Activity trends of Nizhniy Novgorod companies

Information agency Credinform has observed trends in the activity of the largest real economy companies of Nizhniy Novgorod region. Enterprises with the largest volume of annual revenue (TOP-10 and TOP-1000), were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2012-2017). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets -indicator, reflecting the real value of company's property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

| № in TOP-1000 | Name, INN, main type of activity | Net assets value, bln RUB | Solvency index Globas | ||||

| 2013 | 2014 | 2015 | 2016 | 2017 | |||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 1 | AO TRANSNEFT-VERKHNYAYA VOLGA INN 5260900725 Oil transportation by pipeline |

100.06 100.06 |

107.53 107.53 |

113.74 113.74 |

123.66 123.66 |

132.03 132.03 |

180 High |

| 2 | JSC VYKSA STEEL WORKS INN 5247004695 Manufacture of steel pipes, hollow profiles and fittings |

68.23 68.23 |

54.82 54.82 |

54.51 54.51 |

74.50 74.50 |

95.19 95.19 |

174 Superior |

| 3 | LLC LUKOIL-NIZHEGORODNEFTEORGSINTEZ INN 5250043567 Manufacture of oil products |

89.31 89.31 |

110.26 110.26 |

96.66 96.66 |

66.95 66.95 |

70.76 70.76 |

195 High |

| 4 | JSC IDGC of Centre and Volga Region INN 5260200603 Power transmission and technological connection to distribution systems |

48.95 48.95 |

49.79 49.79 |

50.33 50.33 |

52.48 52.48 |

62.15 62.15 |

162 Superior |

| 5 | LLC RUSVINYL INN 5262218620 Manufacture of basic chemicals, fertilizers and nitrogen compounds, plastics and synthetic rubber in primary forms |

33.11 33.11 |

32.36 32.36 |

23.99 23.99 |

27.71 27.71 |

25.30 25.30 |

272 Medium |

| 996 | LLC A.S.& PALITRA INN 5012049730 Manufacture of wallpapers |

-0.14 -0.14 |

-1.06 -1.06 |

-1.43 -1.43 |

-0.86 -0.86 |

-1.19 -1.19 |

337 Adequate |

| 997 | HYGIENE TECHNOLOGIES LTD INN 5261058974 Manufacture of paper products of utility and sanitary-hygienic purpose |

-0.12 -0.12 |

-0.75 -0.75 |

-1.35 -1.35 |

-0.87 -0.87 |

-1.14 -1.14 |

277 Medium |

| 998 | LLC GAZ GROUP INN 7730522644 Market situation survey and public opinion research |

-0.10 -0.10 |

-0.32 -0.32 |

-0.59 -0.59 |

-0.98 -0.98 |

-1.09 -1.09 |

285 Medium |

| 999 | LLC KSTOVO INDUSTRIAL PARK 1 INN 5260200272 Site preparation |

-1.00 -1.00 |

-2.03 -2.03 |

-2.53 -2.53 |

-2.11 -2.11 |

-1.90 -1.90 |

283 Medium |

| 1000 | JSC NIZHEGORODSKY MACHINE BUILDING PLANT INN 5259008768 Manufacture of weapons and ammunition |

-1.33 -1.33 |

-1.27 -1.27 |

-2.59 -2.59 |

-2.28 -2.28 |

-2.26 -2.26 |

232 Strong |

— growth of the indicator to the previous period,

— growth of the indicator to the previous period,  — decline of the indicator to the previous period.

— decline of the indicator to the previous period.

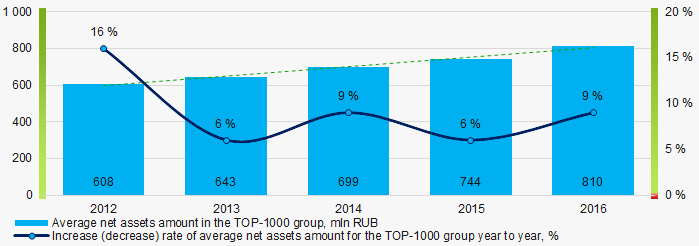

For a five-year period average amount of net assets of TOP-1000 companies have increasing tendency (Picture 1).

