Is it worth expecting for the economic recession?

The escalated geopolitical environment in the events surrounding Ukraine provided a large dose of pessimism to many experts in making an assessment of the national economic growth prospects. The Occident’s sanctions have had an impact on worsening of the not very good investment climate as it was. The capital outflow has increased and according to the Ministry of Finance of the Russian Federation it will be 100 bln dollars in the current year. The devaluation of the ruble at the beginning of the year against the Central Bank’s dollar-euro basket broke up the inflationary developments. The raising of the key discount rate up to 7.5% by the Central Bank has dampened the market for a little bit, but now this solution is the drag for a new impulse to development. What is worth expecting for against the background of these events in the current year?

“The Ministry of Finance of the Russian Federation admits the technical recession in the 2nd and 3rd quarters of the 2014”, says Maxim Oreshkin, the director of division of the long-term strategic planning of The Ministry of Finance.

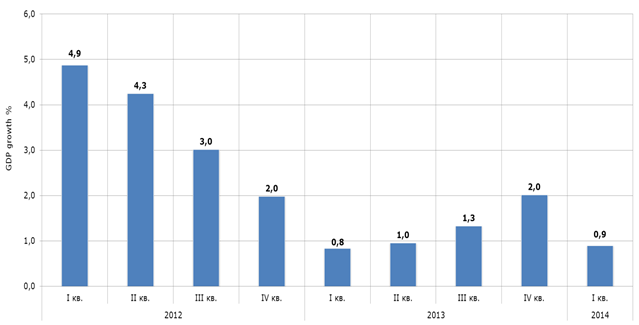

However, not everything is so decisive. On May 15 the Russian Federal State Statistics Service estimated the GDP growth dynamics in the 1st quarter of 2014 at 0.9% that turned out to be 0.1% more than The Ministry of Economic Development and Trade expected in their previous calculation. According to Andrey Klepach, the deputy economics minister, there was not and will be no recession in the economy. There will be lower point in the 1st quarter and taking into account the gradual settlement of a dispute in Ukraine and the sanctions war damping we should expect for its growth acceleration.

Russian GDP growth by quarter, %

There are a number of other facts for the easing of this situation: as on May 20, the Russian stock market has almost won back lost positions in February and April of the current year, caused by the investors panic because of the actions of Russia in Crimea.

Moreover, according to the last estimating of the Russian Federal State Statistics Service in January and April the run-up of the manufacturing output set up 1.4% to January and April in 2013, compared with the same period in the last year there was the industrial recession to -0.6%.

It is gratifying to emphasize that in the considered time-horizon of the current year the manufacturing increased to 2.8%, last year there was the recession to -0.9%.

To sum up, according to our provisional estimate the economy growth at year-end may be 0.6% more than The Ministry of Finance of the Russian Federation considered earlier.

Rosimushchestvo has prepared changes in timing of dividend payments to state companies and state banks

Rosimushchestvo (Federal Agency for State Property Management) has prepared and submitted for consideration a number of amendments to the decree of the Government of 2006, which regulates the timing of dividend payments to state companies and state banks. New amendments may come into force already in 2015, i.e. by dividend payments for the year 2014.

Rosimushchestvo offers to oblige state companies and state banks to allocate for dividends minimum 25% of consolidated net profit, in the event they report in accordance with International Financial Reporting Standards (IFRS), otherwise it must be paid in accordance with Russian Accounting Standards (RAS).

As of today the Federal Tariffs Service (FTS) de facto takes into account the norm of profit by the tariff making for monopolies, but de jure it is mentioned nowhere.

As the base for calculation of dividends of monopolies the government agency offers to take maximum from two indicators: net profit on financial statement or net profit, taken into account by the FTS by adoption of a tariff. According to the representatives of Rosimushchestvo, such approach will motivate the management of monopolies to more efficient operations, because as of today the management of organizations re-examines the budget several times and total profit value appears to be much less, than the planned one.

However, the FTS hasn’t approved this proposal, believed that it could lead to the rise in tariffs for consumers. The position of the representatives of the FTS comes down to the fact that the question of dividends must be solved not on account of tariffs, but on account of cost saving. Besides that, the representatives of the FTS note potential adverse effects for monopolies, because the profit, taken into account by the FTS, is a forecast and by force of objective reasons it can differ essentially from actual values and not always in favor of monopolies.