Return on sales of household electric appliances

Information agency Credinform represents the ranking of the largest Russian wholesalers of household electric appliances. Trading companies with the largest volume of annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (for 2016 - 2018). Then they were ranked by the return on sales ratio (Table 1). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Return on sales (%) is calculated as the share of operating profit in the total sales of a company. The ratio reflects the efficiency of industrial and commercial activity of an enterprise and shows the share of company’s funds obtained as a result of sale of products, after covering its cost of sales, paying taxes and interest payments on loans.

The spread in values of the return on sales in companies of the same industry is determined by differences in competitive strategies and product lines.

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in the sectors, has developed and implemented in the Information and Analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. For wholesalers of household electric appliances the practical value of the return on sales ratio made from 3,96% in 2018.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of indicators and financial ratios.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Return on sales, % | Solvency index Globas | |||

| 2017 | 2018 | 2017 | 2018 | 2017 | 2018 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| RBT COMPANY LLC INN 7452030451 Moscow |

12359,4 12359,4 |

16545,7 16545,7 |

11,9 11,9 |

69,7 69,7 |

2,32 2,32 |

5,98 5,98 |

180 High |

| WHIRLPOOL RUS LLC INN 7717654289 Moscow |

26351,9 26351,9 |

27354,3 27354,3 |

616,4 616,4 |

1268,6 1268,6 |

4,95 4,95 |

5,85 5,85 |

240 Strong |

| ALMA LLC INN 7701713130 Moscow, case on declaring the company bankrupt (insolvent) is proceeding bankruptcy proceedings since 20.11.2019 |

45271,1 45271,1 |

35790,5 35790,5 |

220,2 220,2 |

104,7 104,7 |

-0,45 -0,45 |

4,60 4,60 |

550 Insufficient |

| HASKEL LLC INN 7719269331 Moscow region |

124385,7 124385,7 |

132485,0 132485,0 |

732,3 732,3 |

2394,2 2394,2 |

1,13 1,13 |

3,09 3,09 |

187 High |

| SONY ELECTRONICS NJSC INN 7703001265 Moscow |

32198,8 32198,8 |

37393,8 37393,8 |

223,3 223,3 |

286,1 286,1 |

1,98 1,98 |

2,17 2,17 |

225 Strong |

| DISRTIBUTION CENTRE LLC INN 5047067909 Moscow region |

12867,0 12867,0 |

18746,6 18746,6 |

57,1 57,1 |

58,2 58,2 |

0,54 0,54 |

1,86 1,86 |

204 Strong |

| MONT LLC INN 7703313144 Moscow |

19896,3 19896,3 |

19612,9 19612,9 |

197,3 197,3 |

202,1 202,1 |

0,74 0,74 |

1,29 1,29 |

174 Superior |

| ELEKTROSISTEM LLC INN 7704844420 Moscow, In process of reorganization in the form of acquisition of other legal entities, 11.11.2019 |

43992,8 43992,8 |

46165,3 46165,3 |

232,1 232,1 |

614,7 614,7 |

0,62 0,62 |

0,94 0,94 |

249 Strong |

| TRADE HOUSE ABSOLUT LLC INN 7726600963 Moscow |

18463,2 18463,2 |

16998,2 16998,2 |

139,0 139,0 |

-183,4 -183,4 |

-0,16 -0,16 |

-0,48 -0,48 |

307 Adequate |

| TFN LLC INN 7727696432 Moscow |

18353,2 18353,2 |

14941,7 14941,7 |

262,6 262,6 |

285,4 285,4 |

-2,90 -2,90 |

-2,88 -2,88 |

225 Strong |

| Avearge value by TOP-10 companies |  35414,0 35414,0 |

36603,4 36603,4 |

269,2 269,2 |

510,0 510,0 |

0,88 0,88 |

2,24 2,24 |

|

| Industry average value |  111,4 111,4 |

119,7 119,7 |

1,8 1,8 |

-1,4 -1,4 |

2,84 2,84 |

3,96 3,96 |

|

improvement of the indicator to the previous period,

improvement of the indicator to the previous period,  decline in the indicator to the previous period.

decline in the indicator to the previous period.