Picture 1. Change in TOP-1000 average indicators of the net asset amount in 2012 – 2016

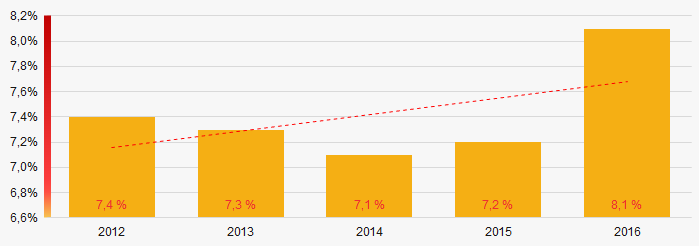

Picture 1. Change in TOP-1000 average indicators of the net asset amount in 2012 – 2016 Besides, share of companies with insufficiency of property in the TOP-1000 has grown for the last five years (Picture 2).

Picture 2. Shares of companies with negative values of net assets in TOP-1000 companies

Picture 2. Shares of companies with negative values of net assets in TOP-1000 companiesSales revenue

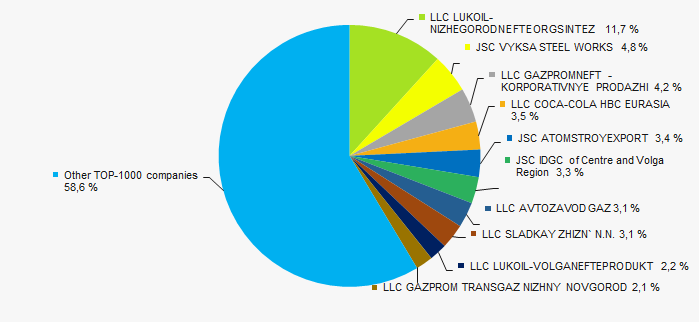

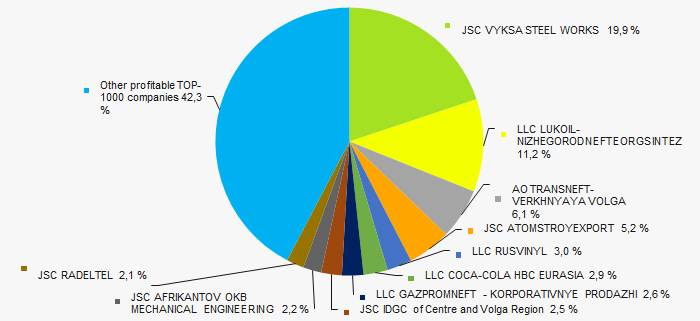

The revenue of 10 leaders of the industry made 41% of the total revenue of TOP-1000 companies in 2016(Picture 3). It demonstrates concentration of large companies in Nizhniy Novgorod region

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 companies for 2016

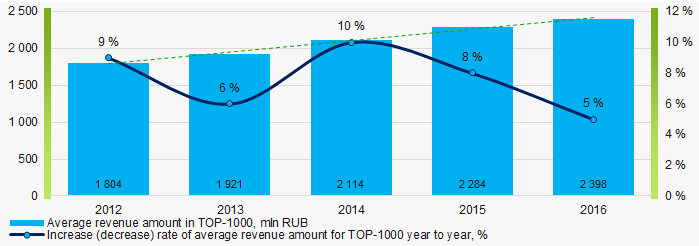

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 companies for 2016In general, an increasing tendency in volume revenue is observed (Picture 4).

Picture 4. Change in the average revenue of TOP-1000 companies in 2012 – 2016

Picture 4. Change in the average revenue of TOP-1000 companies in 2012 – 2016Profit and losses

The profit volume of 10 leading enterprises in 2016 made 58% of the total profit of TOP-1000 companies (Picture 5).

Picture 5. Share of participation of TOP-10 companies in the total volume of profit of TOP-1000 companies for 2016

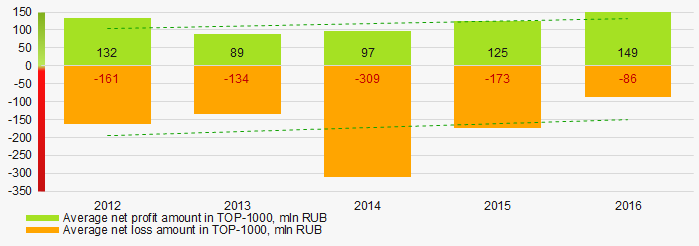

Picture 5. Share of participation of TOP-10 companies in the total volume of profit of TOP-1000 companies for 2016Over a five-year period, the average values of net profit indicators of TOP-1000 companies tend to increase. Besides, the average value of net loss decreases (Picture 6).

