Digital rights

Concept of digital rights is determined by the legislation as an object of civil rights. Amendments were made to the first, second and third parts of the Civil Code of the RF.

In particular, new article 141.1 «Digital rights» was adopted, whereby digital rights are defined as contractual and other rights the contents and conditions of which are determined in accordance with the rules of the information systems. The disposal, transfer, mortgage, encumbrance of digital rights in other ways or limiting the disposition is only possible in the information system without resorting to third parties.

According to the amendments, definition of digital rights holders is regulated. Transfer of digital rights based on transaction is conducted without permission of persons responsible for such digital rights.

Besides, it is defined by the Law:

- conditions of compliance with transactions in written form, conducted with electronic or technical means, permitting to present content of transactions unchanged on material medium;

- retail sales agreements are considered valid from the moment of issuing by trader electronic document, confirming payment of product by buyer;

- it can be provided by information services contracts that one or both parties are obliged during particular period not to perform actions that can be resulted in disclosure of information to third parties;

- nominal account, insurance contracts can be entered by means of one electronic document signed by parties or reciprocation of electronic documents;

- settlement of wills with the use of electronic or other technical means is prohibited.

The Federal Law as of 18.03.2019 №34-FL «On Amendments to the First, Second and Article 1124 of the Third Parts of the Civil Code of the RF» will come into force since October 1, 2019.

Trends in activity of companies of Omsk region

Information agency Credinform has prepared a review of activity trends of the largest companies of real economy sector in Omsk region.

The largest companies of Omsk region (ТОP-1000) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2012 - 2017). The analysis was based on data of the Information and Analytical system Globas.

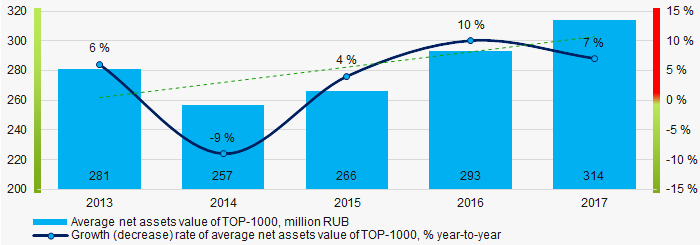

Net assets is a ratio reflecting the real value of company's property. It is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The ratio is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest company in terms of net assets is NAO TRANSNEFT-ZAPADNAYA SIBIR INN 5502020634. In 2017, net assets of the company amounted to 132 billion RUB. The smallest size of net assets in TOP-1000 had LLC APTECHNAYA SET INN 5505212084. The lack of property of the company was expressed in negative terms - 4,6 million RUB.

For the last five years, the average values of TOP-1000 net assets showed the growing tendency (Picture 1).

Picture 1. Change in average net assets value of ТОP-1000 companies in 2013 – 2017

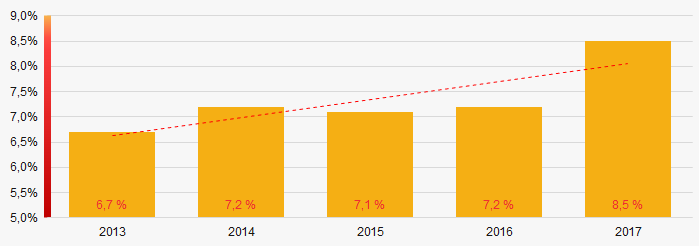

Picture 1. Change in average net assets value of ТОP-1000 companies in 2013 – 2017 For the last five years, the share of ТОP-1000 enterprises with lack of property is growing (Picture 2).

Picture 2. The share of enterprises with negative net assets value in ТОP-1000

Picture 2. The share of enterprises with negative net assets value in ТОP-1000Sales revenue

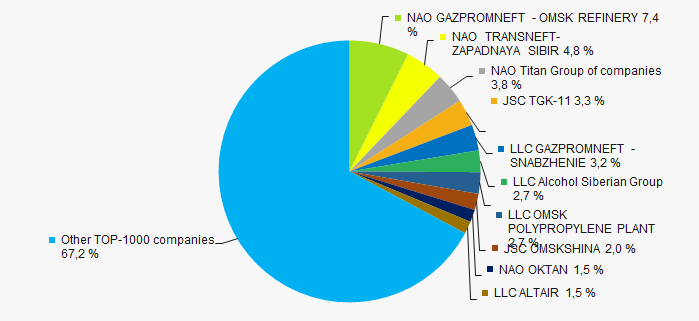

In 2017, the total revenue of 10 largest companies amounted to 33% from ТОP-1000 total revenue (Picture 3). This fact testifies relatively low level of industrial concentration in Omsk region.

