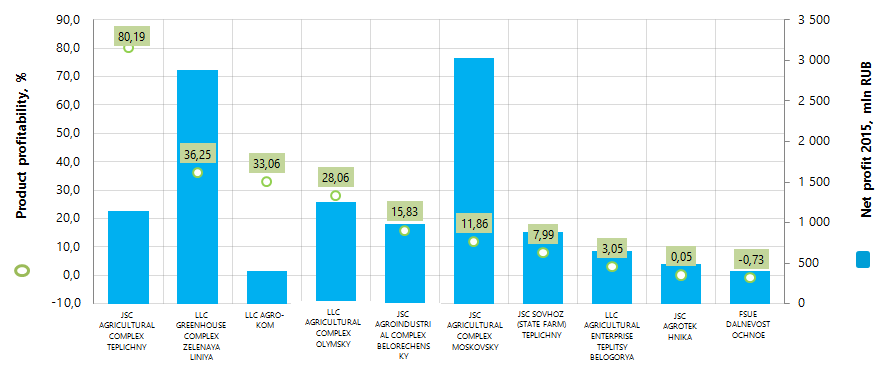

Product profitability of vegetable production enterprises

Information agency Credinform presents a ranking of the largest Russian vegetable production enterprises in terms of product profitability ratio.

The companies with the highest volume of revenue (TOP-10) were selected for this ranking according to the data from the Statistical Register for the latest available period (2015). These enterprises were ranked by decrease in product profitability ratio. (Table 1).

Product profitability is calculated as the ratio of sales profit to expenses from ordinary activities. In general, profitability reflects the economic efficiency of production. Product profitability analysis allows us to make a conclusion whether output of one or another product is reasonable. There are no prescribed values for indicators of this group, because they vary strongly depending on the industry.

For the most full and fair opinion about the company’s financial position, not only product profitability rate should be taken into account, but also the whole set of financial indicators and ratios.

| Name, INN, region | Net profit 2015, mln RUB | Revenue of 2015, mln RUB | Revenue of 2015 to 2014, %% | Product profitability of 2014, % | Product profitability of 2015, % | Solvency index Globas-i |

|---|---|---|---|---|---|---|

| JSC AGRICULTURAL COMPLEX TEPLICHNY ИНН 2312036895 Krasnodar territory |

502,4 | 1 140,0 | 119 | 62,09 | 80,19 | 233 High |

| LLC GREENHOUSE COMPLEX ZELENAYA LINIYA INN 7826084060 Krasnodar territory |

836,7 | 2 877,3 | 244 | 17,90 | 36,25 | 223 High |

| LLC AGRO-KOM INN 0701002574 The Kabardino-Balkar Republic |

71,1 | 404,6 | 94 | 62,36 | 33,06 | 281 High |

| LLC AGRICULTURAL COMPLEX OLYMSKY INN 4608005786 Kursk region |

281,6 | 1 250,0 | 129 | 61,67 | 28,06 | 212 High |

| JSC AGROINDUSTRIAL COMPLEX BELORECHENSKY INN 6639009424 Sverdlovsk region |

134,0 | 977,8 | 100 | 12,95 | 15,83 | 202 High |

| JSC AGRICULTURAL COMPLEX MOSKOVSKY INN 5003003432 Moscow |

159,4 | 3 026,7 | 96 | 19,23 | 11,86 | 246 High |

| JSC SOVHOZ (STATE FARM) TEPLICHNY INN 6501254511 Sakhalin region |

122,5 | 887,7 | 122 | 6,11 | 7,99 | 220 High |

| LLC AGRICULTURAL ENTERPRISE TEPLITSY BELOGORYA INN 3123227670 Belgorod region |

380,6 | 645,8 | 178 | -17,13 | 3,05 | 320 Satisfactory |

| JSC AGROTEKHNIKA INN 4716002207 Leningrad region |

-50,5 | 486,9 | 79 | 10,10 | 0,05 | 550 Unsatisfactory |

| FSUE DALNEVOSTOCHNOE INN 2502003633 Primorie territory |

2,4 | 407,6 | 113 | -5,16 | -0,73 | 245 High |

JSC AGRICULTURAL COMPLEX TEPLICHNY has shown the highest product profitability ratio 80,19%. Enterprise with the largest revenue for 2015 - JSC AGRICULTURAL COMPLEX MOSKOVSKY takes sixth place of the ranking. Its share in total revenue volume of TOP-10 companies is 25%. This enterprise turned out to be among three companies of the TOP-10 list, showing decrease in profit and revenue of 2015 compared to the previous year. FSUE DALNEVOSTOCHNOE has got negative values of product profitability both in 2014 and in 2015.

Summarizing the financial and other indicators, eight out of TOP-10 companies have got high solvency index Globas-i. This demonstrates their ability to pay off the debts in time and to the full extent.

LLC AGRICULTURAL ENTERPRISE TEPLITSY BELOGORYA has got satisfactory solvency index Globas-i due to the information about company being a defendant in debt collection arbitration proceedings.

JSC AGROTEKHNIKA has got unsatisfactory solvency index Globas-i due to the information about bankruptcy claim as well as being a defendant in debt collection arbitration proceedings.

The average product profitability value among TOP-10 companies in 2015 is 21,56%, compared to 23,01% in 2014 . Four enterprises shown decrease in product profitability value.

Total revenue volume of TOP-10 companies in 2015 is 12,1 bln RUB, that is 24% higher than in 2014. Total net profit of this group for the same period increased more than 86%.

