New fire safety requirement

By Resolution of the RF Government N1216 of September 20, 2019, the amendments to the fire prevention rules were made.

These amendments are mainly concern the buildings wherein trading companies, medical, cultural and educational institutions are based. Cinema audience, employees, clients and visitors of the mentioned facilities have to be informed about fire prevention rules.

Smoking areas have to be designated on the territories of facilities connected with sale, extraction, processing and storage of flammable and combustible liquids, and combustible gas, as well as on the territory of facilities producing all types of explosives.

Medical institutions are permitted to set up workshops and storage facilities in the basements and semi-basements, in case they are available in the building’s project.

Amendments are also related to:

- directors of organizations, in part of maintaining the fire protection objects and emergency exits, including during mass-attendance events;

- owners of land and individual dwellings;

- territories of settlements, urban districts and gardening;

- maintenance of electrical and ventilation equipment, gas appliances, elevators, heating systems, etc.

In total, the rules contain over 500 regulatory requirements.

Implementation of the fire prevention rules are mandatory to all state bodies, organizations, farms, institutions, legal entities and natural persons, citizens of the Russian Federation and foreign states, and stateless persons.

According to the Art. 20.4 of the Administrative Code, a fine from 150 thousand RUB to 200 thousand RUB is imposed on legal entities violated the fire prevention rules.

Agriculture of the Southern Federal district of Russia

Information agency Credinform has prepared a review of activity trends of the largest agricultural companies of the Southern Federal district of Russia.

The largest companies (ТОP-1000) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2013 - 2018). The analysis was based on data of the Information and Analytical system Globas.

Net assets is a ratio reflecting the real value of company's property. It is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The ratio is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest company in terms of net assets is JSC FIRMA AGROKOMPLEKS IM. N.I.TKACHEVA, INN 2328000083, which is in process of reorganization in the form of acquisition of other legal entities since 10/04/2019. In 2018 net assets of the company amounted to 23,7 billion RUB.

The smallest size of net assets in TOP-1000 had LLC EVRODON, INN 6125021399. Case on declaring the company bankrupt (insolvent) is proceeding. The lack of property of the company in 2018 was expressed in negative terms -9,3 billion RUB.

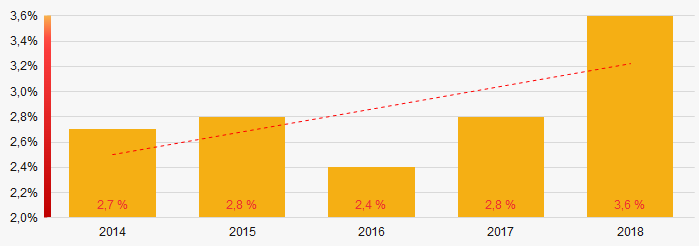

For the last five years, the average values of TOP-1000 net assets showed the growing tendency (Picture 1).

Picture 1. Change in average net assets value of ТОP-1000 companies in 2014 – 2018

Picture 1. Change in average net assets value of ТОP-1000 companies in 2014 – 2018For the last five years, the share of ТОP-1000 enterprises with lack of property is growing (Picture 2).

Picture 2. The share of enterprises with negative net assets value in ТОP-1000

Picture 2. The share of enterprises with negative net assets value in ТОP-1000Sales revenue

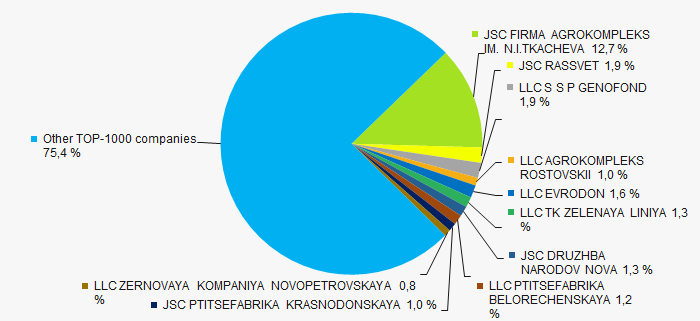

In 2018, the total revenue of 10 largest companies amounted to almost 25% from ТОP-1000 total revenue (Picture 3). This fact testifies the high level of intra-industry competition in the Southern region.

