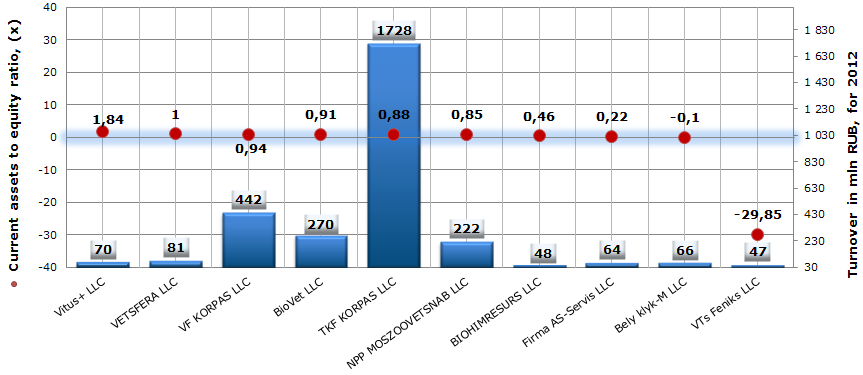

Current assets to equity ratio of organizations, carrying out veterinary activity

Information agency Credinform prepared a ranking «Current assets to equity ratio of organizations, carrying out veterinary activity in Russia». The companies with highest volume of revenue were selected for this ranking according to data from the Statistical Register for the latest available period (for the year 2012). Then, the first 10 enterprises selected by turnover were ranked by decrease in current assets to equity ratio.

Current assets to equity ratio is calculated as the relation of current assets of a company to total value of equity and shows the ability of the enterprise to maintain the current capital level and to finance current assets in case of need with own sources. The recommended value is from 0,2 to 0,5. The closer is the indicator value to the upper limit of recommended values, the more opportunities has the enterprise for a financial maneuver.

| № | Legal form of organization Name INN | Region | Turnover for 2012, in mln RUB | Current assets to equity ratio, (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Vitus+ LLC INN 7713094639 |

Moscow | 70 | 1,84 | 280 (high) |

| 2 | VETSFERA LLC INN 7722285397 |

Moscow | 81 | 1 | 315 (satisfactory) |

| 3 | VETERINARNAYA FIRMA KORPAS LLC INN 7715500910 |

Moscow region | 442 | 0,94 | 288 (high) |

| 4 | BioVet LLC INN 7724707870 |

Moscow | 270 | 0,91 | 250 (high) |

| 5 | TKF KORPAS LLC INN 7717620226 |

Moscow | 1728 | 0,88 | 213 (high) |

| 6 | Nauchno-proizvodstvennoe predpriyatie MOSZOOVETSNAB LLC INN 7725047224 |

Moscow | 222 | 0,85 | 239 (high) |

| 7 | BIOHIMRESURS LLC INN 3328479069 |

Vladimir region | 48 | 0,46 | 225 (high) |

| 8 | Firma AS-Servis LLC INN 5032052018 |

Moscow region | 64 | 0,22 | 208 (high) |

| 9 | Bely klyk-M LLC INN 7733080345 |

Moscow | 66 | -0,1 | 279 (high) |

| 10 | Veterinarny tsentr Feniks LLC INN 5007043958 |

Moscow region | 47 | -29,85 | 285 (high) |

Cumulative turnover of the TOP-10 largest Russian companies, carrying out veterinary activity, reached 3039 mln RUB.

The company Vitus+ LLC is at the top of the ranking with the value of current assets to equity ratio 1,84, that is higher than the recommended value, what isn’t also an positive result and can testify that the enterprise has uncovered loss in the accounting period. The company got a high solvency index GLOBAS-i®, that characterizes it as financially stable.

Current assets to equity ratio of organizations, carrying out veterinary activity in Russia, TOP-10

The second place of the ranking belongs to VETSFERA LLC with the current assets to equity ratio equal 1, that points to an imbalance in the company's capital structure. By that the enterprise got a satisfactory solvency index, because, except the loss for the last accounting period, there are data on non-fulfillment of its obligations in time by the enterprise.

Among TOP-10 companies only two - BIOHIMRESURS LLC and Firma AS-Servis LLC – have the indicator value be of interest to us, which corresponds with the recommended values from 0,2 to 0,5. By that the enterprise BIOHIMRESURS LLC has higher financial maneuverability. However, both companies got a high solvency index GLOBAS-i®.

Only two of TOP-10 companies have the negative value of the current assets to equity ratio: Bely klyk-M LLC and Veterenarny tsentr Feniks LLC. Such results can testify to an imbalance in the company's equity structure. At the same time both companies got a high solvency index GLOBAS-i®.

In summary, it should be noted, that for the objective assessment of a company it is necessary to consider the combination of both financial and non-financial indicators. An assessment basing on only one indicator doesn’t provide a complete picture.

The Central Bank of Russia keeps increasing the limit of bi-currency band

On February 24 the Central Bank of Russia increased the limit of bi-currency band on 5 kopecks to RUR 35,05 – 42,05 for the 13th time within a month. It happens against the backdrop of continuing rally on currency market when ruble since the start of the year went down in value on 9 % to USD and on 8 % to EUR and cut psychologically important historical peak rates, that didn’t change since the financial crisis of 2008.

In order to smooth the process of national currency rate devaluation at the moment of economy slackening, the Central Bank begins using money support, i.e. it sells the currency and increases the demand for the ruble in doing so. When the investment amount reaches USD 350 million, the limit automatically increases on 5 kopecks. The reverse process is similar.

Since the beginning of 2014 during 2 incomplete months the Central Bank has already increased the high limit of the band 29 times, whereas from August to December 2013 there were “only” 25 corresponding increases.

Obviously, the situation in Russian economy is far from stability and the fact that ruble is rapidly losing weight means that there are important macroeconomic reasons for it. It is indirectly confirmed by decrease of the industrial production on 0,2% in January 2014 in comparison with the similar period of the previous year, along with perpetual outflow of investments. Moreover, the financial power is likely to admit in the near future that the beginning of the year was disappointing for the economy and that in whole the lowering of the GDP is expected.

The pattern of growth, based on export of resources, has fully run its course despite high oil prices. The President of the Russian Federation V.V. Putin appealed the expert community, RAS in particular, to formulate a proposal on mobilization of new sources of economic development. It remains to wait, that the expert community and government agencies will find and put into practice consensus concerning new economic policy.