Amendments to the insurance legislation have come into force

In 2016 amendments have come into force made by the Federal Laws of the RF of 14.12.2015 №374-FL «On amendments to the Federal Law «On compulsory medical insurance in the RF» and certain legislative acts of the RF»; of 30.12.2015 №432-FL «On amendments to the article 25 of the RF Law «On organization of insurance system in the RF» and the Federal Law «On compulsory medical insurance in the RF»; of 09.03.2016 №55-FL «Оn amendments to the articles 48 and 13 of the Federal Law « On compulsory medical insurance in case of temporary incapacity to work and in case of maternity»»; of 09.03.2016 №56-FL «On amendments to the Federal Law «On compulsory insurance of civil responsibility of hazardous facility owner for causing of harm in consequence of incident on hazardous facility».

Adopted amendments make significant changes to the insurance legislation.

In particular, regulations to the amount of the share capital of insurance medical companies are hardened. Since January 1, 2017 the share capital must be not less than 120 mln RUB. The year 2016 is oriented to accomplish this regulation. Besides, insurance medical companies are again obliged to form reserve fund that must be used for financing of medical staff education, purchase and repair of medical equipment.

If the company is in process of bankruptcy, Social insurance Fund pays benefit to employees – the list of similar cases is updated.

The system of insurance agents responsible for fulfillment of medical treatment regulations come into use. This function is delegated on the insurance company, and conditions are provided in contract between compulsory medical insurance fund and insurance medical organizations.

Participation interest of the Social insurance Fund is increased up to 60% in the financing program of medical workers coming for work to the countryside.

The companies managing multi-dwelling units are obliged to insure hazardous facilities. An organization providing works on maintenance, capital repair and modernization of hazardous facilities or an organization exploiting hazardous facility must be responsible for insurance.

The list of insurance cases is significantly completed and amount of the insurance payouts for physical and legal entities are increased, in certain cases to 2 mln RUB.

For information:

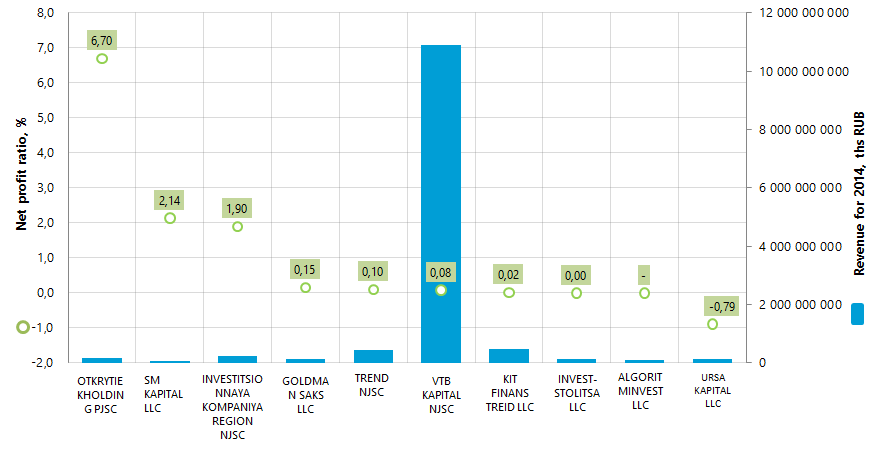

Net profit ratio of the largest asset and securities management companies of Russia

Information agency Credinform prepared the ranking of the largest asset and securities management companies of Russia.

The organizations with the highest volume of revenue were selected for the ranking according to the data from the Statistical Register for the latest available period (for the year 2014). These enterprises were ranked by decrease in net profit ratio.

The net profit ratio (%) is calculated as the relation of net profit (loss) to sales revenue. The ratio shows to what extent the company's sales have been profitable.

There is no specified value for the mentioned ratio that is why it is recommended to compare enterprises of one branch or the time variation of the ratio relative to a certain enterprise. If the indicator is negative, it points to the fact that a company has net loss. The higher is the indicator, the more efficiently the company operates.

