TOP-10 companies engaged in extraction of non-ferrous metal ores

Information agency Credinform represents a ranking of the largest Russian companies engaged in extraction of non-ferrous metal ores. Companies with the largest volume of annual revenue (TOP-10 and TOP-100) were selected for the ranking, according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2017 - 2019). They were ranked by asset coverage ratio (Table 1). The selection and analysis of companies were based on the data of the Information and Analytical system Globas.

Asset coverage ratio(x) is calculated as the difference between equity and non-current assets to current assets.

The ratio shows the ability of an enterprise to finance current activities only with its working capital. The recommended value is > 0.1.

For the most complete and objective view of the financial condition of the enterprise, it is necessary to pay attention to the complex of indicators and financial ratios of the company.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Asset coverage ratio (x), > 0,1 | Solvency index Globas | |||

| 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| JSC SEREBRO MAGADANA INN 4900003918 Magadan region |

24 733 |  25 596 25 596 |

11 094 |  5 615 5 615 |

0,80 |  0,85 0,85 |

284 Medium |

| CHUKOTKA MINING AND GEOLOGICAL COMPANY INN 8709009294 Chukotka autonomous region |

30 436 |  37 516 37 516 |

9 812 |  12 311 12 311 |

0,62 |  0,81 0,81 |

305 Adequate |

| JSC POLYUS MAGADAN INN 4906000960 Magadan region |

7 191 |  37 294 37 294 |

-2 127 |  15 599 15 599 |

0,19 |  0,48 0,48 |

292 Medium |

| JSC BOKSIT TAMANA INN 1117000011 The Republic of Komi |

20 761 20 761 |

23 521 23 521 |

1 622 1 622 |

963 963 |

0,35 0,35 |

0,31 0,31 |

217 Strong |

| LLC MEDVEZHIY RUCHEY INN 2457080792 Krasnoyarsk territory |

25 681 |  55 941 55 941 |

5 897 |  21 254 21 254 |

0,28 |  0,30 0,30 |

298 Medium |

| LLC NERYUNGRI-METALLIK INN 1434024359 The Republic of Sakha (Yakutia) |

9 278 |  23 626 23 626 |

3 970 |  16 631 16 631 |

-3,03 |  -0,79 -0,79 |

275 Medium |

| LLC GRK BYSTRINSKOE INN 7701568891 Zabaikalye territory |

13 137 13 137 |

36 297 36 297 |

-3 672 -3 672 |

22 847 22 847 |

-3,83 -3,83 |

-1,38 -1,38 |

261 Medium |

| MIKHEEVSKY MINING AND PROCESSING PLANT INN 7428007317 Chelyabinsk region |

22 629 22 629 |

23 750 23 750 |

4 418 4 418 |

5 413 5 413 |

-2,52 -2,52 |

-1,47 -1,47 |

202 Strong |

| GAISKY MINING AND PROCESSING PLANT INN 5604000700 Orenburg region |

25 031 25 031 |

25 382 25 382 |

2 416 2 416 |

1 171 1 171 |

-1,04 -1,04 |

-2,09 -2,09 |

252 Medium |

| JSC POLYUS KRASNOYARSK INN 2434000335 Krasnoyarsk territory |

135 881 |  163 654 163 654 |

34 843 |  86 693 86 693 |

-4,10 |  -2,58 -2,58 |

274 Medium |

| Average value for TOP-10 |  31 476 31 476 |

45 258 45 258 |

6 827 6 827 |

18 849 18 849 |

-1,23 -1,23 |

-0,56 -0,56 |

|

| Average value for TOP-1000 |  1 109 1 109 |

1 258 1 258 |

180 180 |

339 339 |

-72,82 -72,82 |

-44,72 -44,72 |

|

growth of indicator to the previous period,

growth of indicator to the previous period,  decrease of indicator to the previous period,

decrease of indicator to the previous period,  colorless – no data for 2017

colorless – no data for 2017

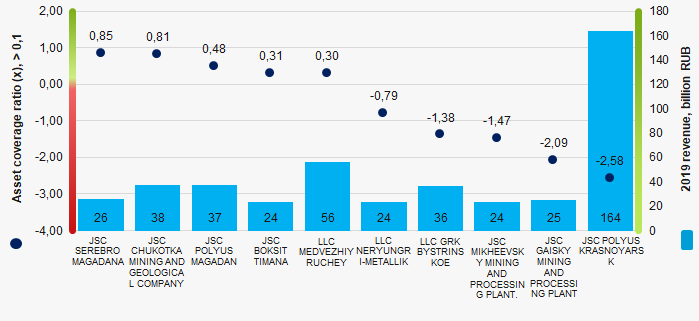

The average indicator of the asset coverage ratio of TOP-10 has negative value and is above the average one of TOP-1000. In 2019, five companies have values above the recommended one. Eight companies increased the value compared to the previous period.

