Federal tax service will manage insurance fees to the state non-budgetary funds

Since January 1, 2017 the Federal tax service (FTS) will proceed with managing of insurance fees to the Pension fund of the Russian Federation (PFR), Social Insurance Fund of the Russian Federation and Federal Compulsory Medical Insurance Fund (FCMIF). This is fixed by two Federal laws as of 03.07.2016 №243-FL and 03.07.2016 №250-FL.

The new order provides:

- registration as insuring party for mandatory pension insurance in the Pension fund only for the purpose of filing the personified reports. FTS will give all registration data of companies and their separate subdivisions, individual entrepreneurs and other taxpayers;

- continuation of registration of companies and entrepreneurs as insuring parties for compulsory health insurance in FCMIF as from registration in FTS. Procedure of registration is unchanged;

- keeping the insuring parties registration in the Social insurance fund based on the data from tax authorities. Separate subdivision and individual entrepreneurs entered with natural person into civil or labor contract with a condition of fees payment are registered in the Social Insurance Fund through filing of the relevant application.

In case of registration as of January 1, 2017 companies and individual entrepreneurs are not obliged to file any additional applications.

The procedure of reporting was also amended.

Annually up to March 1 (since 2018) it is required to provide the Pension fund authorities with data for personified record keeping of all natural persons entered into civil or labor contract. These data have to include the following: insurance individual account number (SNILS); first name, patronymic, surname; hiring or leaving date; date of entering into civil contract requiring fees payment or its termination; periods of activity included in labor experience by the relevant activity types; amount of fees paid for the employee under the system of non-mandatory non-state pension provision; other information necessary for granting non-contributory and funding pension.

When the employee has a right to a pension, the employer is obliged to provide personified data to the Pension fund of Russia within 3 consecutive days after the application receiving date.

Procedure and delivery time for reporting to the Social Insurance Fund authorities remain the same.

It will be necessary to inform tax authorities of salaries and charged pension and medical payments as parts of insurance fees, as well as report on insurance fees for compulsory social insurance as to temporary disability and maternity.

From 01.01.2017 the Social Insurance Fund will continue to take charge of fees for occupational injury and disease insurance.

All non-budgetary funds will keep an obligation to supervise over reporting periods expired before 01.01.2017.

In general, amendments are aimed at simplifying the system of payments managing and economy of budget expenses. Rates of insurance, including benefits, are unchanged. The existing four forms of insurance fees reporting will be united into a unified form. There will be one inspection authority with unified regulations. Information on insurance fees managing is obliged to be added to the taxpayer’s personal account.

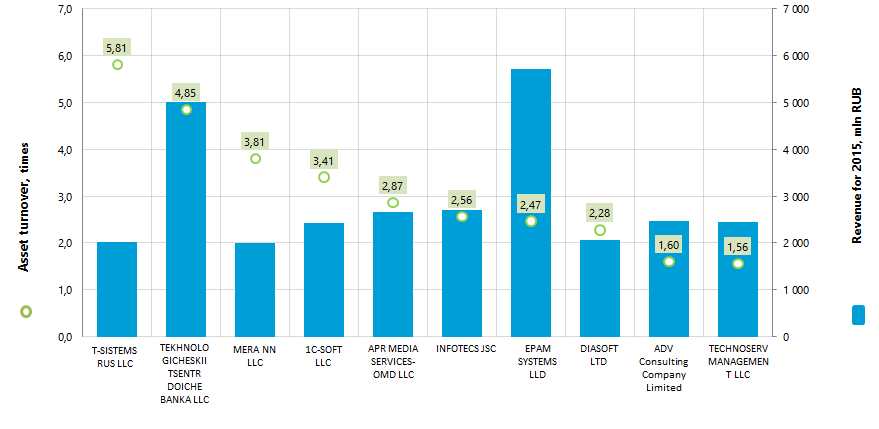

Asset turnover of the largest Russian enterprises – developers of computer software

Information agency Credinform prepared a ranking of the largest Russian enterprises – developers of computer software.

