Activity trends in holding management

Information agency Credinform has observed trends in the activity of the largest Russian holding management companies.

Enterprises with the largest volume of annual revenue (TOP-10 and TOP-1000), engaged in management of holding companies, financial industrial groups and management consultancy, were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2015-2017). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets is an indicator, reflecting the real value of company's property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest company in terms of net assets amount is AO ROSNEFTEGAZ. In 2018 net assets of the company amounted to more than 3454 billion RUB.

LLC CORPORATE MANAGEMENT COMPANY CONCERN TRACTOR PLANTS had the smallest amount of net assets in the TOP-1000 group. Insufficiency of property of the company in 2018 as expressed in negative value -109 billion RUB.

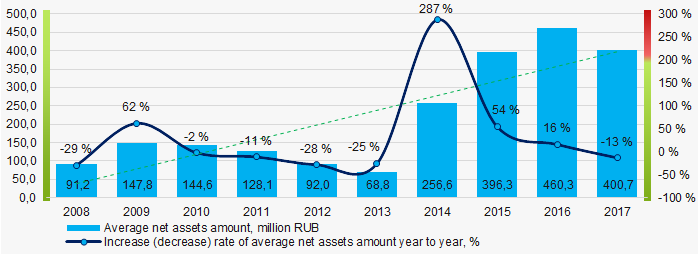

For a ten-year period average amount of net assets of TOP-1000 companies has increasing tendency (Picture 1).

Picture 1. Change in average indicators of the net asset amount of holding management companies in 2008 – 2017

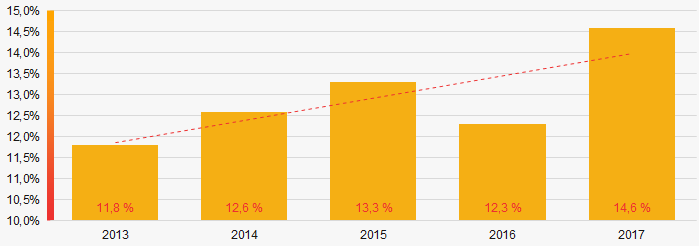

Picture 1. Change in average indicators of the net asset amount of holding management companies in 2008 – 2017Share of companies with insufficiency of property in the TOP-1000 demonstrate increasing tendency (Picture 2).

Picture 2. Shares of companies with negative values of net assets in TOP-1000 companies in в 2013 – 2017

Picture 2. Shares of companies with negative values of net assets in TOP-1000 companies in в 2013 – 2017Sales revenue

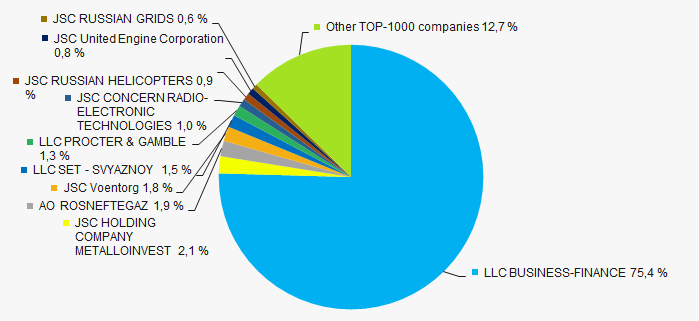

The revenue volume of 10 leaders of the industry made 87% of the total revenue of TOP-1000 companies in 2017 (Picture 3). It demonstrates high level of monopolization in the industry.

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 companies for 2017

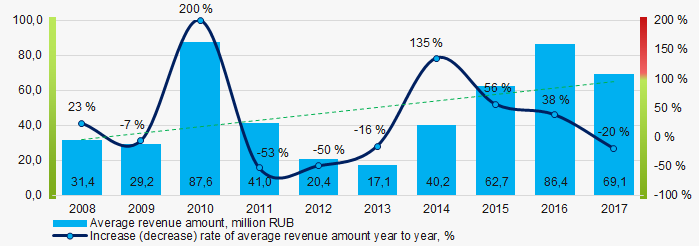

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 companies for 2017In general, over a ten-year period an increasing tendency in revenue volume is observed (Picture 4).