Picture 6. Change in the average indicators of profit and loss of TOP-1000 companies in 2012 – 2016

Picture 6. Change in the average indicators of profit and loss of TOP-1000 companies in 2012 – 2016Key financial ratios

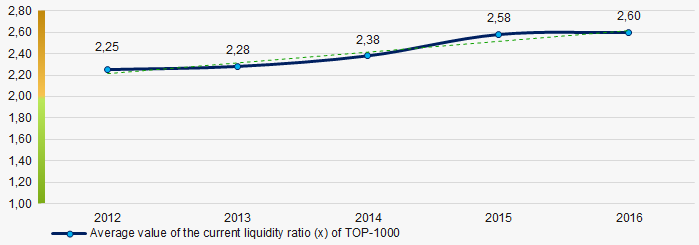

Over the five-year period the average indicators of the current liquidity ratio of TOP-1000 were above the range of recommended values – from 1,0 up to 2,0 with increasing tendency (Picture 7).

The current liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 7. Change in the average values of the current liquidity ratio of TOP-1000 companies in 2012 – 2016

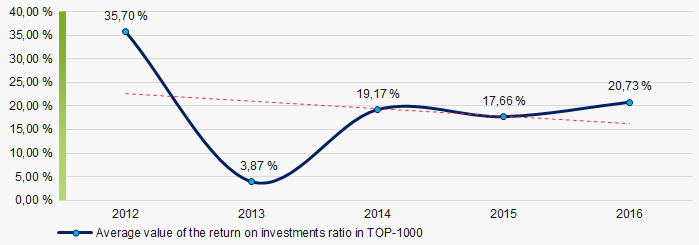

Picture 7. Change in the average values of the current liquidity ratio of TOP-1000 companies in 2012 – 2016Decreasing tendency in the indicators of the return on investment ratio has been observed for five years (Picture 8).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity of own capital and the long-term borrowed funds of an organization.

Picture 8. Change in the average values of the return on investment ratio of TOP-1000 companies in 2012 – 2016

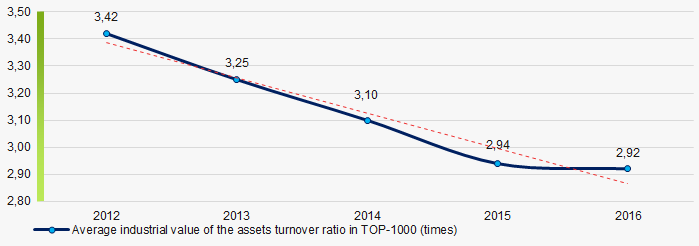

Picture 8. Change in the average values of the return on investment ratio of TOP-1000 companies in 2012 – 2016Asset turnover ratio is calculated as the relation of sales revenue to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

This business activity ratio showed a tendency to decrease for a five-year period (Picture 9).

Picture 9. Change in the average values of the assets turnover ratio of TOP-1000 companies in 2012 – 2016

Picture 9. Change in the average values of the assets turnover ratio of TOP-1000 companies in 2012 – 2016Production structure

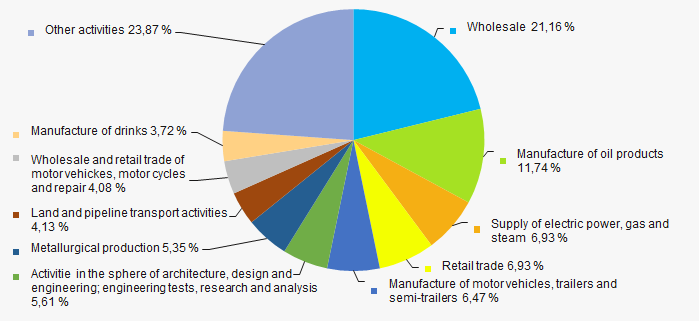

The largest share in the total revenue of TOP-1000 is owned by companies, specializing in wholesale and manufacture of oil products (Picture 10).

