Trends in activity of the largest companies of Saint-Petersburg's real economy

Information Agency Credinform has prepared the review of trends in activity of the largest companies of Saint-Petersburg's real economy.

The largest enterprises (TOP-10 and TOP-1000) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2015 and 2016). The analysis was based on data of the Information and Analytical Globas.

Sales revenue

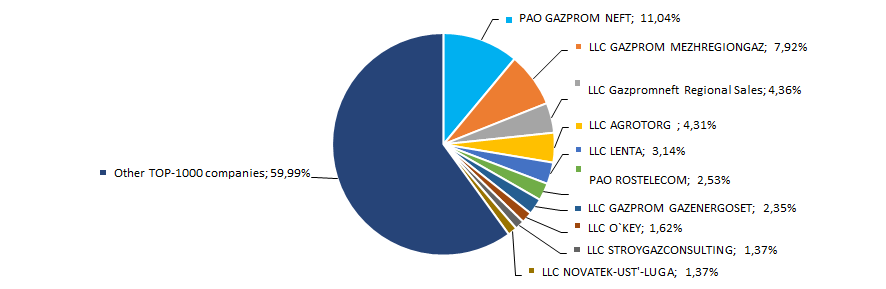

In 2016 total revenue of 10 largest companies amounted to 40% from TOP-1000 total revenue. In 2016, the largest company by total revenue is PAO GAZPROM NEFT – vertically integrated oil company, engaged in oil and gas fields exploration and development, oil refining, production and sale of petroleum products (Picture 1).

Picture 1. Shares of TOP-10 companies in TOP-1000 total revenue for 2016

Picture 1. Shares of TOP-10 companies in TOP-1000 total revenue for 2016For the three-year period, the best results by revenue in TOP-1000 were achieved in 2016. In general, the increase in sales revenue is observed (Picture 2).

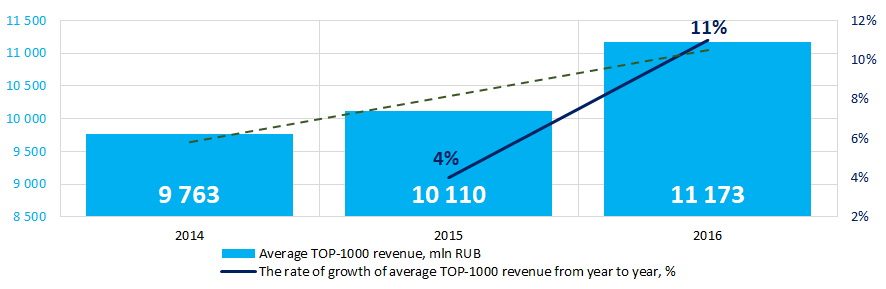

Picture 2. Change in average revenue of the largest companies of Saint-Petersburg's real economy in 2014 – 2016

Picture 2. Change in average revenue of the largest companies of Saint-Petersburg's real economy in 2014 – 2016Profit and loss

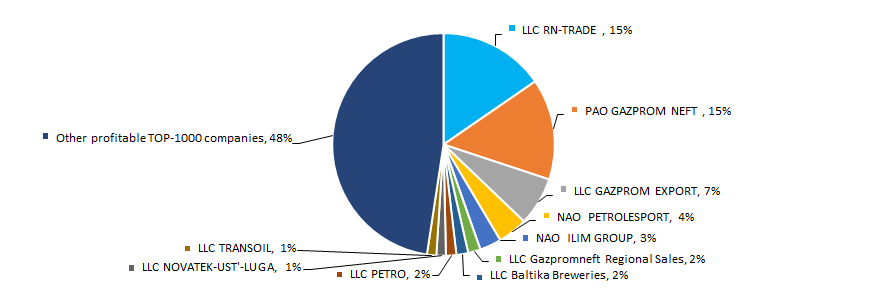

In 2016, profit of 10 largest companies amounted to 52% from TOP-1000 total profit. In 2016, the leading positions by profit take LLC RN-TRADE – the subsidiary of PAO ROSNEFT OIL COMPANY, engaged in retail sale of motor fuels through the filling station chain and to small wholesale consumers, and PAO GAZPROM NEFT (Picture 3).

