Development of the Patent system of taxation in 2016

We have already discussed in our publications the patent system of taxation: «Patent system of taxation in 2015».

According to the Federal Laws of 21.07.2014 №244-FL and of 13.07.2015 №232-FL, individual entrepreneurs whose average number of wage workers is not more than 15 employees for the tax period and that sales income amount does not exceed 60 mln RUB, can use the patent system of taxation. These requirements remain unchanged in 2016.

Changes in the application rules of the patent system of taxation concerned in 2016 the kinds of activity list that was raised from 47 to 63 kinds of activity. You can learn full list of activity kinds in the Tax Code of the RF and on the web-site of the Federal Tax Service of the RF.

For example, the following kinds of activity were included to the new list that came into force since January 1, 2016: caring for retired and disabled people, activities related to computer hardware, manufacture and repair of goods made of natural leather, manufacture of bakery, confectionary and dairy products.

As before, in order to account for the tax authorities, it is necessary to keep the income ledger.

In 2016 the growing popularity of the patent system of taxation among individual entrepreneurs was not once mentioned by the mass media. For example, almost 40 thousand patents were acquired for the first half of 2016 in Moscow that is 80% more than for the 6 months of the previous year. Besides, more than half of patents are related to the sphere of retail trade. Growing interest is observed for patents on the right to carry out activities related to public food services, home renovation and other services.

As a result, according to experts, patent system as one of kinds of simplified taxation system becomes ever more effective instrument of tax policy of the Government.

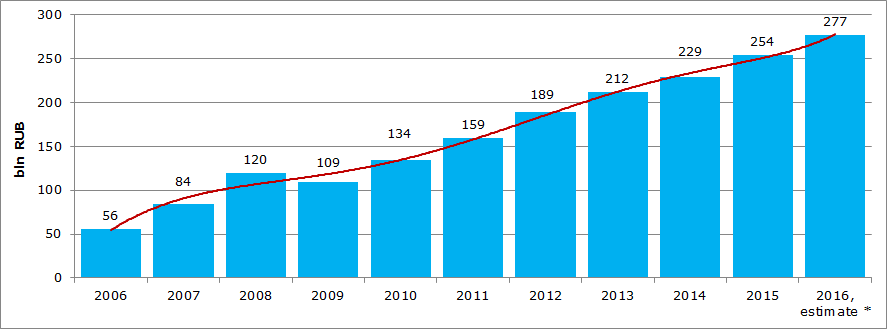

Data from the Federal Tax Service of the RF of assessment and collection of taxes imposed with implementation of the simplified taxation system (Picture 1) confirm the above-mentioned information.

*) – the forecast is based on growth rates for 6 months of 2016

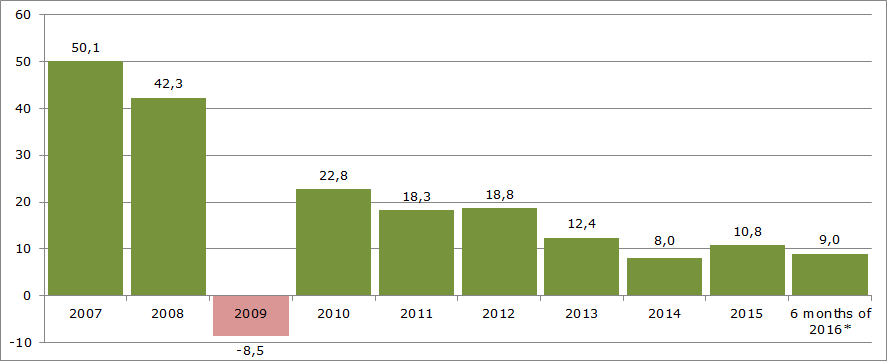

Besides, growth rates of collection of such taxes are recently decreasing because of the macroeconomic situation (Picture 2).

*) – data for 6 months of 2016 are given to the corresponding period of 2015

Easing procedures of company registrations - what does the future hold?

In the past years the Russian authorities have made various efforts to simplify the procedures and rules which govern the registration of legal entities and sole entrepreneurs. The significance of these efforts were not lost on the World Bank “Doing Business” rankings who adjusted Russia’s rankings in the “Ease of Doing Business” from the 51st to 40th place. In the category “Starting a Business” the ranking was reduced from to 41st to 9th. This is a significant improvement from previous years.

Notwithstanding these positive observations, the process of company registrations remains complicated. The following are barriers preventing a fast track registration:

- Choosing of a company name;

- Selecting of a correct activity type according to the activity classification codes;

- Searching for a legal address;

- Choosing an optimal tax structure;

- Selecting appropriate definitions of business activities and their correct reflection in the company’s memorandum of incorporation;

- Notarial certification of documents;

- Filing of registration documents.

Registration documents which are prepared incorrectly may lead to a rejection by the Federal Tax Service – official body in charge for company registrations. Registration fees are non-refundable thus increasing the cost of the overall registration process and the overall time required. To avoid such delays it is advisable to use the services of specialized companies.

Compliance: To prevent fraudulent activities the Federal Tax Service of Russia has sent instructions to its regional offices requiring them to verify the information filed in the Unified State Register of Legal Entities (EGRUL). Particularly for legal entities registered after 01.08.2016 and where the following questionable features are identified:

- CEO of the legal entity is also CEO in over than 5 additional legal entities;

- Shareholders of legal entity are also shareholders in over other 10 legal entities;

- The registered address of the legal entity is also the registered address of more than 10 legal entities;

- CEO is a disqualified person.

A pilot scheme designed to simplify the procedures of business registrations by Russian citizens was launched on November 1, 2016. Two of the biggest Russian banks Sberbank and VTB are assuming the registration functions. Future entrepreneurs are not obligated to go to the local registration bodies - it is enough to apply to one of these banks where they are clients. They may contact the bank distantly or visit the bank’s office to register as individual entrepreneur or as an LLC with a sole shareholder. It is sufficient to fill out an application, for example, on foundation of a Limited Liability Company. The applicants may receive the digital signature, which will be affixed on the application form in case of remote applications. Thereafter after the bank will be responsible for security issues and dealing with registration and tax body without the client’s participation.

The pilot scheme will be operational until 2017. If successful the Russian authorities will assign more banks to extend the initiative nationwide.