Trends in the activity of companies in the sphere of packaging production

Information agency Credinform represents an overview of trends in the activity of companies in the sphere of packaging production.

Enterprises with the largest volume of annual revenue engaged in the sphere of packaging production (TOP-10 and TOP-1000), were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2014, 2015, 2016). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets

The indicator, reflecting the real value of company's property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

| № in TOP-1000 | Name, INN, region | Net assets value, mln RUB.* | Solvency index Globas | ||

| 2014 | 2015 | 2016 | |||

| 1 | 2 | 3 | 4 | 5 | 6 |

| 1. | CJS National Enterprise Naberezhnochelninsky paperboard plant S.P.Titov INN 1650017638 Republic of Tatarstan |

5 460 | 6 458 | 7 400 | 148 Superior |

| 2. | JSC TETRA PAK INN 7706017070 Moscow |

3 082 | 4 931 | 6 784 | 177 High |

| 3. | STORA ENSO PACKAGING BB LLC INN 4003014954 Kaluga region |

2 330 | 3 233 | 4 649 | 148 Superior |

| 4. | Alpla LLC INN 5056000026 Moscow region |

1 921 | 2 707 | 3 813 | 136 Superior |

| 5. | ARKHBUM NJSC INN 2903003430 Arkhangelsk region |

2 088 | 2 608 | 3 425 | 176 High |

| 996. | FIRST FOLDING CARTON PLANT LIMITED INN 3902069327 Kaliningrad region |

-192 | -243 | -319 | 366 Adequate |

| 997. | POLIPAK LLC INN 2632058496 Stavropol territory |

-256 | -452 | -341 | 260 Medium |

| 998. | KONDROVO PAPER COMPANY PJSC INN 4004001796 Kaluga region Process of being wound up, 29.03.2017 |

-468 | -569 | -603 | 600 Insufficient |

| 999. | RUSSKII VINO-VODOCHNYI TREST NJSC INN 7703369034 Moscow Process of being wound up, 02.11.2016 |

1 273 | 1 278 | -2 163 | 600 Insufficient |

| 1000. | MULTIFLEX NJSC INN 7711040733 Moscow |

-1 277 | -2 757 | -5 142 | 320 Adequate |

*) – the indicators of growth or decline to the previous period are marked in columns 4 and 5 with green and red fillings, respectively.