For getting of the most comprehensive and fair picture of company’s standing it is necessary to pay attention not only to values of financial ratios, but also to all combination of financial and non-financial data.

| Name, INN, region | Revenue for 2014, ths RUB | Revenue for 2014 to 2013, %% | Net profit for 2014, ths RUB | Net profit ratio for 2013, % | Net profit ratio for 2014, % | Solvency index Globas-i® |

|---|---|---|---|---|---|---|

| OTKRYTIE KHOLDING PJSC INN 7708730590, Moscow |

177 083 593 | 108 | 11 868 763 | 3,18 | 6,70 | 205 High |

| SM KAPITAL LLC INN 7727529262, Moscow region |

81 809 347 | 103 | 1 753 026 | 1,17 | 2,14 | 550 Unsatisfactory |

| INVESTITSIONNAYA KOMPANIYA REGION NJSC INN 7730095858, Moscow |

239 442 646 | 173 | 4 561 163 | 0,37 | 1,90 | 199 The highest |

| GOLDMAN SAKS LLC INN 7710619750, Moscow |

149 710 552 | 71 | 227 679 | -0,01 | 0,15 | 298 High |

| TREND NJSC INN 7708729065, Moscow |

441 234 425 | 70 | 455 846 | 0,02 | 0,10 | 259 High |

| VTB KAPITAL NJSC INN 7703585780, Moscow |

10 909 966 583 | 71 | 8 646 709 | 0,01 | 0,08 | 205 High |

| KIT FINANS TREID LLC INN 7840471255, Saint-Petersburg |

461 646 367 | 175 | 96 251 | -0,03 | 0,02 | 312 Satisfactory |

| INVEST-STOLITSA LLC INN 7728530221, Moscow |

145 709 932 | 56 | -3 584 | 0,00 | 0,00 | 319 Satisfactory |

| ALGORITMINVEST LLC INN 7725840320, Moscow |

93 918 704 | - | 2 313 | - | - | 269 High |

| URSA KAPITAL LLC INN 7708636639, Moscow region |

142 494 225 | 31 | -1 272 888 | 0,02 | -0,89 | 328 Satisfactory |

The absolute leader of the TOP-10 in terms of revenue for 2014 - VTB KAPITAL NJSC - is on the 6th place of the ranking. The share of this company in total revenue of TOP-10 made 85%. OTKRYTIE KHOLDING PJSC has the highest net profit ratio 6.7%. For ALGORITMINVEST LLC the ratio value was not calculated due to the fact that the enterprise was established in 2014 and accounting data for the previous period are not available.

The cumulative sales result of TOP-10 companies for 2014 amounted to 12,8 trillion rubles or 73% of the figure for 2013. Herewith the largest relative drop in revenue in 2014 compared to 2013 is observed by URSA KAPITAL LLC. The same company is the only one in the TOP-10 with a negative value of the net profit ratio in 2014.

Seven companies from the TOP-10 are registered in Moscow, that points to a high concentration of business on asset and securities management in one region of the country.

Six companies from the TOP-10 have the highest or high solvency index Globas-i®, that testifies to their ability to pay off their debts in time and fully.

SM KAPITAL LLC has unsatisfactory solvency index Globas-i® due to the presence of a significant number of arbitration proceedings, in which the organization acts as a defendant. In December 2015 the monitoring procedure were introduced in the company according to the decision of the Arbitration Court of Moscow Region.

For reference only:

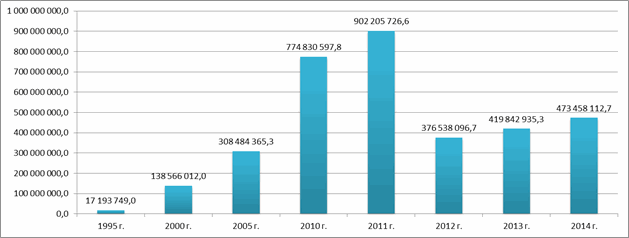

One of the most important indicators, characterizing the property and financial status of organizations, is the cost of fixed assets (including intangible assets, long-term investments, construction in progress, deferred tax assets etc).

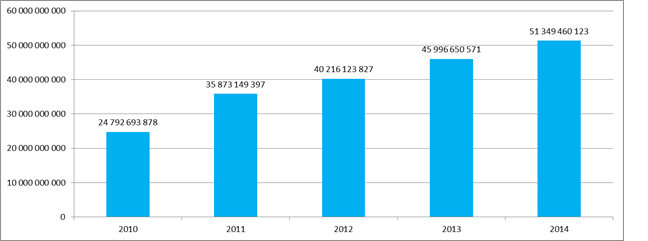

According to Rosstat, in 2010-2014 the value of fixed assets on a circle of Russian organizations, being irrelevant to small businesses, amounted to (thousand rubles):