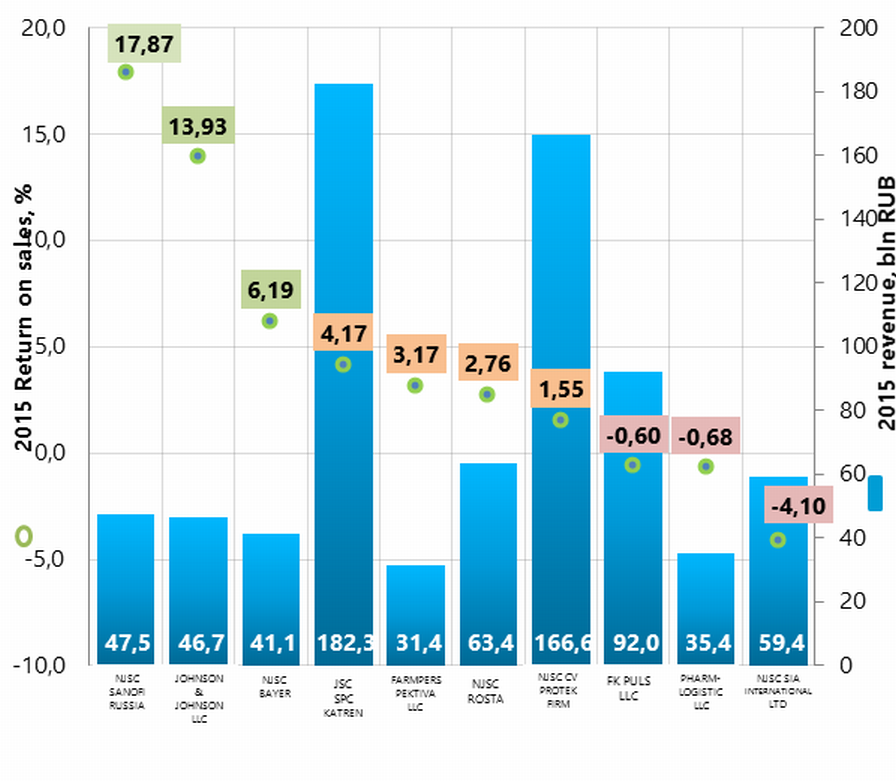

Return on sales ratio of the largest Russian pharmaceutical wholesale distributors

Information agency Credinform has prepared a ranking of the largest Russian pharmaceutical wholesale distributors. The enterprises with the highest volume of revenue (TOP-10) have been selected for the ranking, according to the data from the Statistical Register for the latest available accounting periods (2015 and 2014) (TOP-10). Then they have been ranked by the 2015 return on sales ratio (Table 1).

Return on sales (%) is the share of operating profit in the total sales volume of the company. The return on sales ratio represents the efficiency of the company’s industrial and commercial activity and shows its funds that remained after having covered the cost of production, loan interest and tax payments.

The variety of values of return on sales of companies within one sector is determined by the difference in competitive strategies and product lines. Thus, having the same value of revenue, operation costs and earnings before tax, two different companies may have different return on sales due to the ratio of interest to the net profit.

The calculation of practical values of financial ratios, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas® by the experts of Information Agency Credinform, having taken into account the current situation in the economy as a whole and in the industries. The practical value of the return on sales ratio for pharmaceuticals wholesalers starts from 4,87.

For the most comprehensive and objective opinion on the company’s financial position, the whole set of financial indicators and ratios should be taken into account.

| Name, INN, region | 2015 net profit, mln RUB | 2015 revenue, mln RUB | 2015/ 2014 revenue,% | 2015 return on sales, % | Solvency index Globas® |

| NJSC SANOFI RUSSIA INN 7705018169 Moscow | 2 936,4 | 47 476,6 | 2,8 | 17,87 | 181 The highest |

| JOHNSON & JOHNSON LIMITED LIABILITY COMPANY a159-c4e0f0d3187f INN 7725216105 Moscow | 3 277,7 | 46 715,1 | 7,2 | 13,93 | 191 The highest |

| NJSC BAYER INN 7704017596 Moscow | 508,0 | 41 126,2 | 21,6 | 6,19 | 229 High |

| JOINT STOCK COMPANY SCIENTIFIC PRODUCTION COMPANY KATREN INN 5408130693 Novosibirsk Region | 5 790,7 | 182 301,6 | 26,7 | 4,17 | 187 The highest |

| FARMPERSPEKTIVA LLC INN 6312050583 Kaluga region | 174,4 | 31 422,1 | 51,4 | 3,17 | 223 High |

| NJSC ROSTA INN 7726320638 Moscow region | 415,3 | 63 384,6 | -12,8 | 2,76 | 201 High |

| НNJSC CV PROTEK FIRM INN 7724053916 Moscow | 5 419,7 | 166 578,3 | 25,8 | 1,55 | 197 The highest |

| FK PULS LLC INN 5047045359 Moscow region | 2 150,9 | 92 038,1 | 67,3 | -0,60 | 188 The highest |

