Net profit ratio of grape wine manufacturers

Information agency Credinform prepared a ranking of enterprises manufacturing grape wines, based on net profit ratio.

The companies with highest volume of revenue were selected for this ranking according to data from the Statistical Register for the latest available period (for the year 2012). These enterprises were ranked by decrease in net profit ratio.

Net profit ratio (%) is the ratio of net profit (loss) to net sales. It shows how profitable were sales of a company.

There is no specified value, that is why it is recommended to compare companies of the same branch or ratio's change with time in one specific organization. It is clear that a negative value means that company has net loss. The higher is the net profit ratio the more effective is finally company’s activity.

| № | Name | Region | Turnover for 2012, mln RUB | Net profit ratio | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Abrau-Dyurso CJSC INN 2315092440 |

Krasnodar Territory | 2 474,9 | 19,6 | 201(high) |

| 2 | Stavropolskii vinno-konyachnyi zavod CJSC INN 2634045238 |

Stavropol Territory | 3 873,8 | 17,8 | 210(high) |

| 3 | Igristye Vina CJSC ИНН 7830001010 |

Saint-Petersburg | 4 537,2 | 8,2 | 200(high) |

| 4 | Agropromyshlennaya firma Fanagoriya CJSC INN 2352002170 |

Krasnodar Territory | 2 207,5 | 7,5 | 207(high) |

| 5 | Derbentskii zavod igristyh vin JSC INN 542001269 |

The Republic of Daghestan | 1 725,0 | 5,2 | 270(high) |

| 6 | Kuban-Vino LLC INN 2352034598 |

Krasnodar Territory | 1 565,1 | 3,2 | 256(high) |

| 7 | Kombinat shampanskih vin LLC INN 4702012163 |

Leningrad region | 1 393,6 | 0,7 | 299(high) |

| 8 | Moskovskii kombinat shampanskih vin JSC INN 7729007350 |

Moscow | 2 560,1 | 0,6 | 256(high) |

| 9 | Vinzavod Mayskii LLC INN 703006292 |

Moscow | 1 769,8 | 0,3 | 269(high) |

| 10 | Detchinskii zavod CJSC INN 4011006869 |

Kaluga region | 1 562,6 | 0,3 | 262(high) |

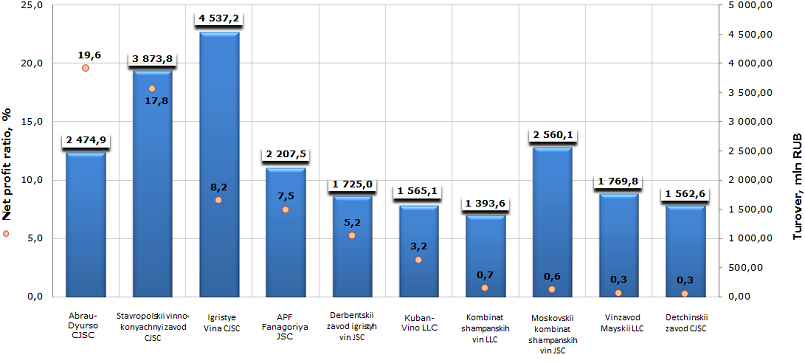

Picture 1. Net profit ratio and turnover of the largest producers of grape wines

Cumulative turnover of TOP-10 the largest grape wine manufacturers at year-end 2012 reached 23 669,6 mln RUB, went up by 13,7% per annum. The average value of net profit ratio is 6,3%. Cumulative net profit of TOP-10 enterprises of the mentioned branch is fixed at the level 1887,6 mln RUB, besides its increment was 9,4% in comparison with the previous year.

It can be stated that the situation in the field of grape wine producing is favorable enough. This can be explained mainly by the growing demand on wine products, including of domestic manufacture.

Abrau-Dyurso CJSC (19,6%) holds the biggest value of net profit ratio, the company with proud history located in Krasnodar Territory, producing sparkling grape wine – champagne under its own recognizable brand name. Also following organizations hold a higher-than-average ratio: Stavropolskii vinno-konyachnyi zavod CJSC (17,8%), Igristye Vina CJSC (8,2%), Agropromyshlennaya firma Fanagoriya CJSC (7,5%).