Picture 3. Shares of TOP-10 in TOP-1000 total revenue for 2017

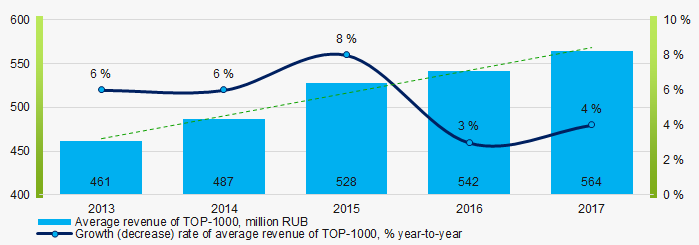

Picture 3. Shares of TOP-10 in TOP-1000 total revenue for 2017In general, the growing trend in sales revenue is observed (Picture 4).

Picture 4. Change in average revenue of TOP-1000 in 2013 – 2017

Picture 4. Change in average revenue of TOP-1000 in 2013 – 2017Profit and loss

The largest company in terms of net profit is JSC GAZPROMNEFT - OMSK REFINERY INN 5501041254. In 2017 the company’s profit amounted to 7,4 billion RUB.

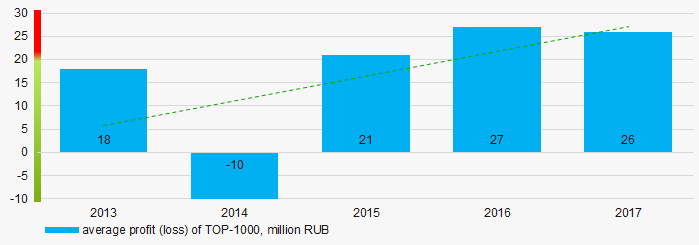

For the last five years, the average profit values of TOP-1000 show the growing tendency (Picture 5).

Picture 5. Change in average profit of TOP-1000 in 2013 – 2017

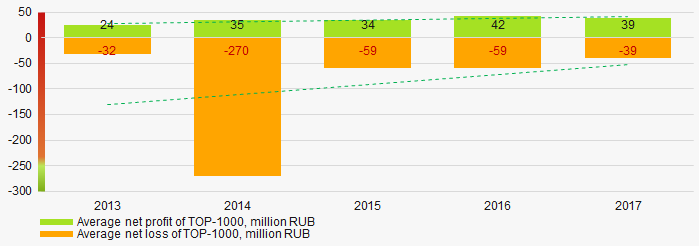

Picture 5. Change in average profit of TOP-1000 in 2013 – 2017Over a five-year period, the average net profit values of ТОP-1000 show the growing tendency, along with this the average net loss is decreasing (Picture 6).

Picture 6. Change in average net profit/loss of ТОP-1000 companies in 2013 – 2017

Picture 6. Change in average net profit/loss of ТОP-1000 companies in 2013 – 2017Main financial ratios

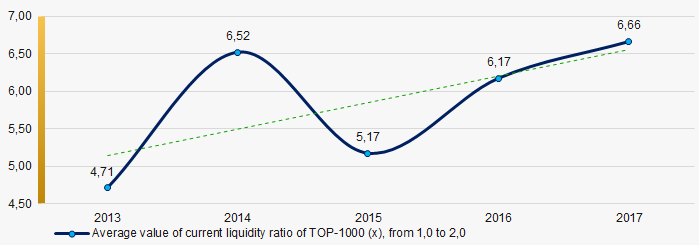

For the last five years, the average values of the current liquidity ratio were higher than the recommended values - from 1,0 to 2,0, with growing tendency (Picture 7).

