | 25 941 | 10,6 | 7,2 | 3,4 |

| 42 | Tula Region | 25 725 | 11,6 | 7,8 | 3,7 |

| 43 | Novgorod Region | 25 167 | 8,3 | 7,5 | 0,8 |

| 44 | Yaroslavl Region | 25 104 | 9,8 | 8,5 | 1,3 |

| 45 | Tver Region | 24 724 | 7,4 | 8,3 | -0,9 |

| 46 | The Republic of Bashkortostan | 24 647 | 9,7 | 6,4 | 3,4 |

| 47 | Astrakhan Region | 24 465 | 8,6 | 6,8 | 1,8 |

| 48 | Voronezh Region | 24 004 | 8,1 | 8,8 | -0,6 |

| 49 | Belgorod Region | 23 975 | 7,8 | 6,3 | 1,5 |

| 50 | Volgograd Region | 23 933 | 13,0 | 7,3 | 5,8 |

| 51 | Ryazan Region | 23 791 | 8,5 | 8,9 | -0,4 |

| 52 | Udmurtia | 23 702 | 10,5 | 6,9 | 3,6 |

| 53 | Orenburg Region | 23 531 | 9,3 | 6,8 | 2,5 |

| 54 | Lipetsk Region | 23 486 | 8,6 | 7,5 | 1,1 |

| 55 | Rostov Region | 23 477 | 8,6 | 7,6 | 1,0 |

| 56 | Kursk Region | 23 161 | 9,8 | 7,0 | 2,7 |

| 57 | Stavropol Region | 22 557 | 8,9 | 6,5 | 2,4 |

| 58 | Vladimir Region | 22 443 | 9,8 | 9,2 | 0,6 |

| 59 | Penza Region | 22 418 | 8,6 | 7,3 | 1,3 |

| 60 | Altai Republic | 22 294 | 8,3 | 7,3 | 1,1 |

| 61 | The Chechen Republic | 22 164 | 2,2 | 5,6 | -3,4 |

| 62 | Saratov Region | 22 002 | 7,3 | 7,3 | 0,0 |

| 63 | Smolensk Region | 21 970 | 7,6 | 9,1 | -1,5 |

| 64 | The Republic of Ingushetia | 21 910 | 2,1 | 4,4 | -2,3 |

| 65 | Kurgan Region | 21 111 | 8,2 | 7,7 | 0,5 |

| 66 | Ulyanovsk Region | 21 096 | 10,0 | 7,8 | 2,3 |

| 67 | Kirov Region | 20 931 | 8,3 | 7,3 | 1,0 |

| 68 | Pskov Region | 20 883 | 5,6 | 8,4 | -2,8 |

| 69 | Kostroma Region | 20 882 | 8,6 | 7,3 | 1,3 |

| 70 | Chuvash Republic | 20 858 | 7,2 | 6,9 | 0,3 |

| 71 | Bryansk Region | 20 812 | 8,7 | 9,1 | -0,4 |

| 72 | Oryol Region | 20 804 | 8,5 | 8,5 | 0,0 |

| 73 | Republic of Adygea | 20 801 | 9,4 | 7,5 | 1,9 |

| 74 | Tambov Region | 20 751 | 8,7 | 8,4 | 0,3 |

| 75 | Ivanovo Region | 20 562 | 8,6 | 9,1 | -0,5 |

| 76 | Mari El Republic | 20 512 | 10,4 | 7,3 | 3,1 |

| 77 | Republic of North Ossetia - Alania | 20 317 | 4,2 | 6,2 | -2,0 |

| 78 | The Republic of Mordovia | 20 098 | 11,3 | 7,5 | 3,9 |

| 79 | The Karachay-Cherkess Republic | 19 831 | 10,5 | 7,1 | 3,3 |

| 80 | The Kabardino-Balkar Republic | 19 698 | 7,8 | 6,7 | 1,1 |

| 81 | Altai Region | 19 457 | 7,4 | 8,1 | -0,7 |

| 82 | The Republic of Dagestan | 19 398 | 12,9 | 4,9 | 8,1 |

| 83 | Republic of Kalmykia | 19 384 | 9,8 | 6,0 | 3,8 |

| 84 | Sevastopol | 14 333 | 17,5 | - | |

| 85 | Republic of Crimea | 14 221 | 25,4 | 18,2 | 7,2 |

Return on assets of enterprises engaged in water gathering and distribution

Information agency Credinform prepared the ranking of enterprises engaged in water gathering and distribution.

The companies with the highest volume of revenue involved in water gathering and distribution were selected for the ranking according to the data from the Statistical Register for the latest available period (for the year 2013).

Return on assets (%) is the relation of the sum of net profit and interests payable to company’s total assets value. It shows how many monetary units of net profit were earned by each unit of total assets.

The ratio characterizes the efficiency of use by a company of its resources, the efficiency of company’s financial management.