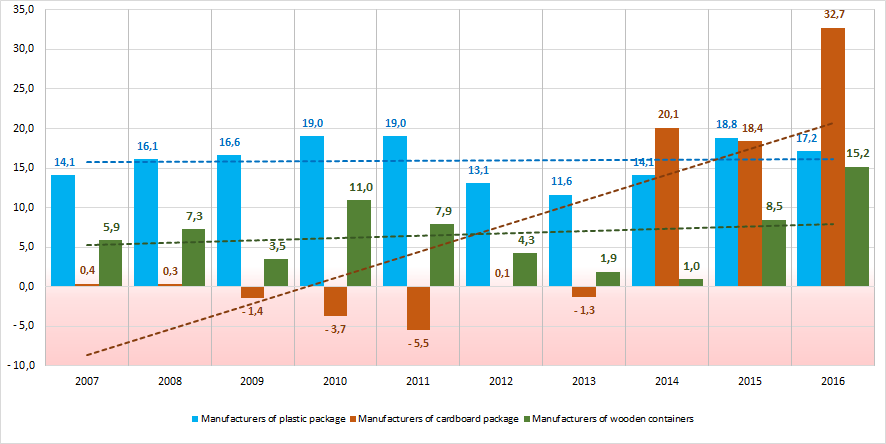

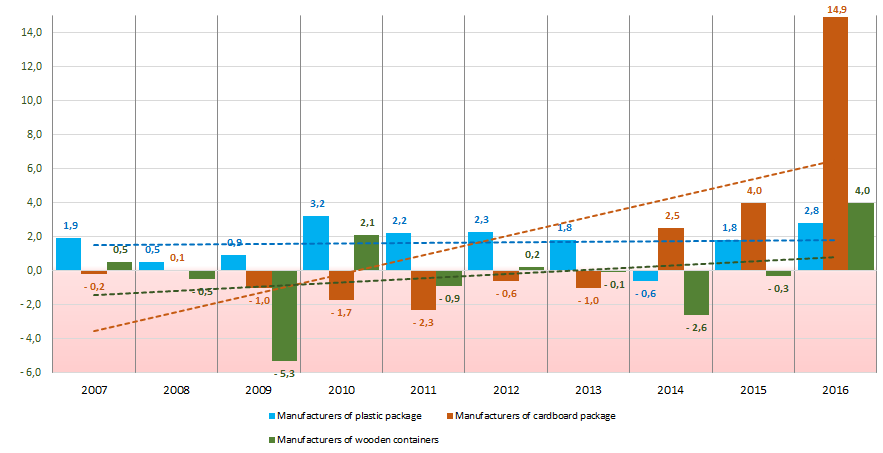

Picture 1. Change in the industry average indicators of the net asset value of companies in the sphere of packaging production in 2007 – 2016

Picture 1. Change in the industry average indicators of the net asset value of companies in the sphere of packaging production in 2007 – 2016Sales revenue

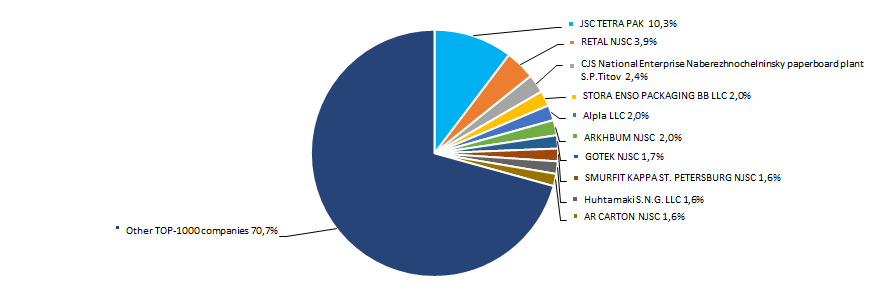

The revenue of 10 industry leaders made 29% of the total revenue of TOP-1000 companies in 2016. It points to a relatively high level of competition in the industry (Picture 2).

Picture 2. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 companies for 2016

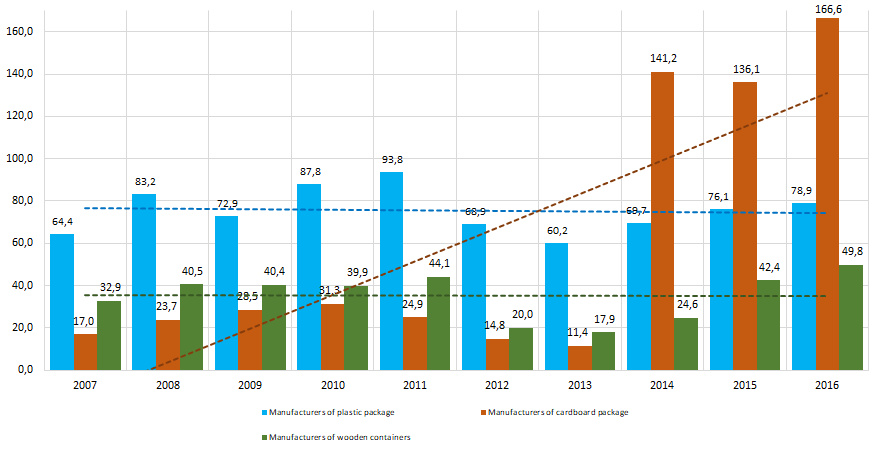

Picture 2. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 companies for 2016In general, there is a trend towards an increase in volume revenue among manufacturers of cardboard package (Picture 3).