Picture 3. Shares of TOP-10 companies in TOP-1000 total profit for 2016

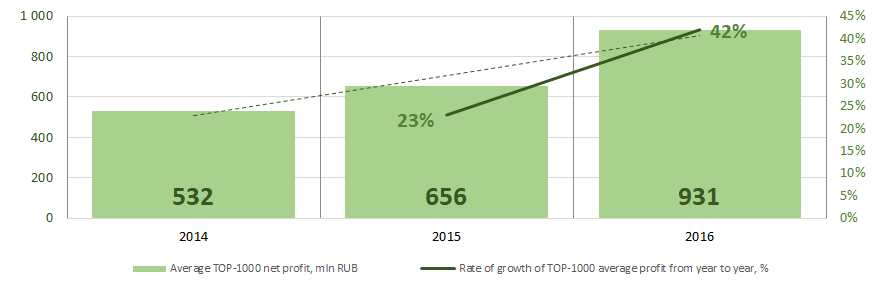

Picture 3. Shares of TOP-10 companies in TOP-1000 total profit for 2016For the three-year period, the average revenue values of TOP-1000 companies show the growing tendency (Picture 4).

Рисунок 4. Picture 4. Change in average profit of the largest companies of Saint-Petersburg's real economy in 2014 – 2016

Рисунок 4. Picture 4. Change in average profit of the largest companies of Saint-Petersburg's real economy in 2014 – 2016Main financial indicators

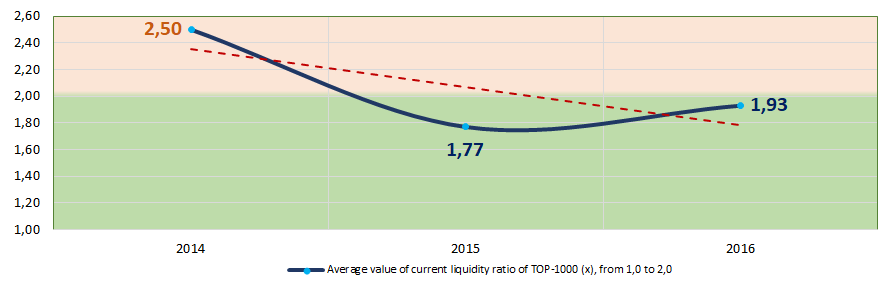

For 2014 – 2016 period the average values of current liquidity ratio of TOP-1000 were higher or within the recommended values – from 1,0 to 2,0 (Picture 5).

Current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Picture 5. Change in average values of current liquidity ratio of the largest companies of Saint-Petersburg's real economy in 2014 – 2016

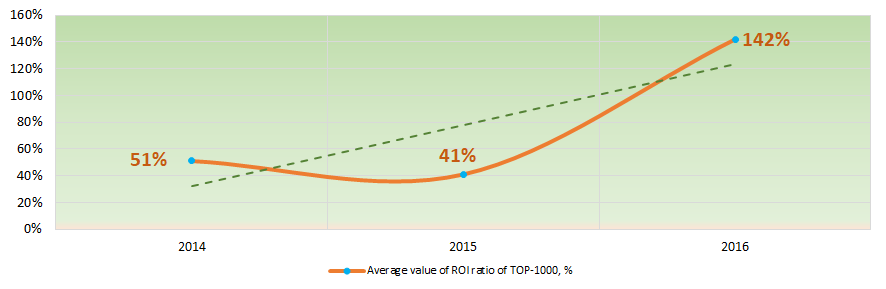

Picture 5. Change in average values of current liquidity ratio of the largest companies of Saint-Petersburg's real economy in 2014 – 2016For the three-year period, the instability of ROI ratio with increasing tendency was observed (Picture 6). The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Picture 6. Change in average values of ROI ratio of the largest companies of Saint-Petersburg's real economy in 2014 – 2016

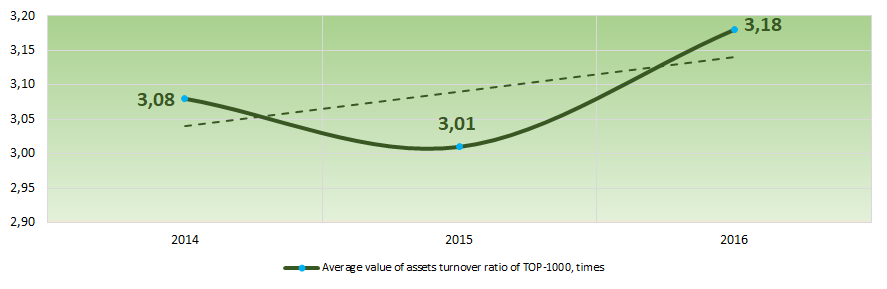

Picture 6. Change in average values of ROI ratio of the largest companies of Saint-Petersburg's real economy in 2014 – 2016Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

For the three-year period, this business activity ratio in general demonstrated the upward trend (Picture 7).