Igristye Vina CJSC (Saint-Petersburg) is besides the largest enterprise of the branch with the turnover 4537,2 mln RUB, it manufactures table grape wines, champagne, cognac.

Other participants of TOP-10 showed although positive, but low enough net profit ratios, that can point to high costs of production.

At the same time, according to the independent estimation of solvency developed by the Agency Credinform, all market leaders have a high solvency index GLOBAS-i®, that can be considered as a guarantee they will pay off their debts, while risk of default is minimal or below average. From investment point of view the business cooperation with participants of the rating looks attractive.

In Russia it will be allowed to take an on-coming property project as collateral

The bill on securitization of financial assets was passed by the State Duma in second reading. Amendments provide for changes in Russian Tax code (T.C.) and Civil Code (C.C.), focused on the attraction of additional financial resources to Russian economy, as well as on the widening of the range of securities available for investors.

CEO of the Russian Direct Investment Fund (RDIF) Kirill Dmitriev, speaking of the intent of securitization, points out that banks, providing loans, should have an opportunity to sell them to somebody then. Currently, such opportunity is limited for credit institutions. Virtually the main point of securitization is the right of banks to resell credits and to buy new credits on the funds received. Therefore, the mechanism of securitization will allow banks to provide much more credits.

So new articles are introducing to the C.C. within the context of the bill, which establish a procedure of opening, keeping and closing of a nominee account by the bank. The nominee account can be opened for its owner for performance of transactions with finances, rights on which belong to another person (to beneficiary). Moreover, within the context of the nominee account agreement, the bank could be obligated to control the use of money by account’s owner on behalf of the beneficiary, who has a right to demand from the bank the provision of information constituting banking secret. By the termination of the nominee account agreement the cash balance is transferred to another nominee account of the owner or given out to the beneficiary.

Also amendments affect the federal law «About securities market». A new chapter is added to the law, in which it is described the establishment procedure of two types of business entities - special-purpose financial entity and special-purpose entity for project financing.

According to the new bill, purposes and subject of the activity of special-purpose financial entity will be the acquisition of property rights and demand of the fulfillment of obligations by debtors, including future rights, which will appear from current and future liabilities, as well as realization of the issue of bonds secured by mortgage of receivables.

As to the special-purpose entity for project financing, so the subject of its activity will be financing of long-term (not less than three years) investment project by the acquisition of book debts, which will appear on grounds of the realization of property created in the result of project implementation, and the issue of bonds secured by mortgage of receivables and other property. Also the amendment spells out the procedure of establishment, functioning of entities and special procedure of their bankruptcy. According to the opinion of Kirill Dmitriev, the establishment of entity for project financing would let attract money to projects much faster and effective. For example, it would be possible to take an on-coming property project as collateral.

Within the context of changes in securities legislation, special priority is given to banks-originators, i.e. primary creditors, which would be obliged to keep 20% of assets on the balance sheet by the securitization. Apart from situations when the matter is about infrastructure projects, for these cases the standard in 10% is prescribed.

A new article is also added to the law «About securities market», which spells out the introduction of individual investment accounts. It is assumed that individual investment account will be opened and kept by a broker or trustee on the ground of separate brokerage agreement or securities trust management agreement. Natural person has a right to have only one agreement for keeping of the individual investment accounts. In case a new agreement will be signed the old one must be terminated within a months.

Changes will affect also notaries in private practice and notary chambers, which will be allowed to sign and extend the premises lease agreements, being publicly and municipally owned and using by them for notarial activities, including for safekeeping of the archive of notarized documents, without holding competitive tenders and auctions. Also the notaries could privatize premises, occupied by them more than 3 years, at market value.

In case the law would be passed in three readings, it could come into effect already on 1 July 2014. As to experts, suggested innovations would ease the access to financing for small and medium-sized enterprises.