Russian enterprises – developers of computer software were selected according to the data from the Statistical Register for the latest available period - for 2015 (TOP-10) and then they were ranked by asset turnover (Table 1).

Asset turnover (times) is calculated as a relation of sales proceeds to the average value of company's total assets for a period and characterizes the efficiency of use by a company of all available resources, apart from sources of their attraction. The ratio shows how many times a year the full cycle of production and circulation completes, which brings the effect in the form of profit.

Asset turnover provides the most accurate assessment of the effectiveness of the operating activity of an enterprise. The duration of finding funds in the turnover of the enterprise is affected by a number of factors of internal and external nature.

The external factors include: business segment of a company, sector profile, size of an enterprise. The macroeconomic situation has a significant impact on the turnover of the company's assets. The breaking of existing ties with other organizations, inflation processes lead to the accumulation of stocks, which significantly slows the turnover of funds.

The factors of internal nature are: company’s pricing policy, structure of assets and method of evaluation of inventories.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all available combination of ratios, financial and other indicators.

| Name, INN, Region | Net profit for 2015, mnl RUB | Revenue for 2015, mnl RUB | Revenue for 2015 by 2014, % | Asset turnover, times | Solvency index Globas-i |

|---|---|---|---|---|---|

| T-SISTEMS RUS LLC INN 7708807718 Saint-Petersburg |

49,3 | 2 012,4 | 158 | 5,81 | 248 High |

| TEKHNOLOGICHESKII TSENTR DOICHE BANKA LLC INN 7714941430 Moscow |

225,0 | 5 013,3 | 736 | 4,85 | 233 High |

| MERA NN LLC INN 5257053317 Nizhny Novgorod region |

124,0 | 1 993,0 | 114 | 3,81 | 259 High |

| 1C-SOFT LLC INN 7730643014 Moscow |

391,6 | 2 427,1 | 780 | 3,41 | 211 High |

| APR MEDIA SERVICES-OMD LLC INN 7702768149 Moscow |

35,1 | 2 661,5 | 117 | 2,87 | 312 Satisfactory |

| INFOTECS JSC INN 7710013769 Moscow |

422,9 | 2 700,0 | 174 | 2,56 | 152 The highest |

| EPAM SYSTEMS LLD INN 7719232155 Moscow |

940,0 | 5 719,6 | 170 | 2,47 | 166 The highest |

| DIASOFT LTD INN 7715560268 Moscow |

56,6 | 2 055,6 | 89 | 2,28 | 226 High |

| ADV Consulting Company Limited INN 7706127570 Moscow |

549,9 | 2 465,7 | 108 | 1,60 | 191 The highest |

| TECHNOSERV MANAGEMENT LLC INN 7722536788 Moscow |

0,4 | 2 455,7 | 146 | 1,56 | 298 High |

The average value of the asset turnover ratio in the group of TOP-10 companies amounted to 3,12 in 2015. The same indicator in the group of TOP-100 companies made 2,80, by the industry average of 1,47.

Nine companies from the TOP-10 got the highest and high solvency index Globas-i, that indicates their ability to repay debt obligations in time and fully.

APR MEDIA SERVICES-OMD LLC got satisfactory solvency index Globas-i, due to the available information about its participation as a defendant in debt recovery proceedings.

The total revenue of the TOP-10 companies made 29,5 billion rubles in 2015, that is by 69% more than in 2014. The total net profit in this group of enterprises increased by 86%. At the same time MERA NN LLC, DIASOFT LTD and ADV Consulting Company Limited allowed a decrease in the value of net profit in 2015 compared with the previous period. DIASOFT LTD reduced also the size of revenue by 11%.

In the group of TOP-100 companies an increase in total revenue made 44% for the same period, in case of an increase in total net income by 45%.

All of TOP-10 companies, as well as enterprises of the industry as a whole, demonstrate positive values of asset turnover ratio.