Picture 4. Change in the average revenue of holding management companies in 2008 – 2017

Picture 4. Change in the average revenue of holding management companies in 2008 – 2017Profit and losses

The largest company in terms of net profit amount is JSC HOLDING COMPANY METALLOINVEST. Net profit of the company amounted to almost 70 billion RUB for 2018.

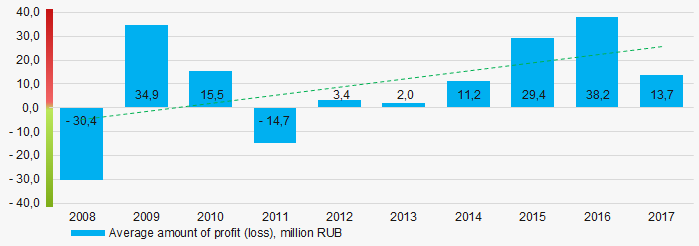

For the last ten years average industrial indicators of net profit have an increasing tendency (Picture 5).

Picture 5. Change in the average indicators of net profit of holding management companies in 2008 – 2017

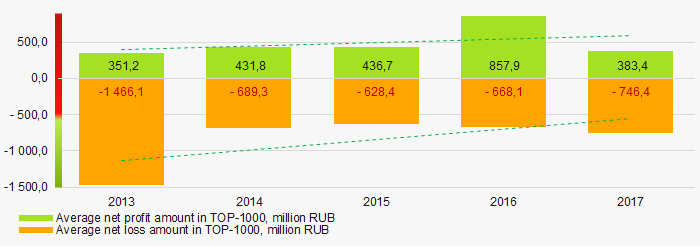

Picture 5. Change in the average indicators of net profit of holding management companies in 2008 – 2017Over a five-year period, the average values of net profit indicators of TOP-1000 companies tend to increase. Besides, the average value of net loss decreases (Picture 6).

Picture 6. Change in the average indicators of net profit and loss of TOP-1000 companies in 2015 – 2017

Picture 6. Change in the average indicators of net profit and loss of TOP-1000 companies in 2015 – 2017Key financial ratios

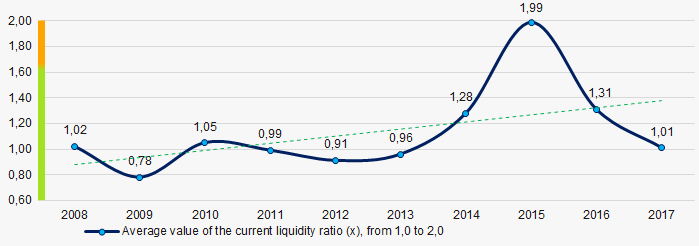

Over the ten-year period the average indicators of the current liquidity ratio in general were within the range of recommended values – from 1,0 up to 2,0 with increasing tendency (Picture 7).

The current liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 7. Change in the average values of the current liquidity ratio of holding management companies in 2008 – 2017

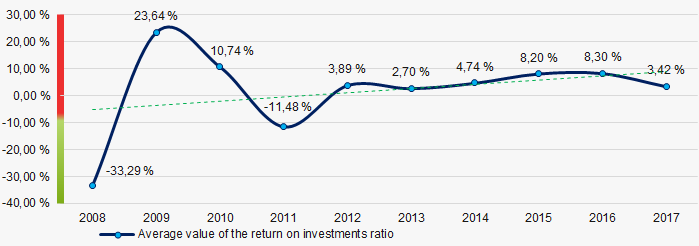

Picture 7. Change in the average values of the current liquidity ratio of holding management companies in 2008 – 2017Average values of the indicators of the return on investment ratio have increasing tendency for ten years (Picture 8).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity of own capital and the long-term borrowed funds of an organization.

Picture 8. Change in the average values of the return on investment ratio of holding management companies in 2008 – 2017

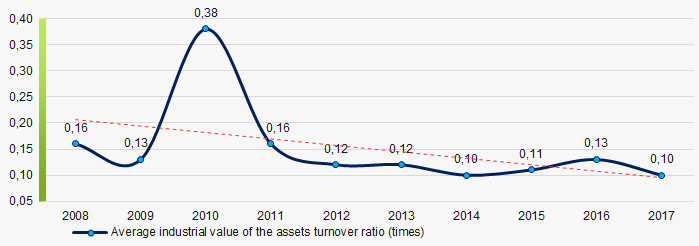

Picture 8. Change in the average values of the return on investment ratio of holding management companies in 2008 – 2017Asset turnover ratio is calculated as the relation of sales revenue to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

This business activity ratio showed a tendency to decrease for a ten-year period (Picture 9).