The current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations .

Picture 7. Change in average values of current liquidity ratio of TOP-1000 companies in 2013 – 2017

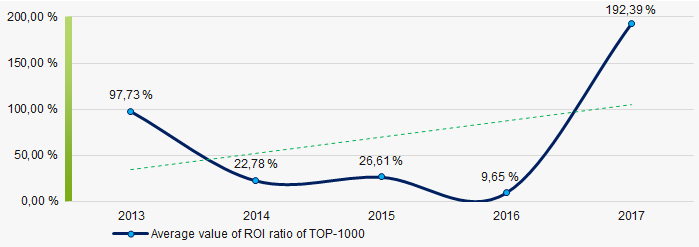

Picture 7. Change in average values of current liquidity ratio of TOP-1000 companies in 2013 – 2017For the last five years, the high level of the average values of ROI ratio with growing tendency is observed (Picture 8).

The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average values of ROI ratio in 2013 – 2017

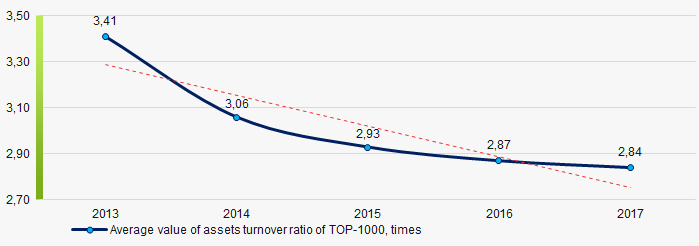

Picture 8. Change in average values of ROI ratio in 2013 – 2017Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

For the last five years, this business activity ratio demonstrated the downward trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio of TOP-1000 companies in 2013 – 2017

Picture 9. Change in average values of assets turnover ratio of TOP-1000 companies in 2013 – 2017Small businesses

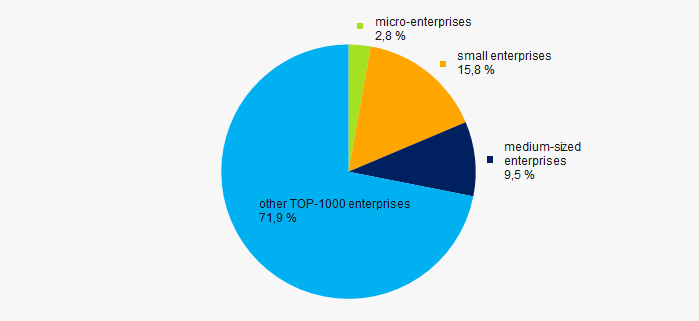

79% of ТОP-1000 companies are registered in the Unified register of small and medium-sized enterprises of the Russian Federal Tax Service. Herein, their share in TOP-1000 total revenue amounted to 28% that is higher than the national average value (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in ТОP-1000

Picture 10. Shares of small and medium-sized enterprises in ТОP-1000Main regions of activity

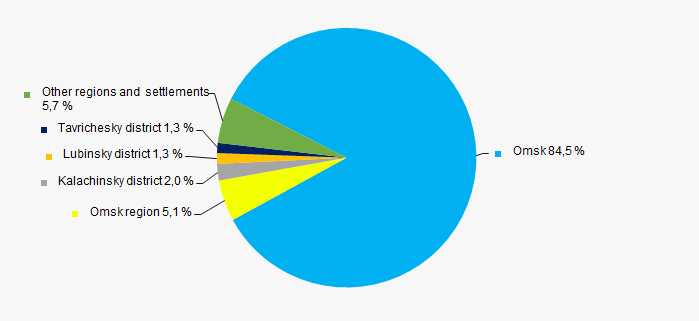

ТОP-1000 companies are unequally located across the country and registered in 33 regions of Russia. Almost 90% of the largest enterprises in terms of revenue are located in Omsk and Omsk region (Picture 11).

