Trends in the field of computer production

Information agency Credinform presents activity trends review of the largest companies in the production of computers, electronic and optical products.

The largest enterprises engaged in the production of computers and peripherals, communication and information protection devices, consumer electronics, measuring, testing, servicing, radar and medical equipment, optical devices, magnetic and optical information carriers, information and telecommunications systems and production of components in terms of annual revenue for the last reporting periods available in the state statistics bodies and the Federal Tax Service (2011 – 2020) were selected for this analysis (TOP 1000). The selection of companies and the analysis were carried out based on data from the Information and Analytical system Globas.

Net assets – is a ratio that reflects the real value of the company's property that is calculated annually as the difference between the assets on the company's balance sheet and its debt obligations. Net asset ratio is negative (insufficient property) if the company's debt exceeds the value of its property.

The largest company in the industry in terms of net assets is SAMSUNG ELECTRONICS RUS KALUGA LLC, INN 4025413896, Kaluga Region, production of television receivers, including video monitors and video projectors. In 2020, net assets of the company amounted to over 66 billion rubles.

TECHNOSERV AS LLC had the smallest amount of net assets in the TOP 1000, INN 7722286471, Moscow, production of computers and peripheral equipment. Property insufficiency in 2020 was expressed by a negative value of -9 billion rubles.

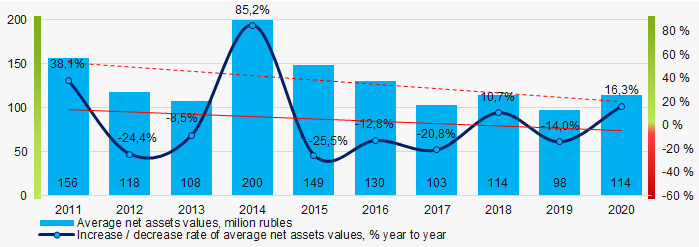

Covering the ten-year period, average net assets of the industry and their growth rates have a downward trend (Picture 1).

Picture 1. Change in average net assets values of the TOP 1000 in 2011-2020

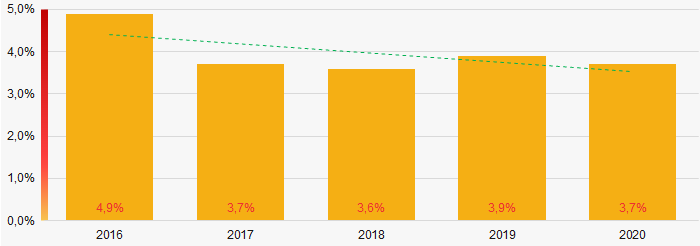

Picture 1. Change in average net assets values of the TOP 1000 in 2011-2020Shares of companies with property insufficiency in the TOP 1000 had a positive downward trend over the past five years (Picture 2).

Picture 2. Shares of companies with negative net assets of the TOP 1000 in 2016-2020

Picture 2. Shares of companies with negative net assets of the TOP 1000 in 2016-2020Sales revenue

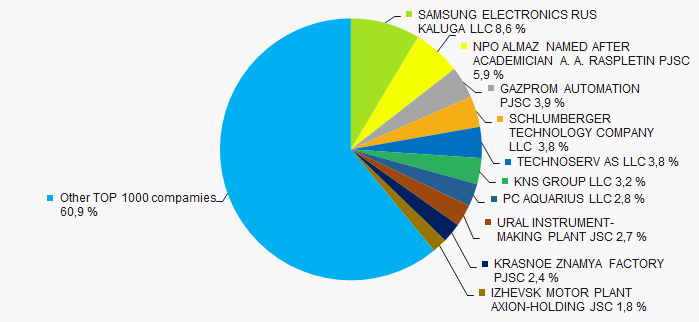

The revenue of the top ten companies in 2020 amounted to almost 39% of the total revenue of the TOP 1000 companies. (Picture 3). This indicates a high level of monopolization in the industry.