Picture 3. Shares of TOP-10 in TOP-1000 total revenue for 2018

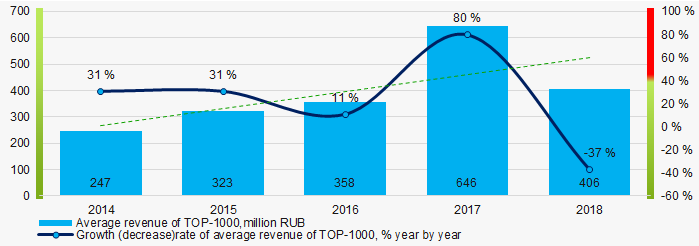

Picture 3. Shares of TOP-10 in TOP-1000 total revenue for 2018In general, the growing trend in sales revenue is observed (Picture 4).

Picture 4. Change in average revenue of TOP-1000 in 2014 – 2018

Picture 4. Change in average revenue of TOP-1000 in 2014 – 2018 Profit and loss

The largest company in terms of net profit is LLC S S P GENOFOND, INN 2371000869. In 2018 the company’s profit amounted to 6,2 billion RUB.

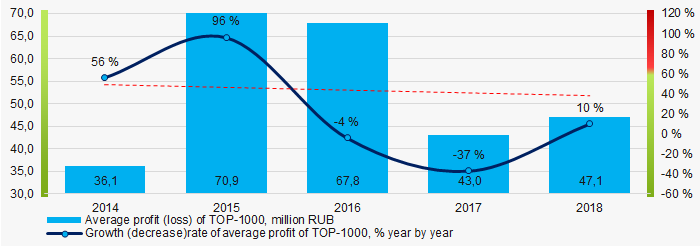

For the last five years, the average profit values of TOP-1000 show the decreasing tendency (Picture 5).

Picture 5. Change in average profit of TOP-1000 in 2014 – 2018

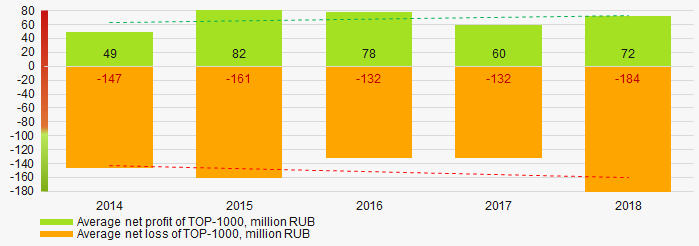

Picture 5. Change in average profit of TOP-1000 in 2014 – 2018 Over a five-year period, the average net profit values of ТОP-1000 show the growing tendency, along with this the average net loss is growing too (Picture 6).

Picture 6. Change in average net profit/loss of ТОP-1000 companies in 2014 – 2018

Picture 6. Change in average net profit/loss of ТОP-1000 companies in 2014 – 2018Main financial ratios

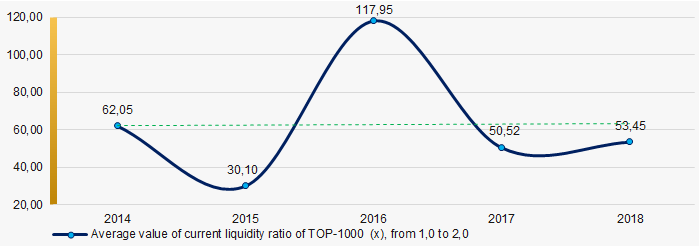

For the last five years, the average values of the current liquidity ratio were higher than the recommended values - from 1,0 to 2,0, with growing tendency (Picture 7).

The current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Picture 7. Change in average values of current liquidity ratio of TOP-1000 companies in 2014 – 2018

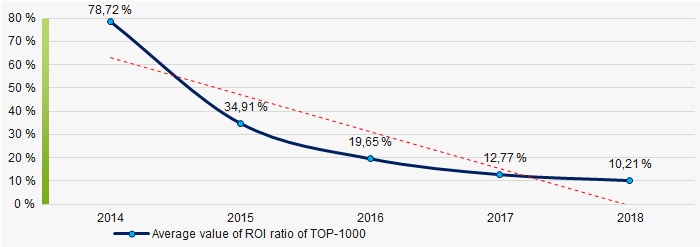

Picture 7. Change in average values of current liquidity ratio of TOP-1000 companies in 2014 – 2018For the last five years, the high level of the average values of ROI ratio with downward trend is observed (Picture 8).