Picture 10. Distribution of companies by types of output in the total revenue of TOP-1000, %

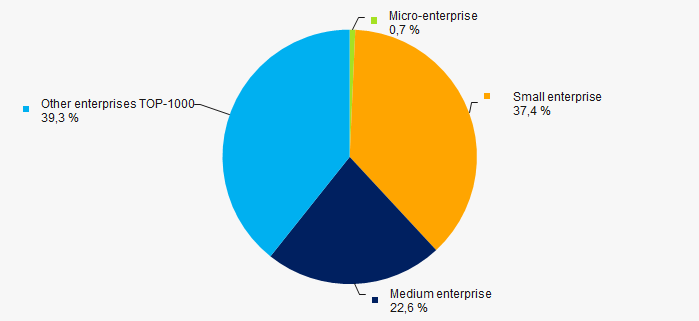

Picture 10. Distribution of companies by types of output in the total revenue of TOP-1000, %61% of TOP-1000 companies are registered in the Register of small and medium enterprises of the Federal Tax Service of the RF (Picture 11).

Picture 11. Shares of small and medium enterprises in TOP-1000 companies, %

Picture 11. Shares of small and medium enterprises in TOP-1000 companies, %Financial position score

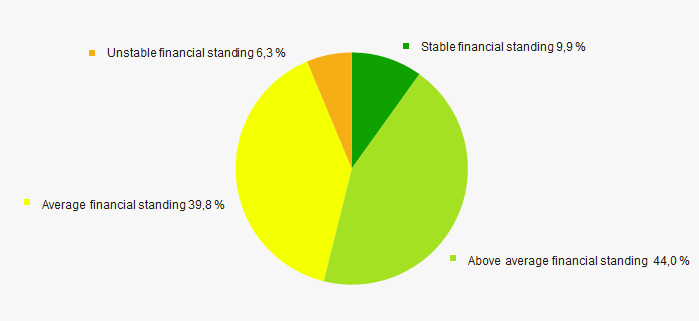

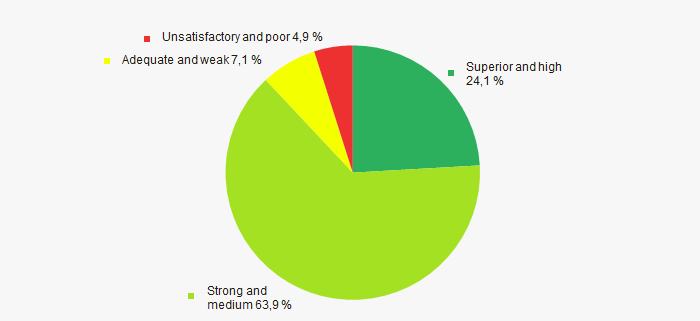

An assessment of the financial position of TOP-1000 companies shows that the largest number is in a stable financial position and above the average. (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

Most of TOP-1000 companies have got from Medium to Superior Solvency index Globas, that points to their ability to repay their debts in time and fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index Globas Conclusion

Comprehensive assessment of the activity of largest companies of real sector of economy of Nizhniy Novgorod region, taking into account the main indexes, financial indicators and ratios, demonstrates the presence of favorable trends. However, among negative factors are increase of share of companies with insufficiency of property, decreasing indicators of return on investment and return on assets ratios.

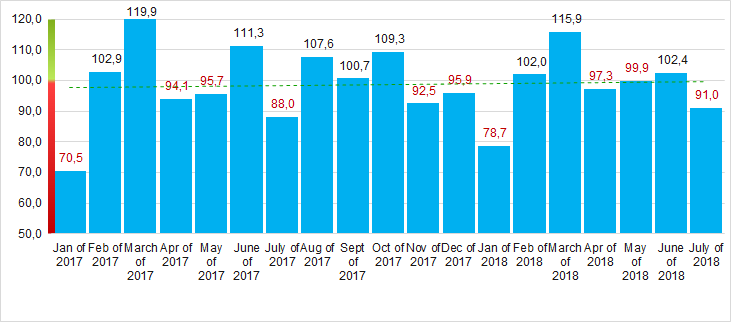

According to the data from the Federal State Statistics Service, tendency for slight increase of the Industrial production index is observed in Nizhniy Novgorod region in 2017 – 2018 (Picture 14). In 2017 industrial production has 1% decreased at average, and for 7 months of 2018 – decrease amounted to 1,8%. In general, for the period of 2017 – 2018 industrial production has 1,3% decreased.