Picture 1. Asset coverage ratio and revenue of the largest Russian companies engaged in extraction of non-ferrous metal ores (TOP-10)

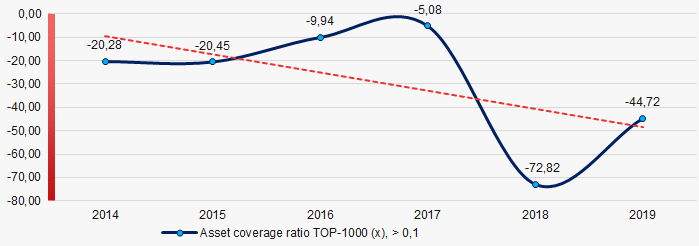

Picture 1. Asset coverage ratio and revenue of the largest Russian companies engaged in extraction of non-ferrous metal ores (TOP-10) During six years, the average values of the asset coverage ratio of TOP-1000 were negative with a trend to decrease (Picture 2).

Picture 2. Change in the average values of the asset coverage ratio of the TOP-50 largest Russian companies engaged in extraction of non-ferrous metal ores in 2014 - 2019

Picture 2. Change in the average values of the asset coverage ratio of the TOP-50 largest Russian companies engaged in extraction of non-ferrous metal ores in 2014 - 2019Trends in petrol trade

Information agency Credinform has prepared a review of activity trends of the largest Russian petrol retailers.

The largest companies (ТОP-1000) in terms of annual revenue were selected according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2014 - 2019). The company selection and analysis were based on data of the Information and Analytical system Globas.

Net assets is a ratio reflecting the real value of company's property. It is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The ratio is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest company in terms of net assets is LLC GAZPROMNEFT - TSENTR, INN 7709359770, Moscow. In 2019 net assets of the company amounted to more than 45 billion RUB.

The smallest size of net assets in TOP-1000 had LLC NEW PETROL TYUMEN, INN 7203254282, Tyumen region, the legal entity is declared insolvent (bankrupt) and bankruptcy proceedings are initiated, 18/12/2020. The lack of property of the company in 2019 was expressed in negative terms -9,4 billion RUB.

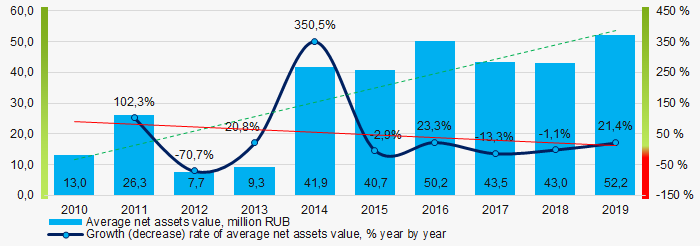

For the last ten years, the average industry values of net assets showed the growing tendency with negative dynamics of growth rates (Picture 1).

Picture 1. Change in average net assets value in 2014 – 2019

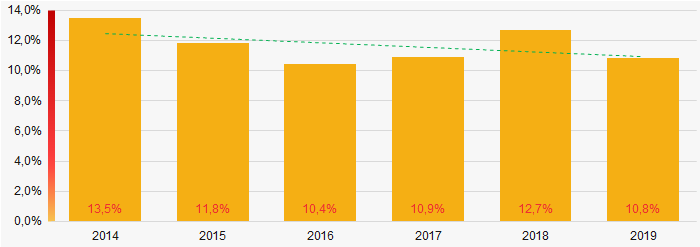

Picture 1. Change in average net assets value in 2014 – 2019For the last six years, the share of ТОP-1000 enterprises with lack of property is decreasing (Picture 2).

Picture 2. The share of enterprises with negative net assets value in ТОP-1000 in 2014-2019

Picture 2. The share of enterprises with negative net assets value in ТОP-1000 in 2014-2019Sales revenue

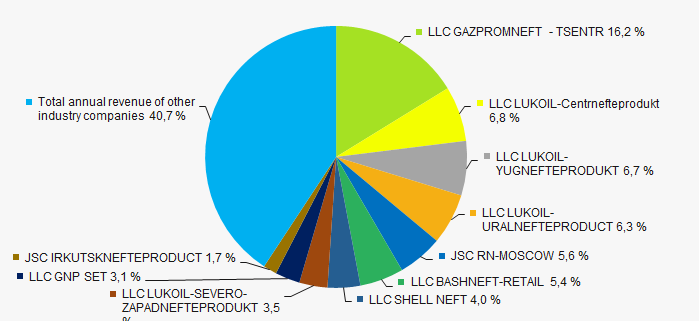

In 2019, the total revenue of 10 largest companies amounted to 59% from ТОP-1000 total revenue (Picture 3). This fact testifies the high level of monopolization in the retail market of petrol.