Picture 3. Change in the industry average revenue of companies in the sphere of packaging production in 2007 – 2016

Picture 3. Change in the industry average revenue of companies in the sphere of packaging production in 2007 – 2016Profit and losses

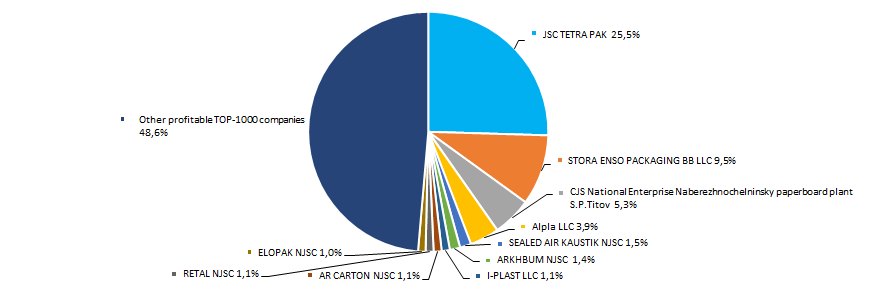

The profit volume of 10 industry leaders in 2016 made 51% of the total profit of TOP-1000 companies (Picture 4).

Picture 4. Share of participation of TOP-10 companies in the total volume of profit of TOP-1000 companies for 2016

Picture 4. Share of participation of TOP-10 companies in the total volume of profit of TOP-1000 companies for 2016Industry average profit’s indicators of manufacturers of cardboard package and wooden containers or the ten-year period trend to increase (Picture 5).

Picture 5. Change in the industry average indicators of profit of companies in the sphere of packaging production in 2007 – 2016

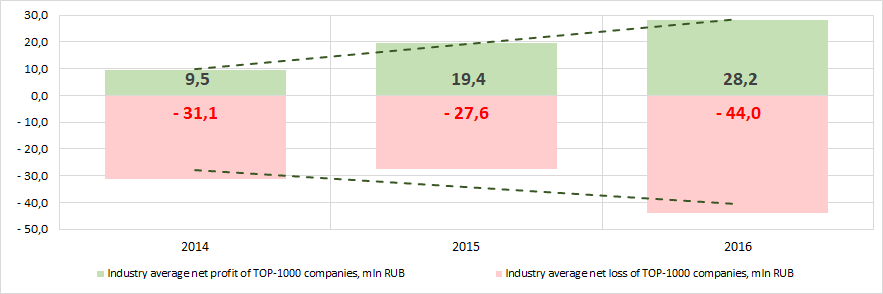

Picture 5. Change in the industry average indicators of profit of companies in the sphere of packaging production in 2007 – 2016Over a three-year period, the average values of profit indicators of TOP-1000 companies tends to increase. The average value of net loss also increases (Picture 6).

Picture 6. Change in the industry average indicators of profit and loss of the largest companies in the sphere of packaging production 2014 – 2016

Picture 6. Change in the industry average indicators of profit and loss of the largest companies in the sphere of packaging production 2014 – 2016Key financial ratios

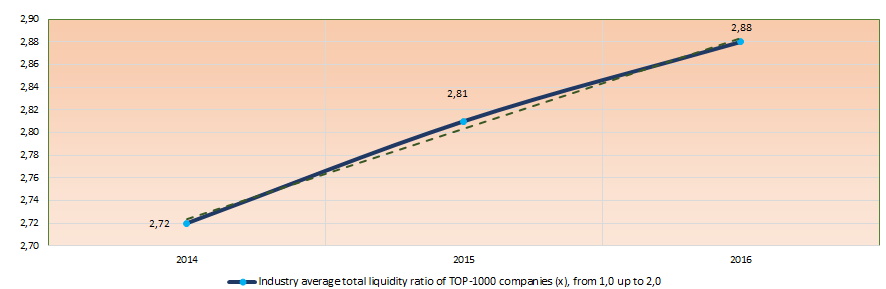

Over the ten-year period the industry average indicators of the total liquidity ratio were in the range of recommended values – from 1,0 up to 2,0 (Picture 7). In general, the ratio indicator tends to increase.

