Return on assets of water transport

Information agency Credinform represents a ranking of the largest Russian water transport companies. Sea and river transport companies with the largest volume of annual revenue TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (2015 - 2017). Then companies were ranked by return on assets ratio (Table 1). The analysis is based on the data of the Information and Analytical system Globas.

Return on assets (%) is the relation of the sum of net profit and interest payable to the total assets value of a company. It shows how many monetary units of net profit gets every unit of total assets.

The ratio characterizes the effectiveness of using own resources by the company and its financial management. That is why the higher is the ratio value, the more effective is business, that is the higher return per every monetary unit invested in assets.

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in the sectors, has developed and implemented in the Information and Analytical system Globas рthe calculation of practical values of financial ratios that can be recognized as normal for a particular industry. For water transport companies the practical value of the return on assets ratio is from -4,11 in 2017.

For the most complete and objective view of the financial condition of the enterprise, it is necessary to pay attention to the complex of indicators and financial ratios of the company.

| Name, INN, region, business scope | Revenue, bln RUB | Net profit (loss), bln RUB | Return on assets, (%) | Solvency index Globas | |||

| 2016 | 2017 | 2016 | 2017 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| VLADIVOSTOK SEA CONTAINER TERMINAL CO., LTD. INN 2537073208 Primorye territory Activity of sea freight transport |

3,53 3,53 |

4,50 4,50 |

0,44 0,44 |

0,31 0,31 |

34,80 34,80 |

37,91 37,91 |

200 Strong |

| JSC ROSNEFTEFLOT INN 6501096047 Moscow Activity of sea freight transport |

6,20 6,20 |

4,99 4,99 |

1,64 1,64 |

1,12 1,12 |

26,88 26,88 |

13,96 13,96 |

166 Superior |

| JSC VOLGA-SHIPPING INN 5260902190 Nizhniy Novgorod region Activity of inland water freight transport In process of reorganization in the form of merger of other legal entities since 28.06.2018 |

4,54 4,54 |

5,27 5,27 |

1,36 1,36 |

0,94 0,94 |

14,03 14,03 |

10,97 10,97 |

153 Superior |

| LLC SCF SHELF INN 7841472237 Saint Petersburg Activity of sea freight transport |

2,89 2,89 |

6,92 6,92 |

0,35 0,35 |

0,36 0,36 |

18,56 18,56 |

10,47 10,47 |

200 Strong |

| JSC NORTH-WESTERN SHIPPING INN 7812023195 Saint Petersburg Activity of sea freight transport |

6,99 6,99 |

7,01 7,01 |

0,40 0,40 |

0,74 0,74 |

5,12 5,12 |

10,04 10,04 |

164 Superior |

| LLC PRIME SHIPPING INN 6317060306 Samara region Activity of inland water freight transport |

5,99 5,99 |

6,05 6,05 |

0,79 0,79 |

0,87 0,87 |

4,67 4,67 |

4,96 4,96 |

195 High |

| LLC GAZPROMNEFT SHIPPING INN 7805480017 Saint Petersburg Activity of sea freight transport |

1,11 1,11 |

5,83 5,83 |

-0,99 -0,99 |

0,74 0,74 |

-0,39 -0,39 |

2,87 2,87 |

239 Strong |

| NAYADA CO., LTD INN 2508042212 Primorye territory Activity of sea freight transport |

1,38 1,38 |

5,44 5,44 |

-0,03 -0,03 |

0,03 0,03 |

-2,45 -2,45 |

2,11 2,11 |

243 Strong |

| LLC NIKO INN 2538001527 Primorye territory Activity of sea freight transport |

5,58 5,58 |

5,64 5,64 |

0,04 0,04 |

0,01 0,01 |

4,44 4,44 |

0,66 0,66 |

247 Strong |

| JSC LENA UNITED RIVER SHIPPING INN 1435029085 Republic of Sakha (Yakutia) Activity of inland water freight transport |

4,82 4,82 |

5,34 5,34 |

0,03 0,03 |

0,04 0,04 |

0,35 0,35 |

0,42 0,42 |

192 High |

| Total for TOP-10 companies |  43,03 43,03 |

56,98 56,98 |

4,94 4,94 |

5,16 5,16 |

|||

| Average value for TOP-10 companies |  4,30 4,30 |

5,70 5,70 |

0,49 0,49 |

0,52 0,52 |

10,60 10,60 |

9,44 9,44 |

|

| Industry average value |  0,061 0,061 |

0,098 0,098 |

0,003 0,003 |

0,000 0,000 |

2,41 2,41 |

-0,03 -0,03 |

|

— growth of indicator to the previous period,

— growth of indicator to the previous period,  — decrease of indicator to the previous period.

— decrease of indicator to the previous period.

