Globas helps to comply with AML/CFT law

- Failure to comply with the requirements for the identification of customers and beneficial owners.

- Failure to conduct a regular check of clients.

- Lack of internal training for employees.

According to the results of Rosfinmonitoring inspections, the violations mentioned above are mostly spread.

In the first half of 2021, the Federal Service for Financial Monitoring of the Russian Federation (Rosfinmonitoring) conducted 145 inspections of legal entities and individual entrepreneurs, and violations were recorded for all inspected subjects; the administrative cases were opened in relation to 95% of violations.

A significant part of the work on AML/CFT within the framework of the corporate checklist is carried out by the Reports service in Globas.

The service helps to identify companies, check them against special lists of Rosfinmonitoring and the Federal Tax Service, identify beneficial owners, conflicts of interest, affiliation, find facts of violation of the law, etc.

The Reports service will help you to create a reliable risk management system that will reduce the likelihood of claims from regulators and reduce the risk of violations of regulations by employees.

All verification criteria comply with the requirements of the Federal Tax Service, AML / CFT (Anti-Money Laundering and Terrorist Financing) legislation in accordance with 115-FL, letters of the Central Bank and Rosfinmonitoring.

All four types of Reports are preinstalled in the personal account in Globas:

- Checklist is designed to streamline the internal rules for checks of counterparties;

- FTS criteria are indispensable when preparing a report on the selection of a counterparty, which is suitable for submission to the tax office;

- Report under the 115-FZ will automate the AML/CFT processes and relieve the company of regulatory claims;

- Compliance control is aimed to protect against financial, operational and reputational losses due to violation of laws and non-compliance with corporate rules.

The checking factors and the final form of the Report are adjusted in accordance with corporate regulations, and in the final document, you can fix the checking date, full name, position of the auditor and his/her resume.

We will tell you more about the possibilities of the new service at the webinar, which will take place on December 1, 2021.

Passenger transport companies in Saint Petersburg

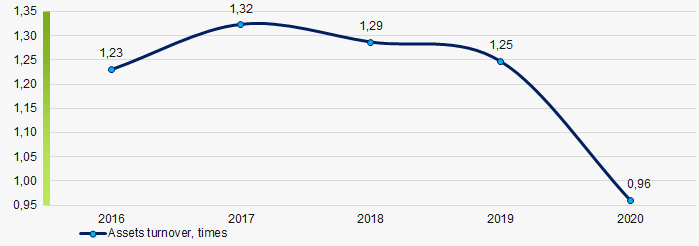

In April 2022, launch of the new model of transportation services is planned in Saint Petersburg. Assets turnover ratio analyses allows to rate accurately effectiveness of the business activity of the companies and shows it’s relatively high but decreasing level among the surface transport companies in Saint Petersburg in 2019 – 2020 with decreasing profit and increasing loss.

For this ranking Information Agency Credinform selected in Globas the largest companies in Saint Petersburg (TOP 10) in terms of annual revenue for the last reporting periods available in the state statistics bodies and the Federal Tax Service (2018 - 2020) that provide passenger bus, trolleybus and tramway transportation. Then these companies were ranked by assets turnover ratio (Table 1).

period. It characterizes efficiency of company's use of all available resources, regardless of sources they were raised. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

External factors include company’s type and industry, size of enterprise. Macroeconomic situation also largely affects company’s assets turnover. Severance of ties with other organizations and inflation development cause stock building, which severely slows down the assets turnover.

Internal factors are price policy, asset profile and inventory valuation system.

