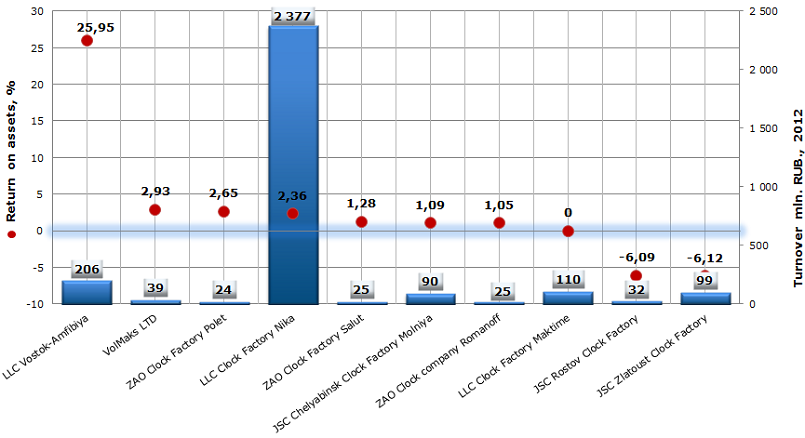

Return on assets of Russian watch manufacturers

Information agency Credinform prepared а ranking of return on assets of Russian watch manufacturers. The ranking list includes industry’s largest companies and is based on turnover as stated in the Statistics register, with the reference period of 2012. The first 10 companies, selected by turnover, later were ranked by decrease of return on assets value.

Return on assets – is a financial indicator, which is calculated as the relation of net profit and interest payable to company’s total assets value. The indicator shows how many monetary units of net profit earned each unit of total assets. There is no normative or recommended value of the profitability ratio, because its value is strongly varied depending on industry.

Despite the widespread use of smart phones, tablets and other gadgets, ordinary watches don’t lose their popularity. Manufacture of watches – is a difficult multistage process, demanding serious capital investments, especially, if it’s a custom-made watches or watches with use of precious stones and metals. Traditionally Japanese watches are considered to be the most qualitative. However, Swiss wrist watches are still classics, being attribute of businessman and demonstrating the high status of its owner. Domestic enterprises try to compete with foreign manufacturers, annually expanding the model range, covering various segments of the market. The leaders of Russian market are represented in the table below.

| № | Name INN | Region | Turnover 2012, mln. RUB. | Return on assets, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | LLC Vostok-Amfibiya INN 1652005589 | The Republic of Tatarstan (Tatarstan) | 206 | 25,95 | 161 (the highest) |

| 2 | VolMaks LTD INN 7709368044 | Moscow | 39 | 2,93 | 254 (high) |

| 3 | ZAO Clock Factory Polet ИНН 7709210360 | Moscow | 24 | 2,65 | 216 (high) |

| 4 | LLC Clock Factory Nika INN 7727510127 | Moscow | 2 377 | 2,36 | 234 (high) |

| 5 | ZAO Clock Factory Salut INN 5404203823 | Novosibirsk region | 25 | 1,28 | 269 (high) |

| 6 | JSC Chelyabinsk Clock Factory Molniya INN 7453006148 | Chelyabinsk Region | 90 | 1,09 | 270 (high) |

| 7 | ZAO Clock company Romanoff INN 7709596121 | Moscow | 25 | 1,05 | 237 (high) |

| 8 | LLC Clock Factory Maktime INN 7723117740 | Moscow | 110 | 0 | 239 (high) |

| 9 | JSC Rostov Clock Factory INN 6152001095 | Rostov Region | 32 | -6,09 | 293 (high) |

| 10 | JSC Zlatoust Clock Factory INN 7404003024 | Chelyabinsk Region | 99 | -6,12 | 290 (high) |

The first place of ranking list takes the second on turnover industry’s company LLC Vostok-Amfibiya with return on assets ratio of 25,95%. In other words each ruble, invested in company’s assets, brings it additional 25,95 kopeks. Moreover, this is the only company in ranking list with the highest solvency index GLOBAS-i®. That characterizes the company as financially stable.

The second and third places of the ranking list take VolMaks LTD and ZAO Clock Factory Polet with return on assets ratio of 2,93% and 2,65% respectively. In spite of the fact that the companies significantly lag behind the leader of research, they have high solvency index GLOBAS-i®. That testifies of company’s ability to repay its financial liabilities in time and fully.

Return on assets of Russian watch manufacturers, TOP-10

The leader of the industry on turnover LLC Clock Factory Nika, due to the high prime cost of products, takes the fourth place of ranking list.

LLC Clock Factory Maktime ended 2012 with return on assets ratio of 0, two other companies of ranking list JSC Rostov Clock Factoryand JSC Zlatoust Clock Factory have negative values of return on assets ratio. That testifies of low quality of capital management and company’s inability to generate the income excluding the structure of its capital.

As return on assets is usually lower for capital-intensive industries than for service companies, which are not demanding large financial investments, the results of ranking are quite predictable. However, be aware, that for full and objective assessment of the enterprise, it is necessary to consider the summation of financial indicators.

International web purchases of the Russians will be put on a special tax

In the course of World Wide Web development entirely new segments of business appeared, including online shops, which are becoming more popular in our country from year to year. Corresponding way of trade may be economically justified for a range of reasons. Firstly, there is no need to pay high rental charges for the room of the goods display. It is sufficient to have a small pick-up point or the buyers can get the parcel in the post by themselves. Secondly, on the virtual shelves we can see the assortment of goods that are uneasy to find in ordinary shops. The most important reason is that frequently the price for identic goods abroad is significantly lower than ours. Obviously, there are some disadvantages. For instance, there is a definite date of delivery and no chance to examine, to check the ordered good by oneself before buying; difficulties with return of defective or unsuitable goods. But in spite of everything the Federal Customs Service of the Russian Federation notes substantial growth of number of international parcels from year to year.

At the present time there is a customs fee of 30% of the good’s cost for international shipments, which declared value exceeds 1 thousand USD and the total weight is more than 30 kilos.

Seeing that the majority of the letter packets don’t satisfy the circumstances for the collection of duties, the government decided to revise current practice and to introduce the so-called special tax of 10% of the goods cost. This money is to be paid by a consumer who bought the goods in the online shop. At the same time, the Western trading internet-platforms don’t pay taxes and special duties and the cost of goods is lower. Corresponding innovation is still in the talking stage. But it is easy to suppose that in the end buyers’ expenses will increase. According to customs officials’ calculations, the federal budget will receive extra 28 million USD per year, if this measure will be taken legally. It is necessary to admit that this sum of money appears to be symbolic at the domestic level. The question why identic goods are cheaper in the Western Europe is left open.