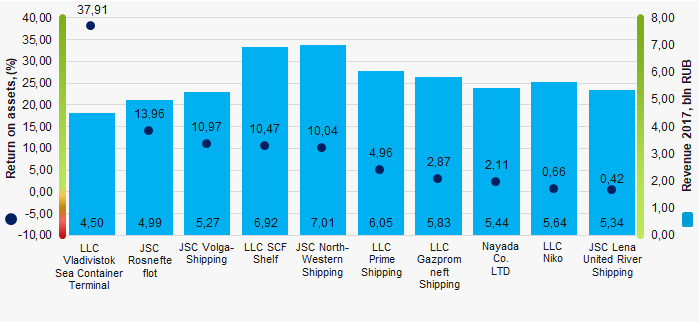

The average indicator of return on assets ratio of TOP-10 companies is higher than recommended, industry average and practical one. In 2017, six companies of TOP-10 demonstrated the upside in comparison with the previous period.

Picture 1. Return on assets ratio and revenue of the largest Russian water transport companies (TOP-10)

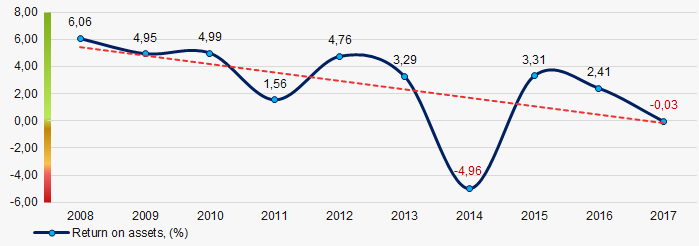

Picture 1. Return on assets ratio and revenue of the largest Russian water transport companies (TOP-10)Over the past 10 years, the industry average values of return on assets ratio have a trend to decrease (Picture 2).

Picture 2. Change in the industry average values of return on assets ratio of the largest Russian water transport companies in 2008 – 2017

Picture 2. Change in the industry average values of return on assets ratio of the largest Russian water transport companies in 2008 – 2017A review of articles about legislation in 2018

Information agency Credinform has prepared a short review of articles about the most important federal acts of legislation, decisions of the Government and authorities.

Legislation amendments on international exchange of financial information for tax purposes

According to the Federal Law as of 27.11.2017 No.340-FL, Chapter 14.4-1 was added to the first part of the Tax Code of the Russian Federation. Submission of documentation for multinational groups of companies. Chapter 20.1 was also added to the first part of the Tax Code of the Russian Federation. Automatic exchange of Country-by-Country Reporting with foreign countries (territories).

Enforcement of foreign judgments on confiscation of criminal proceeds on the territory of the Russian Federation

The Federal Law «On amendments to the Federal Law «On enforcement proceedings» as of 05.12.2017 No.382-FL defines the procedure of enforcement of foreign judgments in Russia related to confiscation of criminal proceeds on the territory of the Russian Federation in accordance with international agreements of Russia and procedural law.

Legal entities and individual entrepreneurs are obliged to inform about opening a business

According to the Federal Law of 26.12.2008 No.294-FL «On protecting rights of legal entities and individual entrepreneurs during the execution of the public control (supervision) and municipal control», the regulations for presenting of notifications for carrying out particular types of business were developed (The Decree of the Government of 16.07.2009 No.584). By the Decree the order of filing of notifications to the correspondent federal executive authorities (or territorial bodies) was established in terms of actual location of providing works or services.

According to the Decree of the Government of the RF of 09.12.2017 No.1500, since January 1, 2018 notification about business opening can be filed regardless from location of providing works or services.

Trading in electricity – a new type of licensed activity

The Federal Law No.451-FL «On amendments to the Federal Law «On electric power industry» and certain legislative acts of the Russian Federation related to the licensing of power supply activity» dated December 29, 2017 has established that power supply activity after December 30, 2018 can be carried out only on the basis of licenses.

Statutory standard ratios for banks with a basic license

According to the Federal Law of 01.05.2017 No.92-FL “On amendments to certain legislative acts of the Russian Federation” entered into force since 01.06.2017, bank licenses are divided into basic and universal. Hence different requirements to minimum amount of own funds or capital were set for banks with universal and basic licenses.

Banks will know their customers better

Through the Federal law from 07.08.2001 No. 115-FL «On counteracting the legalization (laundering) of proceeds received by criminal way and terrorism financing», credit institutions will receive data on accounts of companies and individual entrepreneurs in third party banks. This data will be provided by the Federal Tax Service (FTS) on a round-the-clock basis.

Prevention of bankruptcies in insurance

The Federal Law No. 87-FL dated 23.04.2018 prescribes a package of measures for prevention of bankruptcies of insurance companies, similar to the procedure for financial recovery of banks.