| PHARM-LOGISTIC LLC INN 7727692420 Moscow | -683,9 | 35 408,8 | -12,2 | -0,68 | 400 Low |

| NJSC SIA INTERNATIONAL LTD INN 7714030099 Moscow | -3 111,1 | 59 438,2 | -39,7 | -4,10 | 300 Satisfactory |

| Total for TOP-10 group of companies | 16 878,1 | 765 889,5 | |||

| Average value within TOP-10 group of companies | 1 687,8 | 76 588,9 | 11,5 | 4,43 | |

| Industry average value | 6,1 | 187,6 | 2,0 | 4,87 |

The average value of the 2015 return on sales ratio in TOP-10 group of companies is lower than practical value. Three companies of TOP-10 group of companies have a negative value of the ratio, four companies have a lower value, and three have a value that is higher than the practical one (red, yellow and green highlight respectively, in Table 1 and Picture 1).

Four companies of TOP-10 group decreased their revenue and net profit indicators (having loss) in 2015 as compared to the prior period (red highlight in Table 1).

Picture 1. Return on sales ratio and revenue of the largest Russian pharmaceuticals wholesalers (TOP-10)

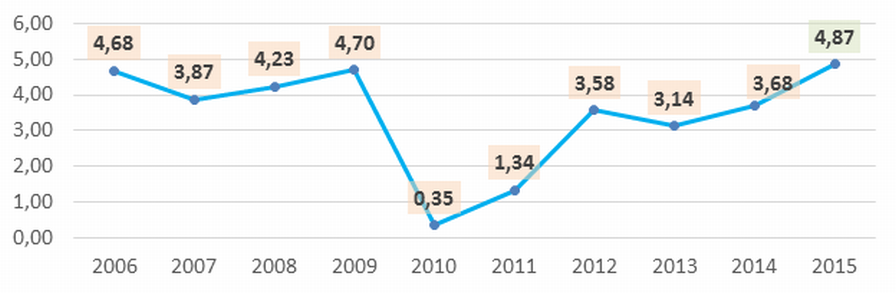

Picture 1. Return on sales ratio and revenue of the largest Russian pharmaceuticals wholesalers (TOP-10) Industry average values of the return on sales ratio (Picture 2) represent the macroeconomic situation in general, with declines during crisis periods.

Picture 2. Industry average values of the return on sales ratio of the largest Russian pharmaceuticals wholesalers in 2006 – 2015

Picture 2. Industry average values of the return on sales ratio of the largest Russian pharmaceuticals wholesalers in 2006 – 2015 Eight of TOP-10 companies got the highest or high solvency index Globas® that demonstrates their ability to pay their debts in time and fully.

PHARM-LOGISTIC LLC got a low solvency index Globas®, due to information concerning a bankruptcy claim against the company. In this regard, one is to expect the results of the case hearing. In addition to this, there are cases of late debt performance, unclosed writs of execution and loss within the balance sheet structure. Index development trends are negative.

NJSC SIA INTERNATIONAL LTD got a satisfactory solvency index Globas®, due to information concerning the company being a defendant in debt collection arbitration proceedings, untimely fulfillment of obligations and unclosed writs of execution. Index development trends are stable.

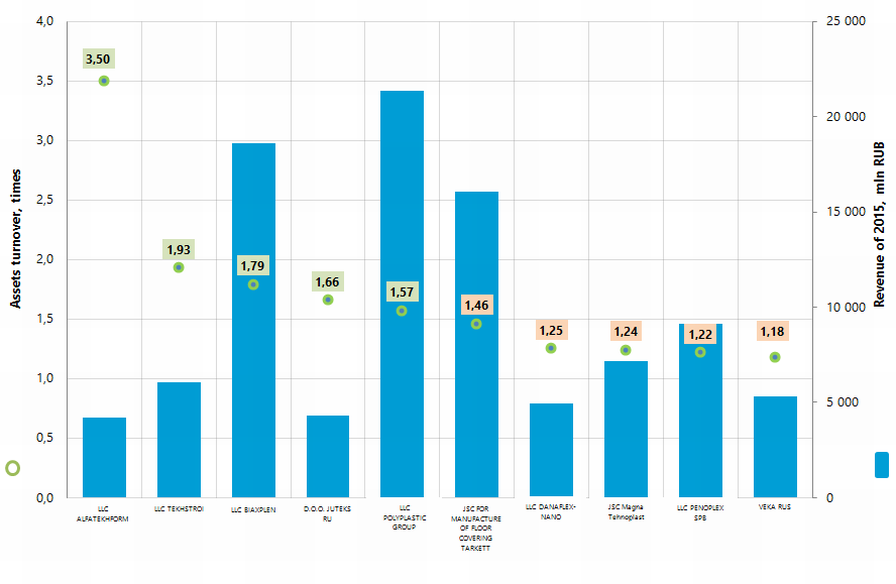

Assets turnover of the largest Russian manufacturers of plastic goods

Information Agency Credinform presents a ranking of the largest Russian manufacturers of plastic goods (except for manufacturers of plastic package). The largest enterprises of the industry (TOP-10) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2015 and 2014). Then the companies were ranked by assets turnover ratio (Table 1).