That’s why the higher is the value of this indicator, the higher is the efficiency of business, i.e. the higher is the return on each monetary unit invested in assets. However, when drawing conclusions about financial standing of an enterprise it is necessary to consider two important points.

Firstly, comparison of companies on return on assets ratio can be correctly done only within one branch. For example, in branches with a high turnover of assets as retail trade this indicator will be significantly higher, as in industries, where asset turnover is traditionally low as in machine building industry.

Secondly, it is necessary to take into account the fact that the book value of assets may significantly not conform to their current market value. For example, under the influence of inflation the book value of fixed assets will be increasingly underestimated in the course of time, that will lead to overestimated return on assets. In other words, even within one branch an analyst should consider not only the structure, but also the age of assets.

The existing trend of this indicator also should be taken into account. Its consistent lowering points out the decline in efficiency of use of assets by business, and vice versa.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to average values of profit, but also to all presented combination of financial data.

| № | Name | Region | Revenues, in mln RUB, for 2013 | Return on assets, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Samarskie kommunalnye sistemy LLC INN 6312110828 |

Samara region | 3 608,9 | 13,09 | 258 high |

| 2 | «MUP Vodokanal Ekaterinburg INN 6608001915 |

Sverlovsk region | 5 671,4 | 8,36 | 178 the highest |

| 3 | «MUP g. Novosibirska GORVODOKANAL» INN 5411100875 |

Novosibirsk region | 4 184,8 | 2,68 | 162 the highest |

| 4 | «GUP Moskollektor INN 7708000882 |

Moscow | 5 288,9 | 2,53 | 189 the highest |

| 5 | NOVOGOR-Prikame LLC INN 5902817382 |

Perm region | 4 381,6 | 2,37 | 241 high |

| 6 | Nizhegorodsky vodokanal OJSC INN 5257086827 |

Nizhnii Novgorod region | 3 483,3 | 1,35 | 240 high |

| 7 | Rostovvodokanal OJSC INN 6167081833 |

Rostov region | 4 235,0 | 0,99 | 260 high |

| 8 | «GUP SKStavropolkraivodokanal INN 2635040105 |

Stavropol territory | 4 713,9 | 0,10 | 220 high |

| 9 | Mosvodokanal OJSC INN 7701984274 |

Moscow | 46 426,9 | 0,04 | 197 the highest |

| 10 | «MUP POVV g. Chelyabinsk» INN 7421000440 |

Chelyabinsk region | 3 226,0 | 0,02 | 220 high |

The revenues of the largest Russian enterprises involved in water gathering and manufacture (TOP-10) according to the last published annual financial statement (for 2013) made 85,2 bln RUB, that is by 8,4% higher, than in the previous period.

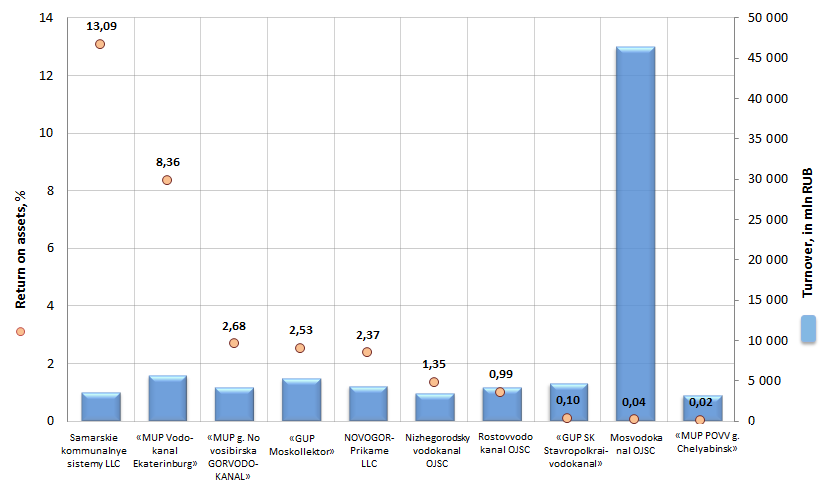

Picture. Return on assets and revenues of the largest enterprises engaged in manufacture and distribution of water (TOP-10)

The return on assets of all organizations of the TOP-10 is in the positive zone, that on its own is a good indicator for enterprises of housing and utility sector (the majority of companies have a negative ratio). In other words, the leaders finished the year with net profit.

The assets are the most effectively used by Samarskie kommunalnye sistemy LLC: return on its assets is 13,1%, that is well over, than the indicator of Mosvodokanal OJSC, Moscow (0,04%) – the production being largest on revenues.

According to the independent estimation of the Information agency Credinform, all participants of the TOP-10 got high and the highest solvency index. This fact points to the ability of market players to pay off their debts in time and fully, while risk of default is minimal.