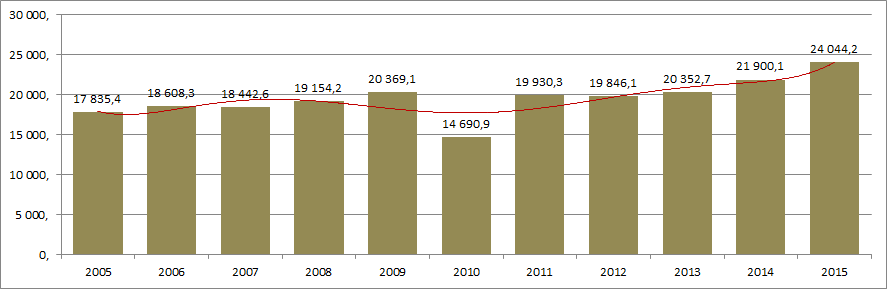

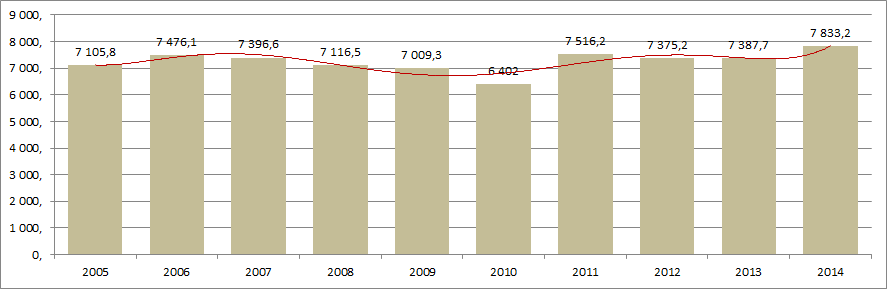

In general, enterprises operate profitably. The industry demonstrates positive dynamics in vegetables production, that is proved by the data of the Federal State Statistics Service (Rosstat)(Picture 2,3).

Vegetables producing companies are located in regions with the best environment for agricultural production and also attracted to the largest distribution areas – Moscow and Saint-Petersburg. According to the data of the Information and analytical system Globas-i, 100 largest companies in terms of revenue volume for 2014 are registered in 44 regions. Most of them are registered in the following regions (TOP-6 regions):

| Region | Number of companies |

|---|---|

| Moscow region | 10 |

| Bryansk region | 7 |

| Samara region | 6 |

| The Republic of Bashkortostan | 5 |

| Leningrad region | 4 |

| Stavropol territory | 4 |

Tax and customs benefits will be revised

It is known that taxes are the integrated part of income of treasuries at all levels. In 2015 taxes and insurance payments in Russia amounted to 79% of the income at all levels. According to 2015 results in the State consolidated budget among taxes the largest share has the personal income tax (PIT) – 41%. The second place takes the income tax - 31% and the third - the property tax with 15%. The shares of other taxes are included in table 1.

| PIT | Income tax | Property tax | Excises | Transport tax | UTII | MET | Others | |

|---|---|---|---|---|---|---|---|---|

| Absolute value, bln RUB | 2 806 | 2107 | 1068 | 486 | 140 | 78 | 67 | 153 |

| Share, % | 41 | 31 | 15 | 7 | 2 | 1 | 1 | 2 |

UTII - unified tax on imputed income for certain activities

MET– mineral extraction tax

Types of taxes, taxpayers, objects of taxation, tax base, tax rates and tax benefits are determined by the Tax code of the Russian Federation, the Budget code of the Russian Federation and in accordance with the laws of constituent entities of the Russian Federation on taxes and other legislative acts. The Federal taxes and charges include value-added tax (VAT), excises, PIT, income tax, MET, water tax and others. The Regional taxes include corporate property tax, gambling tax, transport tax. The local taxes and charges include land value tax, individual property tax and sales tax.

At the present time the summarized tax burden of business entity looks as follows:

- the income tax rate is 20%, among them 2% go to the Federal budget, 18% to the budgets of constituent entities of the Russian Federation; the tax rate for enterprises with the simplified tax system (STS) is 6% of the income (gross profit), or 15% of profit before taxation;

- insurance contributions reach 30%, among them: 22% of wage fund go to the Pension Fund of the Russian Federation, Federal Compulsory Medical Insurance Fund - 5,1% and Social Insurance Fund - 2,9%; the rate of insurance payment for enterprises with the STS is 20%;

- PIT is transferred to the State by the employer according to the accrued salary in the amount of 13%;

- VAT – 18%, for a number of products it decreases;

- Property taxes cannot exceed 2.2%.

At the present time the regions have the right to decrease the income tax rate to 10%. However the benefit applies only to those companies, which will invest from 50 to 500 mln RUB in the development of the region. The decrease in the rate is connected with the necessity to attract the investors to the regional projects and local industries, thereby to increase the activeness of financial investment – one of the most important figures in macroeconomics. According to the assessments of the Ministry of economic development of the Russian Federation, decline in investment in Russian economy may amount to 2,7-3,1%, that definitely is an alarming factor.

The work of the Ministry of Finance in association with the Ministry of economic development, the Federal Tax Service, the Federal Customs Service of the Russian Federation on revision of tax and customs benefits was resumed. The governmental authorities are going to reassess the benefits from the point of loss of revenue from the budget. This is related to preparation of a budget for 2017-2019, which, as expected, will be tight. The reform should be completed in the second half of next year. As a result, the final list of tax and customs benefits will be formed. They will be distributed to state programs or included in non-program budget expenditures.