Picture 14. Industrial production index in Nizhniy Novgorod region in 2017 – 2018, month to month (%)

Picture 14. Industrial production index in Nizhniy Novgorod region in 2017 – 2018, month to month (%)Investment as a barometer of business climate

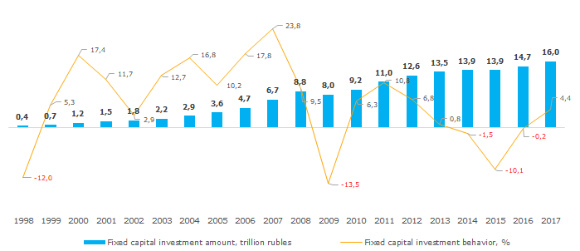

After a 3-year decline, investment in fixed capital have been growing in Russia. Positive trend of 6 months of 2018 amounted to 3,2%.

The Ministry of Economic Development of the Russian Federation expects a 3,5% growth at year-end 2018.

In 2016 investment in Russia decreased by 0,2%, in 2015 – by 10,1%, in 2014 – by 1,5%.

Investment activity started to recover in 2017, with a growth of 4,4%. Total investment in fixed capital of Russian companies amounted to 16 trillion rubles in 2017.

Investment in fixed capital is the key driving force for a company that has an impact on production growth and economic soundness. On a national scale, condition of investment activity influences economic and social development rate, technical level of production and its efficiency, competitive performance at global markets, and – as a result – living standards of the population.

In Russia, projects related to infrastructure have the greatest shortage of investment. This investment has a long payback period and an unattractive profitability, therefore the state is forced to participate in such projects using support of large investment state funds.

Relying on a review of the last 20 years, there were three waves of investment crisis in Russia - 1998, 2009 and 2014-2016. The last one is featured not only by a decrease in investment, but also by a long duration (s. picture 1). Downturn in energy prices coupled with sanction pressure affected the companies’ plans to modernize assets and buy new ones.

Investment growth started in 2017 is still unstable and subject to influence of external economic context.

Picture 1. Fixed capital investment amount and behavior in comparable prices

Picture 1. Fixed capital investment amount and behavior in comparable pricesHowever, Russia earns not only an oil and gas; new production facilities are opening up in the country both in traditional industries and in new segments, for example, production of superconductors or assembling of domestic industrial gas turbines (s. table 1).

Table 1. Domestic investment in new production units launched in Russia in 2017 – 6 months of 2018

| № | Region of production | Company | Investment amount, billion rubles | Project description |

| 1 | Belgorod region | JSC LEBEDINSKIY MINING AND PROCESSING PLANT (JSC METALLOINVEST Holding) | 35,0 | Launch of Hot Briquetted Iron (HBI-3) production unit – the largest Russian and one of the most efficient in the world for production of HBI; design capacity is 1,800 thousand briquettes annually |

| 2 | Yaroslavl region | JSC UEC SATURN (RISTECH Corporation) | 6,7 | Launch of the first Russian assembly and testing complex for gas turbine power units for marine programs |

| 3 | Belgorod region | KRASNAYA GVARDIYA LLC | 5,2 | Production of ceramic bricks by soft-mud process. Design capacity — 60 million bricks annually |

| 4 | Voronezh region | JSC Liski-Fitting | 4,5 | Production of high-resistance longitudinally welded large diameter pipes |

| 5 | Novosibirsk region | VPK-OIL LLC | 4,5 | Production of bitumen. Capacity: 80 thousand annually |

| 6 | Saint Petersburg | JSC PHARMASYNTHEZ-NORD | 2,5 | Oncology drug manufacturing |

| 7 | Moscow region | PETKORM LLC | 1,8 | Production of animal feedstuff |

| 8 | Vladimir region | GUSAR LLC | 1,7 | Foundry operation. Capacity of 8 thousand tons of steel annually |

| 9 | Moscow | 1,7 | The first Russian production unit of current-limiting devices based on high-temperature superconductors | |

| 10 | Ivanovo region | 1,7 | Garment manufacture. Capacity of 200 pcs. per month |