Auditors are obliged to notify the Federal Service for Financial Monitoring about shady deals and financial transactions

The Federal Law from April 23, 2018 No. 112-FL «On countering the legalization (laundering) of criminally obtained incomes and the financing of terrorism» and the Article 13 of the Federal Law «On auditing» were amended. According to them, auditing firms and private auditors are obliged to inform the Federal Service for Financial Monitoring (hereinafter Rosfinmonitoring) about any deals and financials transactions of their clients which were or could be aimed at legalization of criminally obtained incomes or financing of terrorism.

Free registration of legal entities in electronic format

Since 2019 the payment of government fee will be not required in following cases: submitting documents in electronic format to registration authorities for registration of legal entities (individual entrepreneurs) and amending to corporate establishment documents; liquidation of legal entities or termination of individual entrepreneurs activity.

“Transparent business” project of the Federal Tax Service

The Federal Tax Service has launched “Transparent business” project involving disclosure of companies’ data not of tax secrecy.

Legal status of international business

The Federal Law No.292-FL from August 3, 2018 with the amendments to the article 1202 of part three of the Civil Code of the Russian Federation clarified the definition «personal law of the legal entity», as the legal system of the country, where it was established, unless contrary to provisions of this Federal Law and the Federal law No.290-FL "On international business entities" which entered into force on August 3, 2018.

An International business entity is a foreign legal entity, commercial corporate organization, that has changed its personal law in accordance with the established legislative procedure.

Amendments to the law “On credit histories”

The Federal Law No.327-FL from August 3, 2018 detailed the procedure and ways of carrying the consent of borrowers on obtaining their credit reports by users.

Customs Regulation Act

Federal Law No. 289-FL from August 3, 2018, which is generally intended to improve administration and reduce customs formalities, regulates:

- order of import (export) of goods to the Russian Federation and their transportation through the country under customs supervision;

- order of temporary storage and customs declaration of goods, their usage according to the customs procedures;

- procedure of customs control, levying and payment of customs charges and special duties;

- rights and duties of bodies interacting during customs procedures;

- legal status and organizational framework of customs authorities’ activity in the Russian Federation;

- aspects of embargo on certain types of goods within the Russian territory.

Check of companies on engagement in terrorism

Entrepreneurs providing legal or accounting services are obliged by the Federal Financial Monitoring Service (Rosfinmonitoring) to check their clients on participation in shady financial transactions and terrorism.

Signs of shell companies

The Letter of the Federal Tax Service of Russia (hereinafter “the FTS”) No. ED-4-15/13247 from July 10, 2018 “On preventive control of tax legislation” contains updated criteria of identification of legal entities and individual entrepreneurs acting as shell ones.

Audit secret

The Federal Law No. 231-FL from July 29, 2018 introduced provisions (p. 4 of the Art. 82) into the Part One of the Tax Code of the RF on the admissibility of collection, storage and use of documents or information received from audit organizations.

From January 1, 2019, auditors are obliged to submit information to the Federal Tax Service (FTS of the RF) at the first request within a ten-day period based on the decision of the head of the FTS of the RF or his deputy.

Licensing of bus transportation

A bill that revives licensing of bus transportation was approved. The bill provides for compulsory equipping with tachographs the vehicles of a gross weight over 3.5 tons and over 8 passenger seats.

The unified electronic system ZAGS began working

The Unified state register of acts of civil status (EGR ZAGS) was based on software developed by the FTS of the RF. State registration of all acts of civil status as well as amendments to existing entries and arrangements for exit of duplicates are performed in the Register.

Unified trade aggregator for public procurement

According to the Resolution of the Government of the Russian Federation as of 28 April 2018 No.824-р from November 1, all federal executive agencies and their subordinated authorities are obligated to make certain procurement using a Unified trade aggregator (UTA).

Choosing a proper legal address

To avoid risks of denial of registration, as well as during establishment of legal entities and introduction of changes in the EGRUL, one should check prospective legal addresses in the Federal Information Address System (FIAS).

Amendments to the Law «On financial accounts»

The Federal Law of 28.11.2018 No.444-FL «On Amendments to the Federal Law «On financial accounts» have come into force. The State information resource of accounting (financial) statements will be organized in Russia. The Federal Tax Service (FTS RF) is authorized to maintain the resource. Beginning from the financial accounts for 2019, all companies are obliged to file accounts only in electronic form. Small business entities will file accounts in electronic form since 2020. The obligation to file accounting statements to the state statistics authorities is cancelled.

Contracting procurement system has changed

The Federal Law No.393-FL of 30.10.2018 «On introducing amendments to Article 93 Federal Law «On the contract system in the field of procurement of goods, works, services for state and municipal needs» makes an exception for the scientific institutions. Now these organizations can make procurement without tendering procedures for the amount not exceeding 20 million rubles per year.