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in the sectors, has developed and implemented in the Information and Analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. For companies in the sphere of packaging production the practical value of the total liquidity ratio made from 1,02 up to 3,00 in 2016.

Picture 7. Change in the average industry values of the total liquidity ratio of companies in the sphere of packaging production 2014 – 2016

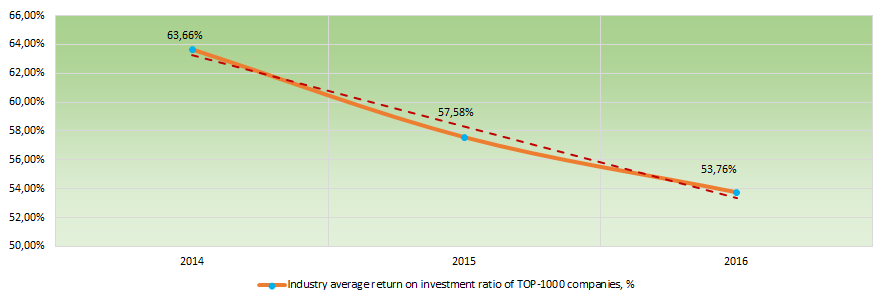

Picture 7. Change in the average industry values of the total liquidity ratio of companies in the sphere of packaging production 2014 – 2016There has been a decline in indicators of the return on investment ratio (Picture 8) for three years. The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity of own capital and the long-term borrowed funds of an organization.

Picture 8. Change in the average industry values of the return on investment ratio of companies in the sphere of packaging production 2014 – 2016

Picture 8. Change in the average industry values of the return on investment ratio of companies in the sphere of packaging production 2014 – 2016Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

This business activity ratio showed a tendency to increase for three-year period (Picture 9).

Picture 9. Change in the average industry values of the asset turnover ratio of companies in the sphere of packaging production 2014 – 2016

Picture 9. Change in the average industry values of the asset turnover ratio of companies in the sphere of packaging production 2014 – 2016Production structure

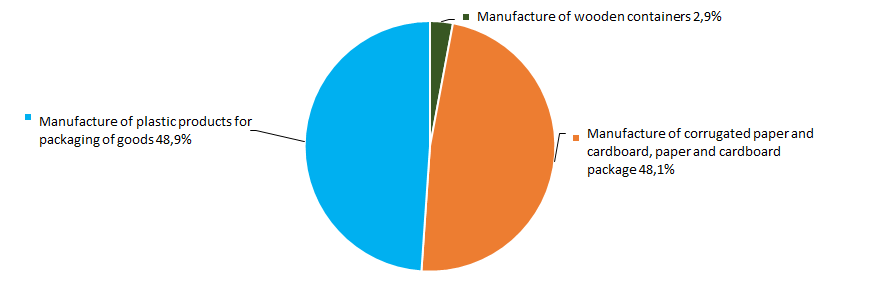

The largest share in the total revenue of TOP-1000 is owned by companies, specializing in the manufacture of plastic products for packaging of goods (Picture 10).

Picture 10. Distribution of companies by types of output in the total revenue of TOP-1000 enterprises, %

Picture 10. Distribution of companies by types of output in the total revenue of TOP-1000 enterprises, %Main regions of activity

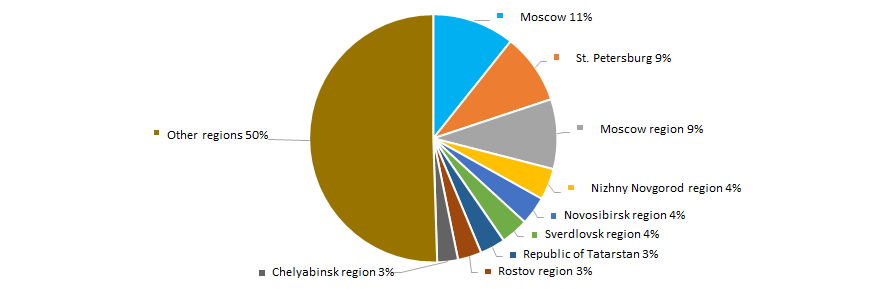

TOP-1000 companies are unequally distributed across the Russian territory and registered in 70 regions (Picture 11).

