Tax optimization abroad will become more complicated

From October 1, 2019 the «Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting», which was concluded in Paris on November 24, 2016 and signed in 68 countries of the world, will enter into force in Russia. The Convention was ratified by the Federal Law №79-FZ of May 1, 2019.

The Convention was developed within the frame of the Action Plan on Base Erosion and Profit Shifting (BEPS plan), the main purpose of which is to ensure profit taxation in those country where business is actually carried out, and to counter the artificial transfer of profit to low-tax jurisdictions with the aim of tax evasion.

The measures specified by the Convention relate primarily to hybrid schemes for reducing of the tax burden, abuses of the provisions of agreements, and artificially avoiding of the status of a permanent establishment.

The countries, which have signed the Convention and carried out the procedures that it provides for, are given the opportunity to toughen simultaneously all current intergovernmental agreements on the avoidance of double taxation, without holding bilateral negotiations on each agreement.

The application of the Convention to specific agreements is subject to the signing of a multilateral Convention by the partner countries and the inclusion of Russia in the list of jurisdictions, in respect of which the Convention applies.

The convention is to be applied to 71 agreements between Russia and other states. As of July 3, 2019, the Convention has already been ratified by 20 states: Austria, Belgium, Great Britain, Ireland, Lithuania, Luxembourg, Malta, the Netherlands, Poland, Serbia, Slovakia, Slovenia, Finland, France, Israel, the United Arab Emirates, India, Singapore, Australia and New Zealand.

Software engineering trends

Information agency Credinform represents an overview of activity trends of the largest Russian software development companies.

The companies with the largest volume of annual revenue (TOP-10 and TOP-1000) were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2015 – 2017). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets value is an indicator, reflecting the real value of company’s property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

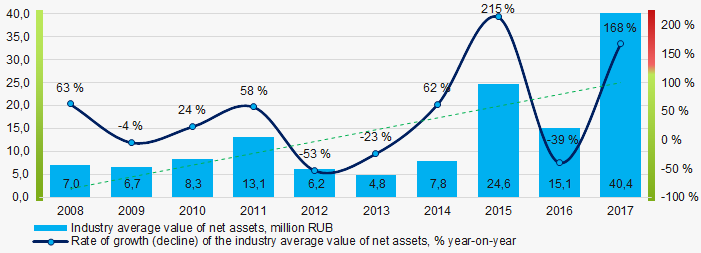

The average values of net assets of TOP-1000 enterprises tend to increase over the ten-year period (Picture 1).

Picture 1. Change in the industry average indicators of the net assets value of software development companies in 2008 – 2017

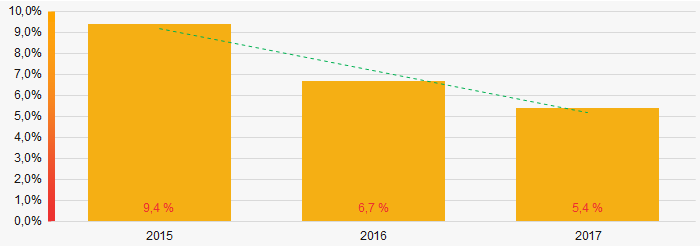

Picture 1. Change in the industry average indicators of the net assets value of software development companies in 2008 – 2017The shares of TOP-1000 enterprises with insufficiency of assets were at relatively low level with a downward trend in the last three years (Picture 2).

Picture 2. Shares of enterprises with negative values of net assets in TOP-1000 in 2015 – 2017

Picture 2. Shares of enterprises with negative values of net assets in TOP-1000 in 2015 – 2017Sales revenue

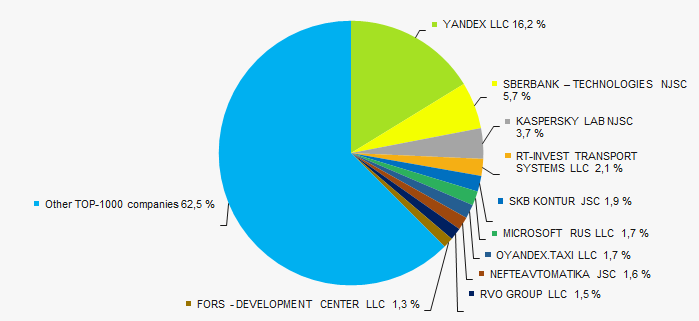

The revenue volume of 10 leading companies of the region made 38% of the total revenue of TOP-1000 in 2017 (Picture 3). It points to a relatively high level of monopolization in the industry.

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises for 2017

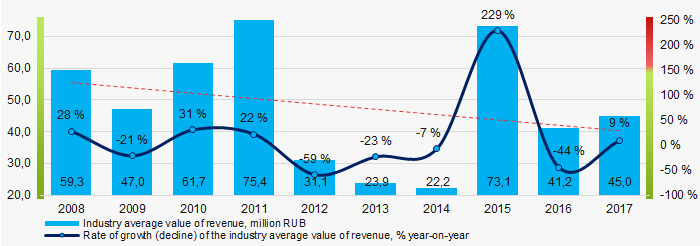

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises for 2017In general, there is a trend towards an decrease in industry average revenue over the ten-year period (Picture 4).