Picture 3. Shares of the TOP 10 companies in the total revenue of the TOP 1000 in 2019

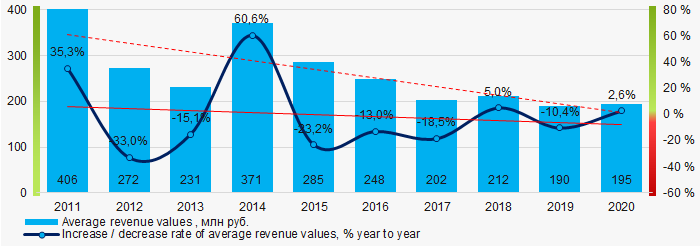

Picture 3. Shares of the TOP 10 companies in the total revenue of the TOP 1000 in 2019In general, there is a trend in revenue and growth rates decreasing. (Picture 4).

Picture 4. Changes in average revenue values in the industry in 2011-2020

Picture 4. Changes in average revenue values in the industry in 2011-2020Profit and loss

The largest company in the industry in terms of net profit in 2020 is SCHLUMBERGER TECHNOLOGY COMPANY LLC, INN 7709413265, Tyumen Region, production of other devices, sensors, equipment, measuring, controlling and testing tools. The profit of the company amounted to over 6 billion rubles.

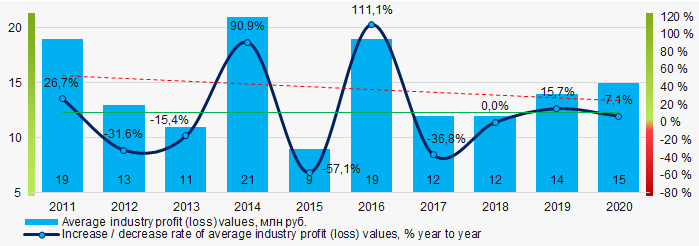

Covering the ten-year period, average profit values in the industry tends to decrease with a stable growth rate about 11% per year on average. (Picture 5).

Picture 5. Change in average profit (loss) values of the TOP 1000 in 2011-2020

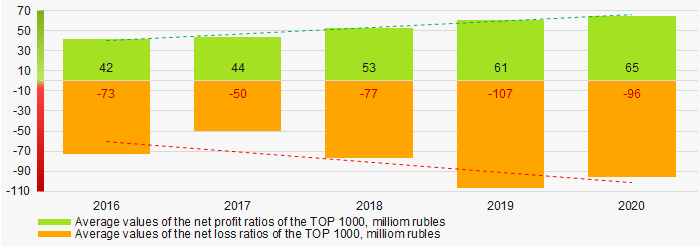

Picture 5. Change in average profit (loss) values of the TOP 1000 in 2011-2020Covering the five-year period, average values of net profit of the TOP 1000 companies are increasing, while average net loss is also growing (Picture 6).

Picture 6. Changes in average values of the net profit and net loss ratios of the TOP 1000 companies in 2016-2020

Picture 6. Changes in average values of the net profit and net loss ratios of the TOP 1000 companies in 2016-2020Key financial ratios

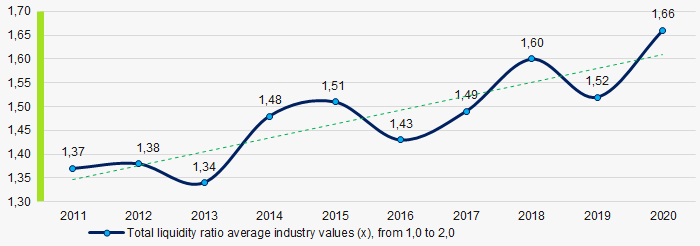

Covering the ten-year period, total liquidity ratio average values were in the range of recommended values - from 1.0 to 2.0, with a trend to grow. (Picture 7).

Total liquidity ratio (current assets to short-term liabilities) shows sufficiency of a company’s assets to settle short-term liabilities.

Picture 7. Changes in the total liquidity ratio average industry values in 2011-2020

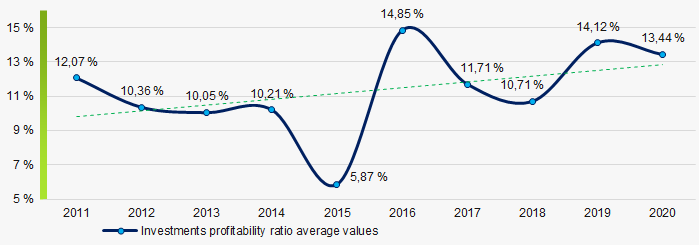

Picture 7. Changes in the total liquidity ratio average industry values in 2011-2020For ten years period, investments profitability ratio average values showed a tendency to increase (Picture 8).

