Changes in legislation

Starting from January 1st, 2021 the new procedure for licensing of the production and technical maintenance of medical equipment will come into force.

The corresponding Provision is approved by the Decree of the Government of the Russian Federation as of 15.09.2020 No. 1445.

The licensing authority for this type of activity is the Federal Service for Surveillance in Healthcare (Roszdravnadzor).

The license applicants are to meet the following obligatory requirements while operating:

- availability of appropriate facilities owned by property rights or on other legal basis in the place of activity;

- availability of the technical means and equipment, measuring tools with the manufacturer’s technical documents and corresponding requirements to its examination, stated in the article 13 of the Federal law “On ensuring the uniformity of measurements”;

- availability of registration certificates on medical equipment, confirming the production of this equipment or relation to the place of its manufacture;

- availability of agreements between the manufacturer and the license applicant on organization of manufacture, which should contain the criteria of quality and safety control assurance of the manufactured products, as well as responsibility to the third parties;

- availability of quality management system, in accordance with the requirements of international standard GOST ISO 13485-2017;

- availability of staff members, having labor contracts, responsible for the manufacture and quality of the medical equipment, with higher or secondary professional (technical) education, having the work experience for at least 3 years in this field and supplementary vocational education (advance training at least once in 5 years) in the field of work performed and services rendered.

The full list of licensing requirements for both license applicants and license holders is contained in the Appendix to this Decree of the Government.

The information relevant to these types of activities, provided by part 1 and 2 of the article 21 of the Federal law ‘On licensing certain activities’ is published in the official web-site of Roszdravnadzor no later than 10 days after the date of arrival at the decision on grant, re-issuance, suspension, renewal or termination of the license.

A state fee is charged for the issuance or renewal of license.

All the licenses issued earlier are to be reissued in accordance with the requirements of the new Decree until December 31st, 2023. This Decree is valid until January 1st, 2027.

The Provision as of 03.06.2013 №469 approved earlier by the Decree of the Government will be invalid since January 1st, 2021.

The users of the Information and Analytical system Globas have access to all the available information (including archive data) about entities engaged in production and technical maintenance of medical equipment. Currently, more than 5300 companies have licenses for these types of activities.

ТОP-1000 of Ural companies

In order to reduce the interregional differences in the level and quality of life of the population, to accelerate economic growth and technological development and to ensure the national security of the country, in February 2019 the Russian Government approved the Strategy of Spatial Development of the Russian Federation until 2025. It consists of 12 macro-regions; one of them is Ural region, which includes Perm region, Republic of Bashkortostan, Udmurt Republic, Kurgan, Orenburg, Sverdlovsk and Chelyabinsk regions.

Information agency Credinform has prepared a review of activity trends of the largest companies of the real economy sector in the Ural Economic Region of Russia. The largest companies (ТОP-1000) in terms of annual revenue were selected according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2014 - 2019). The analysis was based on data of the Information and Analytical system Globas.

Net assets is a ratio reflecting the real value of company's property. It is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The ratio is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest company in terms of net assets is JSC ORENBURGNEFT, INN 5612002469, Orenburg region. In 2019 net assets of the company amounted to 758 billion RUB.

The smallest size of net assets in TOP-1000 had UMMC-STEEL CORPORATION, INN 6606021264, Sverdlovsk region. The lack of property of the company in 2019 was expressed in negative terms -23 billion RUB.

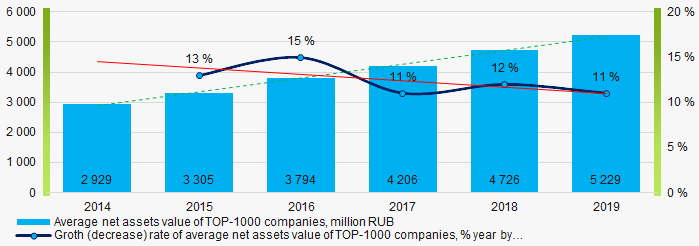

For the last six years, the average values of TOP-1000 net assets showed the growing tendency with negative dynamics of growth rates (Picture 1).