Picture 4. Change in the industry average revenue of software development companies in 2008 – 2017

Picture 4. Change in the industry average revenue of software development companies in 2008 – 2017Profit and loss

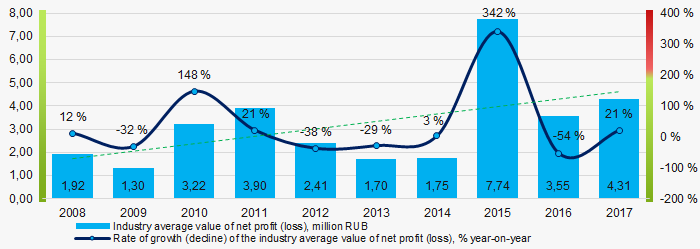

Industry average net profit trends to increase over the past ten years (Picture 5).

Picture 5. Change in the industry average indicators of net profit of software development companies in 2008 – 2017

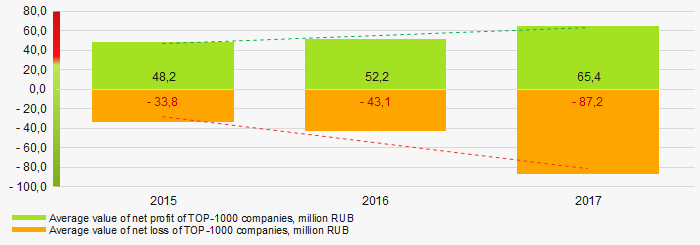

Picture 5. Change in the industry average indicators of net profit of software development companies in 2008 – 2017Average values of net profit’s indicators of TOP-1000 companies increase for the three-year period, at the same time the average value of net loss also increases. (Picture 6).

Picture 6. Change in the industry average values of indicators of net profit and net loss of TOP-1000 companies in 2015 – 2017

Picture 6. Change in the industry average values of indicators of net profit and net loss of TOP-1000 companies in 2015 – 2017Key financial ratios

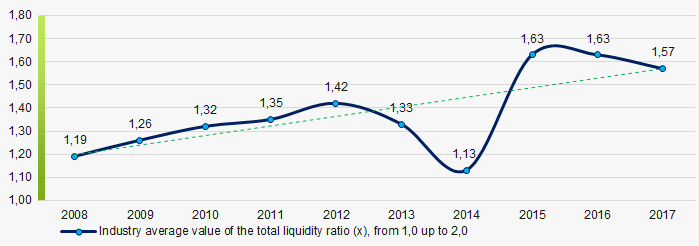

Over the ten-year period the industry average indicators of the total liquidity ratio were in the range of recommended values - from 1,0 up to 2,0, with a tendency to increase (Picture 7).

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 7. Change in the industry average values of the total liquidity ratio of software development companies in 2008 – 2017

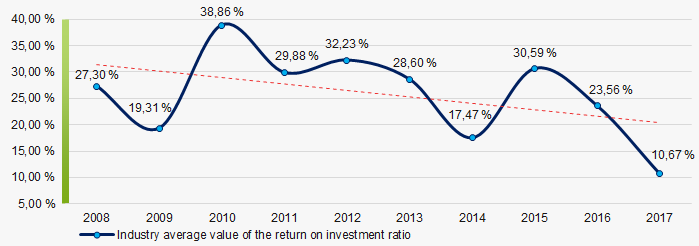

Picture 7. Change in the industry average values of the total liquidity ratio of software development companies in 2008 – 2017The industry average values of the return on investment ratio trend to decrease for ten years (Picture 8).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity of own capital involved in the commercial activity and the long-term borrowed funds of an organization.

Picture 8. Change in the industry average values of the return on investment ratio of software development companies in 2008 – 2017

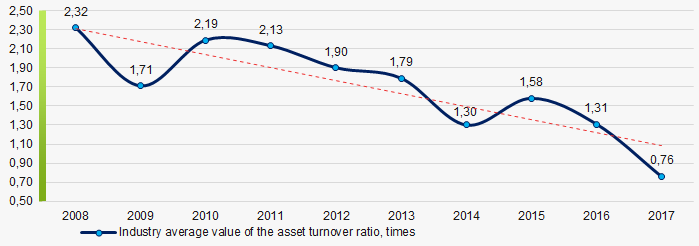

Picture 8. Change in the industry average values of the return on investment ratio of software development companies in 2008 – 2017Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

This ratio of business activity showed a tendency to decrease over the ten-year period (Picture 9).

