Trends in consumer goods trade

Information agency Credinform represents a ranking of the largest Russian non-grocery goods wholesalers. The largest distributors of garments, footwear, household appliances, pharmaceutical and other goods with the highest annual revenue (TOP-1000) were selected for the ranking, according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2014 - 2019). The selection and analysis of companies were based on the data of the Information and Analytical system Globas.

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest company in term of net assets is OTCPHARM JSC, INN 5047149534, Moscow, wholesale of pharmaceuticals. In 2019, net assets value of the company exceeded 58 billion RUB.

The lowest net assets value among TOP-1000 belonged to LLC TK RUS-STEKLO, INN 5047105505, Moscow region, wholesale of ceramics and glass items. The company is in insolvency and under supervision since 08.03.2021. In 2019, insufficiency of property of the legal entity was indicated in negative value of -1,8 billion RUB.

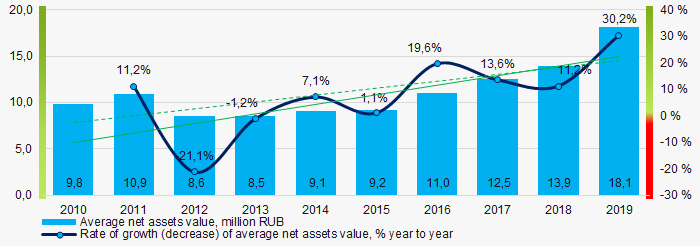

Covering the ten-year period, the average net assets values of TOP-100 have a trend to increase with an increasing growth rate (Picture 1).

Picture 1. Change in industry average net assets value in 2010 – 2019

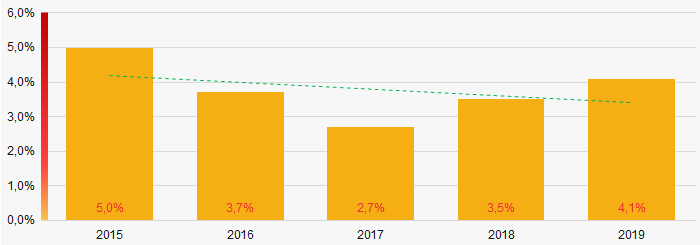

Picture 1. Change in industry average net assets value in 2010 – 2019Over the past six years, the share of companies with insufficient property had a positive trend to decrease (Picture 2).

Picture 2. Shares of TOP-1000 companies with negative net assets value in 2015-2019

Picture 2. Shares of TOP-1000 companies with negative net assets value in 2015-2019Sales revenue

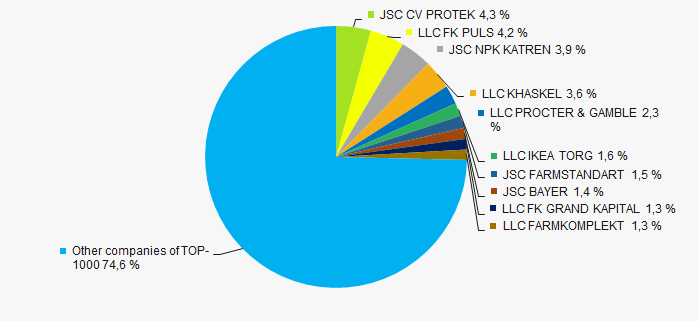

In 2019, the revenue volume of ten largest companies was 25% of total TOP-1000 revenue (Picture 3). This is indicative of a relatively high competition in the non-grocery goods wholesale market.

Picture 3. The share of TOP-10 companies in total 2019 revenue of TOP-1000

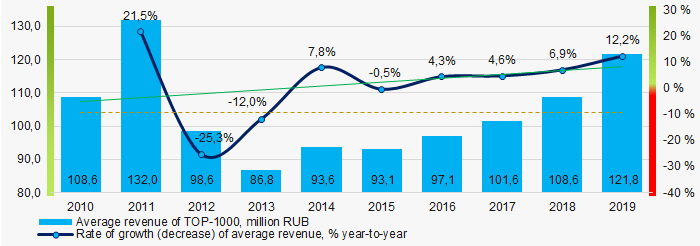

Picture 3. The share of TOP-10 companies in total 2019 revenue of TOP-1000In general, there is a trend to increase in revenue (Picture 4).