Picture 3. Shares of TOP-10 in TOP-1000 total revenue for 2019

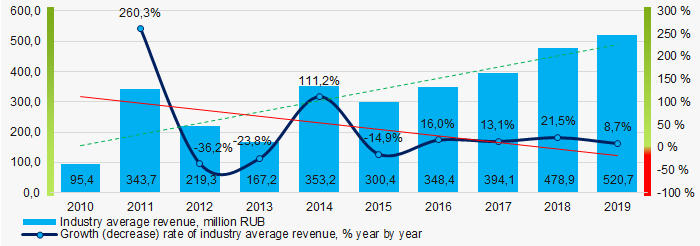

Picture 3. Shares of TOP-10 in TOP-1000 total revenue for 2019In general, the growing trend in sales revenue with negative dynamics of growth rates is observed (Picture 4).

Picture 4. Change in average revenue in 2010 – 2019

Picture 4. Change in average revenue in 2010 – 2019Profit and loss

The largest company in terms of net profit is LLC GAZPROMNEFT - TSENTR, INN 7709359770, Moscow. In 2019 the company’s profit amounted to more than 382 billion RUB.

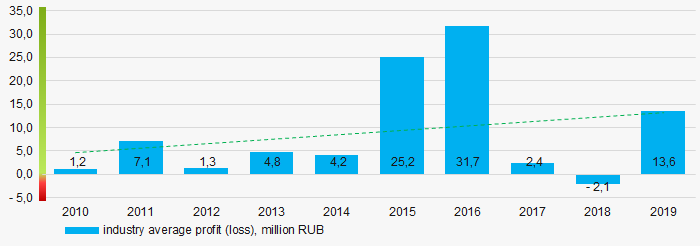

For the last ten years, the average profit values show the growing tendency (Picture 5).

Picture 5. Change in average profit (loss) in 2010 – 2019

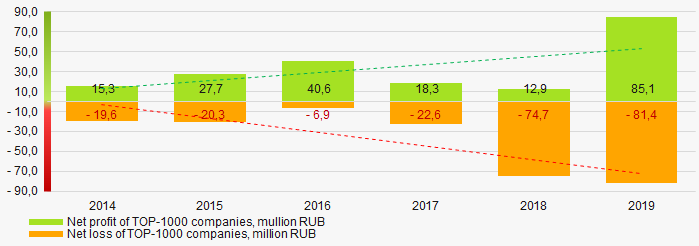

Picture 5. Change in average profit (loss) in 2010 – 2019Over a six-year period, the average net profit values of ТОP-1000 show the decreasing tendency, along with this the average net loss is growing (Picture 6).

Picture 6. Change in average net profit/loss of ТОP-1000 companies in 2014 – 2019

Picture 6. Change in average net profit/loss of ТОP-1000 companies in 2014 – 2019Main financial ratios

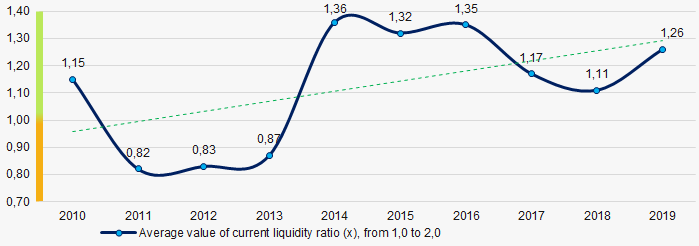

For the last ten years, the average values of the current liquidity ratio were within the recommended values - from 1,0 to 2,0, with growing trend (Picture 7).

The current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Picture 7. Change in average values of current liquidity ratio in 2010 – 2019

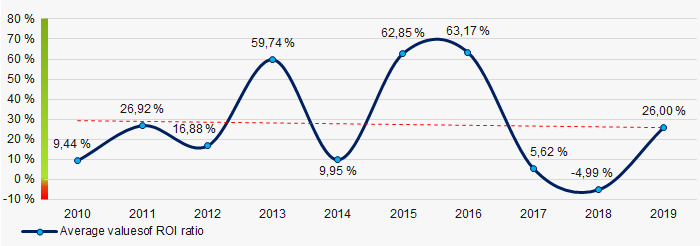

Picture 7. Change in average values of current liquidity ratio in 2010 – 2019Within ten years, the downward trend of the average values of ROI ratio is observed (Picture 8).

