Russia takes gold

In 2014 Russia had almost third part of the world gold purchase volume; last year The Russian Federation had spent the largest sum on purchase of precious metal since the collapse of the USSR.

In 2014 the Central Banks around the world bought 461 tons of gold. This is 13% more than in 2013. In January-November 2014 The Central Bank of Russia bought 152 tons of gold for a total amount of USD 6,1 bln. The growth in purchases volume amounted to 123%. Monetary valuation of gold in reserves increased by 13% (as of 01.02.2015 it was USD 49,1 bln.).

The purchasing of gold by The Central Bank of Russia can be explained by the desire to curtail dollar dependence and to support the considerably flagging ruble. However it also should be taken into account the fact that by 2014 results Russia was the second manufacturer of commodities in the world: 272 tons of gold. The first place took China with 465,7 tons and the third place - Australia with 269,7 tons. In 2014 the global gold output amounted to 3 109 tons.

That is why the hasty growth in purchasing of gold is partly explained by purchasing of home-grown metal; such values are not easy to sell abroad because of sanctions imposed by the West due to events in Ukraine.

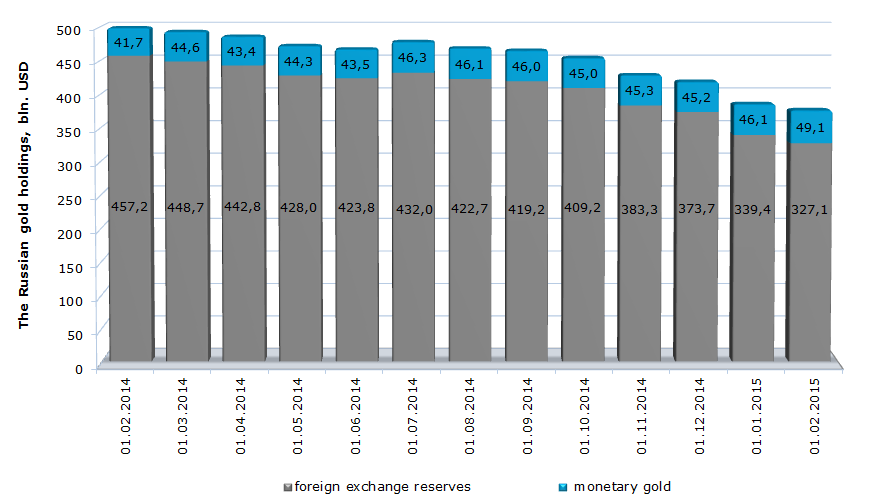

The structure and dynamics of the Russian gold holdings, bln. USD

Unstable position of the Russian economy and currency market has led to decreasing of total gold holdings by 24,6% within a year (as of 01.02.2015, till USD 376,2 bln.). At the same time, the value of monetary gold, in reserves structure, increased within the same period by 17,7% (till USD 49,1 bln.). Thus, we can see the policy of The Central Bank, which is directed on the increasing of gold holdings.

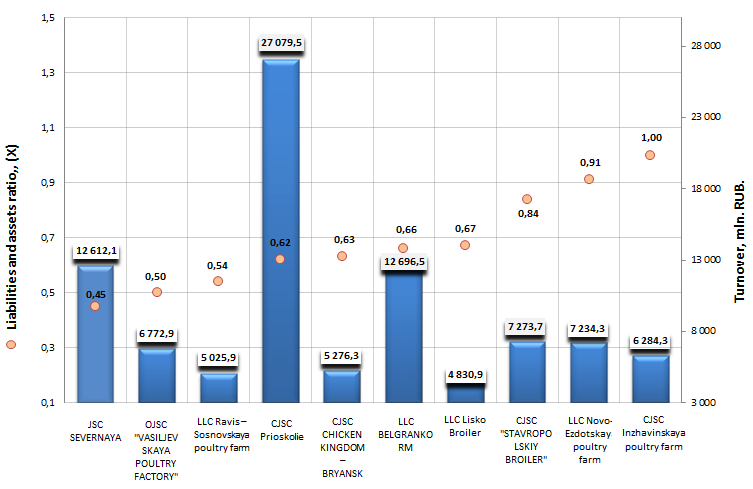

Liabilities and assets ratio of the poultry farms

Information Agency Credinform has prepared the ranking of Russian poultry farms. The largest enterprises engaged in this activity in terms of revenue were selected according to the data from the Statistical Register for the latest available period (for the year 2013). Then, the first ten companies by turnover were ranged by increase in liabilities and assets ratio.