Picture 11. Distribution of TOP-1000 companies by regions of Russia

Picture 11. Distribution of TOP-1000 companies by regions of RussiaFinancial position score

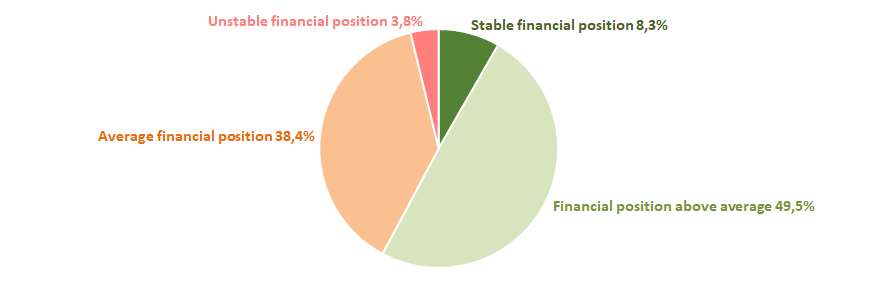

An assessment of the financial position of companies in the industry shows that the largest number is in a stable financial position and above the average (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

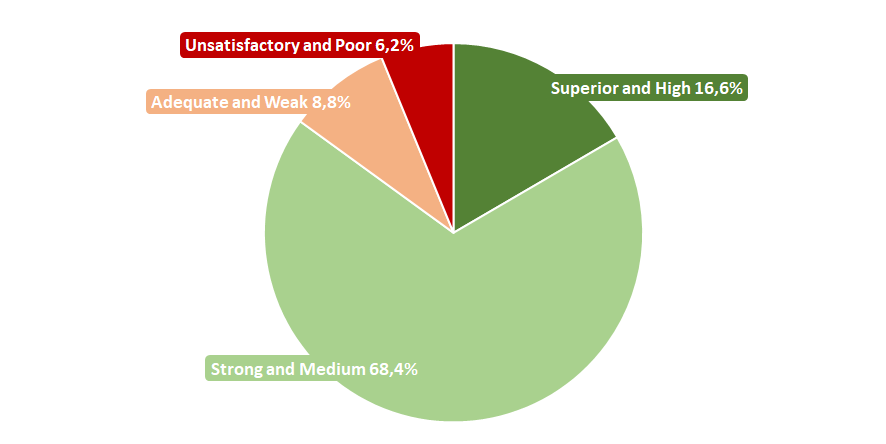

Most of TOP-1000 companies got Superior/High or Medium Solvency index Globas, that points to their ability to repay their debts in time and fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index GlobasThus, a comprehensive assessment of the activity of companies in the sphere of packaging production, taking into account the main indices, financial indicators and ratios, points to the presence of multidirectional trends, depending on the specialization of production. In general, relative stability is observed in the industry.