Picture 4. Change in industry average net profit in 2010 – 2019

Picture 4. Change in industry average net profit in 2010 – 2019Profit and loss

The largest organization in term of net profit is JSC FARMSTANDART, INN 0274110679, Moscow region, wholesale of pharmaceuticals. The company’s profit for 2019 was near 12 billion RUB.

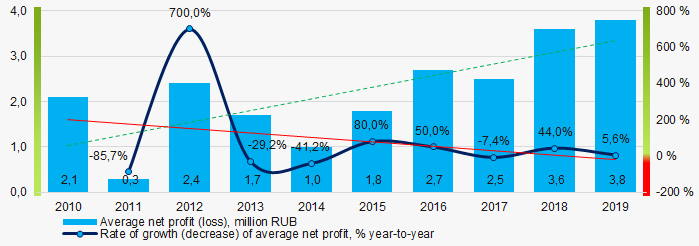

Covering the ten-year period, there is a trend to decrease in average net profit with the decreasing growth rate (Picture 5).

Picture 5. Change in industry average net profit (loss) values in 2010 – 2019

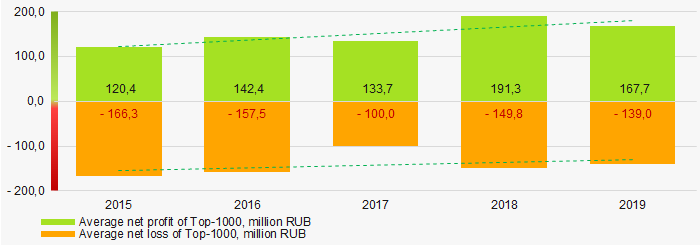

Picture 5. Change in industry average net profit (loss) values in 2010 – 2019For the five-year period, the average net profit values of TOP-1000 have the increasing trend with the decreasing net loss (Picture 6).

Picture 6. Change in average net profit and net loss of ТОP-1000 in 2015 – 2019

Picture 6. Change in average net profit and net loss of ТОP-1000 in 2015 – 2019Key financial ratios

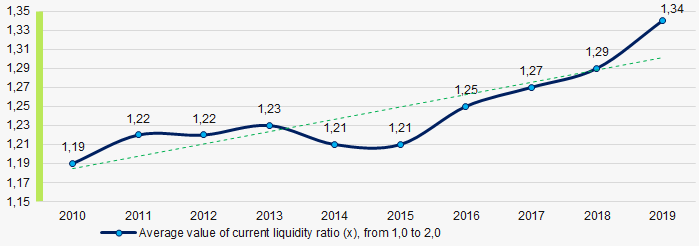

Covering the ten-year period, the average values of the current liquidity ratio were within the recommended one - from 1,0 to 2,0 with a trend to increase (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 7. Change in industry average values of current liquidity ratio in 2010 – 2019

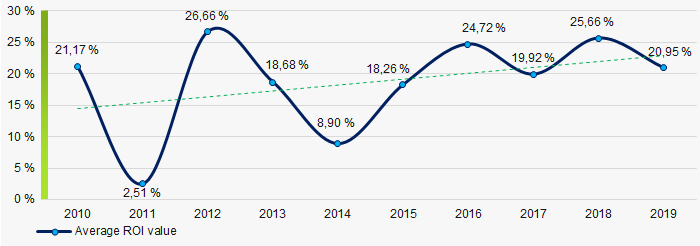

Picture 7. Change in industry average values of current liquidity ratio in 2010 – 2019Covering the ten-year period, the average values of ROI ratio had a trend to increase (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in industry average values of ROI ratio in 2010 – 2019