The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average values of ROI ratio in 2014 – 2018

Picture 8. Change in average values of ROI ratio in 2014 – 2018Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit

For the last five years, this business activity ratio demonstrated the downward trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio of TOP-1000 companies in 2014 – 2018

Picture 9. Change in average values of assets turnover ratio of TOP-1000 companies in 2014 – 2018Small businesses

73% of ТОP-1000 companies are registered in the Unified register of small and medium-sized enterprises of the Russian Federal Tax Service. Herein, their share in TOP-1000 total revenue amounted to more than 35%, which is significantly higher than national average value (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in ТОP-1000

Picture 10. Shares of small and medium-sized enterprises in ТОP-1000Main regions of activity

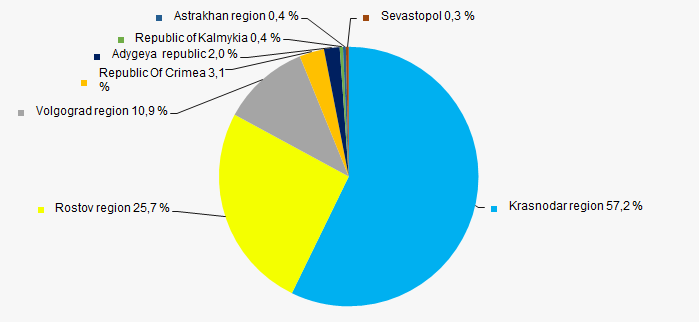

ТОP-1000 companies are registered in 8 regions and unequally located across the federal district. Almost 83% of the largest enterprises in terms of revenue are located in Krasnodar and Rostov regions (Picture 11).

Picture 11. Distribution of TOP-1000 revenue by regions of Southern federal district

Picture 11. Distribution of TOP-1000 revenue by regions of Southern federal districtFinancial position score

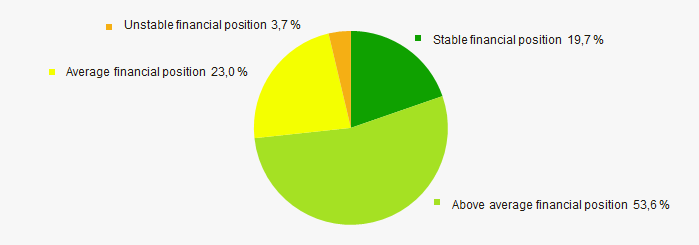

An assessment of the financial position of TOP-1000 companies shows that the largest part have above average financial position (Picture 12)..

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

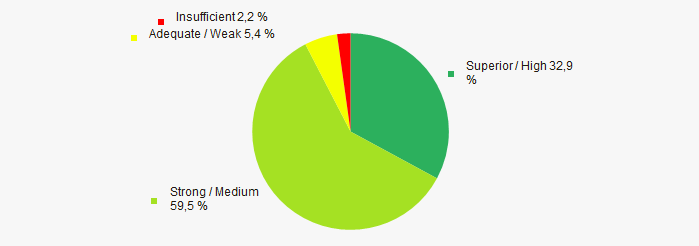

Most of TOP-1000 companies got superior/high or strong/medium Solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by Solvency index Globas

Picture 13. Distribution of TOP-1000 companies by Solvency index GlobasConclusion

A complex assessment of the largest agricultural companies of the Southern federal district, taking into account the main indexes, financial ratios and indicators, demonstrates the presence of positive trends (Table 1).

| Trends and assessment factors | Relative share, % |

| Growth/drawdown rate of average net assets value |  10 10 |

| Increase / decrease in the share of enterprises with negative net assets |  -10 -10 |

| The level of competition / monopolization |  10 10 |

| Growth/drawdown rate of average revenue |  10 10 |

| Growth/drawdown rate of average net profit (loss) |  -10 -10 |

| Increase / decrease in average net profit of companies |  10 10 |

| Increase / decrease in average net loss of companies |  -10 -10 |

| Increase / decrease in average values of current liquidity ratio |  5 5 |

| Increase / decrease in average values of ROI ratio |  -10 -10 |

| Increase / decrease in average values of assets turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses by revenue more than 22% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of factors |  1,1 1,1 |

favorable trend (factor),

favorable trend (factor),  unfavorable trend (factor).

unfavorable trend (factor).