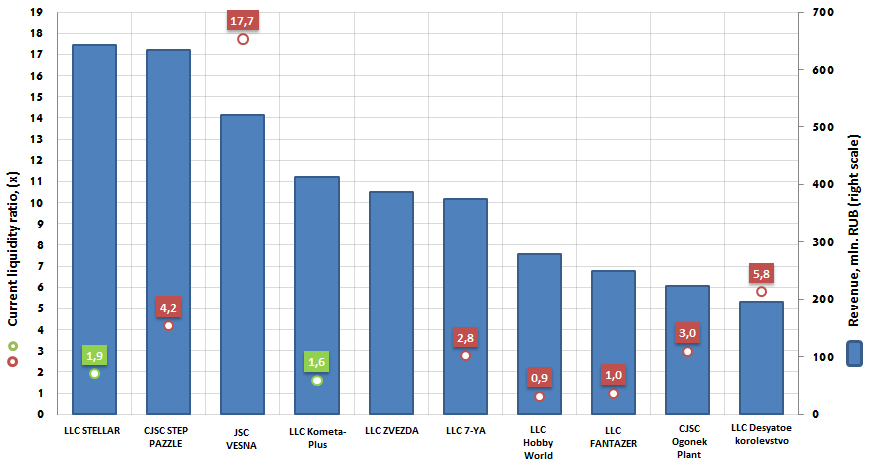

Current liquidity ratio of the largest toys manufacturers

Information Agency Credinform has prepared the ranking of the largest Russian toys manufacturers.

Top-10 enterprises, ranged by decrease in revenue, were selected according to the data from the Statistical Register for the latest available period (for the year 2014); the liquidity ratio was calculated for each company (if data are available).

The current liquidity ratio (х) is a ratio of total working capital and short-term liabilities. It shows the sufficiency of funds to repay the obligations, execution date of which comes earlier than 12 months.

The recommended value: from 1,5 to 2,5. It should be understood, that actual data may significantly vary from the presented normative range for enterprises of different and same industries.

There are highly liquid, low liquid and illiquid values (assets). The easier and faster you can exchange the asset, taking into account its full cost, the more liquid is the asset. The liquidity of the product is the speed of its implementation using nominal price without additional discounts.

The ratio shows the ability of the company to meet its current (short-term) obligations using only current assets and characterizes not only company’s current solvency, but also the solvency in case of emergency. The higher is the rate, the better is the solvency of the company.

Both low and high ratios have negative effect. The ratio lower than 1 indicates about high financial risk, which is connected with the fact, that the company is not able to consistently pay its current bills. The ratio more than 3 may testify about the irrational capital structure; overly cautious financial strategy, which may lead to loss of the share in market. However it should be considered, that the ratio value may significantly vary, it depends on the area of activity, structure and quality of the assets etc.

It should be noted, that the ratio doesn’t always give a full picture. Usually the enterprises, which easily receive money from the payment bills, and with low inventory stocks, may safely operate with a lower ratio value, than the companies with high inventory stocks and sales of goods on credit.

For the most full and fair opinion about the company’s financial condition, not only the average values of the indicators should be taken into account, but also the whole set of financial indicators and ratios.

| № | Name | Region | Revenue, mln. RUB, 2014 | Current liquidity ratio, (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | LLC STELLAR INN 6165021405 |

Rostov region | 642,8 | 1,9 | 190 the highest |

| 2 | CJSC STEP PAZZLE INN 7720249869 |

Moscow region | 633,4 | 4,2 | 197 the highest |

| 3 | JSC VESNA INN 4346008642 |

Kirov region | 520,7 | 17,7 | 168 the highest |

| 4 | LLC Kometa-Plus INN 6714015660 |

Smolensk region | 412,1 | 1,6 | 290 high |

| 5 | LLC ZVEZDA INN 5025025461 |

Moscow region | 386,7 | - | 337 satisfactory |

| 6 | LLC 7-YA INN 7602033398 |

Yaroslavl region | 374,8 | 2,8 | 219 high |

| 7 | LLC Hobby World INN 7708812210 |

Moscow | 278,6 | 0,9 | 366 satisfactory |

| 8 | LLC FANTAZER INN 7728557047 |

Moscow | 249,4 | 1,0 | 320 satisfactory |

| 9 | CJSC Ogonek Plant INN 7724003577 |

Moscow | 223,9 | 3,0 | 229 high |

| 10 | LLC Desyatoekorolevstvo INN 7713321088 |

Moscow region | 195,2 | 5,8 | 187 the highest |

The Central Bank claims to lower the credit risks by thorough examination of the borrower

