Less is better. FTS continues to strike shell companies off EGRUL

Process of reduction of active legal entities being unexampled on a scale is conducting in Russia for two consecutive years: following the results of 2017, the number of active legal entities in Russia reduced by 183 th – to 4 371 th companies. Totally for 2016-2017 almost half a million on one in ten company were removed from EGRUL. It is the first time for the entire time of conducting centralized statistics of legal entities registration when such a result was obtained.

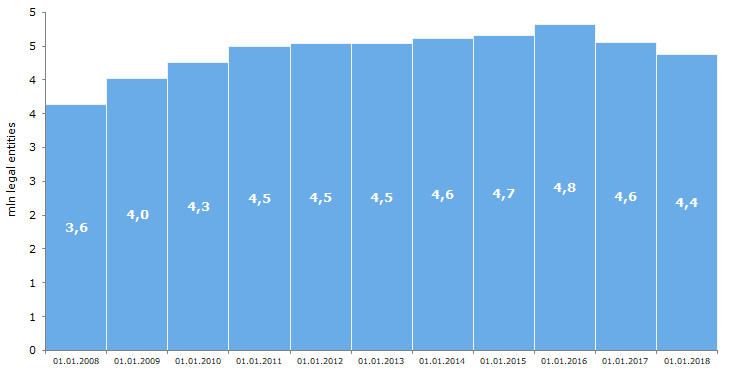

The number of operating companies in 2017 is compatible to eight years ago figures, and the negative dynamics of legal entities registration should be expected in mid-term (see Picture 1).

At first sight, the reason of legal entities reduction is of economic nature: poor demand for several years is resulted in slowdown and ultimately closing of an enterprise. However, relatively few companies in Russia are liquidated after bankruptcy proceedings – about 10 th per year or 0,7% of total ceased companies. The statistics is near the same level without any significant positive or negative changes.

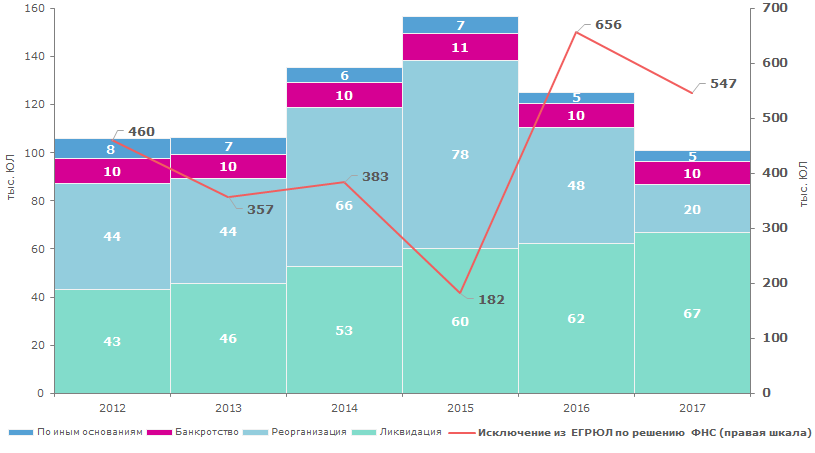

The main reason is striking “paper” and “abandoned” companies off EGRUL by decision of the registering authority – 547 th or 84,4% of total cases of liquidation in 2017 (see Picture 3).

Picture 1. Number of operating legal entities

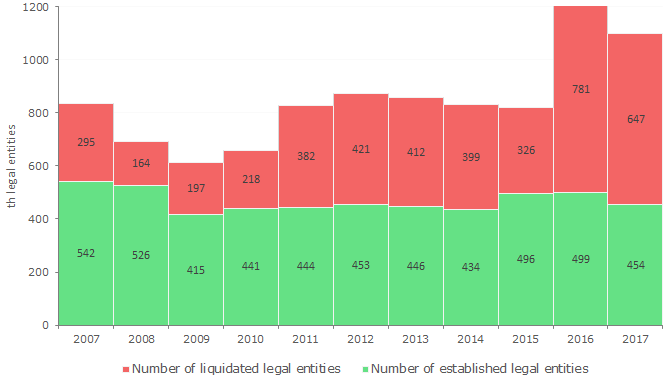

Picture 1. Number of operating legal entities647 th legal entities were liquidated and 454 th were established in 2017. Excess of liquidated legal entities over established ones is 43% (see Picture 2). Over the entire EGRUL history, the highest number of liquidated companies was recorded in 2016 – 781 th. At the same time, there is no positive trend in new companies’ establishment.

