Return on assets of security companies

Information agency Credinform has prepared a ranking of the largest Russian security companies. The largest enterprises (TOP-10) in terms of annual revenue were selected according to the data from the Statistical Register for the available periods (2016-2018). Then the companies were ranged by return on assets ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Return on assets (%) is calculated as the relation of the sum of net profit and interest payable to the total assets value of a company and shows how many monetary units of net profit are earned by every unit of total assets.

The ratio characterizes the effectiveness of using by the company of its resources. The higher is the ratio value, the more effective is business, that is the higher the return per every monetary unit invested in assets.

However, it is necessary to take into account that the book value of assets may not correspond to their current market value. For example, under the influence of inflation, the book value of fixed assets will increasingly be underestimated in time, that will lead to an overestimation of the return on assets. Thus, it is necessary to take into account not only the structure, but also the age of the assets.

It should be also taken into account the dynamics of this indicator. Its consistent decline indicates a drop in asset utilization.

For the most full and fair opinion about the company’s financial position the whole set of financial indicators and ratios should be taken into account.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Return on assets,% | Solvency index Globas | |||

| 2017 | 2018 | 2017 | 2018 | 2017 | 2018 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| PSC BASTION LLC ИНН 8904047159 Yamalo-Nenets Autonomous Okrug |

1 806,2 1 806,2 |

2 291,0 2 291,0 |

288,9 288,9 |

360,5 360,5 |

65,35 65,35 |

86,14 86,14 |

136 Superior |

| CHOO UPRAVLENIE PO OKHRANE OByEKTOV GMK NORILSKII NIKEL LLC ИНН 7705393628 Moscow |

1 042,3 1 042,3 |

1 049,5 1 049,5 |

60,7 60,7 |

26,0 26,0 |

41,97 41,97 |

21,72 21,72 |

191 High |

| LUKOM-A-PERM Agency LLC ИНН 5902189473 Perm Territory |

745,9 745,9 |

848,1 848,1 |

37,6 37,6 |

25,3 25,3 |

16,43 16,43 |

12,95 12,95 |

200 Strong |

| THE PRIVATE SECURITY COMPANY RZD-GUARD LLC ИНН 7701859844 Moscow |

2 169,7 2 169,7 |

2 150,0 2 150,0 |

34,3 34,3 |

68,5 68,5 |

6,37 6,37 |

12,50 12,50 |

202 Strong |

| AN-SECURITY NORTH-WEST LLC ИНН 7806302994 St. Petersburg |

812,7 812,7 |

1 414,2 1 414,2 |

8,5 8,5 |

48,3 48,3 |

4,18 4,18 |

12,19 12,19 |

180 High |

| KENNARD PSC LTD ИНН 1655030632 Republic of Tatarstan |

728,9 728,9 |

1 147,2 1 147,2 |

40,8 40,8 |

49,1 49,1 |

21,16 21,16 |

6,18 6,18 |

181 High |

| PSC VITYAZ LLC ИНН 1649005010 Republic of Tatarstan |

840,3 840,3 |

873,6 873,6 |

5,2 5,2 |

5,2 5,2 |

2,67 2,67 |

2,67 2,67 |

191 High |

| PSC MEGUR LLC ИНН 7724287600 Moscow |

973,0 973,0 |

969,4 969,4 |

0,7 0,7 |

0,7 0,7 |

0,10 0,10 |

0,59 0,59 |

237 Strong |

| PSC POLYUS SHCHIT LLC ИНН 2463069959 Krasnoyarsk region |

1 806,2 1 806,2 |

2 291,0 2 291,0 |

-40,8 -40,8 |

-6,0 -6,0 |

-21,89 -21,89 |

-2,69 -2,69 |

257 Medium |

| LLC ALROSA-Okhrana ИНН 1433018056 The Republic of Sakha (Yakutia) |

1 285,5 1 285,5 |

1 327,8 1 327,8 |

3,9 3,9 |

-12,2 -12,2 |

1,51 1,51 |

-4,08 -4,08 |

220 Strong |

| Average value for TOP-10 companies |  1 131,0 1 131,0 |

1 307,0 1 307,0 |

44,0 44,0 |

56,8 56,8 |

13,79 13,79 |

14,82 14,82 |

|

| Average industry value |  20,4 20,4 |

22,4 22,4 |

1,5 1,5 |

1,7 1,7 |

17,48 17,48 |

17,09 17,09 |

|

growth of indicator in comparison with prior period,

growth of indicator in comparison with prior period,  decline of indicator in comparison with prior period

decline of indicator in comparison with prior period

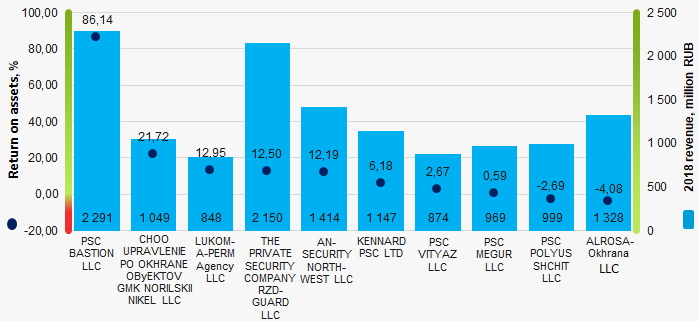

The average value of return on assets for TOP-10 companies is lower than average industry value: in 2018, six companies improved the results.