Picture 9. Change in the average values of the assets turnover ratio of holding management companies in 2008 – 2017

Picture 9. Change in the average values of the assets turnover ratio of holding management companies in 2008 – 2017Small business

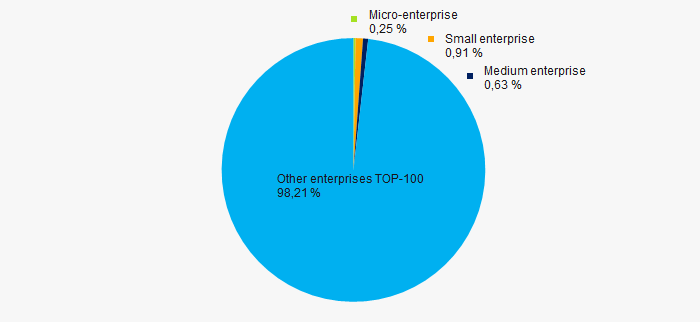

56% of the TOP-1000 companies are registered in the Register of small and medium enterprises of the Federal Tax Service of the RF. Besides, share of revenue in the total volume in 2017 is 1,8%, that is lower than the average indicator countrywide (Picture 10).

Picture 10. Shares of small and medium enterprises in TOP-1000 companies, %

Picture 10. Shares of small and medium enterprises in TOP-1000 companies, %Main regions of activity

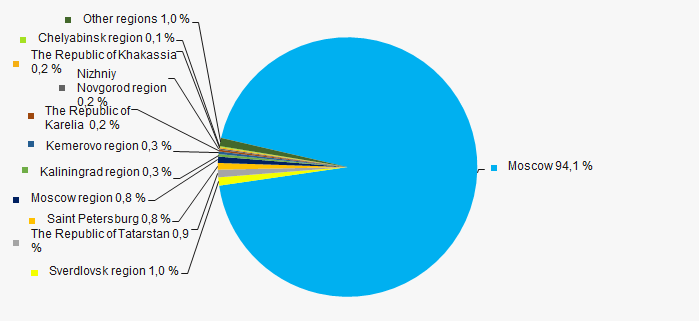

TOP-1000 enterprises are unequally distributed along the territory of Russia and registered in 67 regions. More than 94% of revenue volume is concentrated in Moscow (Picture 11).

Picture 11. Distribution of TOP-1000 companies by regions of Russia

Picture 11. Distribution of TOP-1000 companies by regions of RussiaFinancial position score

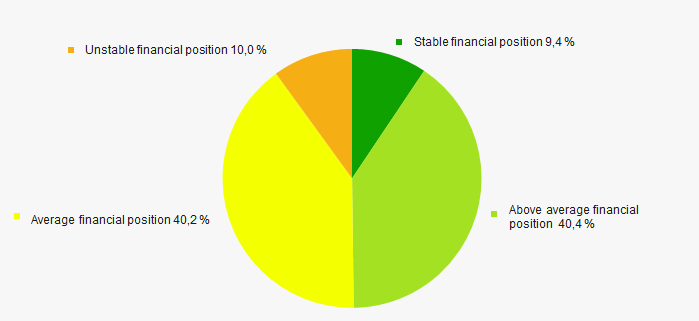

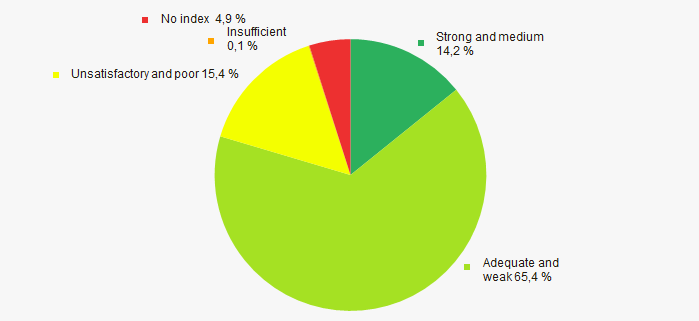

An assessment of the financial position of TOP-1000 companies shows that the largest number is in an above average financial position. (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

Most of TOP-1000 companies have got from Medium to Superior Solvency index Globas, that points to their ability to repay their debts fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index GlobasAccording to the data of the Federal State Statistics Service, share of the companies, engaged in activities of head offices and management consultancy in the volume of revenue from sale of goods, products, works and services countrywide in general amounted to 0,8% for 2018.