Assets turnover (times) is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

Taking into account the actual situation both for the economy in general and in industries, experts of the Information agency Credinform developed and realized in the Information and Analytical system Globas® calculation of actual values of financial ratios that can be normal for the particular industry. For plastic good manufacturers companies practical value of the net profit ratio in 2015 was from 1,47.

For the most full and fair opinion about company’s financial position not only the compliance with standard values, but the whole set of financial indicators and ratios should be taken into account.

| Name , INN, region | Net profit of 2015, mln RUB | Revenue of 2015, mln RUB | Revenue of 2015 to 2014, % | Assets turnover, times | Solvency index Globas® |

| LLC ALFATEKHFORM INN 7705195785 Moscow | 183,2 | 4 226,6 | 30,2 | 3,50 | 196 High |

| LLC TEKHSTROI INN 7743944097 Moscow | 47,3 | 6 076,1 | 218,3 | 1,93 | 212 High |

| LLC BIAXPLEN INN 5244013331 Nizhniy Novgorod region | 1 887,3 | 18 619,0 | 52,7 | 1,79 | 204 High |

| D.O.O. JUTEKS RU INN 3315010390 Vladimir region | 354,0 | 4 310,8 | 6,3 | 1,66 | 210 High |

| LLC POLYPLASTIC GROUP INN 5021013384 Moscow | 1 130,6 | 21 334,7 | 5,4 | 1,57 | 193 The highest |

| JSC FOR MANUFACTURE OF FLOOR COVERING INN 6340007043 Samara region | 683,0 | 16 034,7 | -9,0 | 1,46 | 232 High |

| LLC DANAFLEX-NANO INN 1655177480 The Republic of Tatarstan | 309,5 | 4 970,3 | 54,8 | 1,25 | 232 High |

| JSC Magna Tehnoplast INN 5256076921 Nizhniy Novgorod region | 57,0 | 7 163,8 | -12,6 | 1,24 | 260 High |

| LLC PENOPLEX SPB INN 7825133660 Saint Petersburg | -1,7 | 9 105,1 | 19,1 | 1,22 | 274 High |

| LLC VEKA RUS INN 7728165949 Moscow | 25,9 | 5 296,7 | -6,2 | 1,18 | 245 High |

| Total for TOP-10 group of companies | 4 676,0 | 97 137,8 | |||

| Total for TOP-500 group of companies | 8 930,8 | 397 796,3 | |||

| Average value within group of TOP-10 companies | 467,6 | 9 713,8 | 15,7 | 1,68 | |

| Average value within group of TOP-500 companies | 17,9 | 795,6 | 18,4 | 3,41 | |

| Average value within industry | 1,3 | 72,6 | 4,2 | 1,47 |

In 2015 average values of the assets turnover ratio within TOP-10 and TOP-500 group of companies is higher than the practical value. Five companies from TOP-10 group have indicators that are lower than the practical values and another five have indicators higher than practical values (marked with green and yellow filling, correspondently, in Picture 1).

Picture 1. Assets turnover ratio and revenue of the largest Russian manufacturers of plastic goods (TOP-10)

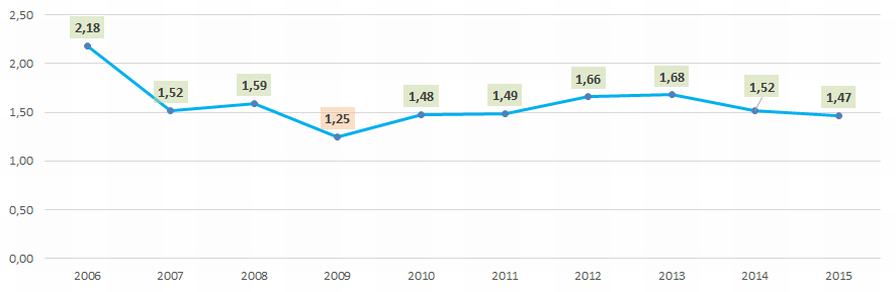

Picture 1. Assets turnover ratio and revenue of the largest Russian manufacturers of plastic goods (TOP-10)Average industrial values of the assets turnover ratio (Picture 2) in general show macroeconomic situation decreasing during crisis periods.

Picture 2. Average industrial values of the assets turnover ratio of Russian manufacturers of plastic goods in 2006 – 2015

Picture 2. Average industrial values of the assets turnover ratio of Russian manufacturers of plastic goods in 2006 – 2015All TOP-10 companies have got the highest or high solvency index Globas®, that shows their ability to meet their obligations in time and fully.

Five companies out of the TOP-10 group in 2015 decreased indicators of revenue or net profit (have loss) compared to the previous period (marked with red filling in the Table 1).