Liabilities and assets ratio refers to a group of financial stability indicators and is calculated as a ratio of long-term and short-term borrowed funds to total assets. The ratio shows which part of the company’s assets is financed by loans. The recommended value is: from 0,2 to 0,5.

| № | Name, INN | Region | Turnover 2013, mln. RUB | Liabilities and assets ratio, (х) | Solvency index Globas-i® |

|---|---|---|---|---|---|

| 1 | JSC SEVERNAYA INN 4706002688 |

Leningrad region | 12 612 | 0,45 | 191 (The highest) |

| 2 | OJSC "VASILJEVSKAYA POULTRY FACTORY" INN 5809022198 |

Penza region | 6773 | 0,5 | 253 (high) |

| 3 | LLC Ravis – Sosnovskaya poultry farm INN 7438016550 |

Chelyabinsk region | 5026 | 0,54 | 243 (high) |

| 4 | CJSC Prioskolie INN 3123100360 |

Belgorod region | 27 080 | 0,62 | 228 (high) |

| 5 | CJSC CHICKEN KINGDOM – BRYANSK INN 3254511269 |

Bryansk region | 5276 | 0,63 | 247 (high) |

| 6 | LLC BELGRANKORM INN 3116003662 |

Belgorod region | 12 697 | 0,66 | 242 (high) |

| 7 | LLC Liskinskaya Investment and Construction Company Broiler INN 3652009724 |

Voronezh region | 4831 | 0,67 | 293 (high) |

| 8 | CJSC "STAVROPOLSKIY BROILER" INN 2623016651 |

Stavropol region | 7274 | 0,84 | 258 (high) |

| 9 | LLC Novo-Ezdotskaya poultry farm INN 3126011038 |

Belgorod region | 7234 | 0,91 | 287 (high) |

| 10 | CJSC Inzhavinskaya poultry farm INN 6805006976 |

Tambov region | 6284 | 1 | 289 (high) |

According to 2014 results, the inner production value of meat and offal poultry amounted to 3,9 mln. tons, that is 9,76% more than in 2013.

With the issuing of food embargo in August 2014 the Russian poultry breeders got the chance to improve the positions on the domestic market. The first results of the assumed measures can be observed already now. Thus according to 2014 results, the import value of meat and offal poultry decreased by 17,5% in monetary terms and 24,5% in physical terms. In this regard the ratio of key importers has changed. According to 2014 results, the largest importers on the territory of the Russian Federation were Belarus (29,4% and 22,1% respectively in monetary and physical terms) and Brazil (28,6% and 20,5% respectively in monetary and physical terms). The most significant decrease in import values showed the USA, which was the traditional leader of poultry import to Russian market. By 2014 results the value of American import decreased by 51,4% in monetary terms. On the other hand, the Turkish poultry breeders have strengthened its positions. By 2014 results the value of Turkish import increased by more than 6,5 times.

The first place of the ranking takes JSC SEVERNAYA with ratio value 0,45, which is compliant with established standards. The company has the highest solvency index Globas-i®, which speaks about high ability to repay debt obligations.

Liabilities and assets ratio of the largest poultry farms in Russia, Top-10

The industry leader by turnover according to 2013 results CJSC Prioskolie takes the fourth place of the ranking with ratio value 0,62, which is slightly higher than recommended values. The company has the high solvency index Globas-i®, which shows company’s stable financial condition.

The liabilities and assets ratio value of CJSC Inzhavinskaya poultry farm is 1, which indicates about equality of total borrowings, credits and accounts payable towards all company’s assets; this might have negative effect on company’s financial stability in the future. However according to total financial and non-financial indicators, the high solvency index Globas-i® was assigned to the company.

In conclusion it should be noted that principals should accurately monitor the ratio of assets and all borrowings and credits, as the significant excess of liabilities might have negative effect on company’s financial stability.