Conclusion

Comprehensive assessment of the activity of largest Russian holding management enterprises, taking into account the main indexes, financial indicators and ratios, demonstrates the presence of favorable trends (Table 1).

| Trends and assessment factors | Share of factor, % |

| Rate of increase (decrease) of average amount of net assets |  10 10 |

| Increase / decrease of share of companies with negative values of net assets |  -10 -10 |

| Increase (decrease) rate of average revenue amount |  10 10 |

| Level of competition |  -10 -10 |

| Increase (decrease) rate of average net profit (loss) amount |  10 10 |

| Increase / decrease of average net profit amount of TOP-1000 companies |  10 10 |

| Increase / decrease of average net loss amount of TOP-1000 companies |  10 10 |

| Increase / decrease of average industrial values of the current liquidity ratio |  10 10 |

| Increase / decrease of average industrial values of the return on investments ratio |  10 10 |

| Increase / decrease of average industrial values of the assets turnover ratio, times |  -10 -10 |

| Share of small and medium enterprises in the industry in terms of revenue volume more than 22% |  -10 -10 |

| Regional concentration |  -10 -10 |

| Financial position (major share) |  10 10 |

| Solvency index Globas (major share) |  10 10 |

| Average value of factors |  2,9 2,9 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).

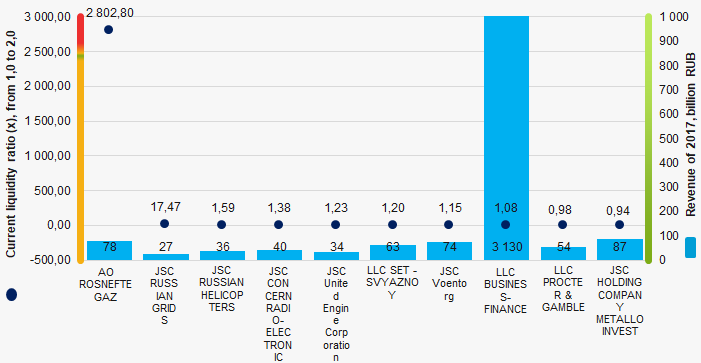

Current liquidity ratio of managing companies

Information agency Credinform presents ranking of the largest Russian holding management companies. Enterprises with the largest volume of annual revenue (TOP-10), engaged in management of holding companies, financial industrial groups and management consultancy, were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2015-2017). Then they were ranked by decrease in current liquidity ratio (Table 1). The analysis was made on the basis of the data of the Information and Analytical system Globas.

The current liquidity ratio(х) is calculated as the relation of the sum of working assets to short-term liabilities.

Recommenmded value is from 1,0 to 2,0. Value of the indicator less than 1,0 demonstrates that short-term liabilities exceed current working assets. Therefore, lower limit of the interval reveals need to provide sufficiency of working assets for complete payment of short-term liabilities. Otherwise, it may cause bankruptcy of an enterprise. However, significant increase of short-term assets over liabilities can demonstrate impairment of capital structure and irrational investments of funds.

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in sectors, has developed and implemented in the Information and Analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. For holding management companies practical value of the current liquidity ratio amounted from 0,71 to 5,17 in 2017.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of indicators and financial ratios.

| Name, INN, region | Revenue, billion RUB | Net profit (loss), billion RUB | Current liquidity rsatio (x), from 1,0 to 2,0 | Solvency index Globas | ||||||

| 2016 | 2017 | 2018* | 2016 | 2017 | 2018* | 2016 | 2017 | 2018* | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| AO ROSNEFTEGAZ INN 7705630445 Moscow |