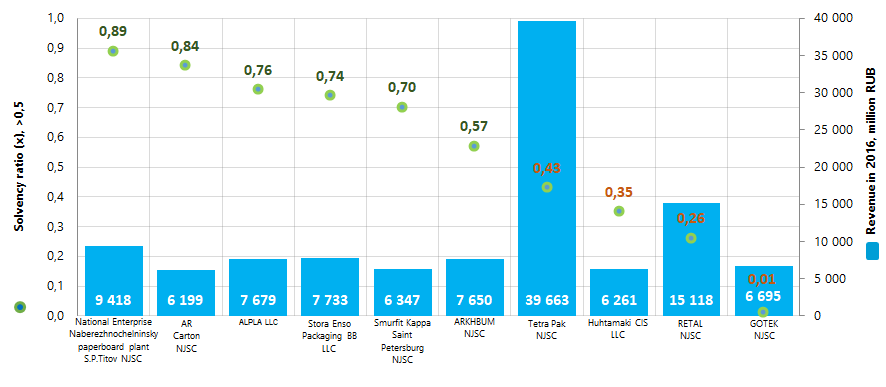

Solvency ratio of the largest Russian manufacturers of packaging

Information agency Credinform has prepared a ranking of the largest Russian manufacturers of packaging. The companies with the largest annual revenue (TOP-10) have been selected for the ranking, according to the data from the Statistical Register for the latest available accounting periods (2016, 2015 and 2014). Then they have been ranked by solvency ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Solvency ratio (x) is a ratio of shareholders’ equity to total assets, and it shows the dependence of the company on external loans. Its recommended value: > 0,5. A value less than a minimum one is indicative of dependence on external sources of funds, which may result in a liquidity crisis, unstable financial standing in the event of economic downturn.

The whole set of indicators and financial ratios is to be considered in order to get a full and comprehensive insight into a company’s financial standing.

| Name, INN, region | Revenue, million RUB | Net profit, million RUB | Solvency ratio (x), > 0,5 | Solvency index Globas | |||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| National Enterprise Naberezhnochelninsky paperboard plant S.P.Titov NJSC INN 1650017638 Republic of Tatarstan |

8 268 | 9 418 | 1 283 | 1 262 | 0,89 | 0,89 | 148 Superior |

| AR Carton NJSC INN 2353017002 Krasnodar territory |

5 579 | 6 199 | 778 | 668 | 0,60 | 0,84 | 130 Superior |

| ALPLA LLC INN 5056000026 Moscow region |

6 695 | 7 679 | 787 | 1 180 | 0,54 | 0,76 | 136 Superior |

| Stora Enso Packaging BB LLC INN 4003014954 Kaluga region |

6 595 | 7 733 | 903 | 1 415 | 0,56 | 0,74 | 148 Superior |

| Smurfit Kappa Saint Petersburg NJSC INN 4703029321 Leningrad region |

5 451 | 6 347 | 250 | 481 | 0,66 | 0,70 | 144 Superior |

| ARKHBUM NJSC INN 2903003430 Arkhangelsk region |

6 169 | 7 650 | 217 | 817 | 0,47 | 0,57 | 176 High |

| Tetra Pak NJSC INN 7706017070 Moscow |

39 018 | 39 663 | 2 643 | 4 744 | 0,26 | 0,43 | 177 High |

| Huhtamaki CIS LLC INN 7724000760 Moscow region |

5 074 | 6 261 | 151 | 591 | 0,23 | 0,35 | 202 Strong |

| RETAL NJSC INN 7704521059 Moscow region |

16 073 | 15 118 | 705 | 657 | 0,30 | 0,26 | 203 Strong |

| GOTEK NJSC INN 4633000037 Kursk region |

5 789 | 6 695 | 159 | 77 | 0,00 | 0,01 | 232 Strong |

| Total for TOP-10 | 104 710 | 112 762 | 7 876 | 11 893 | |||

| Average value for TOP-10 | 10 471 | 11 276 | 788 | 1 189 | 0,45 | 0,56 | |

| Average value for TOP-1000 | 345 | 386 | 14 | 21 | |||

Average value of solvency ratio for TOP-10 companies in 2016 is above the recommended value. Six of TOP-10 companies increased their revenue and net profit in 2015 – 2016 2016 compared to prior period (highlighted green in columns 2 – 5 of Table 1). Other companies had a decrease in revenue or net profit (highlighted red in columns 2 – 5 of Table 1).

Picture 1. Solvency ratio and revenue of the largest Russian manufacturers of packaging (TOP-10)

Picture 1. Solvency ratio and revenue of the largest Russian manufacturers of packaging (TOP-10)