This ratio is calculated as the ratio of net profit to amount of equity and long-term liabilities and demonstrates return on equity capital involved in commercial activities and the long-term funds raised by the organization.

Picture 8. Changes in investments profitability ratio average values in 2011-2020

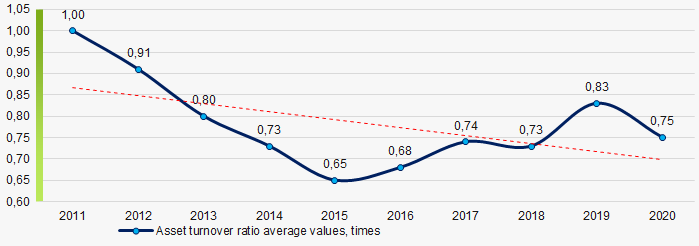

Picture 8. Changes in investments profitability ratio average values in 2011-2020Asset turnover ratio is calculated as ratio of sales revenue to average value of total assets for a period and implicates the efficiency of use of all available resources, regardless of the sources they were raised. The ratio shows how many times per year the full cycle of production and turnover is performed generating corresponding effect in the form of profit.

Covering the ten years period, values of the said business activity ratio showed a trend to decrease (Picture 9).

Picture 9. Changes in asset turnover ratio average values in 2011-2020

Picture 9. Changes in asset turnover ratio average values in 2011-2020Small enterprises

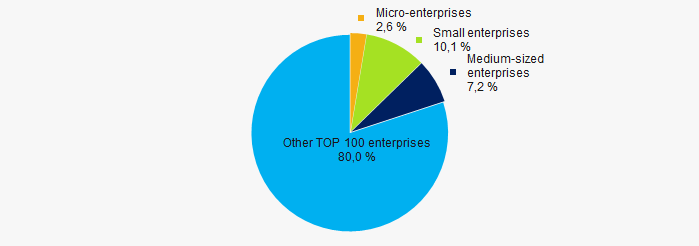

83% of the TOP 1000 companies are registered in the Unified Register of Small and Medium-Sized Enterprises of the Federal Tax Service of the Russian Federation. At the same time, the share of their revenue in the total amount of the TOP 1000 in 2020 is 20%, which is the average value in the country in 2018-2019. (Picture 10).

Picture 10. Revenue shares of small and medium-sized enterprises in the TOP-1000

Picture 10. Revenue shares of small and medium-sized enterprises in the TOP-1000Main regions of activity

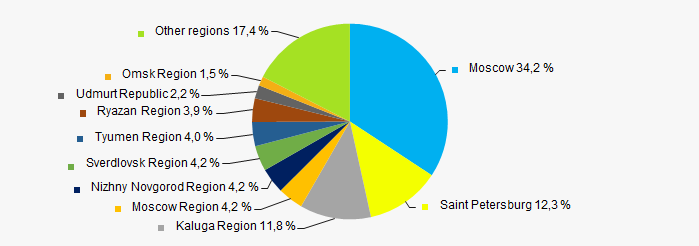

The TOP 1000 companies are registered in 62 regions and are distributed unevenly across the country. Over 58% of the TOP 1000 companies' total revenue in 2020 is concentrated in Moscow, St. Petersburg and the Kaluga Region (Picture 11).