Picture 9. Change in the industry average values of the asset turnover ratio of software development companies in 2008 – 2017

Picture 9. Change in the industry average values of the asset turnover ratio of software development companies in 2008 – 2017Small business

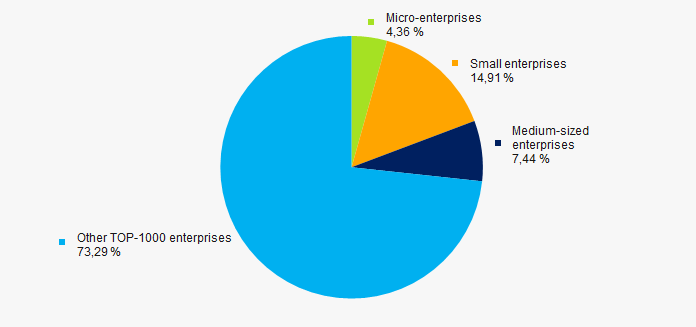

75% of TOP-1000 companies are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the RF. At the same time, their share in the total revenue amounted to 27% in 2017, that is higher than the national average (Picture 10).

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-1000 companies, %

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-1000 companies, %Main regions of activity

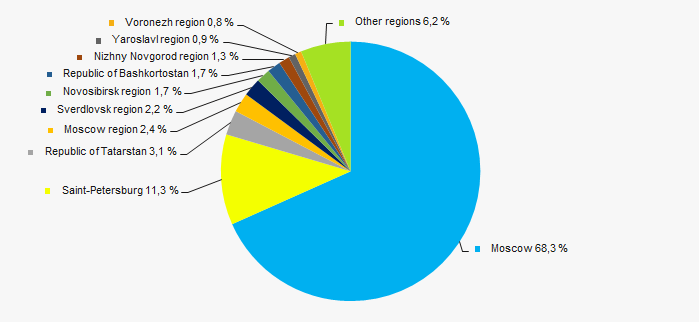

The TOP-1000 companies are distributed unequal across Russia and registered in 52 regions. Almost 80% of their revenue are concentrated in Moscow and Saint-Petersburg (Picture 11).

Picture 11. Distribution of the revenue of TOP-1000 companies by Russian regions

Picture 11. Distribution of the revenue of TOP-1000 companies by Russian regionsFinancial position score

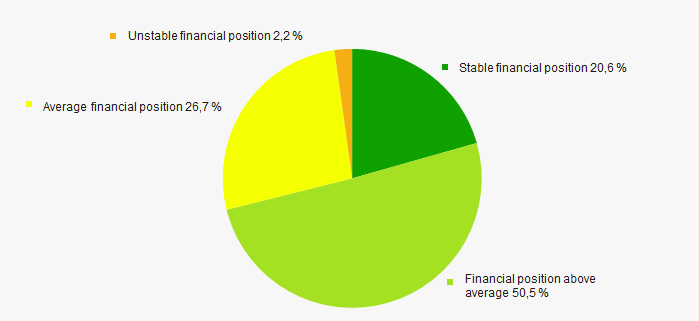

An assessment of the financial position of TOP-1000 companies shows that 70% of them are in a stable and above average financial positions (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

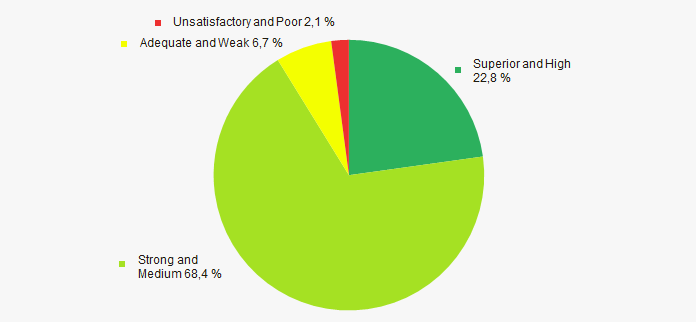

The vast majority of TOP-1000 companies got Superior/High or Strong/Medium Solvency index Globas, that points to their ability to pay off their debts in time and fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index GlobasAccording to the Federal State Statistics Service, the share of computer software development in the revenue volume from the sale of goods, products, works, and services made 0,89% countrywide for 2018.

Conclusion

A comprehensive assessment of activity of the largest Russian software development companies, taking into account the main indices, financial indicators and ratios, points to the prevalence of positive trends in the industry (Table 1).

| Trends and evaluation factors | Specific share of factor, % |

| Rate of growth (decline) in the average size of net assets |  10 10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  10 10 |

| Rate of growth (decline) in the average size of revenue |  -10 -10 |

| Level of competition |  -10 -10 |

| Rate of growth (decline) in the industry average size of net profit (loss) |  10 10 |

| Growth / decline in average values of net profit of TOP-1000 companies |  -10 -10 |

| Growth / decline in average values of net loss of TOP-1000 companies |  -10 -10 |

| Increase / decrease in industry average values of total liquidity ratio |  10 10 |

| Increase / decrease in industry average values of return on investment ratio |  -5 -5 |

| Increase / decrease in industry average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized enterprises in the industry in terms of revenue being more than 22% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of factors |  0,4 0,4 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).