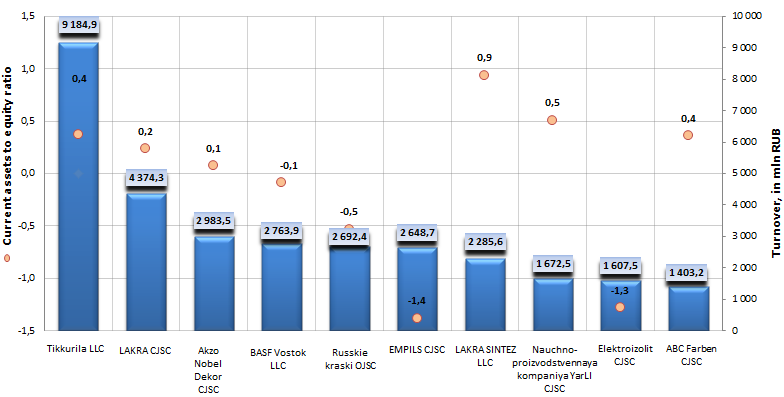

Current assets to equity ratio of manufacturers of paints, varnishes and lacquers in the RF

Information agency Credinform prepared a ranking «Current assets to equity ratio of Russian manufacturers of paints, varnishes and lacquers». The companies with highest volume of revenue were selected for this ranking according to data from the Statistical Register for the latest available period (for the year 2012). Then these enterprises were ranked by decrease in turnover.

Current assets to equity ratio (х) - is calculated as the relation of own current assets of a company to total value of equity. It shows the ability of the enterprise to maintain the current capital level and to finance current assets in case of need with own sources. The recommended value is from 0,2 to 0,5.

High value of the ratio and its stable growth characterizes positively the financial standing of an organization, as well as testifies that its management uses own funds flexible enough.

Some analysts consider as optimal that value of this ratio, which is equal to 0,5. It means that it should be observed the parity principle of investment of own funds in current and non-current assets, what will provide sufficient accounting liquidity. Low value of this ratio means, that significant part of own funds of an organization is focused on the financing of non-current assets, which liquidity is not high. The closer is the ratio value to the optimal one, the more financial opportunities has an enterprise and the more mobile assets are within the equity capital. However, the value of this ratio may change significantly depending on the type of company’s activity and the structure of its assets: the higher is the share of current assets, the lower is the ratio level and, vice versa, if an enterprise rents fixed capital and its property is represented mainly by current assets, the ratio level will be high. Also the ratio level depends to a large extent on the kind of company’s activity. In particular, in asset-intensive industries its normal level should be lower, than in material-intensive, because in these organizations the significant part of own funds is the source of the coverage of fixed capital stock.

Taken as a whole, the financial standing of an organization depends on the outstripping growth of the sum of own current assets in comparison with the growth of tangible assets and equity capital.

| № | Name | Region | Turnover,in mln RUB, for 2012 | Current assets to equity ratio, (х) | Solvency indexGLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Tikkurila LLC INN: 7816424590 |

Saint-Petersburg | 9 184,9 | 0,4 | 195(the highest) |

| 2 | LAKRA CJSC INN: 7726296375 |

Moscow region | 4 374,3 | 0,2 | 226(high) |

| 3 | Akzo Nobel Dekor CJSC INN: 5001027607 |

Moscow region | 2 983,5 | 0,1 | 180(the highest) |

| 4 | BASF Vostok LLC INN: 7710317252 |

Moscow region | 2 763,9 | -0,1 | 201(high) |

| 5 | Russkie kraski OJSC INN: 7605015012 |

Yaroslavl region | 2 692,4 | -0,5 | 202(high) |

| 6 | EMPILS CJSC INN: 6167008343 |

Rostov region | 2 648,7 | -1,4 | 284(high) |

| 7 | LAKRA SINTEZ LLC INN: 7702177932 |

Moscow region | 2 285,6 | 0,9 | 251(high) |

| 8 | Nauchno-proizvodstvennaya kompaniya YarLI CJSC INN: 7602003918 |

Yaroslavl region | 1 672,5 | 0,5 | 207(high) |

| 9 | Elektroizolit CJSC INN: 5042000530 |

Moscow region | 1 607,5 | -1,3 | 225(high) |

| 10 | ABCFarben CJSC INN: 3618003426 |

Voronezh region | 1 403,2 | 0,4 | 232(high) |

Picture 1. Current assets to equity ratio and turnover of the largest Russian manufacturers of paints, varnishes and lacquers (TOP-10)

Cumulative turnover of the first 10 largest Russian paint enterprises made 31 616,6 mln RUB, following the results of the latest published financial statement, that is higher by 26,7%, than the indicator of the previous year, and makes 46% of the revenue of TOP-100 companies of the branch.