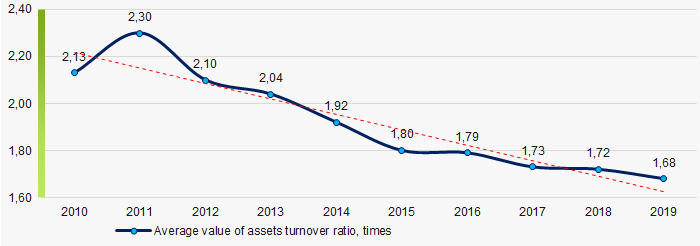

Picture 8. Change in industry average values of ROI ratio in 2010 – 2019Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

Covering the ten-year period, business activity ratio demonstrated the decreasing trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio in 2010 – 2019

Picture 9. Change in average values of assets turnover ratio in 2010 – 2019Small business

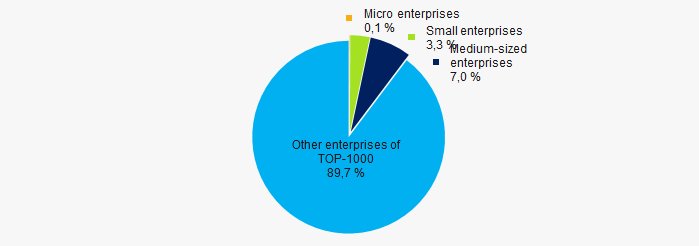

48% of companies included in TOP-1000 are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. In 2019, their share in total revenue of TOP-1000 was 10,3%, lower than the average country values (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in TOP-1000

Picture 10. Shares of small and medium-sized enterprises in TOP-1000Main regions of activity

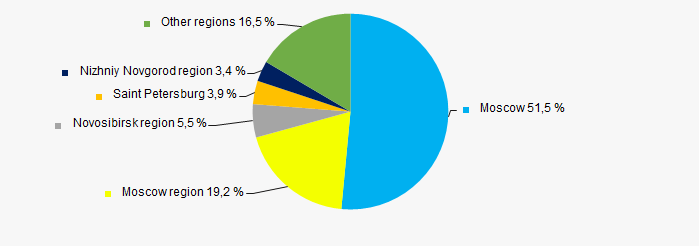

Companies of TOP-1000 are registered in 61 regions of Russia, and unequally located across the country. Near 71% of companies largest by revenue are located in Moscow and Moscow region (Picture 11).

Picture 11. Distribution of TOP-1000 revenue by regions of Russia

Picture 11. Distribution of TOP-1000 revenue by regions of RussiaFinancial position score

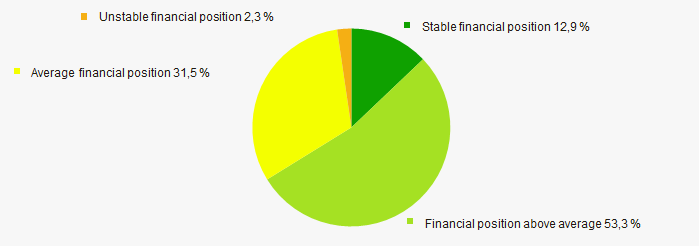

Assessment of the financial position of TOP-1000 companies shows that the majority of them have financial position above average (Picture 11).

Picture 12. Distribution of TOP-100 companies by financial position score

Picture 12. Distribution of TOP-100 companies by financial position scoreSolvency index Globas

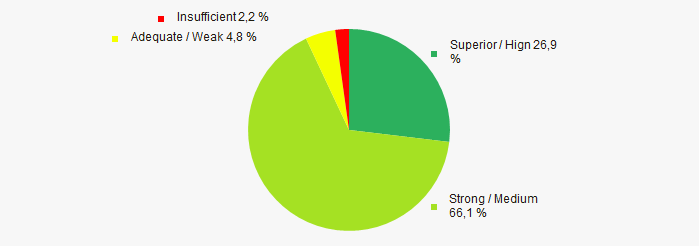

Most of TOP-1000 companies got Superior / High and Strong / Medium indexes Globas. This fact shows their limited ability to meet their obligations fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index GlobasConclusion

Complex assessment of activity of the non-grocery trade wholesalers, taking into account the main indexes, financial ratios and indicators, demonstrates the prevalence of negative trends in 2010 - 2019 (Table 1).