Picture 11. Distribution of TOP-1000 revenue by the districts of Omsk region

Picture 11. Distribution of TOP-1000 revenue by the districts of Omsk regionFinancial position score

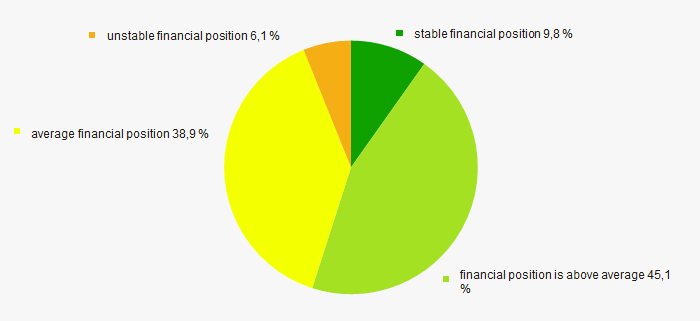

An assessment of the financial position of TOP-1000 companies shows that more than a half of them have stable or above average financial position (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

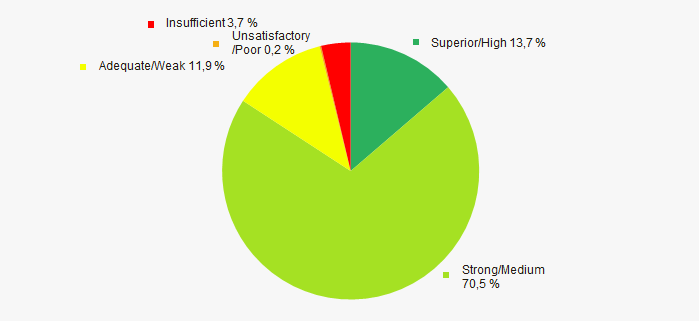

Most of TOP-1000 companies got superior/high or strong/medium Solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by Solvency index Globas

Picture 13. Distribution of TOP-1000 companies by Solvency index GlobasIndustrial production index

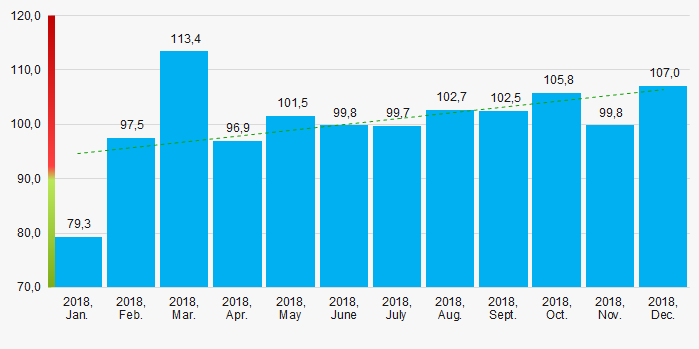

According to the Federal Service of State Statistics, there is an increasing trend in the industrial production index in Omsk region during 12 months of 2018 (Picture 14). Herewith the average index from month to month amounted to 100,5%.

Picture 14. Industrial production index in Omsk region in 2018, month by month (%)

Picture 14. Industrial production index in Omsk region in 2018, month by month (%)According to the same data, the share of enterprises of Omsk region in the amount of revenue from the sale of goods, works, services made 0,37% countrywide in 2018.

Conclusion

A complex assessment of activity of the largest companies of Omsk region real economy, taking into account the main indexes, financial ratios and indicators, demonstrates the presence of negative trends (Table 1).

| Trends and assessment factors | Relative share, % |

| Growth/drawdown rate of average net assets value |  10 10 |

| Increase / decrease in the share of enterprises with negative net assets |  -10 -10 |

| The level of capital concentration |  5 5 |

| Growth/drawdown rate of average revenue |  10 10 |

| Growth/drawdown rate of average net profit (loss) |  10 10 |

| Increase / decrease in average net profit of companies |  10 10 |

| Increase / decrease in average net loss of companies |  10 10 |

| Increase / decrease in average values of current liquidity ratio |  5 5 |

| Increase / decrease in average values of ROI ratio |  10 10 |

| Increase / decrease in average values of assets turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses by revenue more than 22% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Industrial production index |  10 10 |

| Average value of factors |  5,3 5,3 |

— favorable trend (factor) ,

— favorable trend (factor) ,  — оunfavorable trend (factor).

— оunfavorable trend (factor).