Picture 1. Change in average net assets value of ТОP-1000 companies in 2014 – 2019

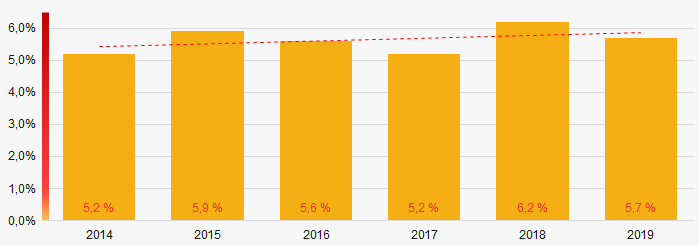

Picture 1. Change in average net assets value of ТОP-1000 companies in 2014 – 2019For the last six years, the share of ТОP-1000 enterprises with lack of property is growing (Picture 2).

Picture 2. The share of enterprises with negative net assets value in ТОP-1000

Picture 2. The share of enterprises with negative net assets value in ТОP-1000Sales revenue

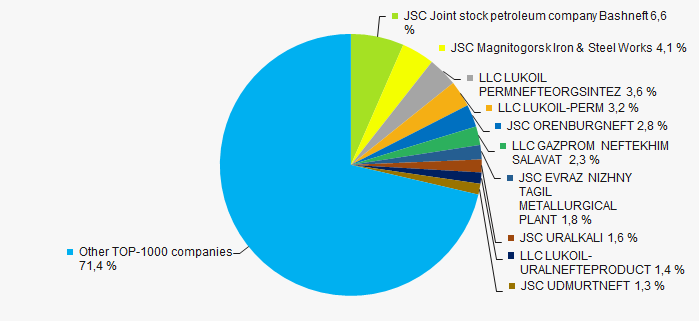

In 2019, the total revenue of 10 largest companies amounted to 29% from ТОP-1000 total revenue (Picture 3). This fact testifies the high level of capital concentration.

Picture 3. Shares of TOP-10 in TOP-1000 total revenue for 2019

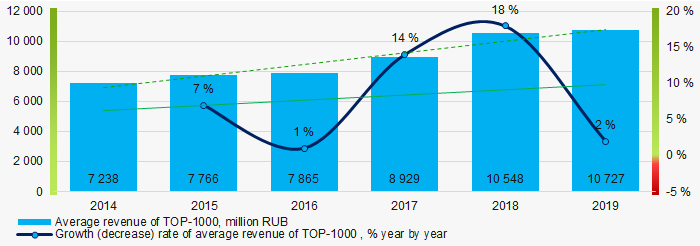

Picture 3. Shares of TOP-10 in TOP-1000 total revenue for 2019In general, the growing trend in sales revenue with positive dynamics of growth rates is observed (Picture 4).

Picture 4. Change in average revenue of TOP-1000 in 2014 – 2019

Picture 4. Change in average revenue of TOP-1000 in 2014 – 2019Profit and loss

The largest company in terms of net profit is JSC EVRAZ NIZHNY TAGIL METALLURGICAL PLANT, INN 6623000680, Sverdlovsk region. In 2019 the company’s profit amounted to almost 111 billion RUB.

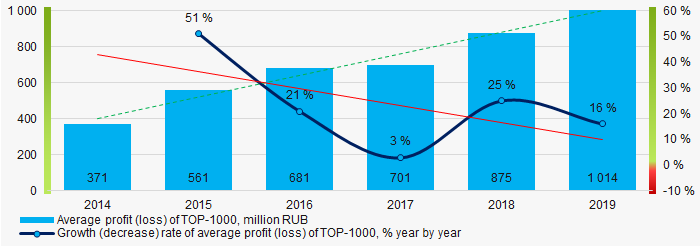

For the last six years, the average profit values of TOP-1000 show the growing tendency with negative dynamics of growth rates (Picture 5).

Picture 5. Change in average profit (loss) in 2014 – 2019

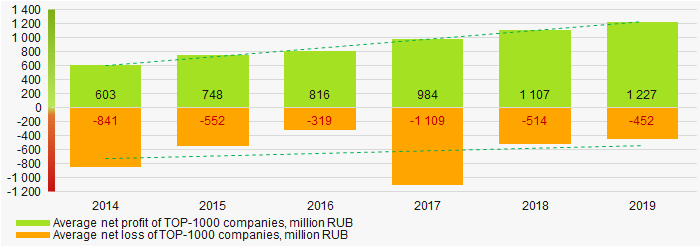

Picture 5. Change in average profit (loss) in 2014 – 2019Over a six-year period, the average net profit values of ТОP-1000 show the growing tendency, along with this the average net loss is decreasing (Picture 6).