| Trends and evaluation factors | Relative share of factors, % |

| Dynamics of the average net assets value |  10 10 |

| Rate of growth (decrease) in the average size of net assets |  10 10 |

| Increase (decrease) in the share of enterprises with negative values of net assets |  10 10 |

| Level of competition / monopolization |  5 5 |

| Dynamics of the average revenue |  5 5 |

| Rate of growth (decrease) in the average size of revenue |  10 10 |

| Dynamics of the average profit (loss) |  10 10 |

| Rate of growth (decrease) in the average profit (loss) |  -10 -10 |

| Growth / decline in average values of companies’ net profit |  10 10 |

| Growth / decline in average values of companies’ net loss |  10 10 |

| Increase / decrease in average values of total liquidity ratio |  10 10 |

| Increase / decrease in average values of return on investment ratio |  10 10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses in terms of revenue being more than 20% |  -10 -10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of relative share of factors |  4,7 4,7 |

positive trend (factor),

positive trend (factor),  negative trend (factor)

negative trend (factor)

Who will work?

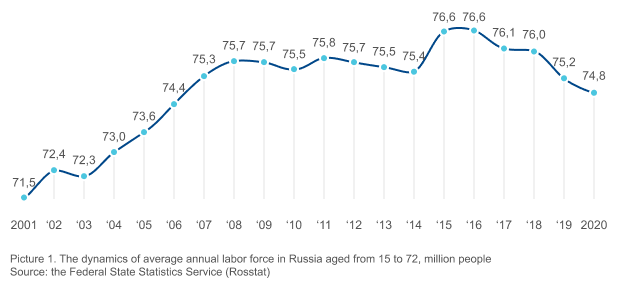

In 2000s, the generation of the 80s promoted the growth potential of the labor force. However, it is completely exhausted by now. Taking into account the demographic problems of the 90s, the dynamics will get worse. How and where to look for labor resources?

In 2020, 74,8 million people aged from 15 to 72 formed the working-age population. There is a 1,9 million decrease in the value of the labor force for the past 5 years. In 2015, the Republic of Crimea and Sevastopol promoted the increase in value, but the negative dynamics has been observing for straight 9 years since 2012.

Picture 1. The dynamics of average annual labor force in Russia aged from 15 to 72, million people

Picture 1. The dynamics of average annual labor force in Russia aged from 15 to 72, million peopleSource: the Federal State Statistics Service (Rosstat)

Problems of the Russian labor market

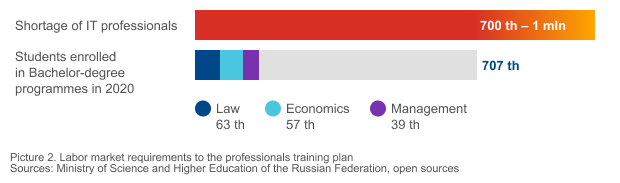

Along with a shrinking and aging working-age population, the Russian companies will face the following staffing problems, including overabundance of labor force in some professions and an acute shortage of it in others. Today in Russia there is a shortage of industrial, engineering, medical workers and IT professionals.

Picture 2. Labor market requirements to the professionals training plan

Picture 2. Labor market requirements to the professionals training planSources: Ministry of Science and Higher Education of the Russian Federation, open sources

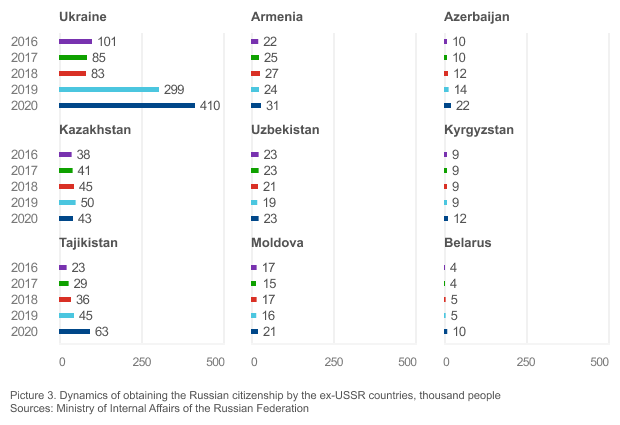

Replenishment of labor resources occurs mainly from the countries of the former USSR

From 2016 to 2020, 1,9 million people obtained Russian citizenship. Of these, 96,8% are from the ex-USSR countries.