Picture 7. Change in average values of business activity ratio of the largest companies of Saint-Petersburg's real economy in 2014 – 2016

Picture 7. Change in average values of business activity ratio of the largest companies of Saint-Petersburg's real economy in 2014 – 2016Production and services structure

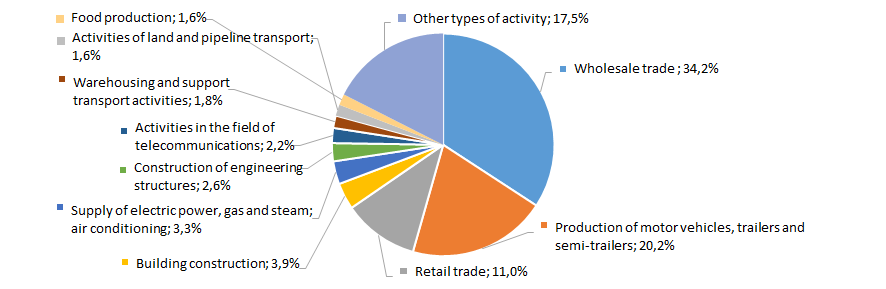

The largest share in TOP-1000 total revenue take companies engaged in wholesale trade and production of motor vehicles (Picture 8).

Picture 8. Distribution of activities in TOP-1000 total revenue, %

Picture 8. Distribution of activities in TOP-1000 total revenue, %Main regions of initial registration

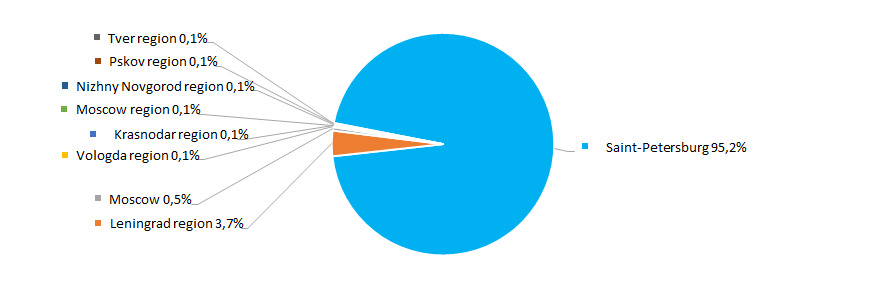

The majority of companies with initial registration outside Saint-Petersburg was founded in Leningrad region (Picture 9).

Picture 9. Distribution of TOP-1000 companies by initial registration regions

Picture 9. Distribution of TOP-1000 companies by initial registration regionsFinancial position score

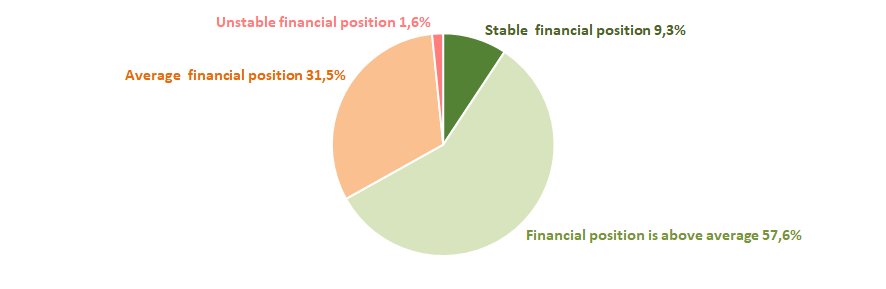

The assessment of company’s financial position shows that more than a half of companies have above average financial position (Picture 10).