The most optimal values of the analyzed ratio, providing sufficient accounting liquidity among the largest manufacturers of varnish-and-paint goods, were shown by following enterprises: Tikkurila LLC (0,4), Nauchno-proizvodstvennaya kompaniya YarLI CJSC (0,5) and ABC Farben CJSC (0,4).

In Russia the concern Tikkurila is the leader of the domestic market, started its activity in the 1980s with the export of industrial coatings from Finland. In the 1990s Tikkurila became the first western company, presented the tinting system in Russia. In 1995 Tikkurila opened the first European paint plant in Russia.

Nauchno-proizvodstvennaya kompaniya YarLI CJSC (0,5) – develops and manufactures paints, varnishes and lacquers of different purpose and is engaged in basic and applied research in the field of the technology of paint materials and coatings. The major part of paint materials, produced by NPK YarLI CJSC, is in competition with an increased inflow of imported (first of all West-European) paints, varnishes and lacquers in the market.

ABC Farben CJSC (0,4) – is one of the largest enterprises-manufacturers of paints, varnishes and lacquers, producing environmentally-friendly products, with using of the latest developments of scientific and technological progress in its field.

Also the company LAKRA CJSC (0,2) felt within the recommended range of current assets to equity ratio – supplies the market with universal and special enamels and paints, decorative plaster, foams and sealants, means of surface protection, as well as ancillary and collateral materials for building and repair.

The rest producers from TOP-10 exceeded recommended values of current assets to equity ratio.

However, according to the independent estimation of solvency, developed by the Information agency Credinform, all TOP-10 enterprises got a high and the highest solvency index GLOBAS-i®, what guarantees that they can pay off their loan liabilities in time and fully. Risk of default in the nearest time is highly improbable, organizations are attractive objects for investment, especially considering high potential of the Russian market.

The territory of rapid development will appear in the Far East

In April 2014 the Ministry of the Russian Federation on development of the Far East introduced a bill of creating territories of rapid development in the Far East. The bill projects the creation a range of preferences for business on these territories on sample of the most successful similar projects in the countries of Asia-Pacific Region like South Korea, China and Singapore.

Conversations about the necessity of the development of the Far East region have being holding for a long time. In the frames of the annual state-of-the-nation address in 2013, Vladimir Putin has set a task to create all necessary conditions for rapid development of the Far East. The government program of the development of the region is scheduled until 2025. The top-priority task is lifting of infrastructure restrictions, which put the brakes on the economy.

In debating the decision of the need to create the rapid development territories was adopted. According to the Deputy Minister of the RF on development of the Far East Kirill Stepanov, pioneer territories of rapid development will be realized in the framework of major cities of the region. In prospect such territories will appear in the whole Far East. Currently more than 400 sites were examined; 23 were selected as primary and they are located at all 9 regions of the Far. However these territories haven’t been specified in the bill yet.

The key idea of the project is to set competitive environment with similar sites in the countries of Asia-Pacific Region, inter alia by means of various benefit programs for business.

It is expected that special land tenure system, preferential rental rates, tax and insurance payment benefits will be applied. In particular the territories’ residents will be given full release from VAT, corporate property tax and import tax on products for industrial needs (materials, raw materials). Income tax crediting to the federal budget will be 0%; it will be 5% to the regional budget during the next 5 years and then 10% maximum. At this rate the total tax burden for the enterprises of the rapid development territories will be 12,2%.

Moreover the custom procedures of free economic zone, technical and sanitary regulations of Largest Economies will be applied. The residents will be given an opportunity to engage qualified foreign specialists in a fast-track procedure.

However it should be noticed that all mentioned benefits will be extended not over the whole Far East, but over sites of rapid development territories.