The average value of the return on sales of TOP-10 enterprises is below industry average and practical values. Nine companies improved results in 2018.

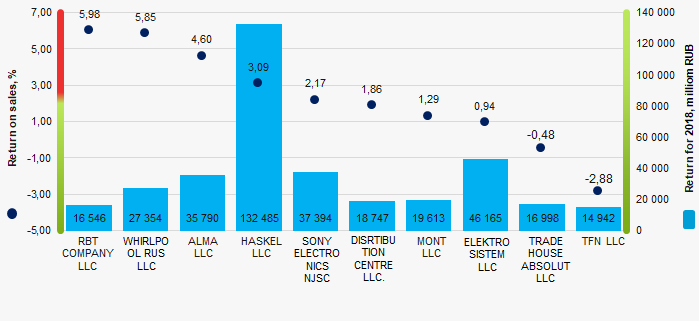

Picture 1. Return on sales ratio and revenue of the largest Russian wholesalers of household electric appliances (TOP-10)

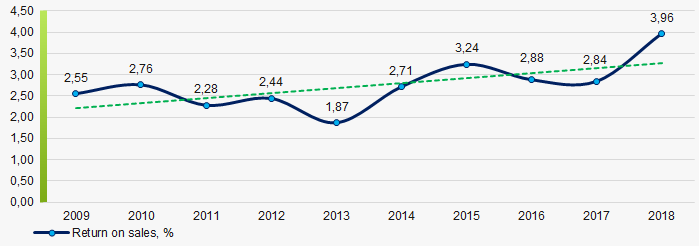

Picture 1. Return on sales ratio and revenue of the largest Russian wholesalers of household electric appliances (TOP-10)The industry average indicators of the return on sales trend to increase over the course of 10 years (Picture 2).

Picture 2. Change in the industry average values of the return on sales ratio of Russian wholesalers of household electric appliances in 2009 – 2018

Picture 2. Change in the industry average values of the return on sales ratio of Russian wholesalers of household electric appliances in 2009 – 2018Mining industry of the Ural Federal District

Information agency Credinform has prepared a review of activity trends of the largest companies within mining industry of the Ural Federal District. The largest companies (ТОP-500) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2013 - 2018). The analysis was based on data of the Information and Analytical system Globas.

Net assets is a ratio reflecting the real value of company's property. It is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The ratio is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest mining company in terms of net assets is JSC SURGUTNEFTEGAS, INN 8602060555, Khanty-Mansiysk Autonomous Okrug - Ugra. In 2018 net assets of the company amounted to 4282 billion RUB.

The smallest size of net assets in TOP-500 had JSC YAMAL LNG, INN 7709602713, Yamalo-Nenets Autonomous Okrug. The lack of property of the company in 2018 was expressed in negative terms -266,8 billion RUB.

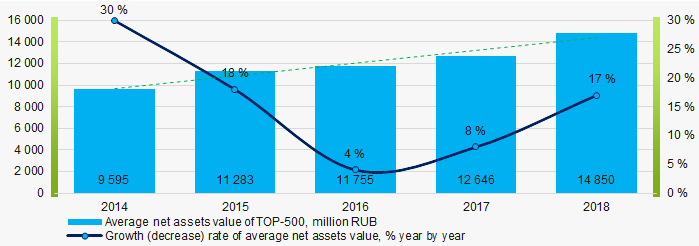

For the last ten years, the average values of net assets showed the growing tendency (Picture 1).

Picture 1. Change in TOP-500 average net assets value in 2014 – 2018

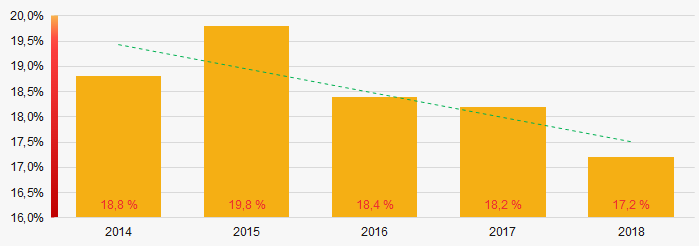

Picture 1. Change in TOP-500 average net assets value in 2014 – 2018 For the last five years, the share of ТОP-500 enterprises with lack of property showed the decreasing tendency (Picture 2).