Picture 10. Distribution of TOP-1000 companies by financial position score

Picture 10. Distribution of TOP-1000 companies by financial position scoreLiquidity index

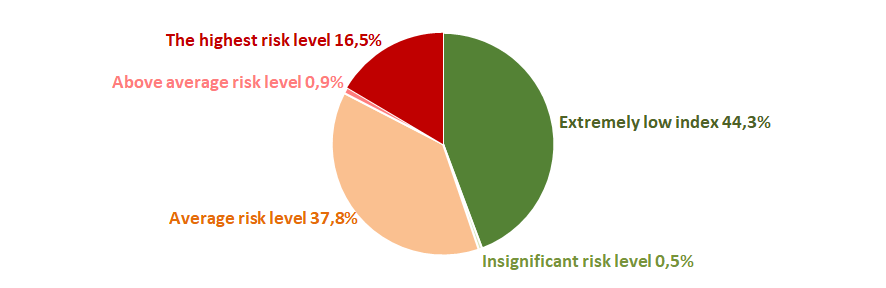

44% of TOP-1000 companies demonstrate rather low level of bankruptcy risk in the short-term period and more than one third have average level of bankruptcy risk (Picture 11).

Picture 11. Distribution of TOP-1000 companies by liquidity index

Picture 11. Distribution of TOP-1000 companies by liquidity indexSolvency index Globas

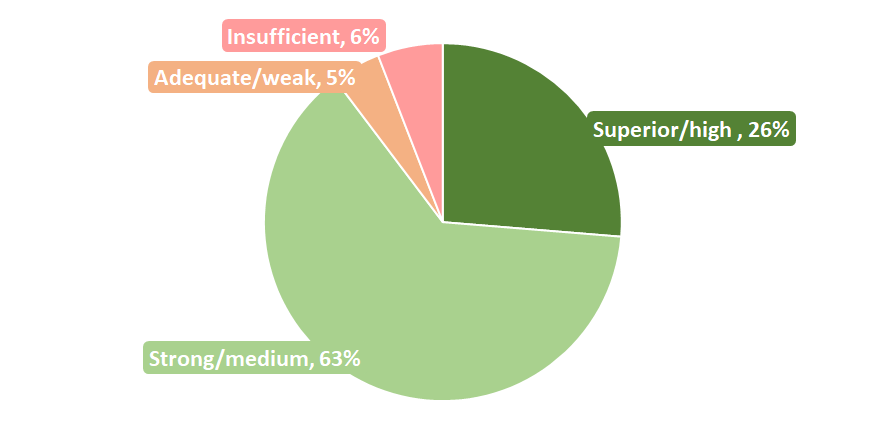

The majority of TOP-1000 companies have superior/high or strong/medium solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully (Picture 12).

Picture 12. Distribution of TOP-1000 companies by solvency index Globas

Picture 12. Distribution of TOP-1000 companies by solvency index GlobasHereby, the complex assessment of the largest companies of Saint-Petersburg's real economy, taking into account main indexes, financial ratios and indicators, demonstrates the denomination of favorable trends.

Increasing number of cyber threats is to result in growth of cyber risk insurance market

Data thefts and damaging of businesses via information technology has become a common crime these days. Cybercrimes like hacker attack, malicious software and DDos attacks are a real danger in the context of global IT development, and it is getting harder to combat them.

Injuries to reputation, violations of internal and external business processes, and payment of damages to clients for the leakage of their data are the main losses of a company from cyberattacks. Cyber risk insurance is not a substitute for data security measures, but it may become the only way to minimize losses.

According to Allied Market Research, a British analytical center, the volume of cyber risk insurance market will reach 14 billion US dollars, and by 2025, it will amount to 20 billion US dollars (according to Allianz, a German insurance company). The USA is the leader in cyber insurance with its domestic market of 1.35 billion US dollars, which is quite natural for the major part of cybercrimes accrues to the USA.

Market volume of cyber risk insurance in Russia is around 15 million US dollars. Demand for this type of insurance has just started to develop: a small number of contracts have been concluded, and most of them have been executed by subsidiaries of foreign insurance companies. Total cyber insurance amount of AlfaStrakhovanie company is 100 million euros. There are over 20 largest Russian business entities among its corporate customers. The first company to protect itself from cyber risks was MTS, a mobile network operator, followed by VimpelCom. Ingosstrakh and Liberty Insurance have started to conclude insurance contracts.

By 2022, a large-scale cyber risk insurance market is going to be created under the government-run program Digital Economy, and insurance premiums are to reach 20 million US dollars. Sberbank will chair the working group. The Ministry of Finance, Central Bank, Federal Security Service and All-Russian Union of Insurers are to assist achieving the goal.

Procedure of cyberattack protection is to become compulsory for a number of sectors and public bodies, such as banks, military and industrial enterprises and tax service. This project is to result in amendments of the Federal Law “On organization of insurance”, and introduction of a new type of service – cyber risk insurance.