Net profit in sale of construction materials

Information agency Credinform presents a ranking of the largest Russian wholesalers of construction materials. The enterprises with the highest volume of revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available accounting periods (2016-2018), performing wholesale of timber, construction materials and sanitary equipment. Then they were ranked by decrease in net profit ratio (Table 1). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net profit ratio (%) is calculated as a relation of net profit (loss) to sales revenue and shows sales profit rate.

There is no prescribed value for this ratio. It is recommended to compare companies within one industry or change of the ratio with time for the particular enterprise. Negative value of the indicator shows net loss. High value of the indicator demonstrates efficient work of an enterprise.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all available combination of financial indicators and ratios.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Net profit ratio, % | Solvency index Globas | |||

| 2017 | 2018 | 2017 | 2018 | 2017 | 2018 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| JSC NATIONAL AGGREGATES COMPANY INN 7716614075 Moscow |

19851,5 19851,5 |

22038,8 22038,8 |

3234,2 3234,2 |

2593,5 2593,5 |

16,29 16,29 |

11,77 11,77 |

229 Strong |

| LLC STD PETROVICH INN 7802348846 Saint Petersburg |

37086,8 37086,8 |

48505,2 48505,2 |

1485,7 1485,7 |

2104,0 2104,0 |

4,01 4,01 |

4,34 4,34 |

187 High |

| TB Standart Company LTD INN 5835029697 Penza region |

7594,4 7594,4 |

10331,6 10331,6 |

203,2 203,2 |

369,3 369,3 |

2,68 2,68 |

3,57 3,57 |

224 Strong |

| LLC SANTEKHKOMPLEKT INN 7736192449 Moscow region |

13074,8 13074,8 |

14540,2 14540,2 |

449,7 449,7 |

391,8 391,8 |

3,44 3,44 |

2,69 2,69 |

202 Strong |

| LLC PCF GREENHOUSE TEHNOLOGIES INN 7713634570 Moscow |

9839,8 9839,8 |

9909,2 9909,2 |

333,6 333,6 |

259,9 259,9 |

3,39 3,39 |

2,62 2,62 |

209 Strong |

| LLC D&POS COMPANY LIMITED INN 7726044240 Altai territory |

22630,4 22630,4 |

31802,8 31802,8 |

752,4 752,4 |

637,7 637,7 |

3,32 3,32 |

2,01 2,01 |

207 Strong |

| JSC TARKETT RUS INN 7727115649 Moscow |

22502,7 22502,7 |

22113,1 22113,1 |

0,0 0,0 |

385,8 385,8 |

0,00 0,00 |

1,74 1,74 |

182 High |

| LLC DEMIDOV GROUP INN 7118818033 Novosibirsk region |

13893,3 13893,3 |

15096,7 15096,7 |

58,4 58,4 |

169,5 169,5 |

0,42 0,42 |

1,12 1,12 |

212 Strong |

| LLC NV-TRADE INN 2315171300 Moscow |

10172,8 10172,8 |

11771,1 11771,1 |

39,7 39,7 |

60,4 60,4 |

0,39 0,39 |

0,54 0,54 |

228 Strong |

| JSC TD PARTNER INN 7704602692 Moscow |

7564,8 7564,8 |

9402,2 9402,2 |

4,5 4,5 |

20,7 20,7 |

0,06 0,06 |

0,22 0,22 |

222 Strong |

| Average value by TOP-10 companies |  16421,1 16421,1 |

19551,1 19551,1 |

656,1 656,1 |

699,3 699,3 |

3,40 3,40 |

3,06 3,06 |

|

| Industry average value |  52,0 52,0 |

53,8 53,8 |

0,8 0,8 |

1,0 1,0 |

1,46 1,46 |

1,93 1,93 |

|

growth of indicator to the previous period,

growth of indicator to the previous period,  decrease of indicator to the previous period

decrease of indicator to the previous period

The average indicator of the net profit ratio of TOP-10 companies is above the industry average value. Six companies have improved their results in 2018.