Picture 2. The share of enterprises with negative net assets value in ТОP-500

Picture 2. The share of enterprises with negative net assets value in ТОP-500Sales revenue

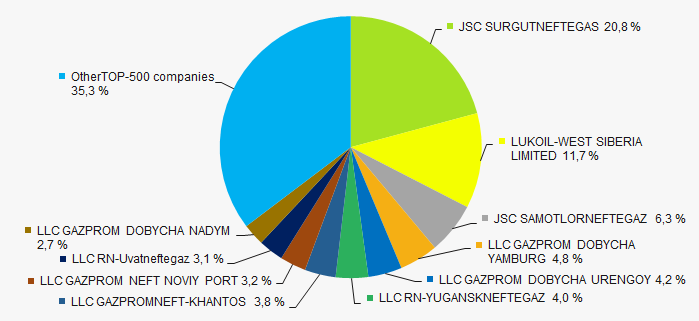

In 2018, the total revenue of 10 largest companies amounted to almost 65% from ТОP-500 total revenue (Picture 3). This fact testifies the high level of monopolization in mining industry of the Ural region.

Picture 3. Shares of TOP-10 in TOP-500 total revenue for 2018

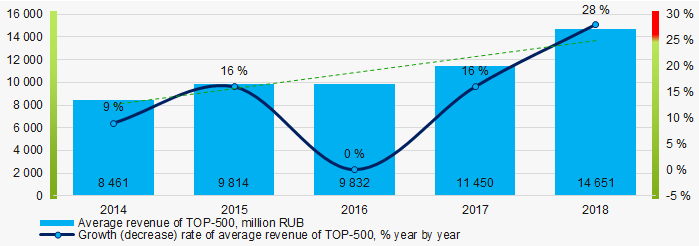

Picture 3. Shares of TOP-10 in TOP-500 total revenue for 2018In general, the growing trend in sales revenue is observed (Picture 4).

Picture 4. Change in average revenue of TOP-500 in 2014 – 2018

Picture 4. Change in average revenue of TOP-500 in 2014 – 2018Profit and loss

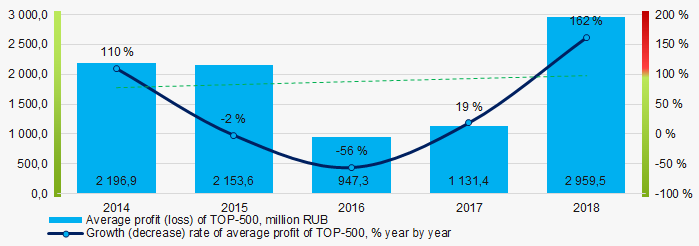

The largest company in terms of net profit is also JSC SURGUTNEFTEGAS, INN 8602060555, Khanty-Mansiysk Autonomous Okrug - Ugra. In 2018 the company’s profit amounted to 827,6 billion RUB.

For the last five years, the profit values of TOP-500 companies showed the increasing tendency (Picture 5).

Picture 5. Change in average profit (loss) of TOP-500 in 2014 – 2018

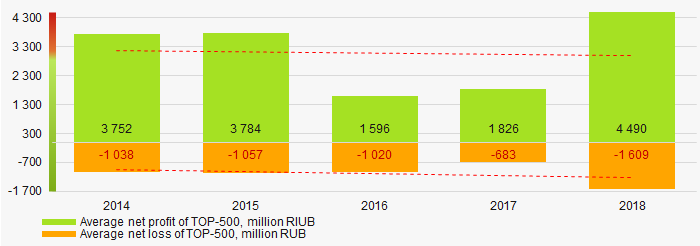

Picture 5. Change in average profit (loss) of TOP-500 in 2014 – 2018Over a five-year period, the average net profit values of ТОP-500 show the decreasing tendency, along with this the average net loss is increasing (Picture 6).