The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average values of ROI ratio in 2010 – 2019

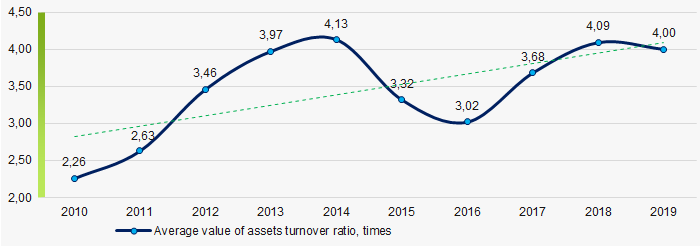

Picture 8. Change in average values of ROI ratio in 2010 – 2019Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

For the last ten years, this business activity ratio demonstrated the growing trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio in 2010 – 2019

Picture 9. Change in average values of assets turnover ratio in 2010 – 2019Small businesses

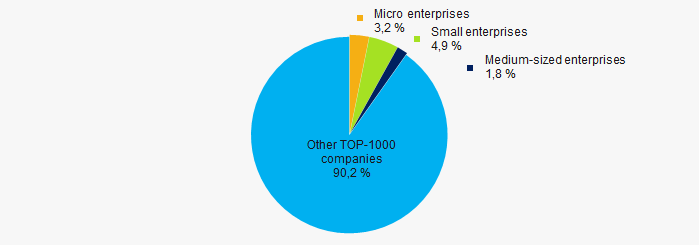

90% of ТОP-1000 companies are registered in the Unified register of small and medium-sized enterprises of the Russian Federal Tax Service. Herein, their share in TOP-1000 total revenue is 9,8%, which is significantly lower than the national average value in 2018 – 2019 (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in ТОP-1000

Picture 10. Shares of small and medium-sized enterprises in ТОP-1000Main regions of activity

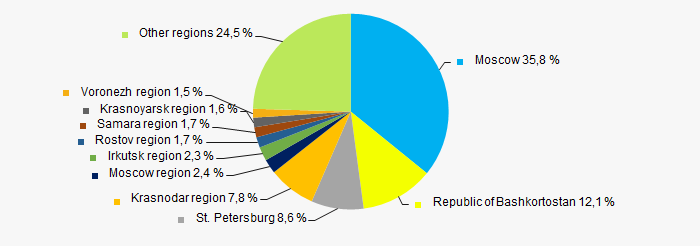

TOP-1000 companies are registered in 80 regions of Russia and are unequally located across the country. Almost 48% of the largest enterprises in terms of revenue are located Moscow and Republic of Bashkortostan (Picture 11).

Picture 11. Distribution of TOP-1000 revenue by the regions of Russia

Picture 11. Distribution of TOP-1000 revenue by the regions of RussiaFinancial position score

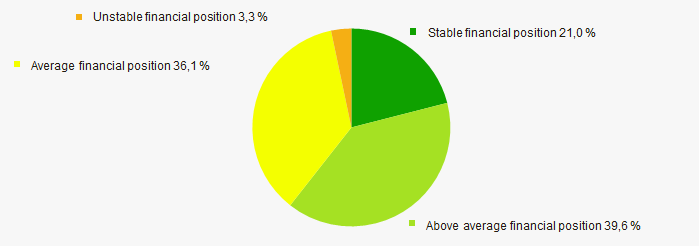

An assessment of the financial position of TOP-1000 companies shows that the largest part have above average financial position (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

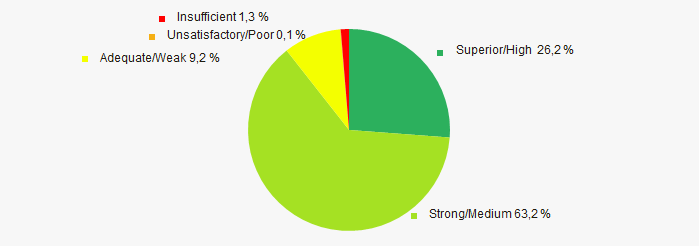

Most of TOP-1000 companies got superior/high and strong/medium Solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by Solvency index Globas

Picture 13. Distribution of TOP-1000 companies by Solvency index GlobasConclusion

A complex assessment of activity of the largest Russian petrol retailers, taking into account the main indexes, financial ratios and indicators, demonstrates the presence of positive trends within 2010-2019 (Table 1).

| Trends and assessment factors | Relative share, % |

| Dynamics of average net assets value |  10 10 |

| Growth/drawdown rate of average net assets value |  -10 -10 |

| Increase / decrease in the share of enterprises with negative net assets |  10 10 |

| The level of capital concentration |  -10 -10 |

| Dynamics of average net profit |  10 10 |

| Growth/drawdown rate of average revenue |  -10 -10 |

| Dynamics of average profit (loss) |  10 10 |

| Increase / decrease in average net profit of companies |  10 10 |

| Increase / decrease in average net loss of companies |  -10 -10 |

| Increase / decrease in average values of current liquidity ratio |  10 10 |

| Increase / decrease in average values of ROI ratio |  -10 -10 |

| Increase / decrease in average values of assets turnover ratio, times |  10 10 |

| Share of small and medium-sized businesses by revenue more than 22% |  -10 -10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of factors |  1,3 1,3 |

favorable trend (factor),

favorable trend (factor),  unfavorable trend (factor)

unfavorable trend (factor)