Picture 1. Return on assets and revenue of the largest Russian security companies (ТОP-10)

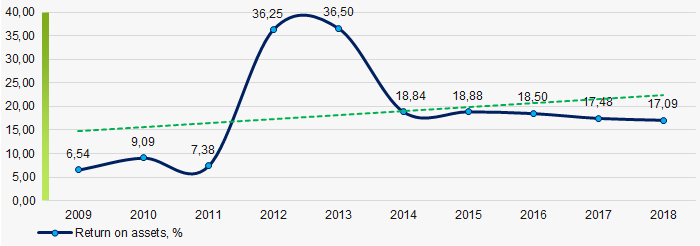

Picture 1. Return on assets and revenue of the largest Russian security companies (ТОP-10)Within 10 years, the average industry indicators of return on assets ratio showed the growing tendency. (Picture 2).

Picture 2. Change in average industry values of return on assets of Russian security companies in 2009 – 2018

Picture 2. Change in average industry values of return on assets of Russian security companies in 2009 – 2018The largest manufacturers of urban transport in Russia

Public service vehicles are strategically important for the urban infrastructure and plays an important role in people’s life. Total passenger flow in buses and trolleybuses have been reaching 11 billion people and more annually for ten years. In early 2019, the length of all-purpose roads in Russia exceeded 1,5 million kilometers, and the length of trolley lines in use were 5 thousand kilometers.

According to the Federal State Statistics Service for early 2019, there are about 116 thousand buses and 9 thousand trolleybuses in Russia. The share of foreign buses and trolleybuses and the country’s ability to manufacture own public service vehicles are the points of interest of many people. The Information Agency Credinform represents a ranking of the largest manufacturers of public service vehicles in Russia. Using the Information and Analytical system Globas, the experts of the Agency have selected enterprises engaged in buses (excluding public minibus taxis) and trolleybuses manufacturing by 2019 revenue, and analyzed the results..

| No | Name | Revenue for 2019, billion RUB | Line of production |

| 1 | Pavlovsky Bus Plant (PAZ) Nizhniy Novgorod region |

19,2 | Buses |

| 2 | Likinsky Bus Plant (LIAZ) Moscow region |

17,4 | Buses |

| 3 | Volgabas Volzhsky Volgograd region |

8,0 | Buses |

| Volgabas Volgograd region |

|||

| Bakulin Motors Group Vladimir region |

|||

| 4 | Kurgan Bus Plant Kurgan region |

2,6 | Buses |

| 5 | Trans-Alfa Vologda region |

1,6 | Trolleybuses, electric buses |

| 6 | Trolza Saratov region |

No data | Trolleybuses, electric buses |

The Top leaders are Pavlovsky (19,2 billion RUB) and Likinsky (17,4billion RUB) bus plants. Aggregate revenue of these enterprises exceeds 36 billion RUB and forms 75% of the market. 9 457 buses were manufactured in 2019.

According to the Information and Analytical system Globas, Pavlovsky, Likinsky and Kurgan plants are linked through the managing company GAZ Group, which is owned by Gorky Automobile Plant (GAZ).

The 5th and 6th in the ranking are manufacturers of trolleybuses and electric buses. The company Trans-Alfa (1,6 billion RUB) has the largest increase in 2019 revenue (+228,9% to the previous period). Electric buses in use made the enterprise’s turnover successfully increase.

Trolza was unable to recover after sever challenges. Interdistrict inspection of the Federal Tax Service in Saratov region filed to the Arbitration court an application for bankruptcy of the enterprise. The case is under consideration at the first instance.

| Rank | Country | Volume, units | Share, % | Cost, million USD |

| Export, 2019 | ||||

| 1 | Kazakhstan | 634 | 18,1 | 19,9 |

| 2 | Republic of Belarus | 555 | 15,8 | 10,8 |

| 3 | Uzbekistan | 419 | 11,9 | 7,2 |

| 4 | Mongolia | 360 | 10,3 | 3,4 |

| 5 | Vietnam | 357 | 10,2 | 7,3 |

| Total for TOP-5 | 2325 | 66,3 | 48,6 | |

| Total exports | 3506 | 100,0 | 82,1 | |

| Import, 2019 | ||||

| 1 | China | 1434 | 50,9 | 108,0 |

| 2 | Republic of Belarus | 867 | 30,8 | 63,1 |

| 3 | Turkey | 123 | 4,4 | 21,0 |

| 4 | Japan | 97 | 3,4 | 2,4 |

| 5 | Germany | 81 | 2,9 | 6,6 |

| Total for TOP-5 | 2602 | 92,4 | 201,1 | |

| Total imports | 2817 | 100,0 | 222,7 | |

Source: the Federal Tax Service, calculations by Credinform.

There are only 10% of foreign-manufactured vehicles among the Russian aboveground public transport (excluding public minibus taxis). In 2019, export of domestic-manufactures buses exceeded import. The main strategic partners of Russia are Kazakhstan (export share of 18,1%) and the Republic of Belarus (export share of 15,8%; import share of 30,8%). The share of import from the number of manufactured buses was only 20% in 2019.

The results of the ranking show that domestic-manufactured vehicles prevail in Russia, and passenger transportation is provided mainly by own facilities.

However, the situation is not that good. Age is a serious problem for the Russian service vehicles park. According to the Ministry of Transport of Russia, the average age of buses and trolleybuses is over 15 years. In some regions, passengers are transported by the Soviet-style buses that have been in use for more than 30 years.