Picture 6. Change in average net profit/loss of ТОP-500 companies in 2014 – 2018

Picture 6. Change in average net profit/loss of ТОP-500 companies in 2014 – 2018Main financial ratios

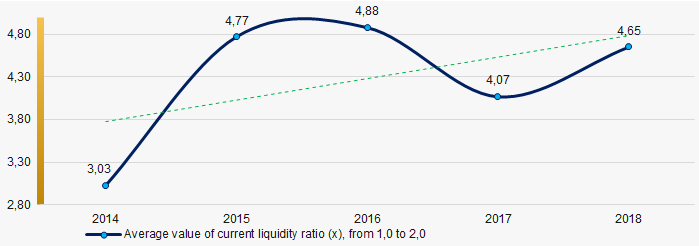

For the last five years, the average values of the current liquidity ratio were higher than the recommended values - from 1,0 to 2,0, with increasing tendency (Picture 7).

The current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Picture 7. Change in average values of current liquidity ratio in 2014 – 2018

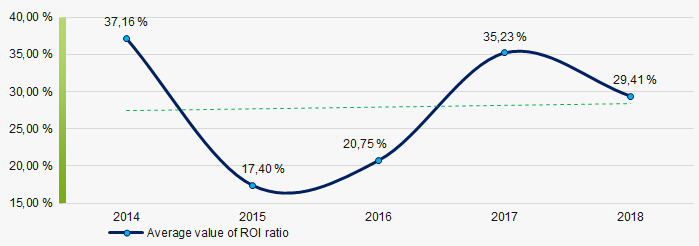

Picture 7. Change in average values of current liquidity ratio in 2014 – 2018For the last five years, the high level of average values of ROI ratio with growing tendency is observed (Picture 8).

The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average values of ROI ratio in 2014 – 2018

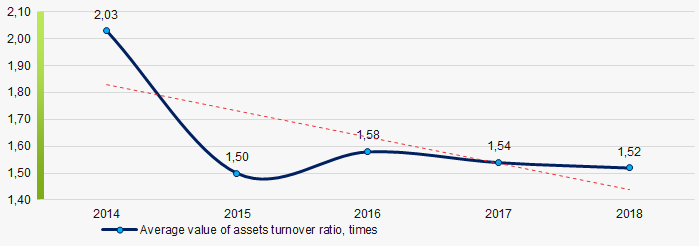

Picture 8. Change in average values of ROI ratio in 2014 – 2018Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

For the last five years, this business activity ratio demonstrated the downward trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio in 2014 – 2018

Picture 9. Change in average values of assets turnover ratio in 2014 – 2018 Small businesses

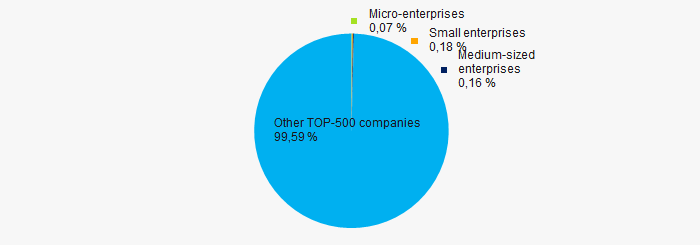

63% of ТОP-500 companies are registered in the Unified register of small and medium-sized enterprises of the Russian Federal Tax Service. Herein, their share in TOP-500 total revenue amounted to 0,41%, which is significantly lower than national average value (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in ТОP-500

Picture 10. Shares of small and medium-sized enterprises in ТОP-500Main regions of activity

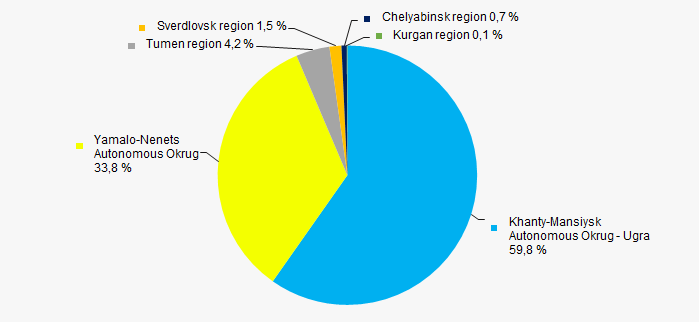

ТОP-500 companies are registered in 6 regions and unequally located across the country, taking into account the geographical location. More than 94% of the largest enterprises in terms of revenue are located in Khanty-Mansiysk Autonomous Okrug - Ugra and Yamalo-Nenets Autonomous Okrug (Picture 11).

