Assets turnover of the largest Russian manufacturers of plastic goods

Information Agency Credinform presents a ranking of the largest Russian manufacturers of plastic goods (except for manufacturers of plastic package). The largest enterprises of the industry (TOP-10) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2015 and 2014). Then the companies were ranked by assets turnover ratio (Table 1).

Assets turnover (times) is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

Taking into account the actual situation both for the economy in general and in industries, experts of the Information agency Credinform developed and realized in the Information and Analytical system Globas® calculation of actual values of financial ratios that can be normal for the particular industry. For plastic good manufacturers companies practical value of the net profit ratio in 2015 was from 1,47.

For the most full and fair opinion about company’s financial position not only the compliance with standard values, but the whole set of financial indicators and ratios should be taken into account.

| Name , INN, region | Net profit of 2015, mln RUB | Revenue of 2015, mln RUB | Revenue of 2015 to 2014, % | Assets turnover, times | Solvency index Globas® |

| LLC ALFATEKHFORM INN 7705195785 Moscow | 183,2 | 4 226,6 | 30,2 | 3,50 | 196 High |

| LLC TEKHSTROI INN 7743944097 Moscow | 47,3 | 6 076,1 | 218,3 | 1,93 | 212 High |

| LLC BIAXPLEN INN 5244013331 Nizhniy Novgorod region | 1 887,3 | 18 619,0 | 52,7 | 1,79 | 204 High |

| D.O.O. JUTEKS RU INN 3315010390 Vladimir region | 354,0 | 4 310,8 | 6,3 | 1,66 | 210 High |

| LLC POLYPLASTIC GROUP INN 5021013384 Moscow | 1 130,6 | 21 334,7 | 5,4 | 1,57 | 193 The highest |

| JSC FOR MANUFACTURE OF FLOOR COVERING INN 6340007043 Samara region | 683,0 | 16 034,7 | -9,0 | 1,46 | 232 High |

| LLC DANAFLEX-NANO INN 1655177480 The Republic of Tatarstan | 309,5 | 4 970,3 | 54,8 | 1,25 | 232 High |

| JSC Magna Tehnoplast INN 5256076921 Nizhniy Novgorod region | 57,0 | 7 163,8 | -12,6 | 1,24 | 260 High |

| LLC PENOPLEX SPB INN 7825133660 Saint Petersburg | -1,7 | 9 105,1 | 19,1 | 1,22 | 274 High |

| LLC VEKA RUS INN 7728165949 Moscow | 25,9 | 5 296,7 | -6,2 | 1,18 | 245 High |

| Total for TOP-10 group of companies | 4 676,0 | 97 137,8 | |||

| Total for TOP-500 group of companies | 8 930,8 | 397 796,3 | |||

| Average value within group of TOP-10 companies | 467,6 | 9 713,8 | 15,7 | 1,68 | |

| Average value within group of TOP-500 companies | 17,9 | 795,6 | 18,4 | 3,41 | |

| Average value within industry | 1,3 | 72,6 | 4,2 | 1,47 |

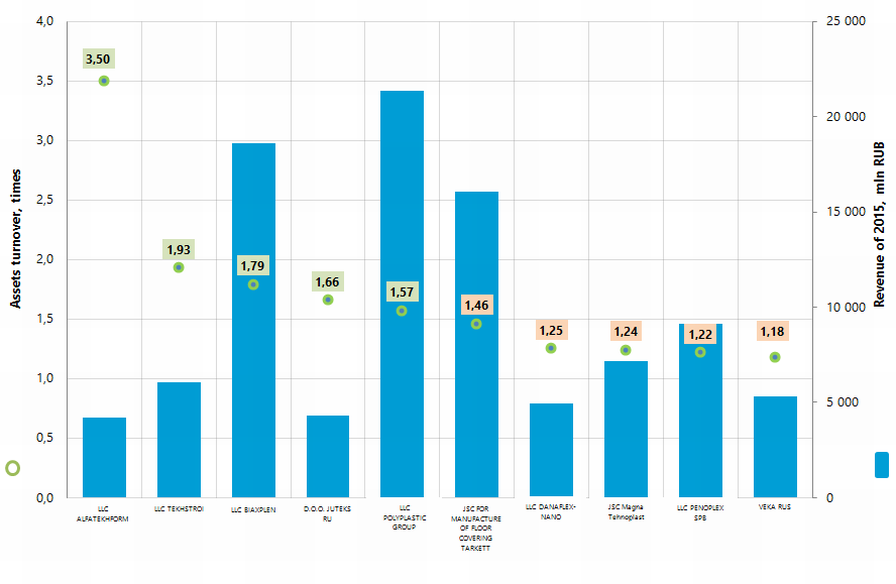

In 2015 average values of the assets turnover ratio within TOP-10 and TOP-500 group of companies is higher than the practical value. Five companies from TOP-10 group have indicators that are lower than the practical values and another five have indicators higher than practical values (marked with green and yellow filling, correspondently, in Picture 1).