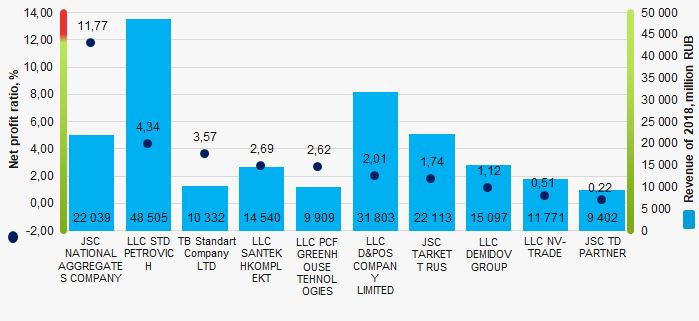

Picture 1. Net profit ratio and revenue of the largest Russian wholesalers of construction materials (TOP-10)

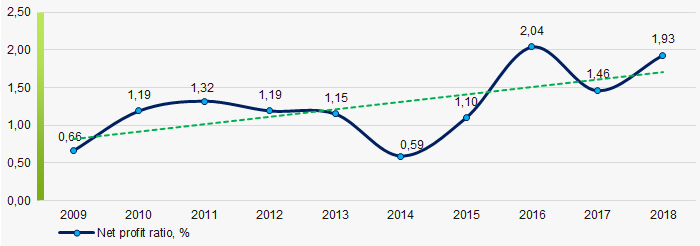

Picture 1. Net profit ratio and revenue of the largest Russian wholesalers of construction materials (TOP-10)During 10 years average industrial values of the net profit ratio have increasing trend. (Picture 2).

Picture 2. Change in the average indicators of profit of the Russian wholesalers of construction materials in 2009 – 2018

Picture 2. Change in the average indicators of profit of the Russian wholesalers of construction materials in 2009 – 2018Changes in legislation

The Government of Russia and the Central bank implement measures to minimize the negative impact of COVID-19 pandemic and changes on financials and commodities markets on the economy and citizens. The tasks are to promote financial stability and good standing of the economy, and to support population and regional budgets.

The table below contains measures aimed at the first two tasks solving:

| Measures | |

| Government | The Central bank |

| Delayed tax payments for air transport and tourism companies, with further implementation of this measure to other affected sectors. Granting “tax holidays” to air transport and tourism companies for the payment of taxes, insurance contributions, the deadline for payment of which is prior to May 1, 2020. |

Provide the economy with rouble and currency liquidity. |

| Until the end of 2020, travel companies are exempted from paying contributions to the reserve fund of the Turpomosch association and to personal liability funds. | Implementation of regulatory actions to simplify the adaptation of financial institutions to the changing market situation. |

| Providing state guarantees for restructuring and prolonging of loans. | Enabling banks to crediting or restructuring of loans of borrowers engaged in transport and tourism without reduction their financial rating. |

| Updating the list of systemically important companies. | Softening the requirement to banks aimed at additional opportunities of lending for manufacturers of medicines and medical equipment. |

| Creation of a special joint group for monitoring the financial condition of systemically important companies. If necessary, the adoption by the control headquarter of the Government of decisions on supporting measures for these companies. | |

| Extension of concessional lending to small and medium-sized businesses, including the removal of restrictions on types of lending and industries, and increase in subsidies. Subsidies for loans up to two years increased by one percentage point. | Removing restrictions on the list of industries and increasing the attractiveness of the refinancing program for loans to small and medium-sized businesses. |

| Extension of the SME Corporation's guarantee support program for lending to small and medium enterprises. | If necessary, implementation of measures applied in the field of transport and tourism and not worsening the assessment of their financial situation on small and medium-sized enterprises or companies of other industries experiencing serious temporary difficulties. |

| Deferral of rental payments for up to three months for small and medium-sized businesses - tenants of state or municipal property. | |

| Removal of penalties from government contractors under negative influence. This also applies to fines for non-compliance with foreign exchange control for non-resource exports. | |

| Additional measures to support trade enterprises to ensure sufficient reserves of socially significant products, including the provision of short-term soft loans for working capital financing. | |

| Removing import duties and expanding the use of the “green corridor” for certain types of socially significant goods during customs control. | |

| Moratorium on bankruptcy of companies that owe debts to regional and local budgets, as well as debts to banks, provided that previously the relevant bankruptcy cases have not been initiated. | |

| Within the current budgetary parameters of 2020, the limit of state guarantees can be increased and a reserve of 300 billion RUB will be used to cover urgent expenses. | |