State companies will be allowed to place funds only in specially approved banks

The Ministry of Finance of the RF has prepared amendments focused on the strengthening of requirements to banks, in which the companies with state participation are allowed to place their funds. As of today it is enough, if a bank has the credit rating not below BB- from the international rating agencies Fitch, Standard & Pooor`s and Moody`s. The assessments of Russian rating agencies were also considered, such as «NRA» (minimum rating AAA), «AKM» and «Ekspert RA» (minimum rating A++) and «Rusreiting» (minimum rating A-).

The experts note, that, although the rating of a bank directly testifies to its financial strength, last recalls of banking licenses is evidence that even a bank formally meeting accepted criteria can occur at risk. So that, the loss of 1,5 bln RUB by the Fund of assistance to reforming of housing and communal services, invested in Investbank, which was revoked a license, has given an impulse to the strengthening of selection criteria.

According to new rules, to the already existing criterion it is added the necessity of being in the list of systemically important banks, establishing by the Central Bank of the RF. Within assessment, based on the first criterion (agencies’ rating), 27 credit institutions have an access to the auction. However, the introduction of a new criterion can significantly shorten their number, but the list of socially important banks is not released to the public.

Information agency Credinform is preparing to issue own bank financial strength index, which will help the users estimate how reliable is a credit institution.

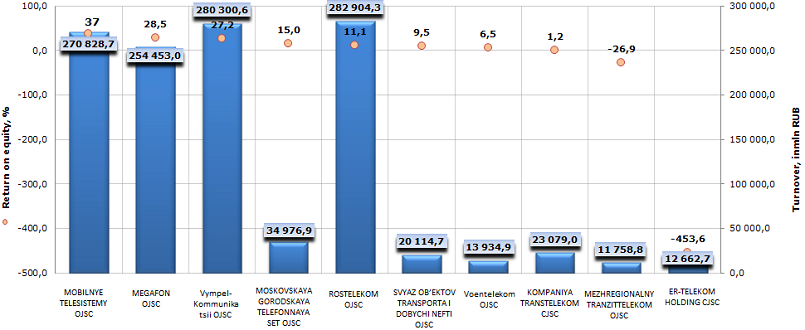

Return on equity of Russian telecommunication companies

Information agency Credinform prepared a ranking of Russian telecommunication companies.

The companies with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2012). These enterprises were ranked by decrease in return on equity.

Return on equity (%) is the relation of company’s net profit to its equity capital. The ratio shows, how many monetary units of net profit were earned by each unit invested by company owners. It allows assessing the effectiveness of use of the capital invested by the owners and general financing strategy of the management of the enterprise; benefit from shareholders’ investments in terms of accounting profit. The higher is the indicator value, the more efficient «have worked out» the investments. If the ratio is negative, it means that the enterprise has net loss.

| № | Name | Region | Turnover,in mln RUB, for 2012 | Return on equity, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | MOBILNYE TELESISTEMY OJSC INN: 7740000076 |

Moscow | 270 828,7 | 37,7 | 215(high) |

| 2 | OJSC MEGAFON INN: 7812014560 |

Moscow | 254 453,0 | 28,5 | 222(high) |

| 3 | Vympel-KommunikatsiiOJSC INN: 7713076301 |

Moscow | 280 300,6 | 27,2 | 237(high) |

| 4 | MOSKOVSKAYA GORODSKAYA TELEFONNAYA SET OJSC INN: 7710016640 |

Moscow | 34 976,9 | 15,0 | 174(the highest) |

| 5 | ROSTELEKOM OJSC INN: 7707049388 |

Saint-Petersburg | 282 904,3 | 11,1 | 183(the highest) |

| 6 | SVYAZ OB’EKTOV TRANSPORTA I DOBYCHI NEFTI OJSC INN: 7723011906 |

Moscow | 20 114,7 | 9,5 | 232(high) |

| 7 | Voentelekom OJSC INN: 7718766718 |

Moscow | 13 934,9 | 6,5 | 251(high) |

| 8 | KOMPANIYA TRANSTELEKOM CJSC INN: 7709219099 |

Moscow | 23 079,0 | 1,2 | 266(high) |

| 9 | MEZHREGIONALNYTRANZITTELEKOMOJSC INN: 7705017253 |

Moscow | 11 758,8 | -26,9 | 293(high) |

| 10 | ER-TELEKOM HOLDING CJSC INN: 5902202276 |

Perm Territory | 12 662,7 | -453,6 | 327(satisfactory) |

Picture. Return on equity of the largest on turnover telecommunication companies in Russia (TOP-10)

Cumulative annual turnover of the first 10 largest on turnover telecommunication companies of Russia made 1 205,0 bln RUB, following the results of the latest available financial statement for the year 2012, went up by 15,1% per annum. Industry leaders accumulate 82,8% of sales revenue of companies from the TOP-100 list in the same branch.

Operators of «the Big Three»: MTS OJSC, Megafon OJSC and VympelKom OJSC (TM Beeline) maintain leadership not only on turnover, but also on the value of return on equity ratio – 37,7%, 28,5%, 27,2% respectively, by this they left their nearest competitor trailing far behind – Rostelekom OJSC (11,1%). That confirms once more the thesis that a private company is more efficient than a state one.

Other participants of TOP-10 aren’t comparable in consolidated revenues with the enterprises mentioned above and are second to them in the value of return on equity ratio (except MGTS OJSC– 15%). By this MEZHREGIONALNY TRANZITTELEKOM OJSC and ER-TELEKOM CJSC showed negative return on equity, what points at net loss from activity following the results of the financial year.

According to the independent estimation of solvency of companies, developed by the Information agency Credinform, all market leaders mentioned above (except ER-TELEKOM CJSC) have a high and the highest solvency index GLOBAS-i®. It means for investors, that the organizations can pay off their debts in time and fully, while risk of default is minimal or low.

Net loss of ER-TELEKOM CJSC and participation in arbitrations as a defendant cause a satisfactory solvency index, what points at that the organization isn’t resistant enough to changes of the economic situation, the level of default risk is from average to above the average.