Picture 1. Assets turnover ratio and revenue of the largest Russian manufacturers of plastic goods (TOP-10)

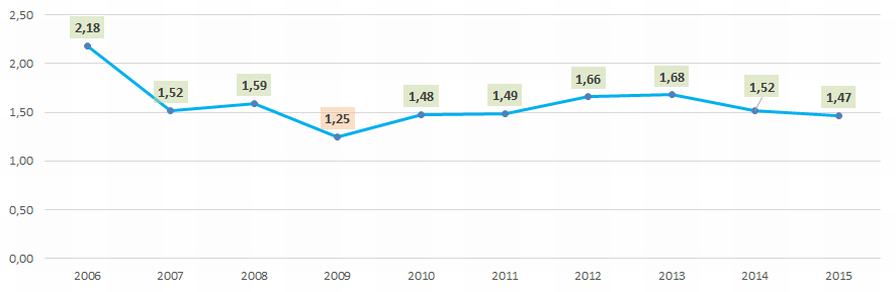

Picture 1. Assets turnover ratio and revenue of the largest Russian manufacturers of plastic goods (TOP-10)Average industrial values of the assets turnover ratio (Picture 2) in general show macroeconomic situation decreasing during crisis periods.

Picture 2. Average industrial values of the assets turnover ratio of Russian manufacturers of plastic goods in 2006 – 2015

Picture 2. Average industrial values of the assets turnover ratio of Russian manufacturers of plastic goods in 2006 – 2015All TOP-10 companies have got the highest or high solvency index Globas®, that shows their ability to meet their obligations in time and fully.

Five companies out of the TOP-10 group in 2015 decreased indicators of revenue or net profit (have loss) compared to the previous period (marked with red filling in the Table 1).

Secret tax information could be publicly available

According to the paragraph 1 of the article 102 of the Tax Code of the Russian Federation, the secret tax information include all data on state non-budget funds and tax or contribution payers received by tax, investigative and customs authorities, internal affairs bodies, with the exception of publicly available information, including information that has become public with consent of the owner.

Non-confidential tax information include data on:

- taxpayer ID numbers (INN);

- violations of tax legislation, including amounts of arrears, debts on penalties and fines and sanctions for violations;

- special tax treatments used by taxpayers and their participation in consolidated group of taxpayers;

- the amounts of income and expenses according to financial accounts, paid taxes and fees, the average number of employees in official year preceding the year of placing information in the Internet;

- registration with tax authority of foreign companies and individuals.

The list of non-confidential tax information also include information provided by tax authorities on international contracts or cooperation agreements; information about elections (according to the Federal Law as of 27.07.2010 №210-FZ «On the organization of public and municipal services»); data provided to local self-governing authorities in order to control the completeness and accuracy of information on local fees, for calculation of fees and on amount of arrears.

According to the order of the Federal Tax Service of Russia as of 15.11.2016 №ММВ-7-17/615@ (entered into force from 01.04.2017), the consent form of taxpayer on recognition secret tax information as publicly available, the procedure of its filling and presentation to tax authorities were approved.

The taxpayer or its representative can provide the consent form to tax authorities at the place of its location (residence or stay) personally in written form, by telecommunication channels using reinforced qualified electronic signature or by personal account of taxpayer in electronic form.

The detailed instructions for the procedure of consent form filling and its presentation to tax authorities are available on the official website of the Federal Tax Service.

Among secret tax information, the following data could be publicly available:

- Information about individual: First name, Second name, Patronymic, passport data; date and place of birth; nationality; registered address; country of residence; residential address.

- Information about subdivisions of the legal entity, licenses and permits for subsoil use.

- Financial accounts.

- Bank and personal accounts: bank name; account number; account type; opening and closing date of the account; cash flow details. Name of the authority, responsible for opening and maintenance of accounts in accordance with the budget legislation of the Russian Federation, customer account number, opening and closing date of customer account.

- Results of tax control: detection date of tax violation; date of tax declaration, calculation date – for in-house tax audit; date of tax audit report; start and end date of tax inspection; the subject and period of the inspection; name of audited tax or fee; interest charged.

- The amounts of tax and advance payments, fees and insurance payments: tax/advance payment/fee/insurance payment/excise name; tax period; amount to be paid; date and number of document - basis for tax computation (advance payment), fee, insurance payments, excise.

- Taxes to be refund from budget: date of tax declaration; the name of tax, for which tax declaration is provided; amount of tax refund; tax period; date of tax audit report, decisions on refund (fully or partially) of value added tax, decisions on refusal to refund (fully or partially) value added tax, the amount of excise tax.

- The objects of taxation: details of document on state registration of real property/ transport vehicles rights and deals with them; property type, cadastral number, type of transport vehicle; identification number of transport vehicle; model of car; registration plate.

- Information contained in tax declarations (calculations), provided at the end of each tax (reporting) period.

- Personal income: information contained in tax declarations (calculations), provided at the end of each tax (reporting) period, information on personal income (form 2-NDFL), information from tax declarations on personal income tax (form 3-NDFL), information from tax declarations on presumptive personal income (form 4-NDFL), information on calculation of income tax amount calculated and retained by tax agent (form 6-NDFL).

- Information about insurance payments.

While filling the consent form, the taxpayer has the right to determine the list of subjects and terms of their disclosure.

In accordance with the article 7 of the Federal Law as of 27.07.2006 №149-FZ «On information, information technologies and protection of information», the publicly available information include common knowledge and other information with unlimited access.

The Federal Tax Service is planning to post on the website information on companies that became publicly available. As soon as such information will be publicly available, it would be available in the Information and Analytical system Globas