Picture 6. Change in average net profit/loss of ТОP-1000 companies in 2014 – 2019

Picture 6. Change in average net profit/loss of ТОP-1000 companies in 2014 – 2019Main financial ratios

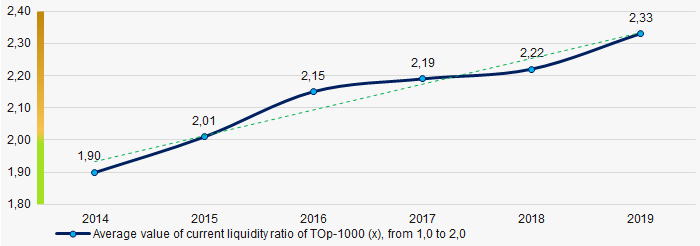

For the last six years, the average values of the current liquidity ratio were higher than the recommended values - from 1,0 to 2,0, with growing trend (Picture 7).

The current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Picture 7. Change in average values of current liquidity ratio in 2014 – 2019

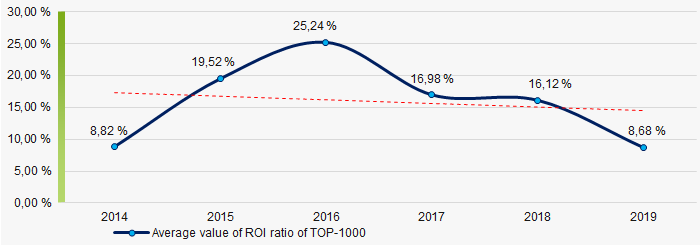

Picture 7. Change in average values of current liquidity ratio in 2014 – 2019Within six years, the downward trend of the average values of ROI ratio is observed (Picture 8).

The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average values of ROI ratio in 2014 – 2019

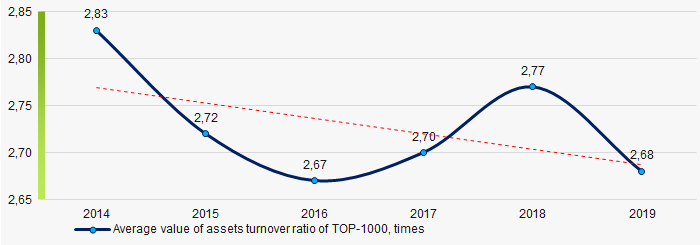

Picture 8. Change in average values of ROI ratio in 2014 – 2019Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

For the last six years, this business activity ratio demonstrated the downward trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio in 2014 – 2019

Picture 9. Change in average values of assets turnover ratio in 2014 – 2019Small businesses

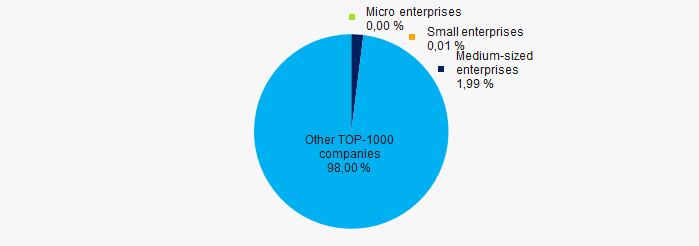

15% of ТОP-1000 companies are registered in the Unified register of small and medium-sized enterprises of the Russian Federal Tax Service. Herein, their share in TOP-1000 total revenue is only 2%, which is significantly lower than the national average value in 2018 – 2019 (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in ТОP-1000

Picture 10. Shares of small and medium-sized enterprises in ТОP-1000Main regions of activity

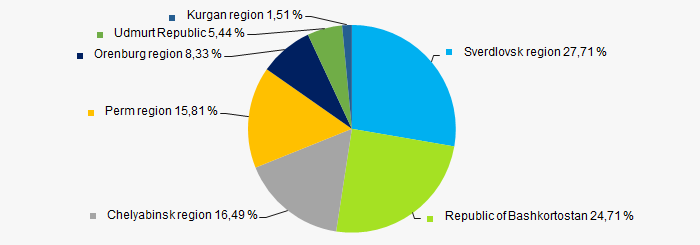

TOP-1000 companies are registered in 7 regions of Russia and are unequally located across the country/ 52% of the largest enterprises in terms of revenue are located Sverdlovsk region and the Republic of Bashkortostan (Picture 11).