Picture 11. Distribution of the TOP 1000 companies' revenue by Russian regions

Picture 11. Distribution of the TOP 1000 companies' revenue by Russian regionsFinancial position score

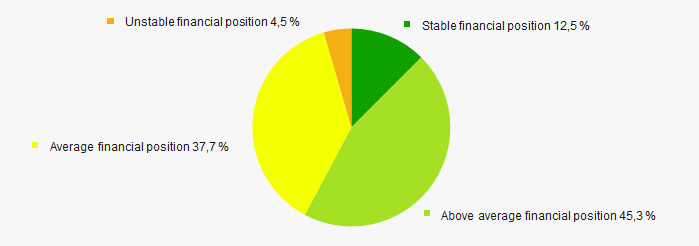

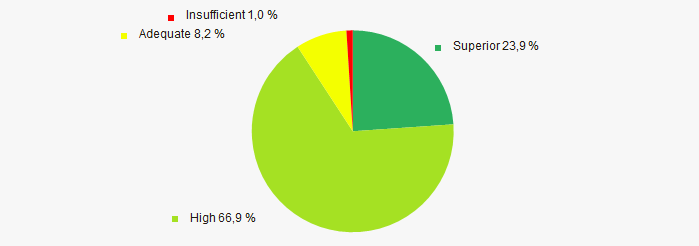

Financial position assessment of the TOP 1000 companies shows that the largest part of them is in financial position above average. (Picture 12).

Picture 12. Distribution of the TOP 1000 companies by accounting report scoring

Picture 12. Distribution of the TOP 1000 companies by accounting report scoringGlobas Solvency Index

The vast majority of the TOP 1000 companies are assigned the highest and high Globas Solvency Index. This indicates their ability to repay their debt liabilities on time and fully (Picture 13).

Picture 13. Distribution of the TOP 1000 companies according to the Globas Solvency Index

Picture 13. Distribution of the TOP 1000 companies according to the Globas Solvency Index Conclusion

The comprehensive assessment of activities of the largest companies in the field of computers, electronic and optical products manifacture that includes the main indexes, financial indicators and ratios shows predominance of negative trends in their activities in the period from 2015 to 2020. (Table 1).

| Trends and evaluation factors | Share of factor, % |

| Dynamics of average net assets values |  -10 -10 |

| Increase (decline) rate in average size of net assets |  -10 -10 |

| Enterprises' share increase / decrease with net assets negative values |  10 10 |

| Level of equity concentration |  -10 -10 |

| Dynamics of average revenue values |  -10 -10 |

| Increase / decline rate in the average size of revenue |  -10 -10 |

| Dynamics of the average profit (loss) |  -10 -10 |

| Increase / decline rate in the average size of profit (loss) |  5 5 |

| Increase / decline in average values of net profit |  10 10 |

| Increase / decline in average values of net loss |  -10 -10 |

| Increase / decrease in average values of total liquidity ratio |  10 10 |

| Increase / decrease in average values of return on investment ratio |  10 10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| The share of small and medium-sized enterprises in revenue is more than 20% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Globas Solvency Index (the largest share) |  10 10 |

| Average value of factors share |  -0,9 -0,9 |

<span st

Food manufacturers in Novosibirsk

Information agency Credinform has prepared a ranking of food industry enterprises in Novosibirsk. Companies engaged in manufacture of food products and beverages (TOP-10) in terms of annual revenue were selected according to the data from the Statistical Register and the Federal Tax Service for the available periods (2018 - 2020). Then the companies were ranged by asset coverage ratio (Table 1). The selection and analysis of companies were based on the data from the Information and Analytical system Globas.

Asset coverage ratio (x) is calculated as the difference between equity and non-current assets to current assets.

The ratio characterizes the ability of a company to finance current activities only with its current assets. The recommended value of the ratio is > 0.1.

In order to get the most comprehensive and fair picture of the financial standing of an enterprise, it is necessary to pay attention to all the combination of financial indicators and company’s ratios.

| Name, INN, type of activity | Revenue, million RUB | Net profit (loss), million RUB | Asset coverage ratio (x) | Solvency index Globas | |||

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| AO KOMPANIYA PROKSIMA INN 5405143630 manufacture of condiments and seasonings |