800,39 800,39 |

78,23 78,23 |

142,94 142,94 |

-90,44 -90,44 |

33,85 33,85 |

177,95 177,95 |

1,90 1,90 |

2802,80 2802,80 |

269,24 269,24 |

175 High |

| JSC RUSSIAN GRIDS INN 7728662669 Moscow |

26,66 26,66 |

26,51 26,51 |

27,19 27,19 |

222,44 222,44 |

-13,24 -13,24 |

-11,55 -11,55 |

9,17 9,17 |

17,47 17,47 |

36,22 36,22 |

226 Strong |

| JSC RUSSIAN HELICOPTERS INN 7731559044 Moscow |

45,20 45,20 |

36,26 36,26 |

35,53 35,53 |

15,46 15,46 |

15,71 15,71 |

19,97 19,97 |

1,36 1,36 |

1,59 1,59 |

1,65 1,65 |

148 Superior |

| JSC CONCERN RADIO-ELECTRONIC TECHNOLOGIES INN 7703695246 Moscow |

24,98 24,98 |

39,83 39,83 |

28,71 28,71 |

1,17 1,17 |

4,38 4,38 |

7,96 7,96 |

1,50 1,50 |

1,38 1,38 |

1,79 1,79 |

151 Superior |

| JSC United Engine Corporation INN 7731644035 Moscow |

32,28 32,28 |

34,44 34,44 |

42,18 42,18 |

0,64 0,64 |

1,74 1,74 |

7,74 7,74 |

1,25 1,25 |

1,23 1,23 |

1,15 1,15 |

158 Superior |

| LLC SET - SVYAZNOY INN 7714617793 Moscow |

59,17 59,17 |

63,32 63,32 |

48,32 48,32 |

-4,26 -4,26 |

-0,89 -0,89 |

-2,68 -2,68 |

1,35 1,35 |

1,20 1,20 |

0,84 0,84 |

299 Medium |

| JSC Voentorg INN 7704726183 Moscow |

66,35 66,35 |

73,90 73,90 |

72,06 72,06 |

0,03 0,03 |

0,04 0,04 |

0,05 0,05 |

1,16 1,16 |

1,15 1,15 |

1,23 1,23 |

210 Strong |

| LLC BUSINESS-FINANCE INN 7707572492 Moscow |

2158,73 2158,73 |

3129,78 3129,78 |

0,00 0,00 |

0,14 0,14 |

0,57 0,57 |

0,45 0,45 |

1,09 1,09 |

1,08 1,08 |

1,48 1,48 |

269 Medium |

| LLC PROCTER & GAMBLE INN 7701032910 Moscow |

52,38 52,38 |

53,73 53,73 |

2,37 2,37 |

0,32 0,32 |

7,99 7,99 |

1,23 1,23 |

0,63 0,63 |

0,98 0,98 |

6,59 6,59 |

196 High |

| JSC HOLDING COMPANY METALLOINVEST INN 7705392230 Moscow |

221,47 221,47 |

86,66 86,66 |

69,98 69,98 |

207,65 207,65 |

76,93 76,93 |

45,52 45,52 |

10,16 10,16 |

0,94 0,94 |

0,44 0,44 |

271 Medium |

| Total for TOP-10 companies |  3487,61 3487,61 |

3622,65 3622,65 |

469,28 469,28 |

353,14 353,14 |

127,08 127,08 |

246,65 246,65 |

||||

| Average value for TOP-10 companies |  348,76 348,76 |

362,26 362,26 |

46,93 46,93 |

35,31 35,31 |

12,71 12,71 |

24,66 24,66 |

2,96 2,96 |

282,98 282,98 |

32,06 | |

| Average industrial value |  0,09 0,09 |

0,07 0,07 |

0,04 0,04 |

0,01 0,01 |

1,31 1,31 |

1,01 1,01 |

||||

*) data for 2018 are given for reference

growth decrease of indicator to the previous period,

growth decrease of indicator to the previous period,  decrease of indicator to the previous period

decrease of indicator to the previous period

Average value of the current liquidity ratio of the TOP-10 group is significantly higher than the average industrial, recommended and practical values of 2017. Five companies have shown results within the interval of the recommended value in 2018.

Picture 1. Current liquidity ratio and revenue of the largest Russian holding management companies (TOP-10)

Picture 1. Current liquidity ratio and revenue of the largest Russian holding management companies (TOP-10)Over a ten-year period average industrial values of the current liquidity ratio were, in general, within the interval of recommended values with increasing tendency. (Picture 2).

Picture 2. Change in the average industrial values of the current liquidity ratio of Russian holding management companies in 2008 – 2017

Picture 2. Change in the average industrial values of the current liquidity ratio of Russian holding management companies in 2008 – 2017