Picture 3. Dynamics of obtaining the Russian citizenship by the ex-USSR countries, thousand people

Picture 3. Dynamics of obtaining the Russian citizenship by the ex-USSR countries, thousand peopleSources: Ministry of Internal Affairs of the Russian Federation

In 2020, the post-Soviet record 410 thousand applicants from Ukraine received Russian citizenship. For 5 years, 978 thousand Ukrainian immigrants changed allegiance to Russian that is more than half of the total number of new citizens.

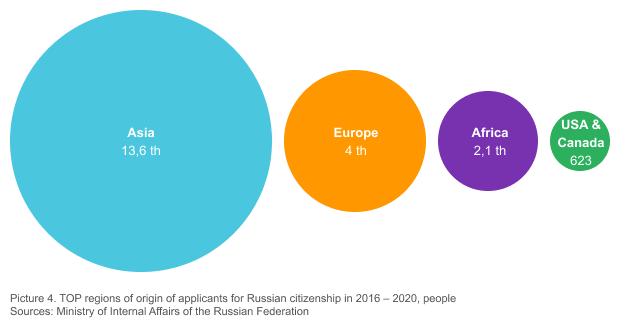

There are significantly fewer applicants from other countries.

Picture 4. TOP regions of origin of applicants for Russian citizenship in 2016 – 2020, people

Picture 4. TOP regions of origin of applicants for Russian citizenship in 2016 – 2020, peopleSources: Ministry of Internal Affairs of the Russian Federation

Solutions

Realizing the complexity of the situation, the Russian authorities made unprecedented changes in the migration policy. Amendments were made to the Federal law of May 31, 2002 No. 62-FL "On the Citizenship of the Russian Federation". Since July 24, 2020, the most simplified procedure for obtaining Russian citizenship has been in effect for the citizens of Ukraine, Belarus, Kazakhstan and Moldova. Now it is enough to submit an appropriate application, while the condition of five years of continuous residence in the Russian Federation is canceled. Confirmation of the availability of livelihood, as well as renunciation of a second citizenship are not required. If the citizens of Ukraine and Belarus are recognized as a native speaker, an interview for knowledge of the Russian language has been cancelled for them from June 17, 2020.

Cancellation from July 24, 2020 for all foreign citizens of the mandatory requirement to renounce another citizenship upon entering the citizenship of the Russian Federation may additionally attract migrants, especially from the EU, the USA and Canada, where many of our former compatriots live. Renouncing foreign citizenship was a significant obstacle to moving to Russia, especially for people from relatively prosperous countries who do not want to fall out of touch with their second homeland.

The process of attracting the young people is in progress: all foreign students who were educated in Russian universities and have a labor experience in the country for at least 1 year can obtain Russian citizenship in a simplified procedure, without a five-year residence permit and confirmation of a legitimate source of livelihood.

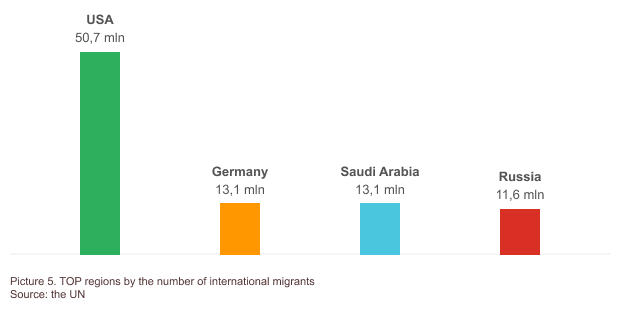

The growth potential of those wishing to obtain Russian citizenship is high: according to the UN on 2019, in terms of the number of international migrants, Russia ranks 4th in the world.

Picture 5. TOP regions by the number of international migrants

Picture 5. TOP regions by the number of international migrantsSource: the UN