Picture 11. Distribution of TOP-1000 revenue by the regions of Russia

Picture 11. Distribution of TOP-1000 revenue by the regions of RussiaFinancial position score

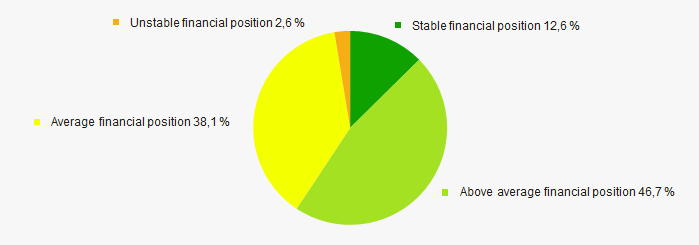

An assessment of the financial position of TOP-1000 companies shows that the largest part have above average financial position (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

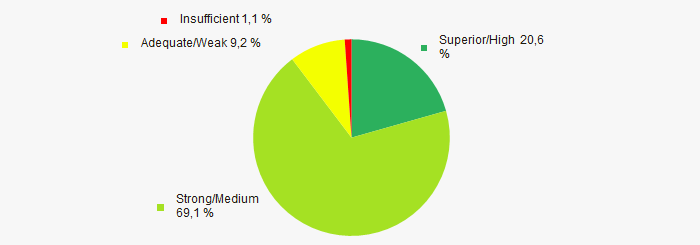

Most of TOP-1000 companies got superior/high or strong/medium Solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by Solvency index Globas

Picture 13. Distribution of TOP-1000 companies by Solvency index GlobasIndustrial production index

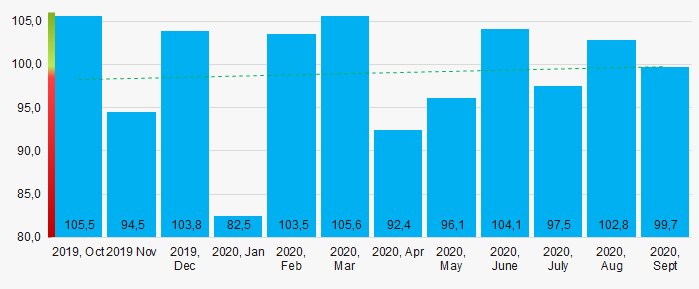

According to the Federal Service of State Statistics, there is a growing trend in the industrial production index in the Ural Region of Russia during 12 months of 2019 – 2020 (Picture 14). Herewith the average index from month to month amounted to 99%.

Picture 14. Average industrial production index in the Ural Economic Region of Russia in 2019-2020, month by month (%)

Picture 14. Average industrial production index in the Ural Economic Region of Russia in 2019-2020, month by month (%)Conclusion

A complex assessment of activity of the largest companies of real economy sector in the Ural Economic Region of Russia, taking into account the main indexes, financial ratios and indicators, demonstrates the lack of pronounced trends (Table 1).

| Trends and assessment factors | Relative share, % |

| Dynamics of average net assets value |  10 10 |

| Growth/drawdown rate of average net assets value |  -10 -10 |

| Increase / decrease in the share of enterprises with negative net assets |  -10 -10 |

| The level of competition / monopolization |  5 5 |

| Growth/drawdown rate of average profit |  10 10 |

| Dynamics of average net profit |  10 10 |

| Growth/drawdown rate of average revenue |  -10 -10 |

| Increase / decrease in average net profit of companies |  10 10 |

| Increase / decrease in average net loss of companies |  10 10 |

| Increase / decrease in average values of current liquidity ratio |  5 5 |

| Increase / decrease in average values of ROI ratio |  -10 -10 |

| Increase / decrease in average values of assets turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses by revenue more than 20% |  -10 -10 |

| Regional concentration |  -5 -5 |

| Solvency index Globas (the largest share) |  10 10 |

| Industrial production index |  -5 -5 |

| Average value of factors |  0,0 0,0 |

favorable trend (factor),

favorable trend (factor),  unfavorable trend (factor).

unfavorable trend (factor).