Statistics of legal entities’ registration: new tendencies

Despite significant slackening of economic growth rates and stagnation of business, establishing of new organizations in Russia continues. As of April 1st, 2014 there are around 4, 6 million legal entities in Russia, that is 1,3% more in comparison with the same period in 2013.

On the other hand, the number of dissolved companies went up by 14, 7% during the same time period. Thus, the negative tendency in growth of number of closed companies over the last period is observed. It couldn’t be offset by creation of new companies.

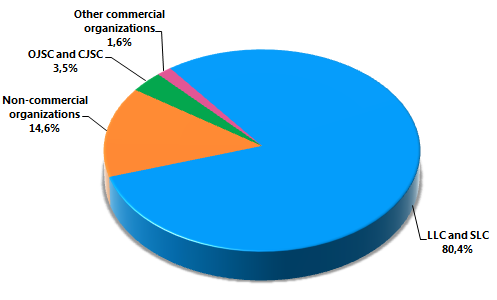

The most popular legal form among others in our country is LLC. It generates more than 80% of active organizations. The percent of joint-stock companies is incomparably small – 3,5%, 2,8% of which - closed joint-stock companies and 0,7% - open joint-stock companies.

Fig. 1. Breakdown of active legal entities on the basis of legal form as of 01.04.2014

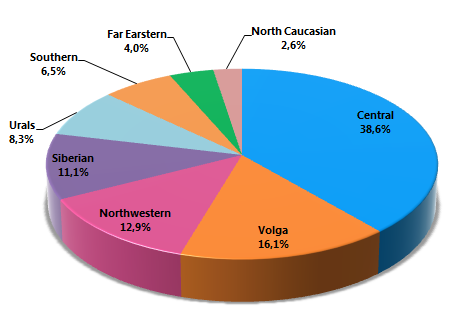

The majority (38, 6%) of the active organizations is registered in the Central Federal District, where 23, 6% (1 092 031 units) of all Russian legal entities are situated in Moscow. Then follows Saint Petersburg with the interest of 7, 6% (350 890 units) and the Moscow region rounds out the top three leaders with 4, 9% (226 089 units).

Fig.2. Breakdown of active organizations on the basis of Federal districts

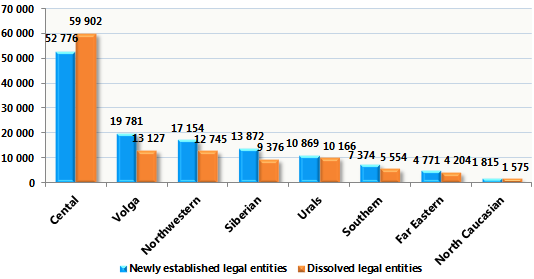

The Central Federal District is also ahead of other regions on the basis of newly established legal entities number during the 1st quarter of 2014 - 52 776 units, which is 41% more than in the 1st quarter of 2013. This circumstance confirms the leading role of this region by business activity rate, both in relative and absolute terms. Therefore, the surplus of the number of legal entities having ceased the activity (59 902 units) over the number of newly established ones in this federal district may be considered as a negative tendency for the country in the whole.

Fig. 3. Newly established and dissolved organizationы during the 1st quarter of 2014 on the basis of federal districts

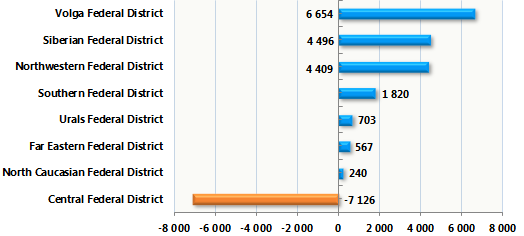

On the basis of the difference in number of newly established and dissolved organizations during the 1st quarter of 2014, it may be concluded that the most congenial investment climate is in Volga federal district, where the number of new companies exceeds the number of dissolved organizations by 6 654 units. The bulk of them (1 503 units) accounts for the Republic of Tatarstan. The Central Federal District appeared to be an outsider. The number of dissolved companies exceeds the number of newly established by 7 126 units for the period under review. In Moscow this excess comes up to 10 013 units: the higher figure districtwide was compensated by means of better figures of other federal subjects in the district.

Fig. 4. Difference between newly established and dissolved organizations for the 1st quarter of 2014 on the basis of federal districts

Countrywide the number of established legal entities is 11 763 units more than the number of the closed ones. A year ago there was the same tendency with the smaller result - 7 020 entities (difference surplus 67, 5%).

The majority of reasons for ceasing the activity of the legal entities in the 1st quarter of 2014 belongs to individual decision of the registering authority – 77, 8% cases, then goes liquidation – 9,4% and bankruptcy – 2 %.

Thus, despite uncertain economic situation of the beginning of the year, generated by the stagnation of industrial production and strained geopolitical environment due to events in Ukraine, the number of new enterprises exceeded the number of dissolved ones. The Central Federal District and above all Moscow is outlined against relatively congenial background, where the number of the closed organizations has sharply risen. It can be assumed that it happens due to legislation tightening combating fly-by-night, which are used for paying illegal salary, and with the developing decentralization of business.

You may get the detailed information about all registered legal entities in Russia, bankruptcies, reorganization and liquidation, fly-by-night companies in daily updated Information and Analytical System Globas-i®.

Russia will not return to the international borrowing markets to the end of the year

Russian emitters don’t plan to make borrowings on foreign markets to the end of the year. Andrey Klepach, the deputy minister of Economic Development of RF, made this announcement answering the questions of journalists within the framework of Astana Economic Forum.

Deputy Minister explained the rejection of Russian companies and the state in the whole from foreign borrowings with negative political climate as a result of Ukrainian crisis and a number of sanctions towards Russia. However Klepach noticed that it is early to speak about complete leaving the world borrowing markets, while howling potential on Asian markets exists.

Similar point of view was given by the head of the Ministry of Finance of RF Anton Siluanov, stated that according to the last amendments in the 2014 budget, the Ministry of Finance doesn’t plan to entry the foreign borrowings market because of its negative environment.

Business representatives also incline to rouble fundraising and creating the sources of long-term rouble credits. This has already been stated by the president of VTB Andrey Kostin and the president of JSC Russian Railways Vladimir Yakunin. Yakunin also noted that the company raised all borrowings projected for the current year forecasting the possibility of backset. As a reminder, the deputy head of the department of corporate finance of Russian Railways Pavel Ilyichev stated earlier that for the current year the company is planning to borrow approximately 100 bln. RUB. The half of this amount will be borrowed through the mechanism of infrastructural bonds, and the other half – through other financial instruments. In May the senior president of Russian Railways Vadin Mikhaylov stated that the company doesn’t plan foreign borrowings up to the end of 2014. However the company technically has this opportunity, in spite of the credit ratings reduction from «BBB» to «BBB-» in the current April.

Experts agree that the situation created is challenge to Russian economy and a signal to necessity of upgrading national economy using all internal reserves.