Totally 1,4 mln companies ceased activities om 2016 – 2017 that is compatible to four previous years 2012 – 2015 (1,6 mln legal entities).

Picture 2. Number of established and liquidated legal entities, per year

Picture 2. Number of established and liquidated legal entities, per yearNumber of companies ceased activities after reorganization reduced in 2,5 times (from 48 th to 20 th) in 2017. When reorganizing the proprietor is obliged to prove the company has passed tax audit and has no debts. When the company starts to reorganize, tax authorities begin to check legal address and the company’s reality. That is why shell companies reject “alternative” form of liquidation through reorganization.

In 2017, the FTS has got the right to remove companies in case of record on false data in EGRUL, if the company does not provide true information within 6 months. Totally 550 th records were entered the register for the previous year.

Picture 3. Dynamics of reasons for cessation of legal entities activity in Russia by years

Picture 3. Dynamics of reasons for cessation of legal entities activity in Russia by yearsThe majority of legal entities are registered in Moscow – 938,8 th; 337,9 th in Saint-Petersburg and 229,2 th in Moscow region. The share of these three subjects in total number of companies in Russia is 34,4%. The first 10 regions together accumulates 53% companies in Russia.

| Rank | Region | Number of registered legal entities as of 01.01.18 | Share in total number of registered legal entities, % |

| 1 | Moscow | 938 783 | 21,5 |

| 2 | Saint-Petersburg | 337 913 | 7,7 |

| 3 | Moscow region | 229 222 | 5,2 |

| 4 | Sverdlovsk region | 149 188 | 3,4 |

| 5 | Krasnodar territory | 139 698 | 3,2 |

| 6 | Novosibirsk region | 118 886 | 2,7 |

| 7 | Republic of Tatarstan | 113 470 | 2,6 |

| 8 | Samara region | 104 948 | 2,4 |

| 9 | Chelyabinsk region | 95 585 | 2,2 |

| 10 | Nizhny Novgorod region | 91 996 | 2,1 |

| – | Total for Top-10 | 2 319 689 | 53 |

| – | Total | 4 371 335 | 100 |

In absolute terms the highest decrease in number of legal entities for 2017 was registered in the Republic of Tatarstan – minus 13 th. Then follows Sverdlovsk region and Moscow – minus 12 th. As a reminder, there was a decrease by 172 th companies in 2016 when Moscow was absolute leader in shell companies liquidation. Nowadays the FTS conducts removal in regions.

Speaking about relative figures, Khanty-Mansi autonomous district – Yugra sustained the highest losses of 14% of total legal entities.

Sevastopol and the Republic of Crimea demonstrates increase in legal entities both in absolute and relative terms. It is connected with entering the territories into the Russian Federation and re-registration of local companies.

| Rank | Region | Increase / decrease of legal entities to 1.01.17, % | Region | Increase / decrease of legal entities to 1.01.17, pcs. |

| 1 | Sevastopol | 6,5 | Republic of Crimea | 4 369 |

| 2 | Republic of Crimea | 3,7 | Belgorod region | 1 738 |

| 3 | Belgorod region | 3,1 | Sevastopol | 832 |

| 4 | Chukotka autonomous district | 2,2 | Smolensk region | 750 |

| 5 | Smolensk region | 2,0 | Tyumen region | 134 |

| ... | ... | ... | ... | ... |

| 81 | Republic of North Ossetia-Alania | -11,0 | Nizhny Novgorod region | -9 164 |

| 82 | Vologda region | -11,5 | Saint-Petersburg | -11 281 |

| 83 | Republic of Mari El | -11,7 | Moscow | -11 472 |

| 84 | Republic of Khakassia | -12,5 | Sverdlovsk region | -11 722 |

| 85 | Khanty-Mansi autonomous district - Yugra | -13,6 | Republic of Tatarstan | -12 880 |

Rapid decrease in the number of legal entities in Russia is not resulted from slackening of economic activity, but from the FTS policy of striking «paper» companies off EGRUL. Business community was waiting for targeted measures concerning registration of companies working on paper alone, as well as curtailing of business schemes for tax evasion or fraudulent transactions.