The Central Bank of the Russian Federation (CB RF) claims credit organizations to identify the entities (clients), being under their customers, and beneficiaries. These requirements are determined by the Central Bank in the “Clause on identification of clients and beneficiaries by credit organizations for purposes of countermeasure to income legalization (laundering) obtained by illegal means and terrorism financing” as of August 19th, 2004 №262C (from there Clause). This Clause is implemented by the Regulator in accordance with the requirements of the federal law “Concerning the Combating of income legalization (laundering) obtained by illegal means and terrorism financing” as of 07.08.2001 №115-FL.

According to the Clause, the corresponding program should be developed in the credit organization. The program is to have the procedure of clients’ identification, beneficiaries’ determination and identification, including procedure of risk level estimation of transaction performed by the client in order to legalize (launder) income obtained by illegal means or to finance the terrorism and the arguments of the risk estimation.

The credit organization ought to collect information, mentioned in the appendixes of the listed Clause, documents being the evidence of banking transactions or other operations’ performance, in order to fulfil the program. The credit organization is also entitled a right to use other data (documents), which is definable in its internal documents. Moreover, it should use the information from the open databases of the federal executive authorities posted in the information and telecommunication network Internet and other information sources, available for the credit organization legitimately.

The regulator of the federal law and the Clause implementation practice set that the largest credit organizations fulfil the requirements of the law documents incompletely. Thus, the banks for instance, take the check of the legal entity as a mere formality. In particular, they doesn’t examine whether the company is situated at the stated operational address by visiting the office. As a result, the banks have more than 100 legal entities, the operational address of which doesn’t correspond with the office address.

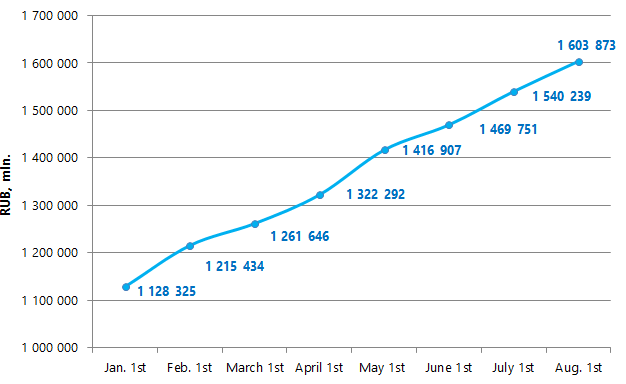

Disregarding of the actions on the legal entities’ inspection leads subsequently to high credit risks: payments delay, slight credit default or common default on monetary means. According to the Statistics of the Central Bank of Russia, the total sum of the delayed credit indebtedness of the resident legal entities or individual entrepreneurs as of August 1st, 2015 amounts to more than RUB 1,6 trillion. Comparing with the situation on January 1st, 2015 this indicator increased by a factor of 1,42. The growth dynamics of the delayed credit indebtedness during 2015 is represented on the figure 1.

Figure 1. Total sum of the delayed credit indebtedness of the resident legal entities or individual entrepreneurs in Russian from January 1st to August 1st, 2015.

The existing situation cannot but concern the Regulator. In this regard the 262C Clause (“Concerning identification of clients…”) of the Central bank is being prepared in the new version. It is expected that the effect to the Clause will be given in the IV quarter of 2015. According to the Clause, it is required for banks to check the originality of the received data, including visiting of the prospective borrower in order to make sure that the legal entity is situated at the listed address; that it carries on operation activity and has the stated charges. According to the Central Bank, this action will not only provide an opportunity to identify the corporate clients together with other actions, but also to determine its credit risk level and the sum of the required reserves on the issued loans.

Besides, market experts state that the services of checking “fly-by-nights” companies on the web-sites of the Central Bank and the Federal Tax Service doesn’t help the banks in a proper way, due to their rare updating.

Nowadays, the significant assistance in solving the corresponding problems might be rendered by Information and Analytical System Globas-i®. This resource within a very short time makes it possible to identify beneficiaries both of Russian and international legal entity; to determine whether the Russian firms has attributes of a “fly-by-night” company; to analyze the ability to meet debt obligations and practicability of credit granting, its maximum amount on short-term and long-term periods.