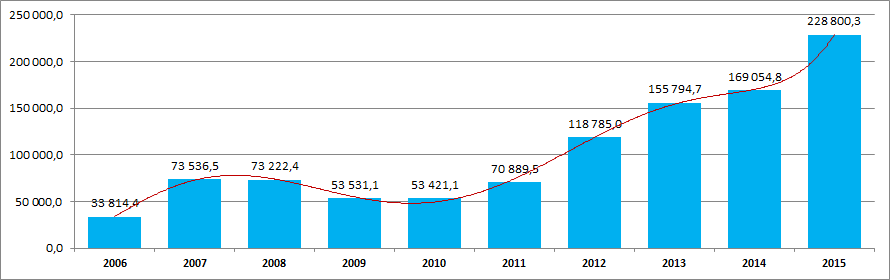

All of this points to a high enough efficiency of the work of the industry, that is confirmed also by the data of the Federal Service of State Statistics (Picture 2).

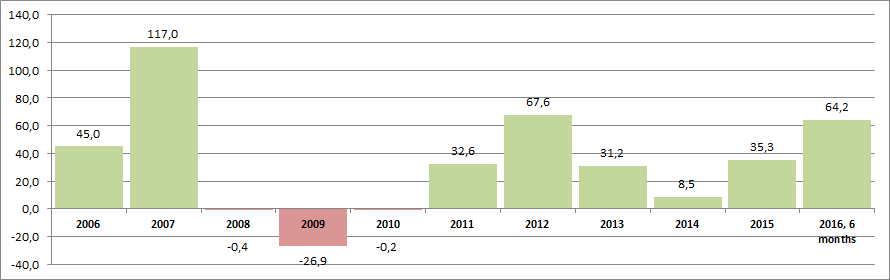

At the same time it is observed the dependence of the growth rates on the macroeconomic situation (Picture 3).

*) - data for 6 months 2016 are presented by the corresponding period of 2015

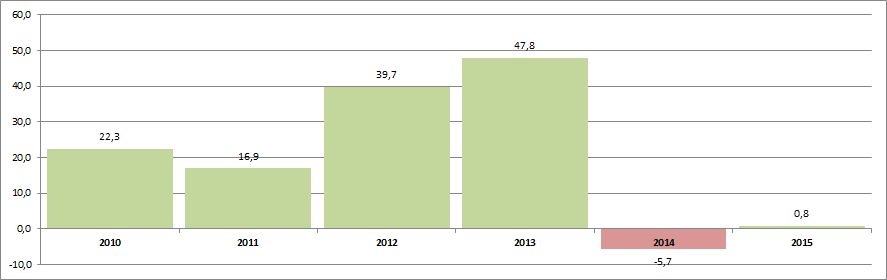

In addition, it may be noted also the prospectivity of this industry in terms of the availability of significant reserves for further growth. Thus, according to the same data from Rosstat, the common costs of Russian organizations on information and communication technologies, including capital and current technologies, costs for their development, acquisition, introduction and use rose by more than 2 times in 2015 compared to 2010 and amounted to 1 184 184 mln RUB. This trend to an increase of these costs is due to the scientific-technical progress and will remain probable for the next few years, even though the decline in growth rates in recent times (Picture 4).

Companies - developers of computer software tend to a large extend to the biggest industrial and financial centers of the country - Moscow and Saint-Petersburg. This is testified by the data of the Information and analytical system Globas-i, according to which 100 the largest developers of computer software in terms of revenue for 2015 are focused in 15 regions of Russia (TOP-7 regions):

| Region | Number of registered companies |

|---|---|

| Moscow | 65 |

| Saint-Petersburg | 13 |

| Republic of Tatarstan | 5 |

| Nizhny Novgorod region | 3 |

| Belgorod region | 2 |

| Moscow region | 2 |

| Novosibirsk region | 2 |

Thus, 78% of the largest companies in the industry are concentrated in Moscow and Saint-Petersburg.