On the background of active struggle against shell companies, it is necessary to clarify the idea of possibility of registering a legal entity without legal address (office) on the basis of a mail box or electronic service approved in January 2018 by the Presidium of the President's Council for Strategic Development and Priority Projects chaired by the prime minister Dmitry Medvedev. Initiative is promoted within the frameworks of virtual economy formation. According to Maxim Oreshkin, Minister for Economic Development, related amendments could come into force this year.

The proposal contravenes current practice of the FTS considering physical absence of the company or its executive at the address specified in EGRUL as one of the signs of shell company. Monitor the situation through news on Credinform.

Return on assets of the largest enterprises of the real economy sector of St. Petersburg

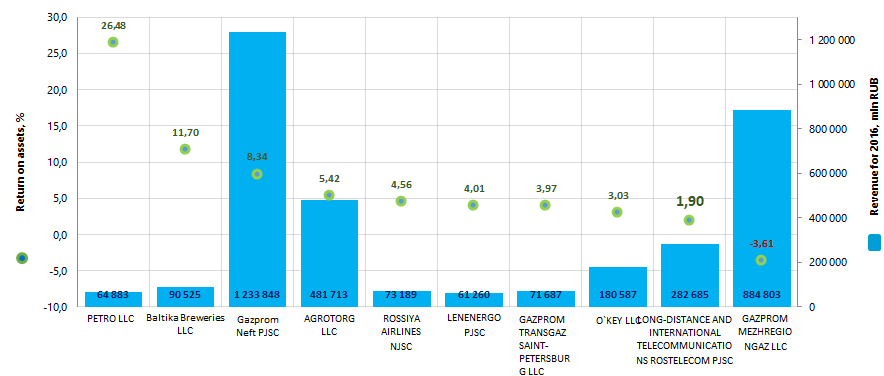

Information agency Credinform offers a ranking of the largest enterprises of the real economy sector of St. Petersburg. The companies with the largest volume of annual revenue (TOP-1000 and TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods from 2007 to 2016. Then (Table 1) they were ranked by the return on assets ratio. The analysis was made on the basis of the data of the Information and Analytical system Globas.

Return on assets (%) is calculated as the relation of the sum of net profit and interest payable to the total assets value of a company and shows how many monetary units of net profit gets every unit of total assets. The ratio characterizes the effectiveness of using by the company of all available resources and financial management. The higher is the ratio value, the more effective is business, that is the higher return per every monetary unit invested in assets.

Dynamics of this indicator should be considered. Its subsequent decrease points to the decline in the efficiency of the use of assets.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of indicators and financial ratios.

| Name, INN, main type of activity | Revenue, mln RUB | Net profit, mln RUB | Return on assets, % | Solvency index Globas | |||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | ||

| PETRO LLC INN 7834005168 Manufacture of tobacco products |

47 274,7 | 64 882,8 | 10 653,1 | 12 515,8 | 34,97 | 26,48 | 199 High |

| Baltika Breweries LLC INN 7802849641 Beer production |

86 608,4 | 90 525,2 | 12 030,9 | 14 308,2 | 11,20 | 11,70 | 183 High |

| Gazprom Neft PJSC INN 5504036333 Wholesale of solid, liquid and gaseous fuels |