3 443 3 443 |

3 835 3 835 |

611,2 611,2 |

1 247,2 1 247,2 |

0,90 0,90 |

0,75 0,75 |

155 Superior |

| OOO PK KORMA INN 5403359641 manufacture of prepared farm animal feeds |

2 212 2 212 |

2 424 2 424 |

201,2 201,2 |

181,8 181,8 |

0,65 0,65 |

0,74 0,74 |

273 Medium |

| NL KONTINENT CO LTD INN 5401305707 manufacture of other food products n.e.c. |

2 475 2 475 |

3 574 3 574 |

336,1 336,1 |

670,0 670,0 |

0,09 0,09 |

0,36 0,36 |

222 Strong |

| OOO RRK-SIBIR INN 5407950904 processing and preserving of meat |

3 013 3 013 |

2 512 2 512 |

58,0 58,0 |

45,1 45,1 |

0,29 0,29 |

0,16 0,16 |

293 Medium |

| OOO SPK INN 5405200166 processing and preserving of meat and production of meat products |

13 476 13 476 |

12 916 12 916 |

335,3 335,3 |

362,5 362,5 |

0,34 0,34 |

0,03 0,03 |

205 Strong |

| NAO PTITSEFABRIKA OKTYABRSKAYA INN 5433128031 manufacture and preserving of poultry meat |

3 123 3 123 |

3 245 3 245 |

2,5 2,5 |

10,5 10,5 |

0,03 0,03 |

0,02 0,02 |

176 High |

| OOO NOVOSIBIRSKII MELKOMBINAT #1 INN 2222849374 manufacture of mill and grain products |

871 871 |

2 719 2 719 |

2,5 2,5 |

58,8 58,8 |

-0,22 -0,22 |

-0,06 -0,06 |

241 Strong |

| OOO PO TOPCHIKHINSKII MELKOMBINAT INN 5405495618 manufacture of mill and grain products |

1 950 1 950 |

2 271 2 271 |

22,3 22,3 |

4,4 4,4 |

-0,13 -0,13 |

-0,08 -0,08 |

550 Insufficien |

| NAO MASLOKOMBINAT CHANOVSKII INN 5415100805 manufacture of dairy products |

1 997 1 997 |

2 304 2 304 |

32,4 32,4 |

19,8 19,8 |

-0,24 -0,24 |

-0,14 -0,14 |

221 Strong |

| OOO NM INN 5405950881 manufacture of grain flour |

2 609 2 609 |

2 818 2 818 |

79,1 79,1 |

80,6 80,6 |

-0,50 -0,50 |

-0,19 -0,19 |

224 Strong |

| Average value for TOP-10 companies |  3 517 3 517 |

3 862 3 862 |

168,1 168,1 |

268,1 268,1 |

0,12 0,12 |

0,16 0,16 |

|

| Average value for TOP-100 companies |  725 725 |

790 790 |

27,8 27,8 |

39,4 39,4 |

0,03 0,03 |

0,10 0,10 |

|

improvement compared to prior period,

improvement compared to prior period,  decline compared to prior period

decline compared to prior period

The average value of the asset coverage ratio of TOP-10 in 2020 is above the recommended one and the value for the previous period. In 2019 and 2020 four companies have the negative values. Four companies decreased their value in 2020, whereas in 2019 the decrease was recorded for three companies of TOP-10.

At the same time, in 2020 two companies decreased the revenue and four companies - the net profit. In average, the revenue in TOP-10 increased by 10%, in TOP-100 – by 9%. The profit in TOP-10 increased by 59%, in TOP-100 – by 42%.

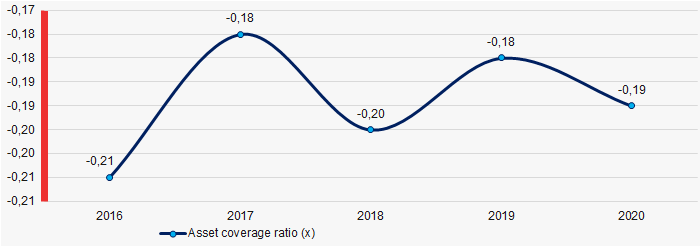

In general, during last 5 years, the average industry values of the asset coverage ratio of TOP-10 were negative. The growth was observed during two periods (Picture 1). The best value was registered in 2017, the worst - in 2016.

Picture 1. Change in average industry values of asset coverage ratio of food industry enterprises in 2016 – 2020

Picture 1. Change in average industry values of asset coverage ratio of food industry enterprises in 2016 – 2020