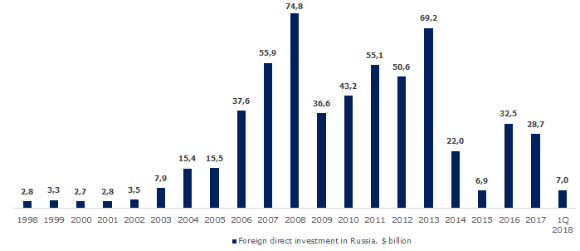

There are also no stable trends in foreign direct investment (FDI) behavior: after a dramatic drop in investment in the Russian business against the backdrop of sanctions and oil price downturn, investment growth started in 2016, but in 2017 introduction of liquidity has slowed down again (s. picture 2). In general, accumulated FDI amounts to $583,4 billion since 1994 by now. This figure is absolutely incommensurable with the scale of the Russian Federation, with its role in foreign policy. For reference: about 380 bln USD of foreign investment annually comes to the United States, about 160 bln USD to Hong Kong, 130 bln USD to China. This situation comes out of favorable conditions for investment growth and developed protection of investors' interests in these countries.

FDI has a significant influence on any country’s economic development, and Russia is no exception. Receipt of FDI promotes innovation projects, growth in product production and revenue, federal budget replenishment and economic growth acceleration.

During 1Q 2018 FDI increased by 33,4% compared to similar period of 2017. However, the result seems less optimistic, if the investment of several countries that are traditionally considered offshore ones is excluded. Investors registered in Bahamas, Bermuda Islands, British Virgin Islands, and Cyprus, which is not an official offshore area, contribute jointly almost three-quarters of investment in Russian companies.

A significant part of foreign investment in Russia from offshore areas is money of Russian origin, capital of Russian beneficiaries, transited through offshore jurisdictions.

Picture 2. Foreign direct investment behavior in Russia

Picture 2. Foreign direct investment behavior in RussiaMany multinational corporations operate in Russia, despite investment environment problems, risks and threats of new sanctions from the USA. Efficient companies are not inclined to give up a large market (s. table 2).

The interests of present-days’ investors are multidirectional – this is production of automobile tires, and construction of the country's first industrial wind farm.

It merits mention the projects using innovative technologies. For example the opening of the Italian network of fueling and renting electric vehicles Enel in October 2017. The pilot project will be launched in Moscow with further integration into the regions.

Table 2. Foreign investment in new production units launched in Russia in 2017 – 6 months of 2018

| № | Region of production | Company | Investment amount, billion rubles | Project description | Parent company |

| 1 | Ulyanovsk region | BRIDGESTONE TIRE MANUFACTURING C.I.S. | 12,5 | Manufacture of car tires | Bridgestone, Japan |

| 2 | Voronezh region | DONSKOY BACON LLC | 7,5 | Pig breeding units | Tönnies Holding, Germany |

| 3 | Moscow region | TH-RUS MILK FOOD LLC | 5,5 | Dairy farming unit | TH True Milk, Vietnam |

| 4 | Ulyanovsk region | WIND PARKS FRV LLC | 5,0 | The first Russian 35 MW wind park | Fortum Corporation, Finland |

| 5 | Saint Petersburg | TOYOTA MOTOR LLC | 3,9 | Modernization of new generation Toyota Camry production line | Toyota Motor Corporation, Japan |

| 6 | Vladimir region | JSC QUARZWERKE RYAZAN | 2,1 | Extraction and processing of high-quality silica sand | Quarzwerke GmbH, Germany |

| 7 | Krasnodar territory | PEPSICO HOLDINGS LLC | 2,0 | Baby food production plant | PepsiCo, Inc., USA |

| 8 | Leningrad region | JOTUN PAINTS LLC | 2,0 | Production of paints and powder coverings | Jotun, Norway |

| 9 | Lipetsk region | PPG Industries Lipetsk LLC | 2,0 | Production of paints and varnishes | PPG Industries, USA |

| 10 | Lipetsk region | Viessmann Lipetsk LLC | 1,5 | Industrial water boilers production plant | Viessmann Werke GmbH, Germany |

Russia remains to be a country with one of the most underestimated markets. Low investment activity of Russian companies impedes economic capacity. Moreover, external restrictions lead to artificial obstacles for foreign investors.

In the message to the Federal Assembly in March, President Vladimir Putin instructed to accelerate the growth rate of investment and increase it to 25% in GDP. In July 2018, the Government Decision approved the draft plan of the Ministry of Economic Development of Russia, suggesting an improvement of the investment climate through comprehensive development of infrastructure and competitive environment, increasing the efficiency of companies with state participation, and lowering the level of interest rates in the economy.