It is necessary to pay attention to the entire set of indicators and financial ratios to get the most complete and objective picture of enterprise's financial condition.

| Name, INN, types of activity | Revenue, million rubles | Net profit (loss), million rubles | Asset turnover, times | Globas Solvency Index | |||

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| Comtrade INN 7841399812 Scheduled passenger bus transport |

49,09 49,09 |

184,49 184,49 |

2,34 2,34 |

4,76 4,76 |

4,58 4,58 |

9,34 9,34 |

219 Strong |

| IBF-Nord Company Limited INN 7804328651 Scheduled passenger bus transport |

72,16 72,16 |

67,10 67,10 |

0,02 0,02 |

-0,05 -0,05 |

8,69 8,69 |

7,27 7,27 |

284 Medium |

| BUS-EXPRESS CO. LTD INN 7816465733 Scheduled passenger bus transport |

37,70 37,70 |

34,50 34,50 |

15,95 15,95 |

16,57 16,57 |

6,23 6,23 |

4,71 4,71 |

177 High |

| ATP BARS 2 INN 4703086802 Scheduled passenger bus transport |

795,87 795,87 |

598,27 598,27 |

12,89 12,89 |

3,60 3,60 |

3,19 3,19 |

2,27 2,27 |

263 Medium |

| AO TRETII PARK INN 7814010096 Scheduled passenger bus transport |

4 753,94 4 753,94 |

3 641,02 3 641,02 |

8,41 8,41 |

0,26 0,26 |

2,71 2,71 |

1,74 1,74 |

229 Strong |

| SHPUNT-SEVERO-ZAPAD INN 7805472231 Scheduled passenger bus transport |

530,77 530,77 |

371,90 371,90 |

26,70 26,70 |

-17,57 -17,57 |

1,91 1,91 |

1,61 1,61 |

285 Medium |

| SPB GUP PASSAZHIRAVTOTRANS INN 7830001758 Scheduled passenger bus transport |

15 248,11 15 248,11 |

14 600,10 14 600,10 |

3,88 3,88 |

-677,87 -677,87 |

0,93 0,93 |

0,75 0,75 |

234 Strong |

| SPB GUP GORELEKTROTRANS INN 7830001927 Scheduled passenger tramway and trolleybus transport |

15 360,70 15 360,70 |

15 179,92 15 179,92 |

-166,89 -166,89 |

-631,80 -631,80 |

0,81 0,81 |

0,71 0,71 |

249 Strong |

| PALMIRA COMPANY LIMITED INN 7806345155 Scheduled passenger bus transport |

553,61 553,61 |

542,11 542,11 |

17,98 17,98 |

-36,28 -36,28 |

0,85 0,85 |

0,68 0,68 |

277 Medium |

| LIMITED LIABILITY COMPANY TRANSPORT CONCESSION COMPANY INN 6952036026 Scheduled passenger tramway transport |

1 312,76 1 312,76 |

3 017,99 3 017,99 |

-70,11 -70,11 |

679,99 679,99 |

0,09 0,09 |

0,19 0,19 |

256 Medium |

| TOP 10 average value |  3 871,47 3 871,47 |

3 823,74 3 823,74 |

-14,88 -14,88 |

-65,84 -65,84 |

3,00 3,00 |

2,93 2,93 |

|

| The industry average value (Scheduled passenger conveyance by public surface transport) |  418,06 418,06 |

347,72 347,72 |

-12,92 -12,92 |

-39,67 -39,67 |

1,25 1,25 |

0,96 0,96 |

|

Improvement of the indicator to the previous period,

Improvement of the indicator to the previous period,  deterioration of the indicator to the previous period

deterioration of the indicator to the previous period

In 2020, average values of assets turnover of TOP 10 were above the industry average. There was a decline in values among eight companies out of TOP 10, while in 2019 there were six companies like this.

In 2020, two companies out of ten increased revenue and three companies increased net profit. However average revenue in TOP 10 decreased by 1%, industry average value declined by 17%. Average loss in TOP 10 increased more than four times and industry average loss increased more than three times.

For the last five years industry average values of assets turnover ratio have been growing for only one period. The indicator reached the best values in 2017, and the worst result was shown in 2020. (Picture 1)

Picture 1. Change in industry average values of assets turnover of surface transport companies in 2016 – 2020

Picture 1. Change in industry average values of assets turnover of surface transport companies in 2016 – 2020