Picture 11. Distribution of TOP-500 revenue by regions of the Ural Federal District

Picture 11. Distribution of TOP-500 revenue by regions of the Ural Federal DistrictFinancial position score

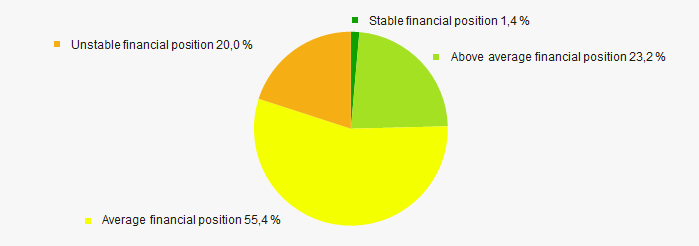

An assessment of the financial position of TOP-500 companies shows that the largest part have the average financial position (Picture 12).

Picture 12. Distribution of TOP-500 companies by financial position score

Picture 12. Distribution of TOP-500 companies by financial position scoreSolvency index Globas

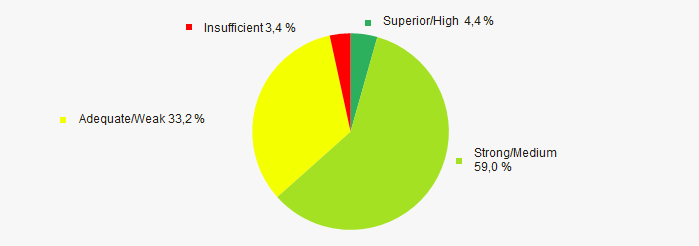

Most of TOP-500 companies got superior/high or strong/medium Solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully (Picture 13).

Picture 13. Distribution of TOP-500 companies by Solvency index Globas

Picture 13. Distribution of TOP-500 companies by Solvency index GlobasIndustrial production index

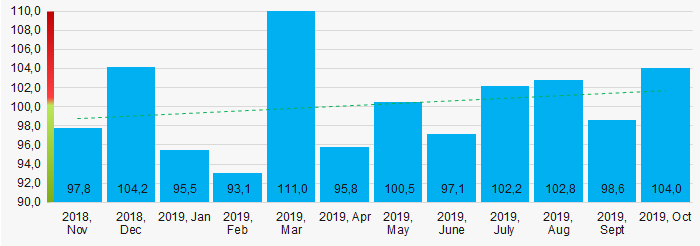

According to the Federal Service of State Statistics, the growing tendency of industrial production index is observed in the Ural Federal District during 12 months of 2018 – 2019 (Picture 14). Herewith the average index from month to month amounted to 100,2%.

Picture 14. Industrial production index in the Ural Federal District in 2018-2019, month by month (%)

Picture 14. Industrial production index in the Ural Federal District in 2018-2019, month by month (%)Conclusion

A complex assessment of the largest companies within mining industry of the Ural Federal District, taking into account the main indexes, financial ratios and indicators, demonstrates the presence of positive trends (Table 1).

| Trends and assessment factors | Relative share, % |

| Growth/drawdown rate of average net assets value |  10 10 |

| Increase / decrease in the share of enterprises with negative net assets |  10 10 |

| The level of competition / monopolization |  -10 -10 |

| Growth/drawdown rate of average revenue |  10 10 |

| Growth/drawdown rate of average net profit (loss) |  10 10 |

| Increase / decrease in average net profit |  -10 -10 |

| Increase / decrease in average net loss |  -10 -10 |

| Increase / decrease in average values of current liquidity ratio |  5 5 |

| Increase / decrease in average values of ROI ratio |  10 10 |

| Increase / decrease in average values of assets turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses by revenue more than 22% |  -10 -10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Industrial production index |  10 10 |

| Average value of factors |  1,3 1,3 |

favorable trend (factor),

favorable trend (factor),  unfavorable trend (factor).

unfavorable trend (factor).