1 272 981,1 | 1 233 847,8 | 16 145,8 | 122 462,2 | 1,15 | 8,34 | 180 High |

| AGROTORG LLC INN 7825706086 Other retail sale in non-specialized stores |

228 908,6 | 481 713,4 | 499,0 | 10 567,9 | 0,34 | 5,42 | 212 Strong |

| ROSSIYA AIRLINES NJSC INN 7810814522 Transportation by air passenger transport |

38 754,5 | 73 189,0 | 817,7 | 904,5 | 6,91 | 4,56 | 197 High |

| LENENERGO PJSC INN 7803002209 Transmission of electricity and technological connection to distribution networks |

43 726,7 | 61 260,1 | -5 916,5 | 7 561,3 | -3,04 | 4,01 | 205 Strong |

| GAZPROM TRANSGAZ SAINT-PETERSBURG LLC INN 7805018099 Gas transportation through pipelines |

69 248,9 | 71 687,4 | 1 223,6 | 2 032,5 | 2,43 | 3,97 | 189 High |

| O`KEY LLC INN 7826087713 Retail sale mainly of food products in non-specialized stores |

170 598,6 | 180 587,1 | 448,0 | 2 152,2 | 0,71 | 3,03 | 215 Strong |

| LONG-DISTANCE AND INTERNATIONAL TELECOMMUNICATIONS ROSTELECOM PJSC INN 7707049388 Activity in the field of communication on the basis of wire technologies |

283 169,5 | 282 684,9 | 21 564,5 | 10 902,2 | 3,78 | 1,90 | 260 Medium |

| GAZPROM MEZHREGIONGAZ LLC INN 5003021311 Wholesale of solid, liquid and gaseous fuels |

853 476,4 | 884 803,2 | -29 787,8 | -31 359,5 | -3,51 | -3,61 | 215 Strong |

| Total by TOP-10 companies | 3 094 747,4 | 3 425 180,7 | 27 678,4 | 152 047,4 | |||

| Average value by TOP-10 companies | 309 474,7 | 342 518,1 | 2 767,8 | 15 204,7 | 5,50 | 6,58 | |

| Average value by TOP-1000 companies | 4 583,2 | 4 904,7 | 12,3 | 347,0 | 6,51 | 6,57 | |

The average value of the return on assets ratio of TOP-10 companies is above the average value of TOP-1000 enterprises. Seven from TOP-10 companies increased revenue and net profit indicators in 2016 in comparison with the year 2015. The enterprises, which decreased revenue, profit and return on assets indicators in comparison with the previous periods are marked with red filling in from 2nd up to 7th columns in Table 1.

Picture 1. Return on assets ratio and revenue of the largest enterprises of the real economy sector of St. Petersburg (TOP-10)

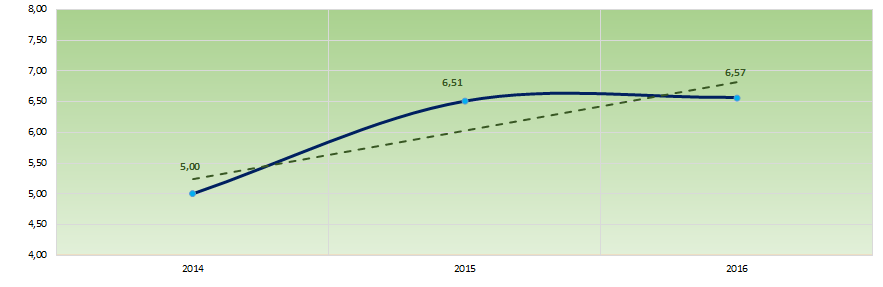

Picture 1. Return on assets ratio and revenue of the largest enterprises of the real economy sector of St. Petersburg (TOP-10)The industry average values of the return on assets ratio tended to increase over the past three years (Picture 2).

Picture 2. Change in the average industry values of the return on assets ratio of the largest enterprises of the real economy sector of St. Petersburg in 2014 – 2016

Picture 2. Change in the average industry values of the return on assets ratio of the largest enterprises of the real economy sector of St. Petersburg in 2014 – 2016All TOP-10 companies got High or Strong/Medium solvency index Globas, that testifies to their ability to repay their debt obligations timely and fully.